1. The Absolute Income Hypothesis developed by Keynes states that aggregate consumption is a linear or non-linear function of current disposable income. Consumption increases but by less than the increase in income. In the short run the relationship is non-proportional, but in the long run it becomes proportional.

2. The Relative Income Hypothesis by Duesenberry holds that consumption depends on relative income compared to others rather than absolute income. People attempt to keep up with their neighbors and consumption patterns are interdependent. The past peak income also influences current consumption.

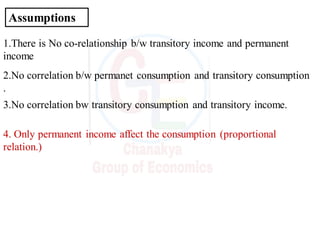

3. Milton Friedman's Permanent Income Hypothesis argues that consumption depends on permanent rather than current income. Income has permanent and transitory components