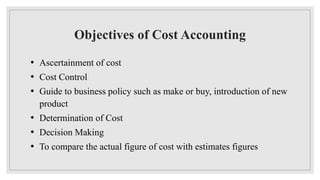

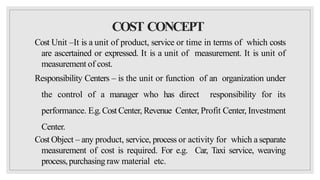

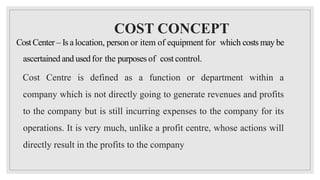

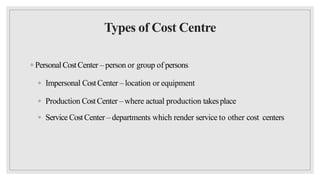

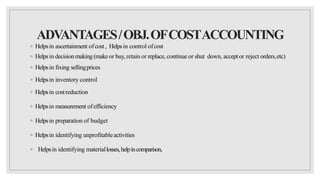

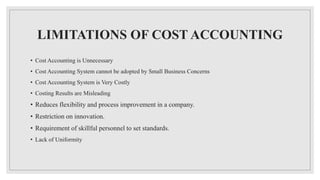

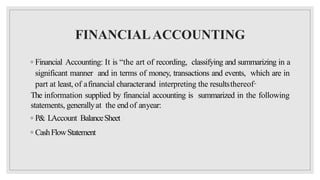

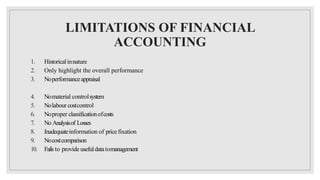

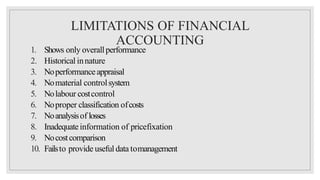

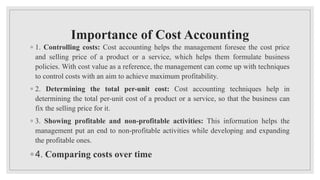

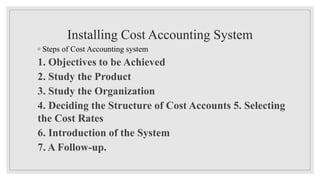

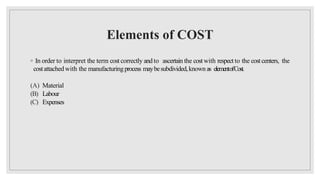

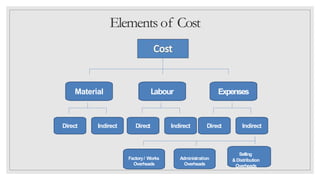

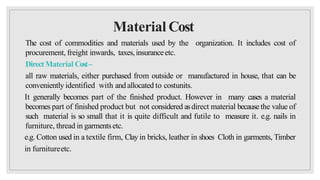

Cost accounting involves recording, classifying, and summarizing costs to determine the costs of products, services, or activities. It provides information to management for decision making, cost control, and reducing costs. Cost accounting determines unit costs by categorizing costs as direct materials, direct labor, and expenses. It helps identify profitable and unprofitable activities. Financial accounting only provides overall performance and is historical in nature, while cost accounting provides more detailed cost information and analysis to management.