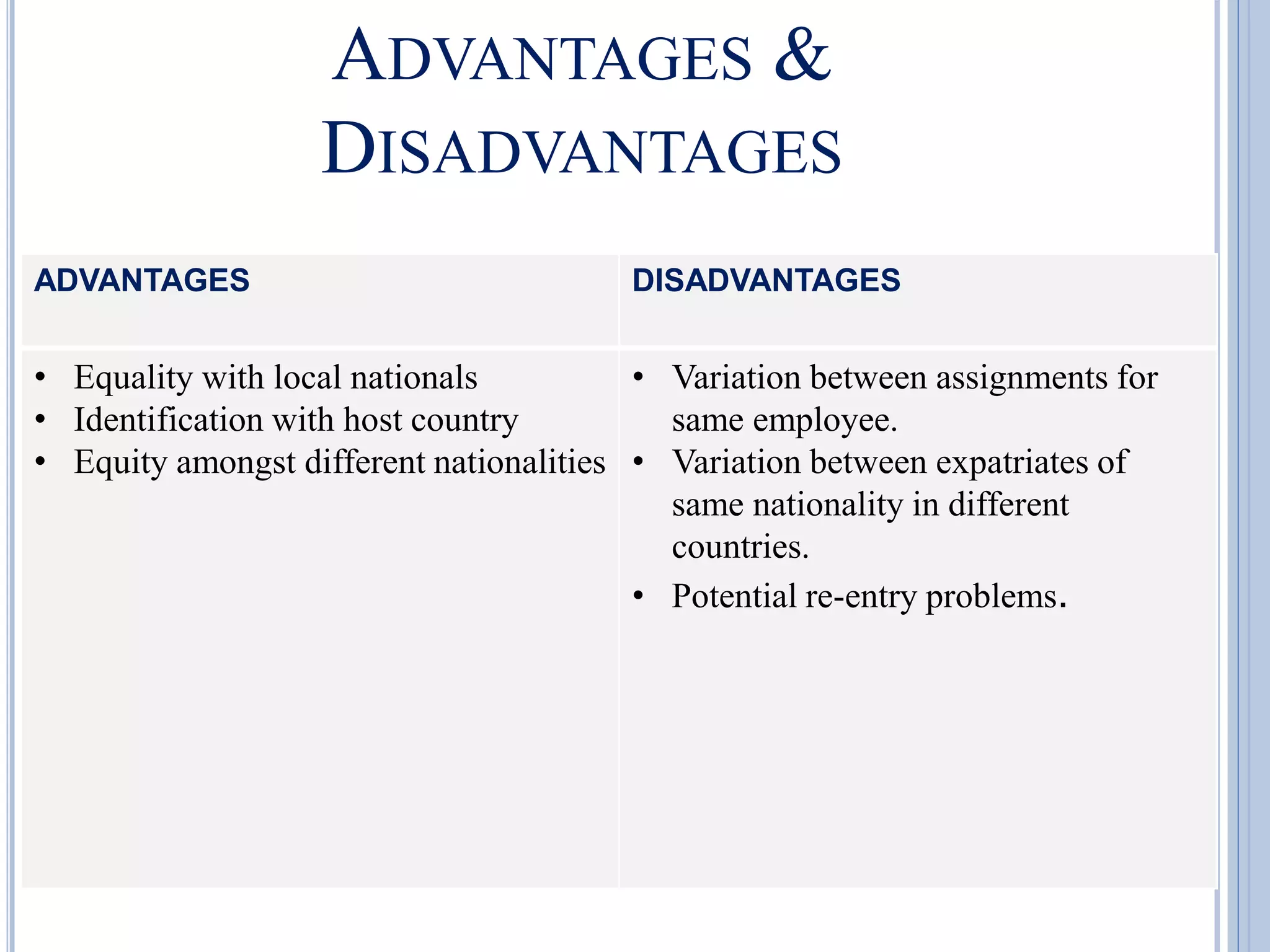

The document provides an overview of international compensation, detailing its definition, objectives, components, and two primary approaches: the going rate and balance sheet approaches. It emphasizes the significance of compensation in attracting and retaining talent within multinational corporations, highlighting both monetary and non-monetary benefits. Key components include base salary, allowances for hardship, cost of living adjustments, and support for expatriate families.