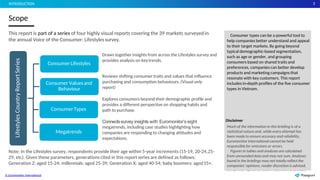

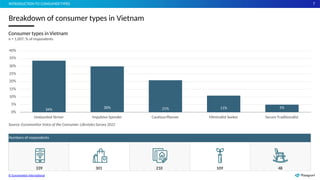

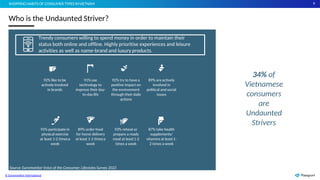

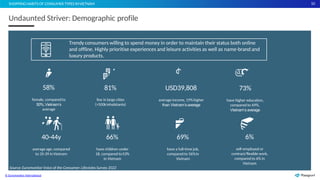

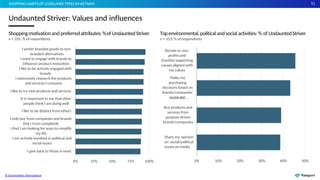

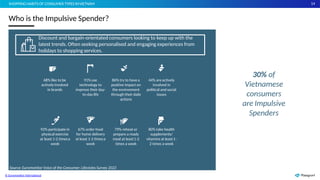

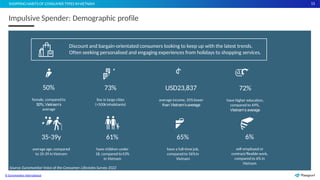

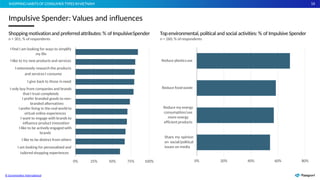

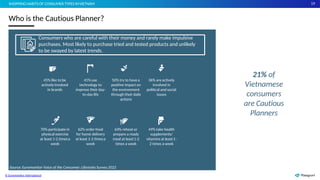

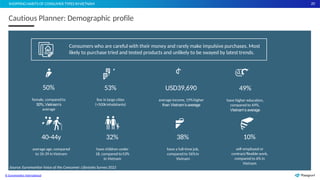

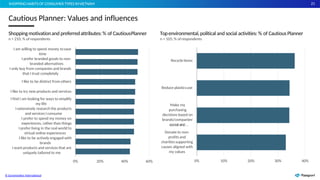

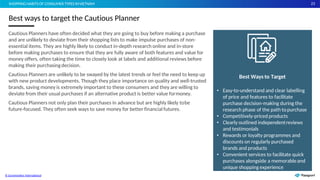

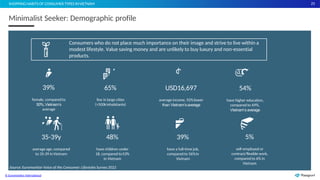

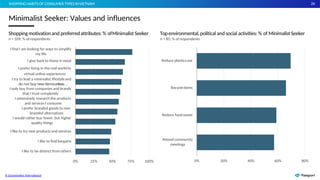

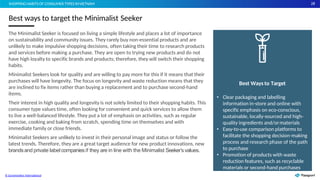

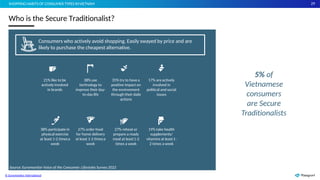

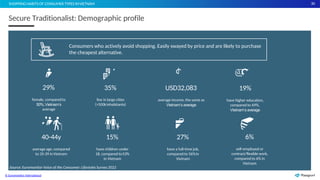

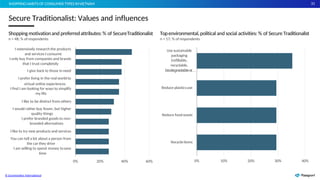

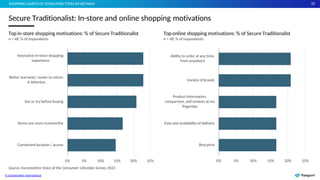

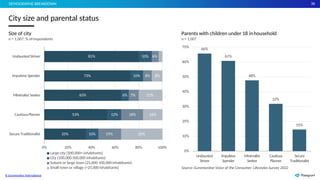

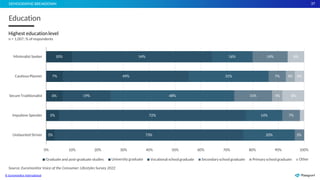

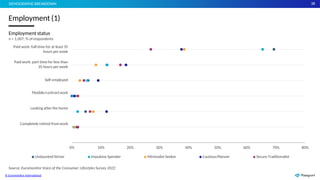

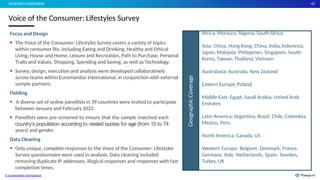

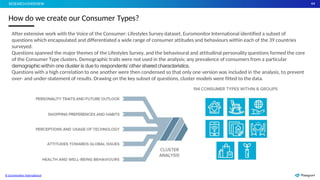

The document provides an overview of consumer types in Vietnam based on a survey conducted by Euromonitor International in 2022. It identifies the five main consumer types in Vietnam and their respective proportions of the population. The largest group is the Undaunted Striver, making up 34% of respondents. The document then profiles each consumer type in more detail, providing their demographic characteristics, values, shopping motivations, and preferences. It also outlines the best ways for companies to target each consumer type to appeal to their traits and develop resonant marketing campaigns. The profiles are intended to help companies better understand their target markets in Vietnam beyond typical demographics.