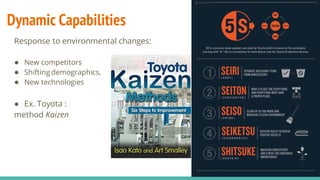

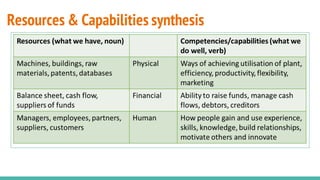

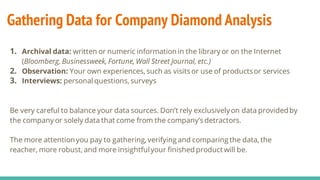

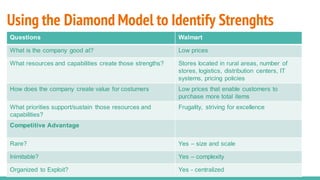

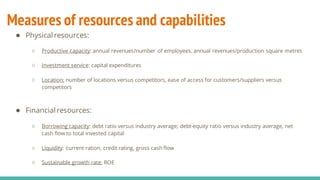

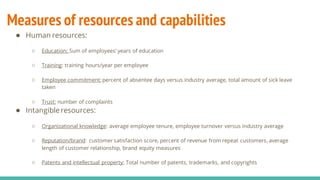

The document discusses resources and capabilities as internal abilities that allow firms to succeed. It defines resources as tangible and intangible assets that firms can use to implement strategies, and capabilities as operating routines and dynamic processes for adapting resources. Examples include McDonald's efficient operating capabilities and Toyota's continuous improvement processes. Priorities are guided by values and influence resource allocation. The VRIO model assesses if resources provide competitive advantage by being valuable, rare, inimitable, and exploitable. Firms must analyze their resources and capabilities using multiple data sources to understand strengths and competitive positions.