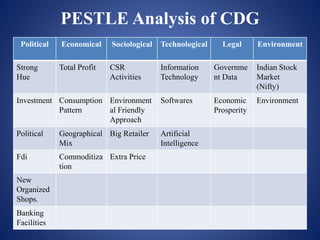

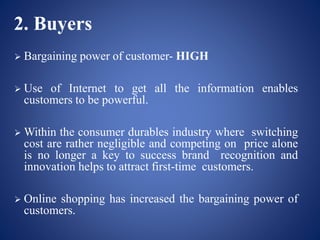

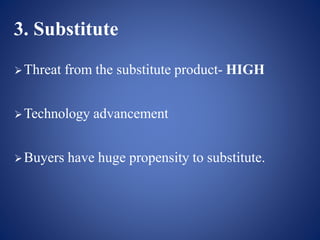

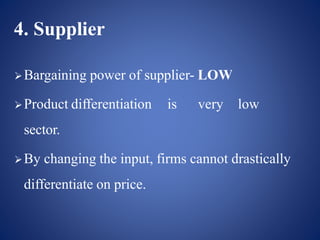

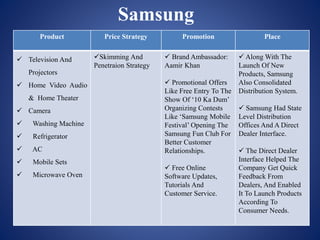

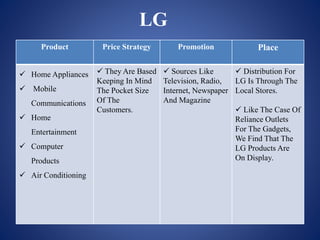

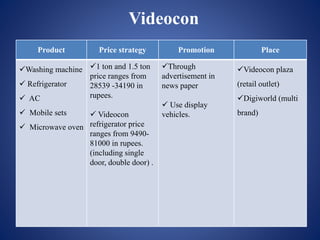

The document provides an overview of the consumer durable goods industry in India. It discusses key segments like white goods, brown goods, and consumer electronics. Some of the major players in the industry are Sony, Samsung, Whirlpool, LG, and Videocon. Their product portfolios and marketing strategies are briefly outlined. The industry is growing at around 10% annually due to rising incomes and availability of financing. However, competition is intense and bargaining power of customers is high due to online shopping and price transparency.