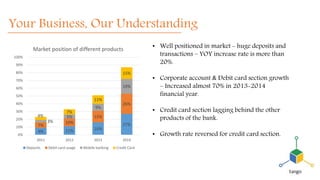

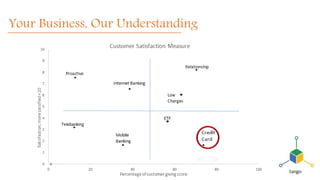

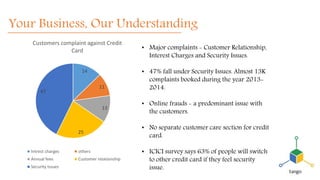

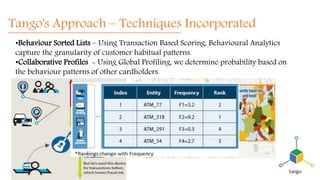

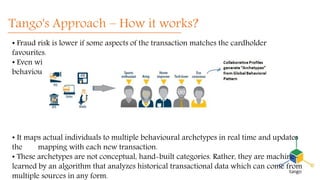

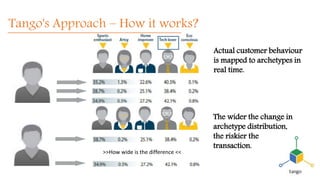

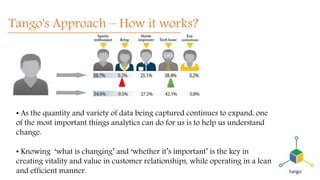

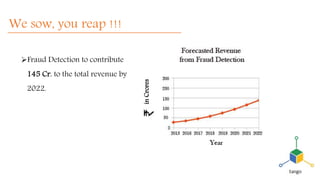

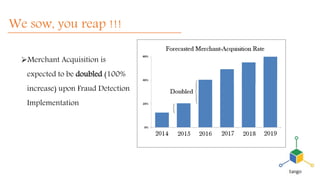

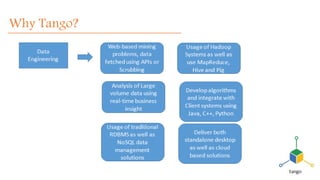

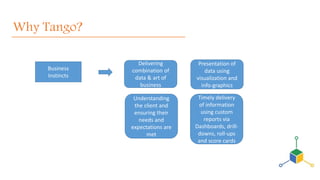

Tango Technologies, founded in 2008 with a global presence, specializes in fraud detection in the BFSI sector, helping businesses enhance growth, profitability, and customer satisfaction. The document details their innovative fraud analytics approach, including advanced techniques such as transaction-based scoring and global profiling, aimed at improving customer experience while minimizing fraud risks. It also highlights positive feedback from clients regarding their expertise in data science and successful project outcomes.