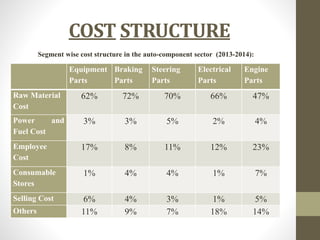

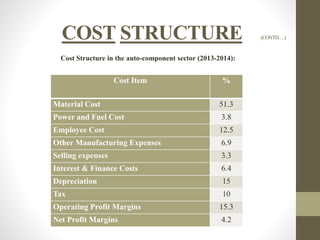

The document discusses the Indian automobile sector's significance, revealing its contribution of 22% to the country's manufacturing GDP. It highlights substantial growth in vehicle production and sales, particularly in the two-wheeler segment, along with substantial foreign direct investment. Key players, market trends, product variety, cost structures, and government regulations are also examined, indicating a cautiously optimistic outlook for the industry's future.