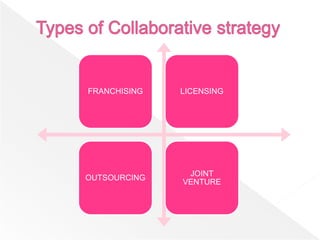

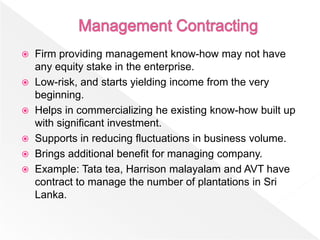

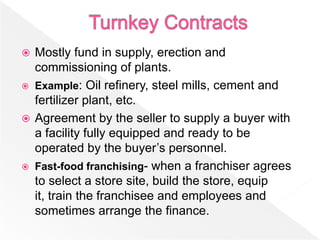

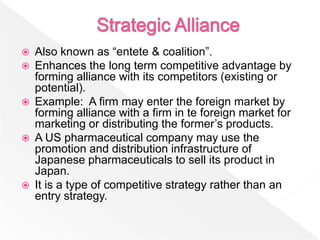

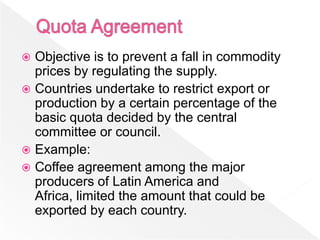

The document discusses various modes of international business collaboration such as outsourcing, turnkey contracts, franchising, licensing, and joint ventures. It also examines factors that influence collaboration between international firms like costs, core competencies, risks, capacities, and government policies. Finally, it provides examples of management contracting, technological alliances, and commodity agreements between countries.