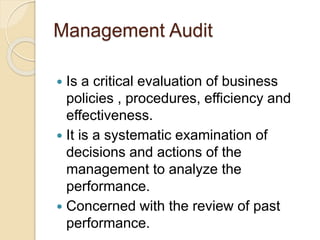

This document discusses various types of audits including financial audits, internal audits, cost audits, efficiency audits, and management audits. The main objectives of an audit are to determine the reliability of financial statements and accounting records, detect and prevent errors and frauds, and ensure adherence to accounting standards. Only chartered accountants are legally allowed to conduct audits in India according to the Companies Act of 1956. Internal audits verify ongoing operations while external audits provide independent oversight of financial reporting.