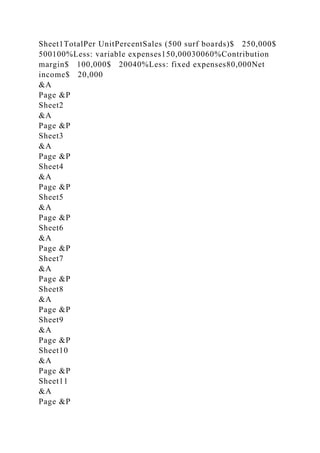

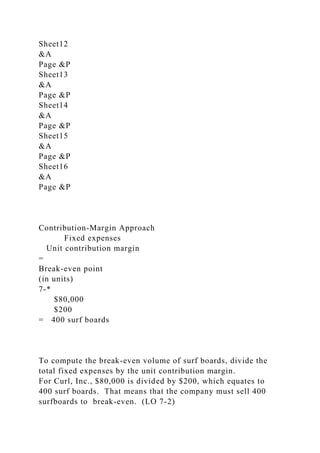

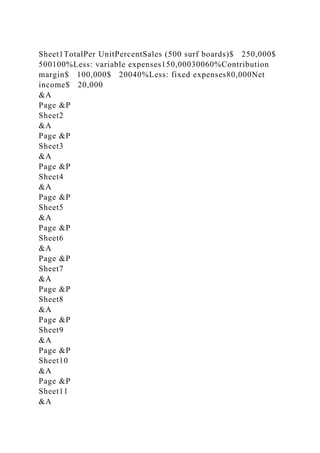

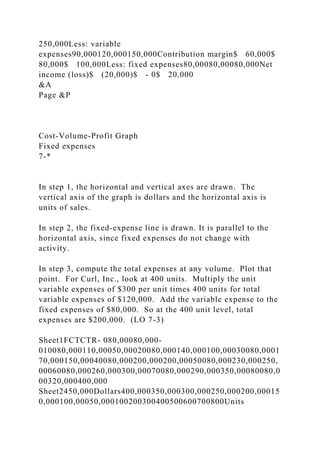

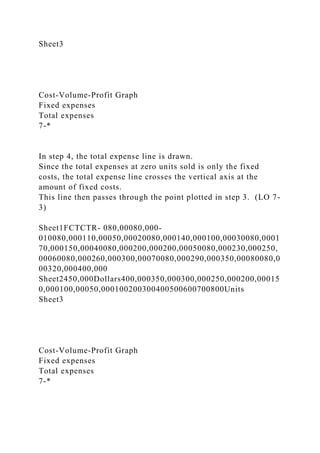

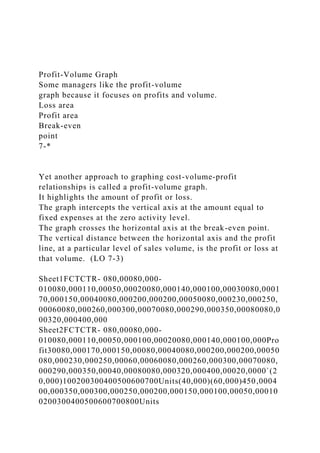

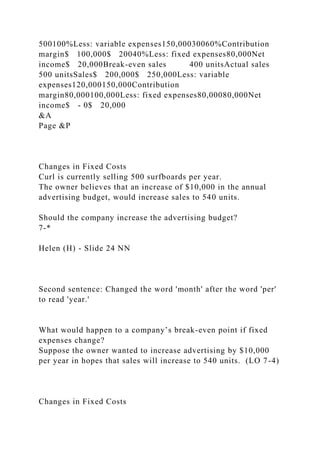

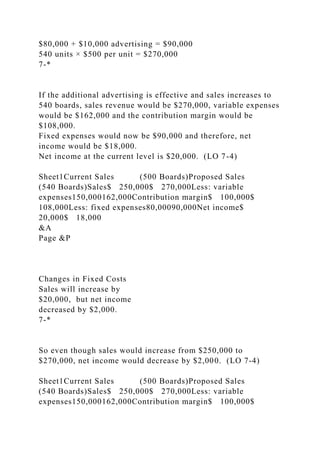

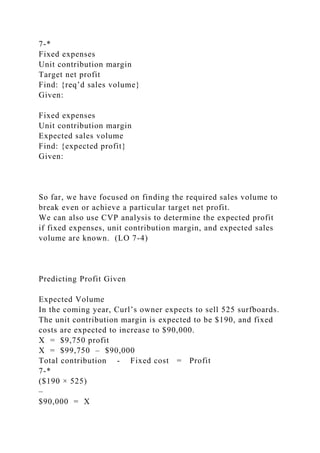

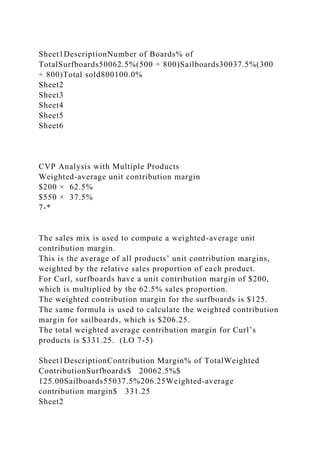

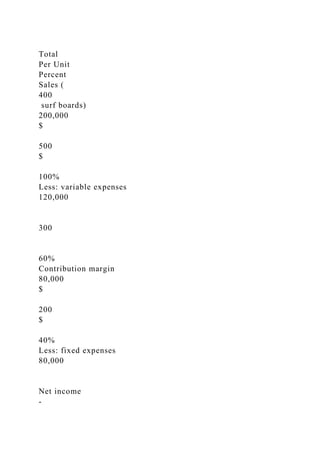

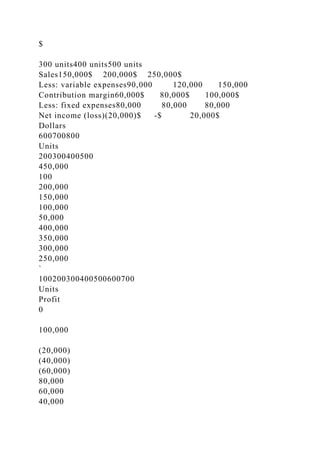

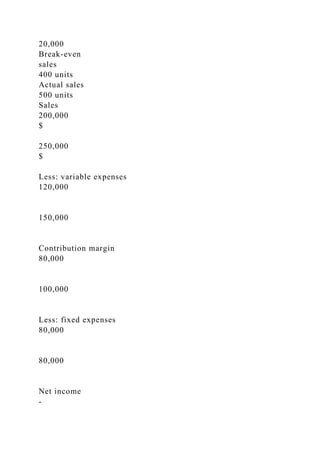

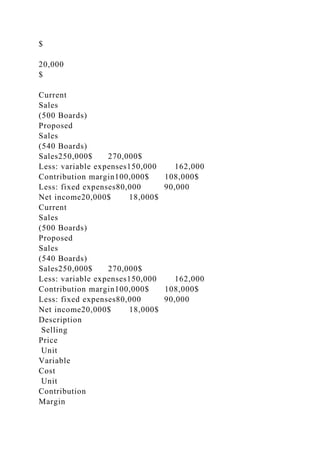

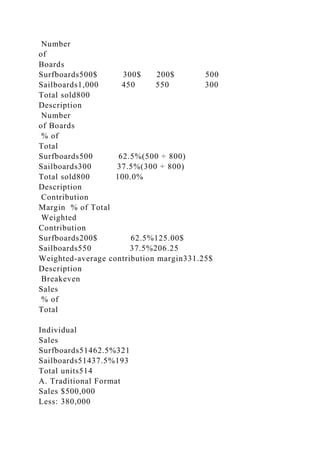

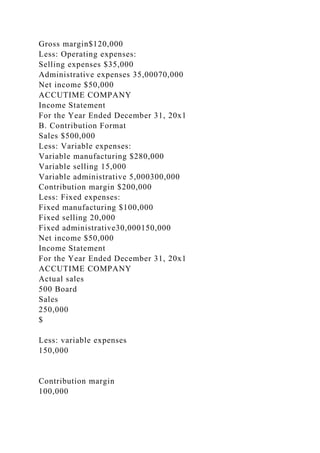

Chapter 7 of the document details cost-volume-profit (CVP) analysis, focusing on how to compute break-even points using both contribution-margin and equation approaches. It introduces key concepts such as fixed and variable expenses, total contribution margin, and the use of graphs to visualize the relationship between profit and activity level. Additionally, it discusses how changes in fixed/variable expenses and sales can impact overall profit.