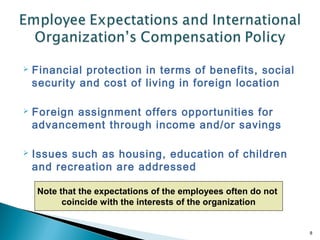

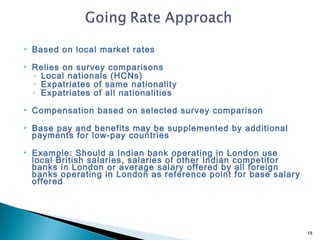

1) The document discusses factors that organizations must consider when developing an international compensation policy, including employment laws, economic conditions, and attracting and retaining qualified staff.

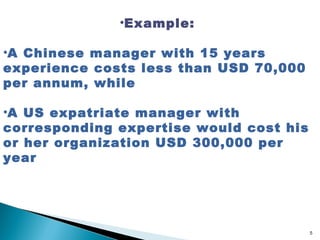

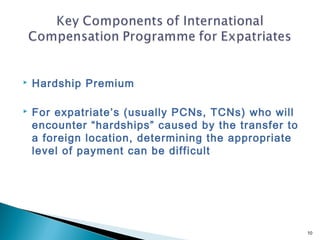

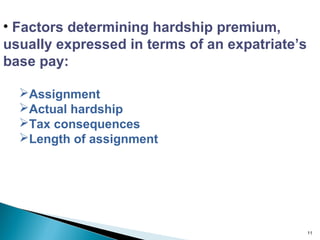

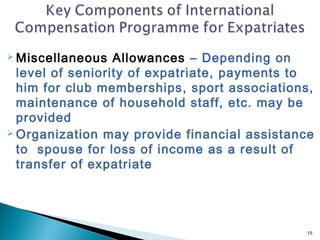

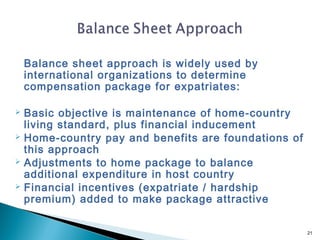

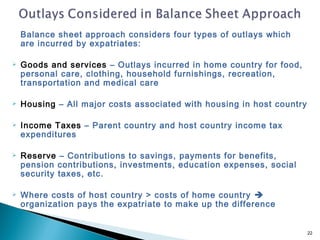

2) Expatriate costs are typically much higher than local employees due to allowances for housing, taxes, and other expenses associated with living abroad.

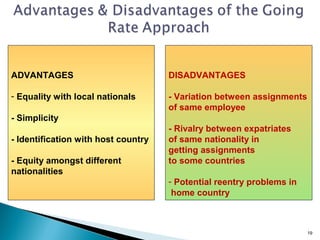

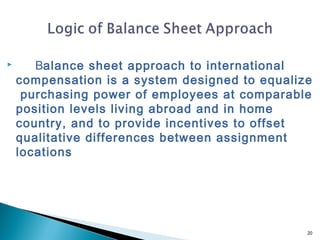

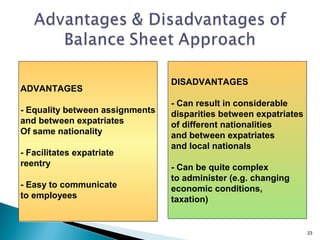

3) Effective compensation policies balance maintaining purchasing power for expatriates with incentives, equity between employees, and ease of administration across different locations.