Here are the key points from the information provided:

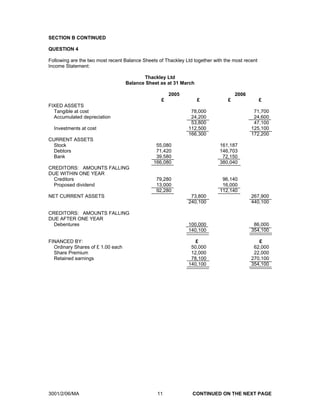

- Fixed assets have decreased due to depreciation exceeding additions

- Investments have increased

- Stock, debtors and bank have all increased significantly indicating higher activity levels

- Creditors have increased in line with higher activity

- Net current assets have increased substantially

- Retained earnings have increased substantially, indicating good profitability

- Share capital and share premium have increased due to a rights issue

So in summary, the company appears to be growing its operations and investments, experiencing higher activity levels and improving profitability based on the increase in retained earnings. The rights issue also indicates they are financing this growth internally for now. Overall the financial position of the company appears stronger based

![MODEL ANSWER TO QUESTION 5

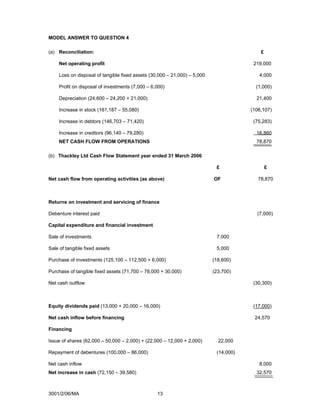

(a) Goodwill on the acquisition of Goole Ltd £

Goodwill at 31 December 2004 (1/5) 18,000

Goodwill written off (4 x 18,000) 72,000

∴ Goodwill on acquisition 90,000

(b) Total net profit of Goole Ltd since acquisition £

Minority interest -

Share capital (20% x 20,000) 4,000

Retained earnings (R) 20,000

24,000

Retained earnings at 31 December 2004 (5 x 20,000) 100,000

Retained earnings at 1 January 2001 36,000

∴ Total net profits since acquisition 64,000

(c) Retained earnings of Pickering Ltd at 31 December 2004 £

Retained earnings as per Balance Sheet 176,300

LESS: Group share of Goole Ltd’s profits (0.80 x 64,000) 51,200

125,100

ADD: Goodwill written off 72,000

∴ Retained earnings of Pickering Ltd 197,100

(d) Goodwill on the acquisition of Maltby Ltd £

Goodwill attributable to Goole Ltd NIL

∴ Goodwill attributable to Maltby Ltd (4/5) 46,000

Goodwill written off (0.25 x 46,000) 11,500

∴Goodwill on acquisition 57,500

(e) Net profit of Maltby Ltd since acquisition £

Minority interest -

Share Capital Goole Ltd (20% x 20,000) 4,000

Share Capital Maltby Ltd (30% x 4,000) 1,200

Retained earnings Goole Ltd [20,000 + (20% x 10,500)] 22,100

Retained earnings Maltby Ltd (R) 10,500

37,800

Retained earnings at 31 December 2005 (10,500 x 10/3) 35,000

Retained earnings at 1 January 2005 16,000

∴ Net profit of Maltby Ltd - year to 31 December 2005 19,000

3001/2/06/MA 16](https://image.slidesharecdn.com/47246781-2006-lcci-level-3-series-2answer-120418031555-phpapp02/85/47246781-2006-lcci-level-3-series-2-answer-16-320.jpg)