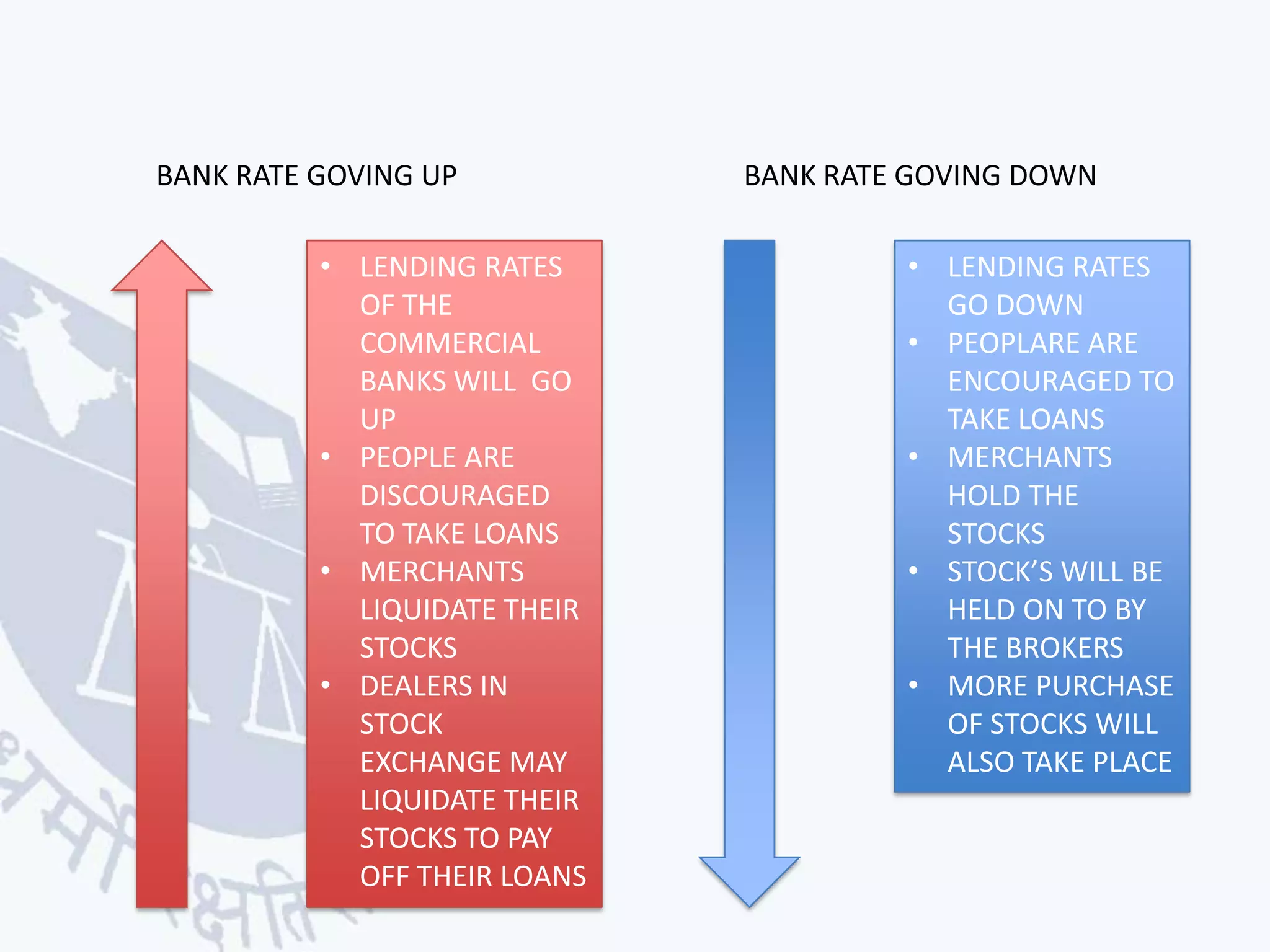

Central banks have two main methods for controlling credit in an economy: quantitative and qualitative. Quantitative methods like adjusting the bank rate, conducting open market operations, and setting reserve requirements aim to broadly restrict or encourage credit across all sectors. Qualitative or selective controls target specific uses of credit and can include imposing margin requirements, regulating consumer loans, issuing directives, and rationing credit for certain purposes. Both approaches influence monetary conditions but qualitative controls allow distinguishing essential vs non-essential credit uses.