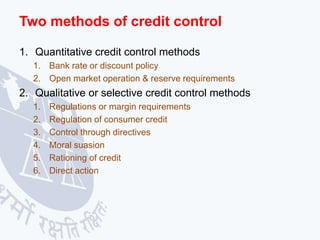

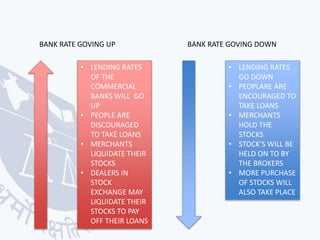

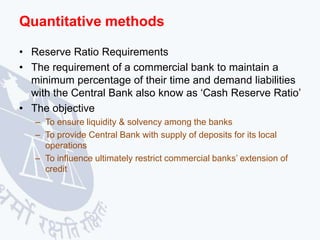

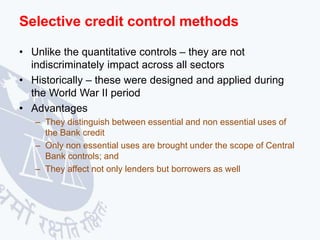

This document provides an overview of the methods used by central banks to control credit in the economy. It discusses two main types of credit control methods: quantitative and qualitative. Quantitative methods like bank rate policy and open market operations aim to control the overall supply of credit indiscriminately. Qualitative or selective methods target specific sectors or uses of credit to distinguish essential vs non-essential lending. Examples given include regulating margins for stock market loans, consumer credit terms, and directly rationing or restricting certain types of lending. The goal of these credit control methods is to influence monetary conditions and support the central bank's economic objectives.