The document discusses four approaches to international compensation:

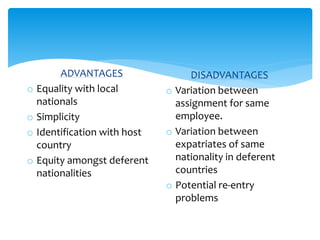

1. The going rate approach links expatriate pay to local market salaries in the host country. It aims to treat expatriates as local citizens. Advantages include equality with locals, simplicity, and host country identification, while disadvantages include pay variations and potential re-entry problems.

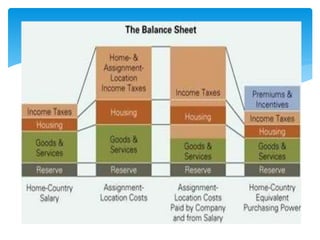

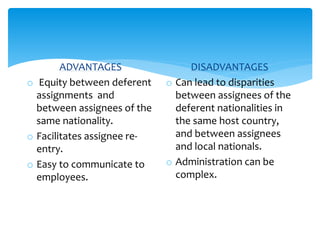

2. The balance sheet approach equalizes costs between international assignments and home country roles. It protects expatriates from financial impacts of living abroad. Advantages include equity and facilitating re-entry, while disadvantages include potential pay disparities versus locals.

3. The international citizen's approach uses a standard basket of goods to determine pay worldwide, rather than adjusting pay to perfectly match local costs.