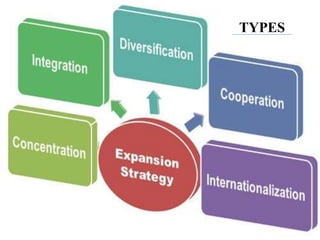

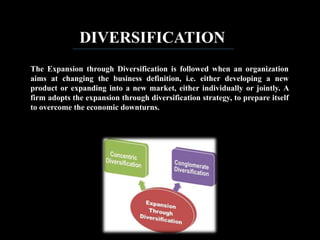

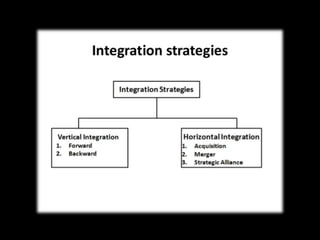

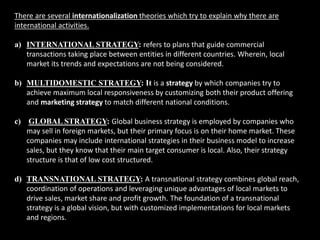

The document discusses various expansion strategies that a company can pursue for growth, including concentration, diversification, integration, cooperation, and internationalization. Concentration involves focusing resources on existing product lines or markets. Diversification means entering new product lines or industries, either related (concentric) or unrelated (conglomerate). Cooperation strategies involve strategic alliances, joint ventures, or equity partnerships with other companies. Internationalization refers to expanding into international markets. The document analyzes the types and approaches within each category of expansion strategy.