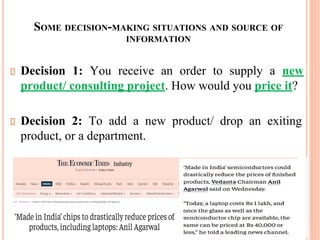

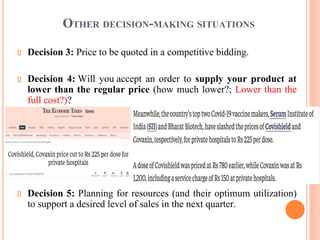

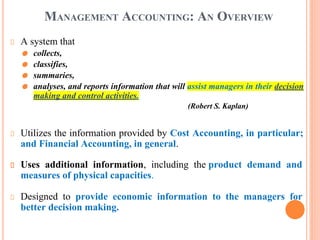

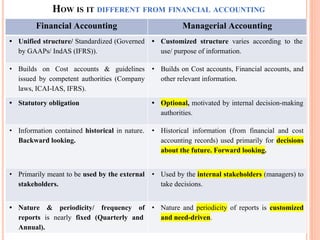

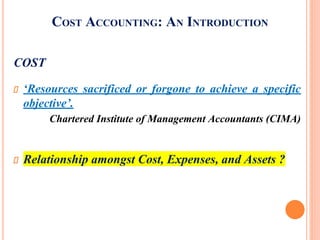

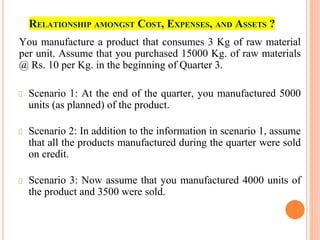

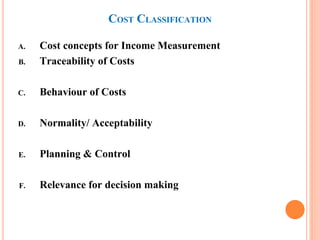

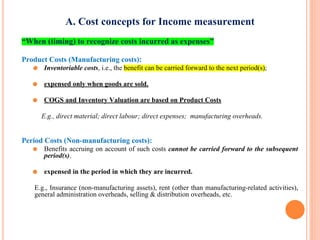

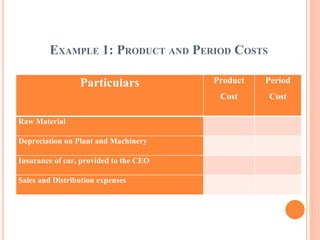

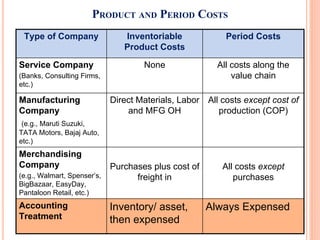

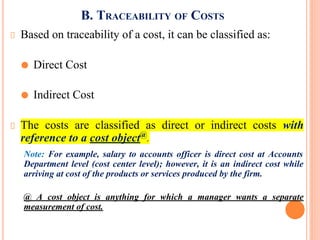

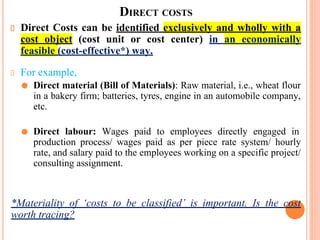

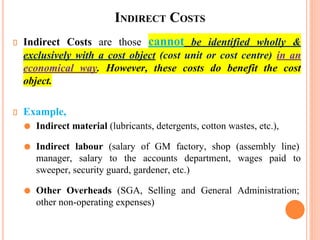

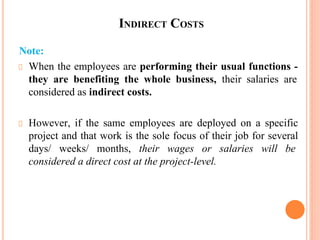

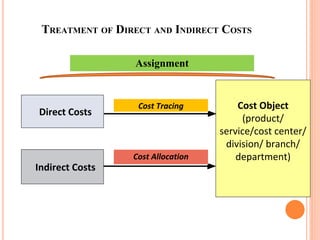

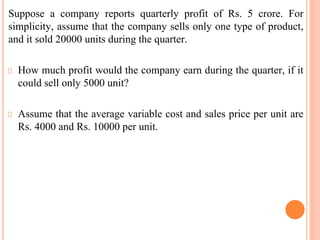

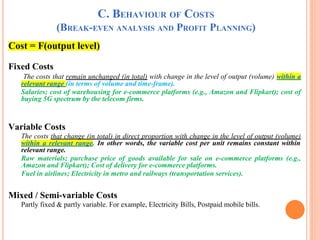

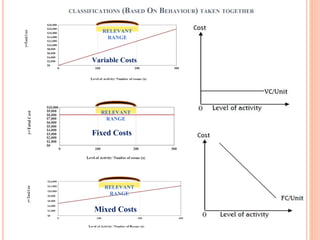

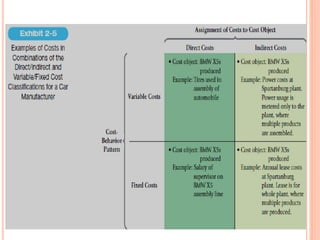

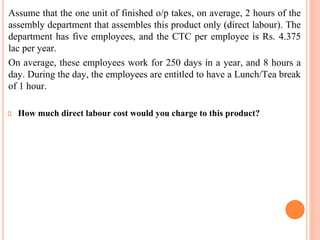

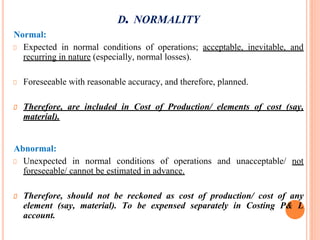

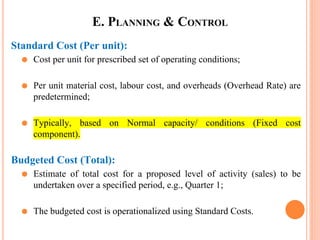

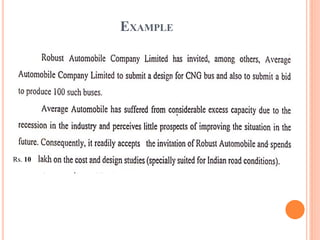

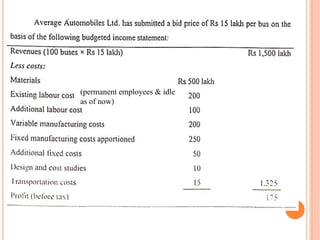

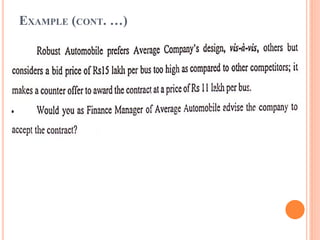

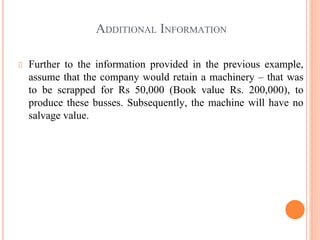

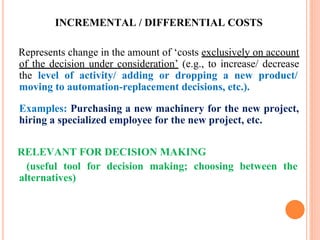

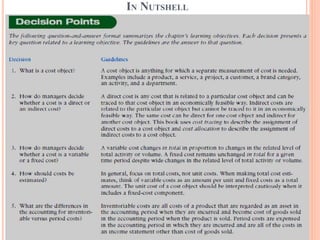

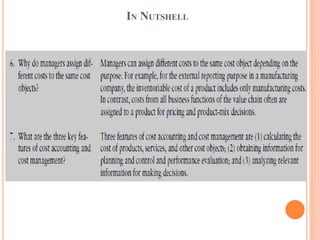

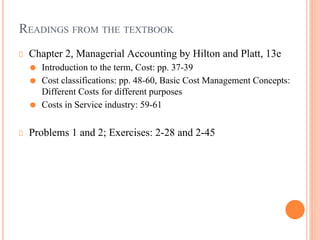

The document provides an overview of management accounting and cost accounting concepts, emphasizing the importance of cost classification for decision-making and resource allocation in businesses. It differentiates between management accounting and financial accounting, explaining their respective purposes, users, and reporting requirements. Various cost concepts such as direct and indirect costs, fixed and variable costs, and the relevance of these classifications for planning and control are discussed, along with examples and scenarios for better understanding.