The document summarizes key concepts related to consumer demand, including:

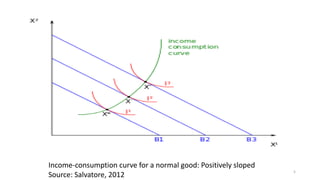

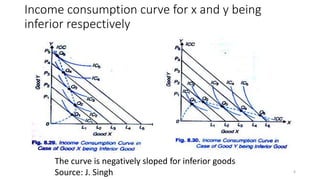

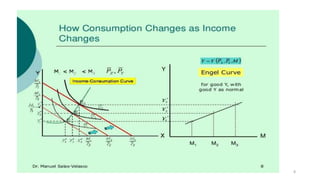

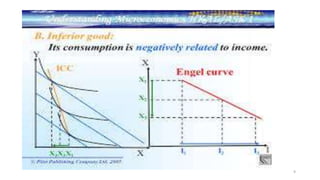

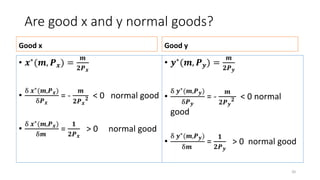

1. The income-consumption curve shows how consumption of goods changes as income increases, holding prices constant. It is positively sloped for normal goods and negatively sloped for inferior goods.

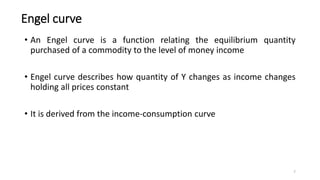

2. The Engel curve relates the quantity purchased of a good to income levels, holding other factors constant. It is derived from the income-consumption curve.

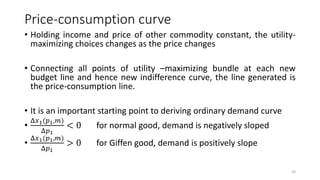

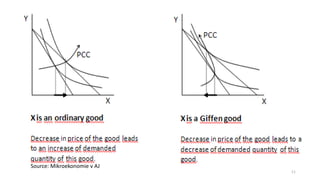

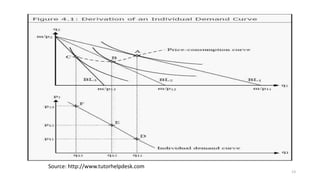

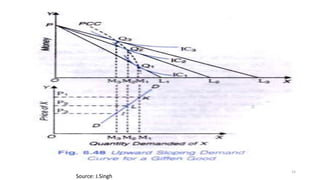

3. The price-consumption curve shows how consumption changes as the price of a good changes, holding income and other prices constant. It is negatively sloped for normal goods and positively sloped for Giffen goods.

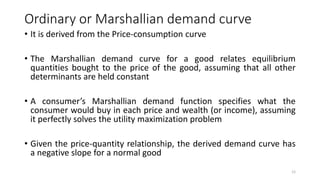

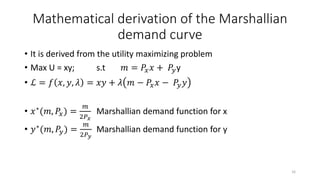

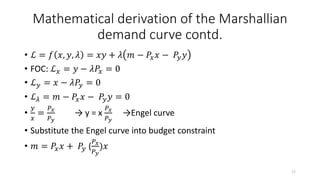

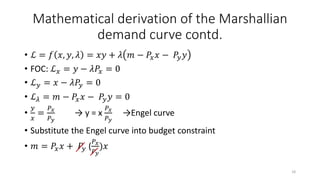

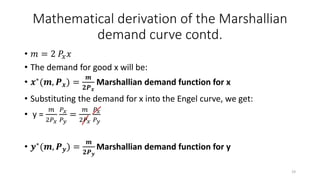

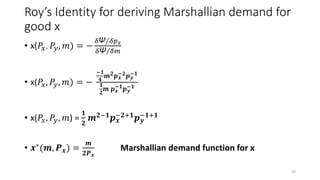

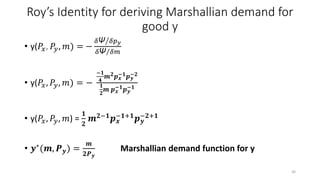

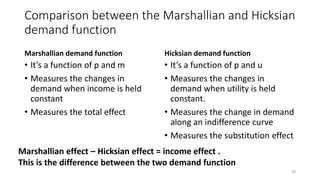

4. The Marshallian demand curve relates the quantity demanded of