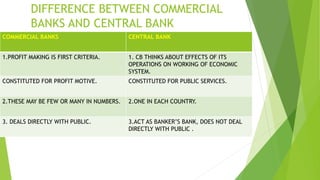

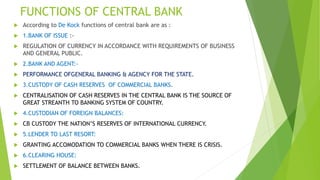

The document discusses the role and functions of central banking. It begins by defining a central bank and explaining how they evolved from privately owned banks to taking on public functions. It then contrasts central banks with commercial banks and outlines the key functions of central banks, including bank of issue, bank and agent to the state, lender of last resort, and controller of credit. The document also examines various credit control methods used by central banks like bank rate, open market operations, and selective controls. It notes the challenges of central banking in underdeveloped economies.