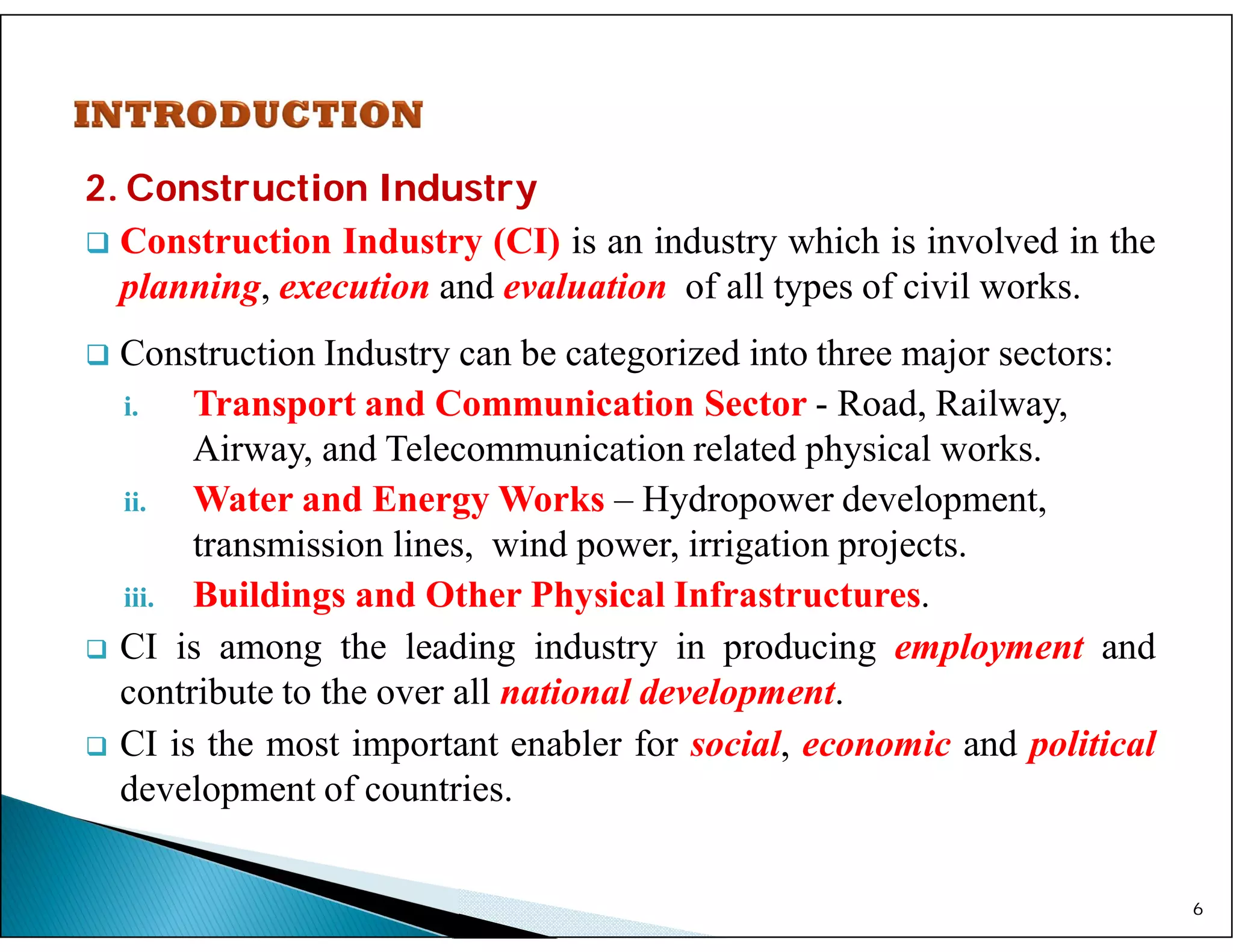

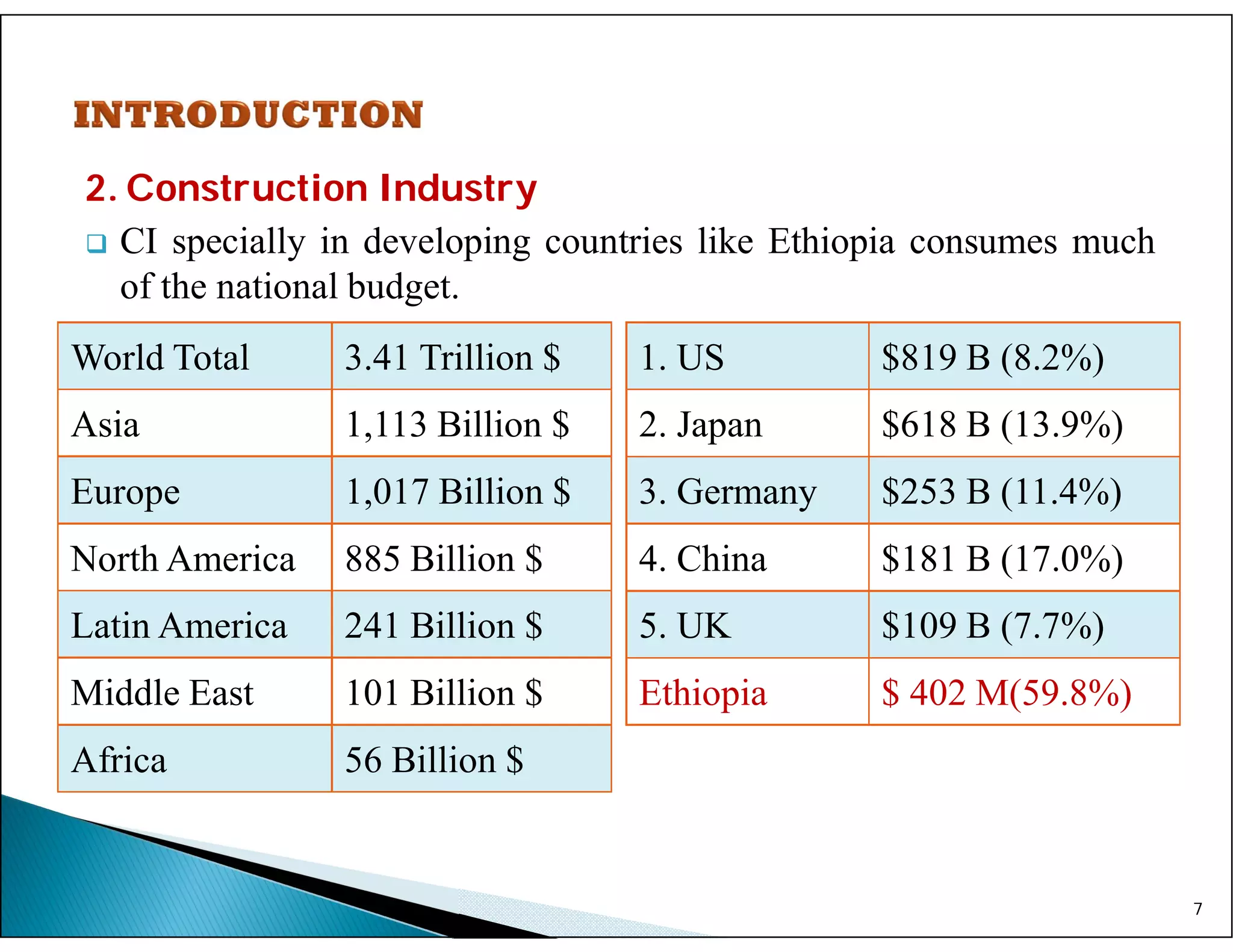

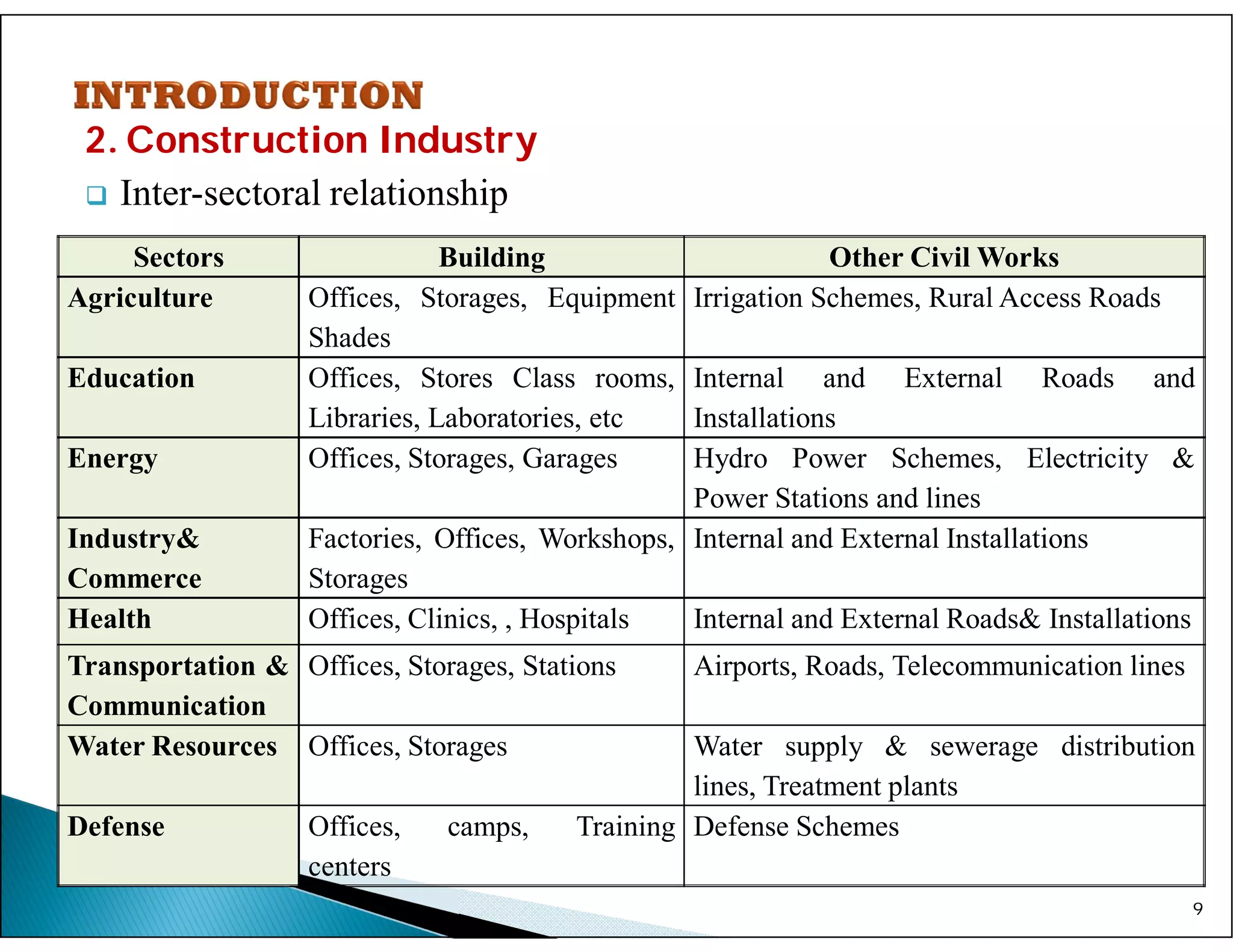

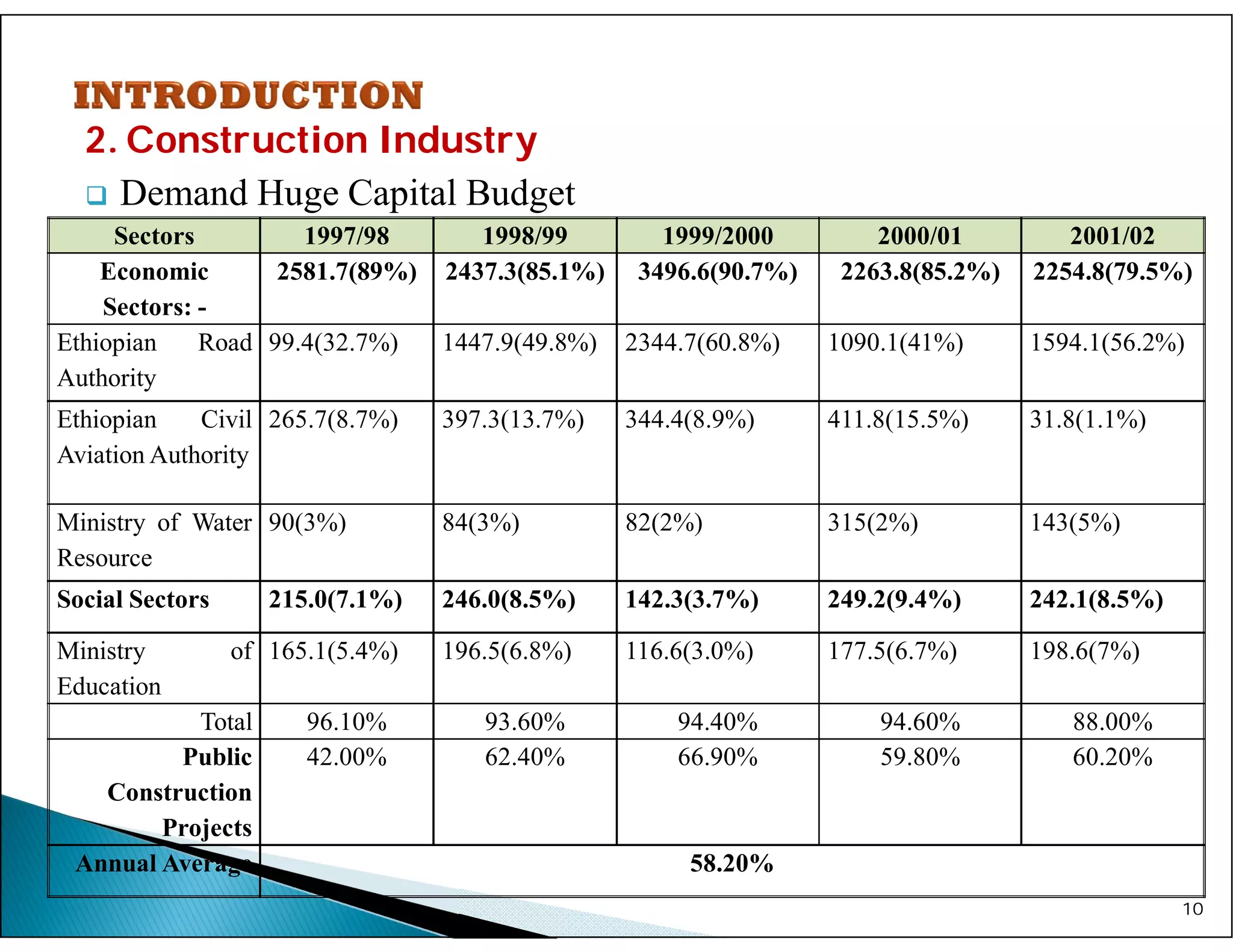

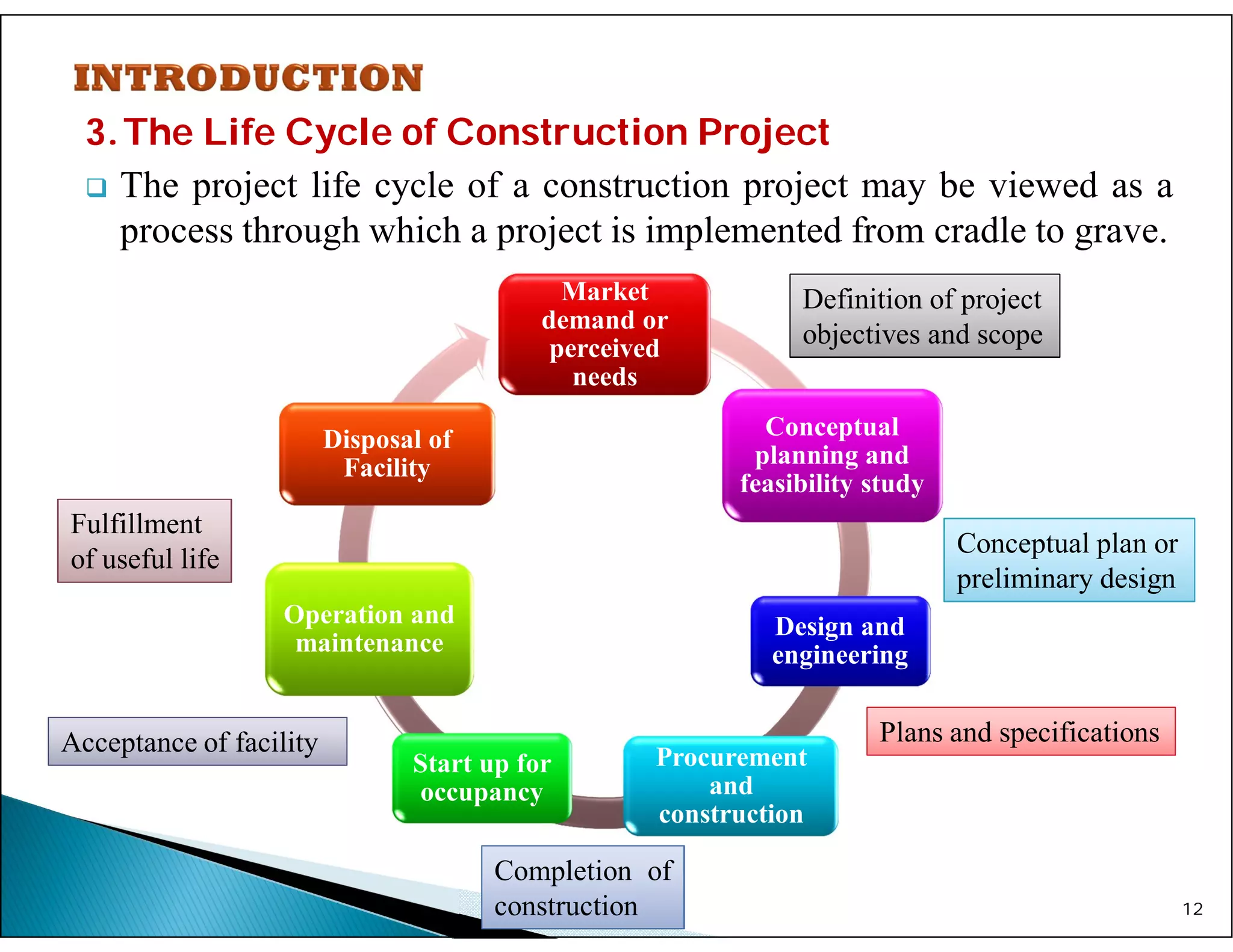

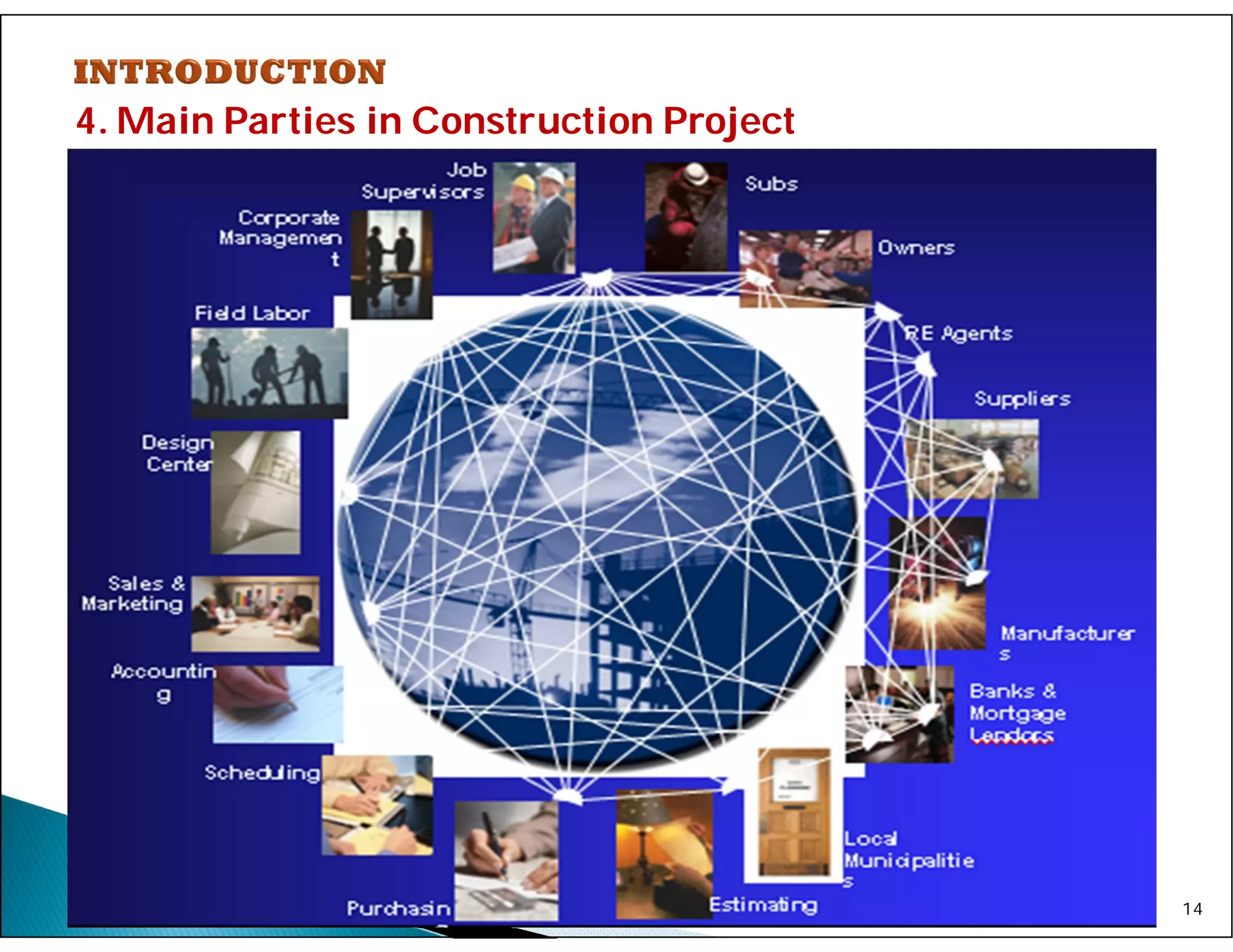

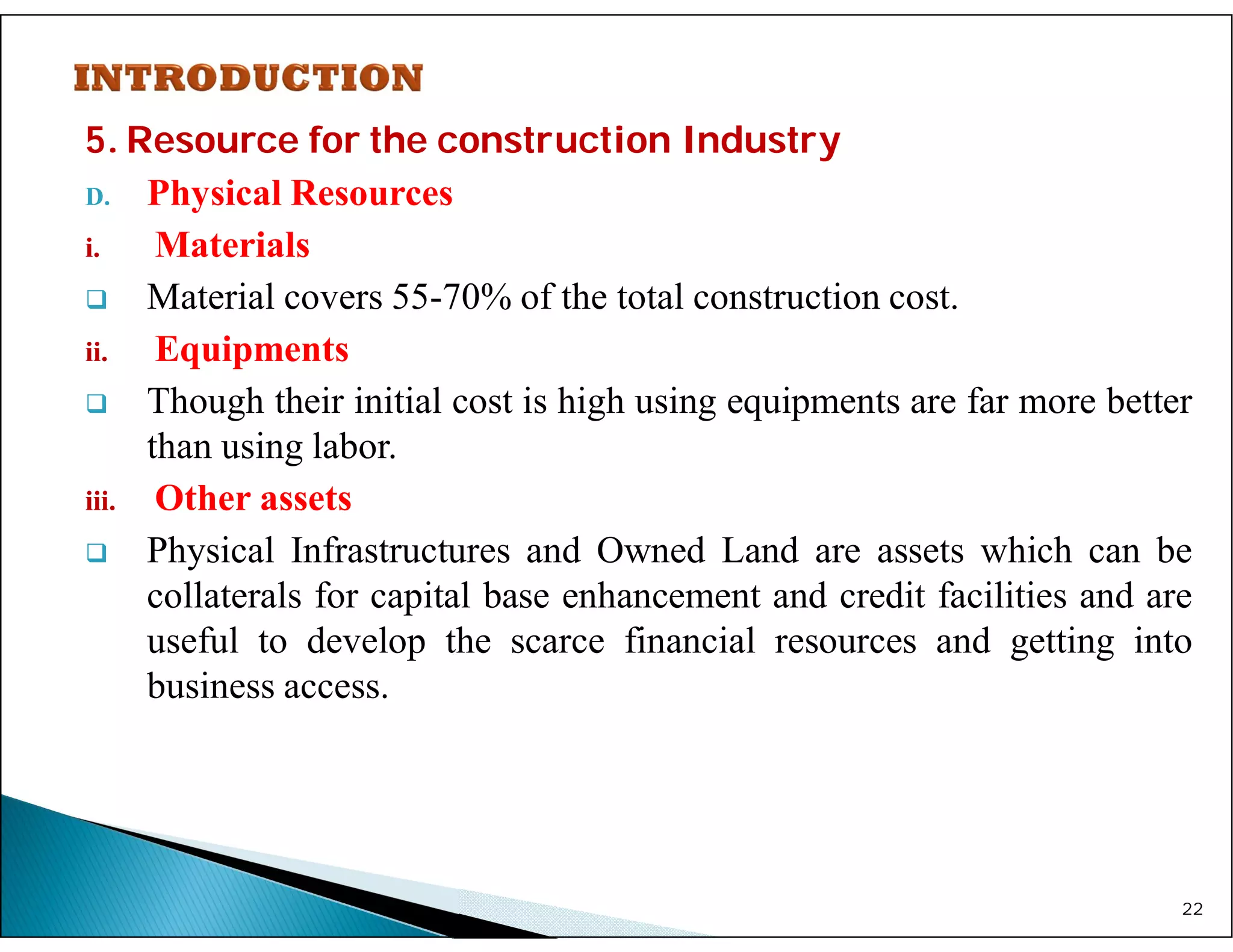

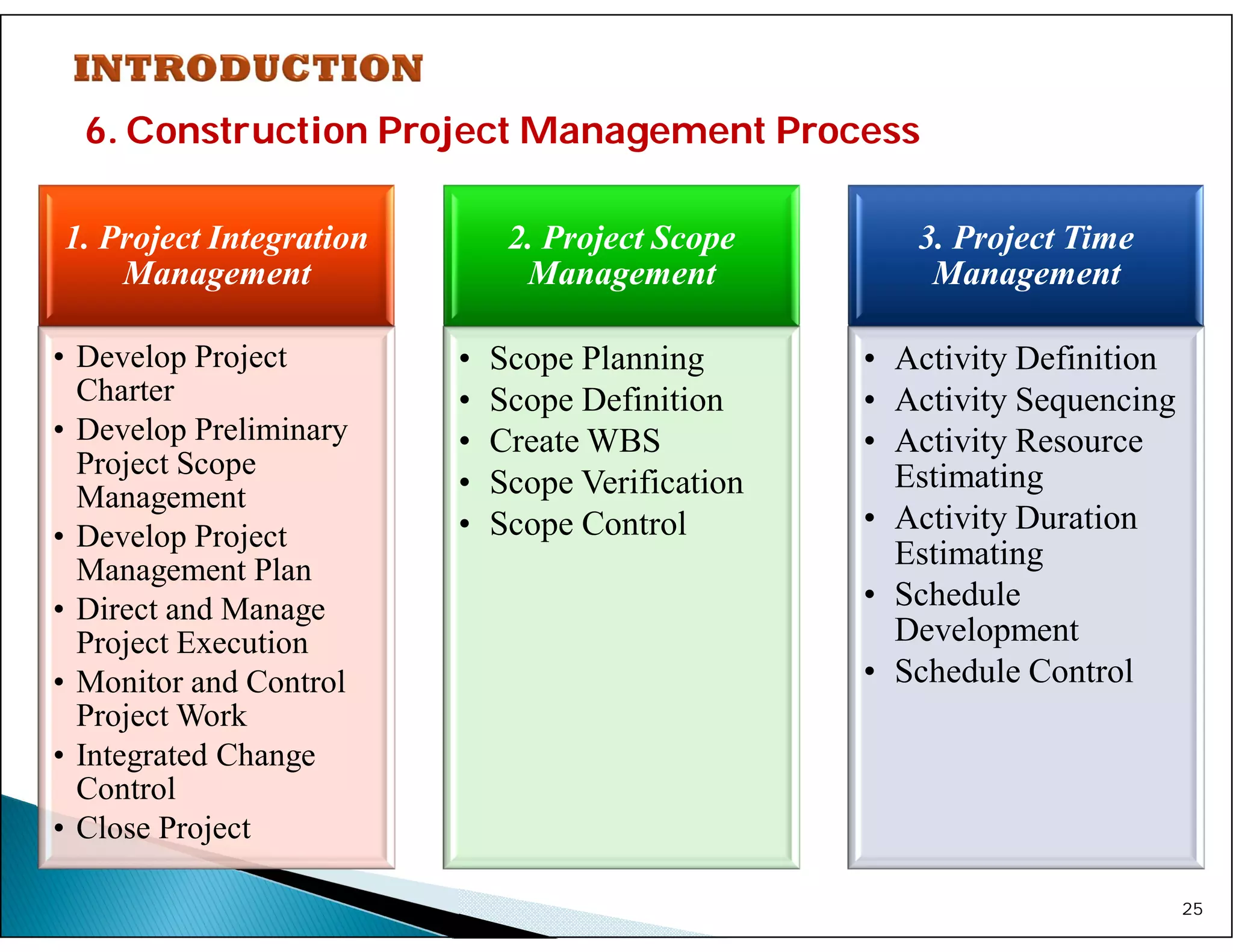

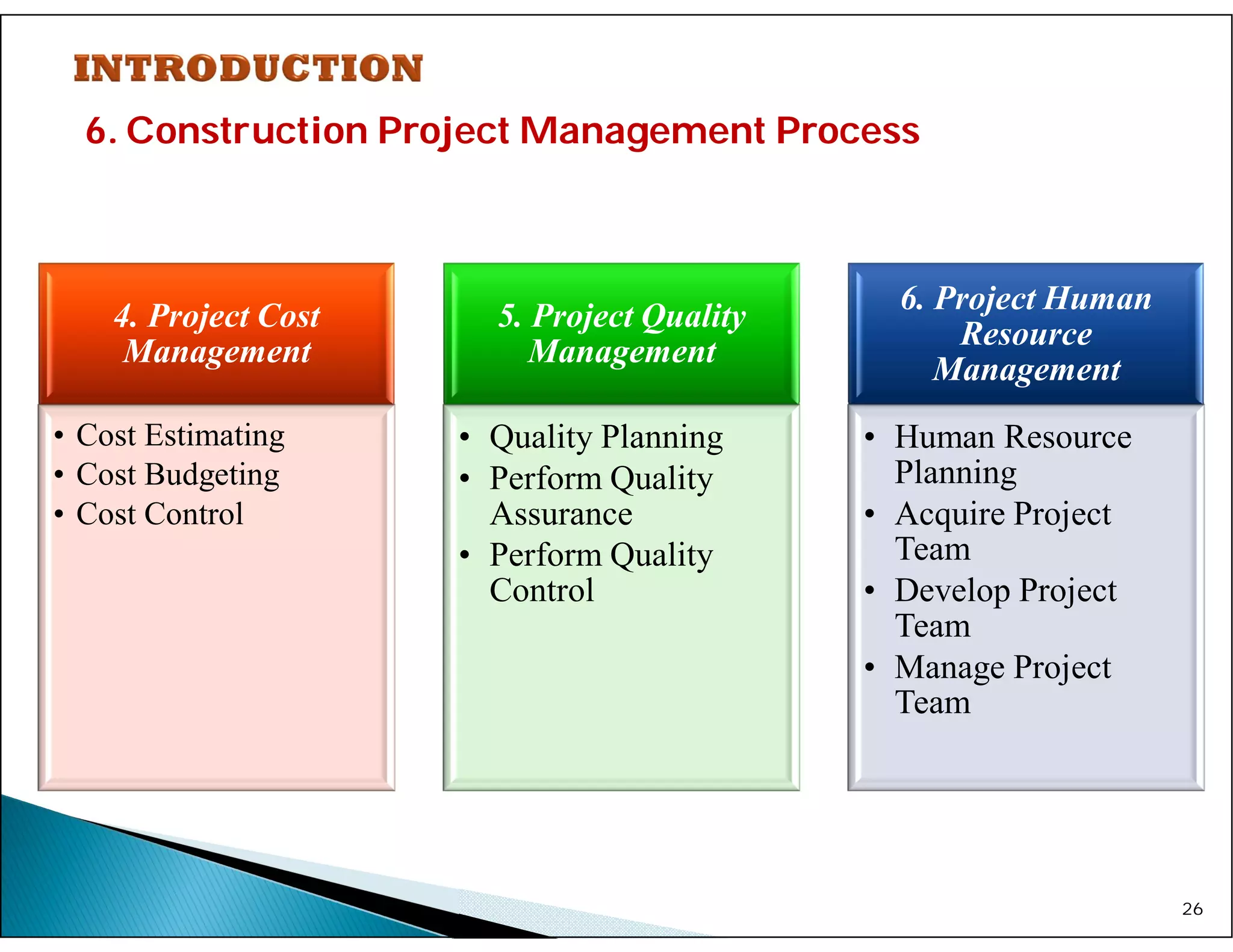

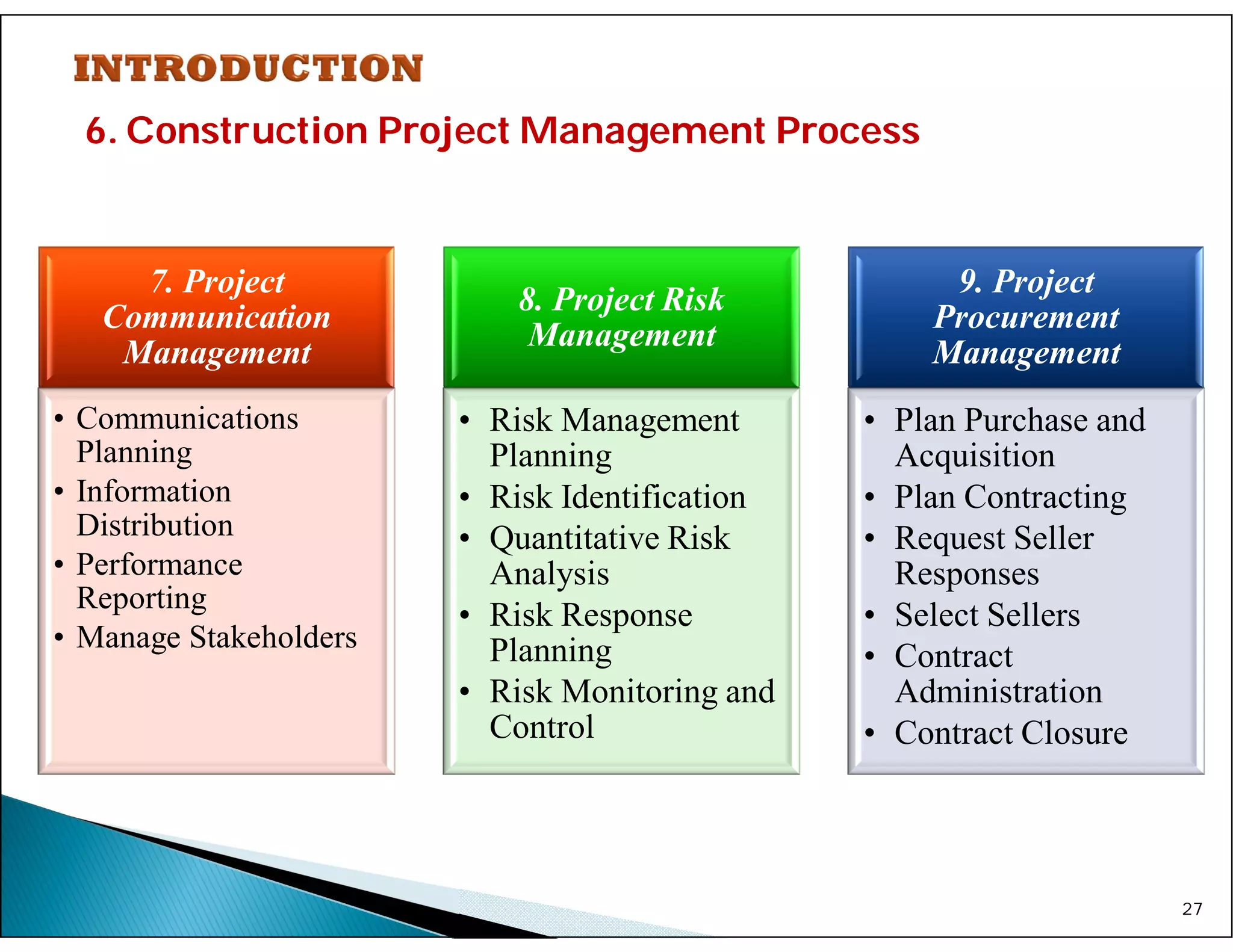

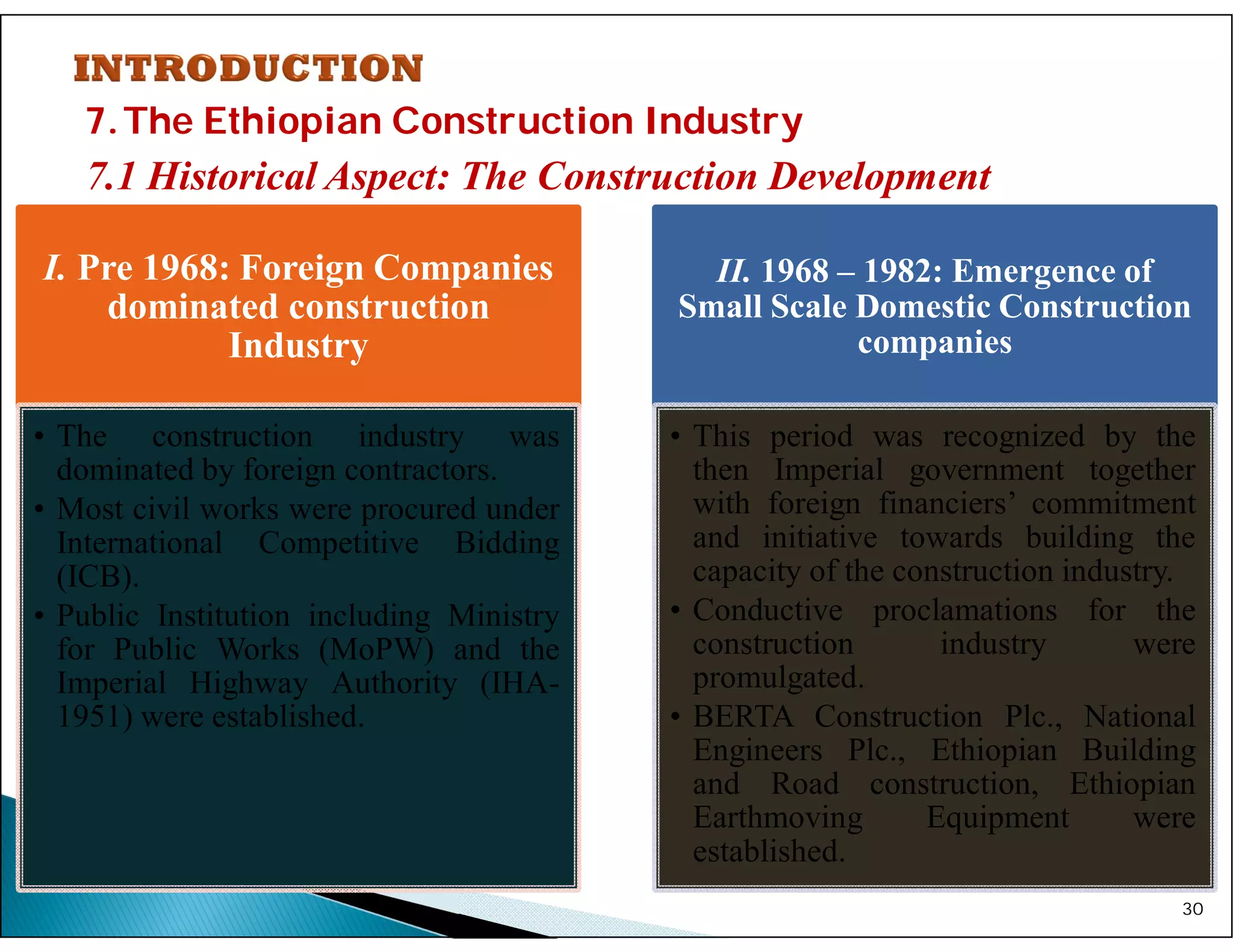

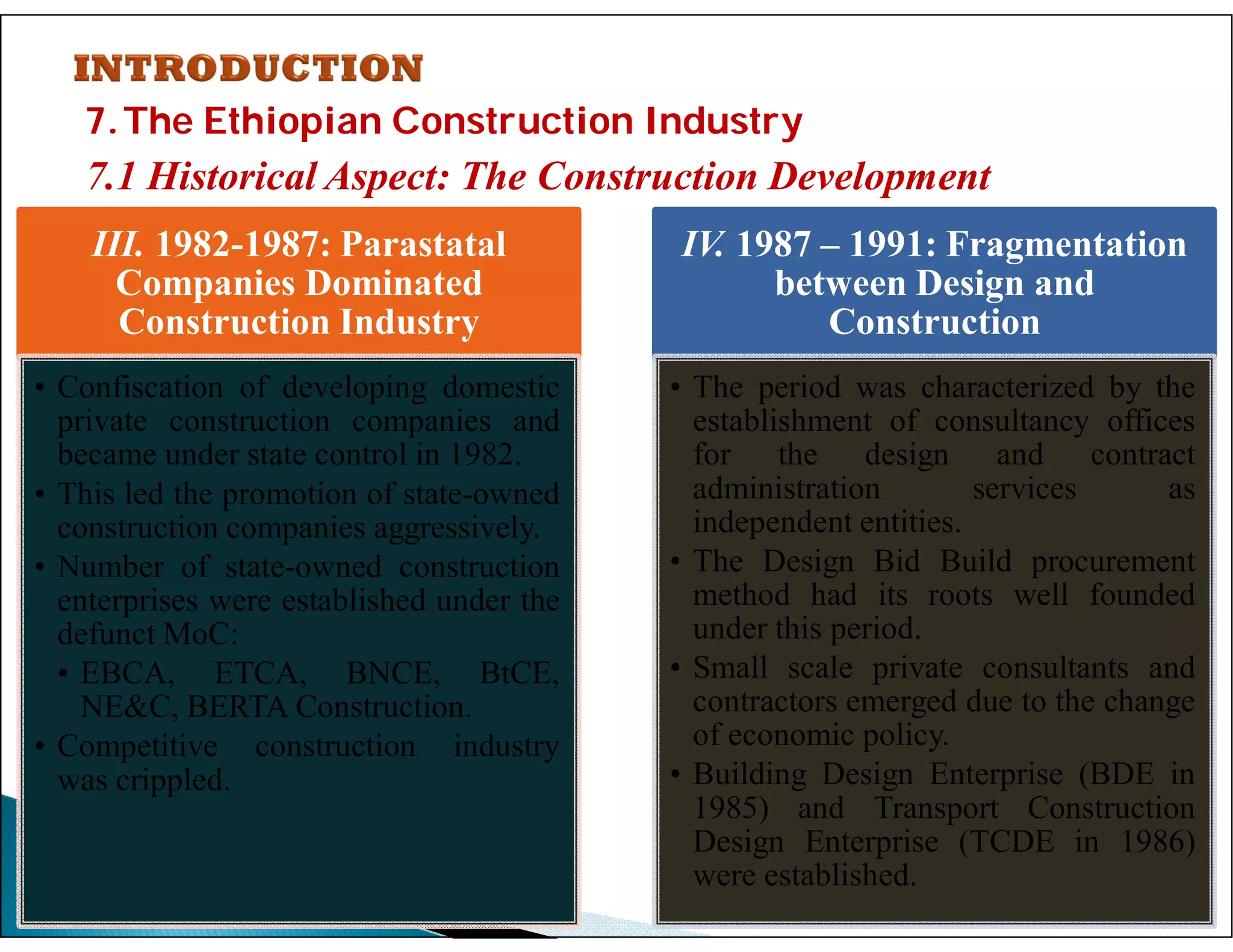

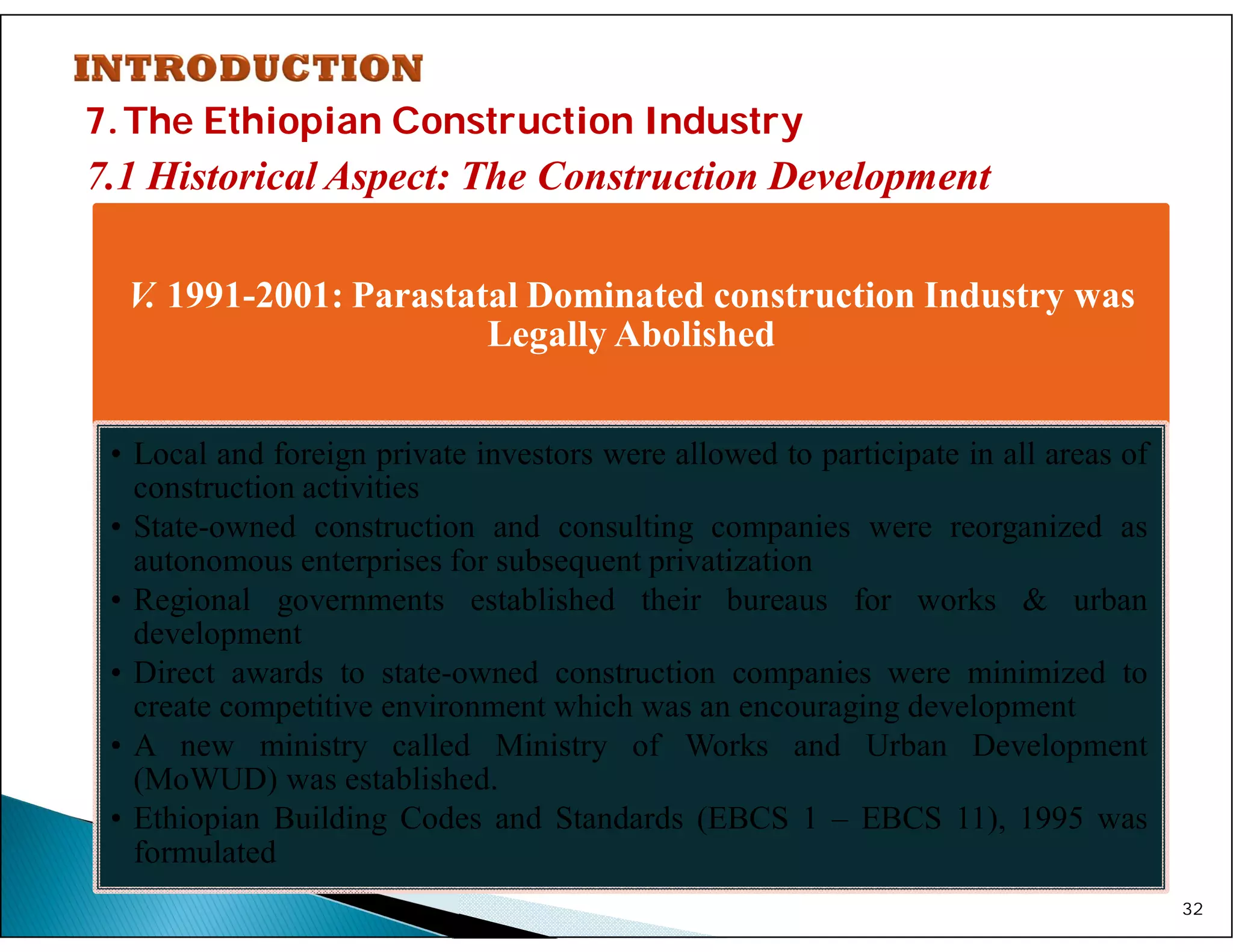

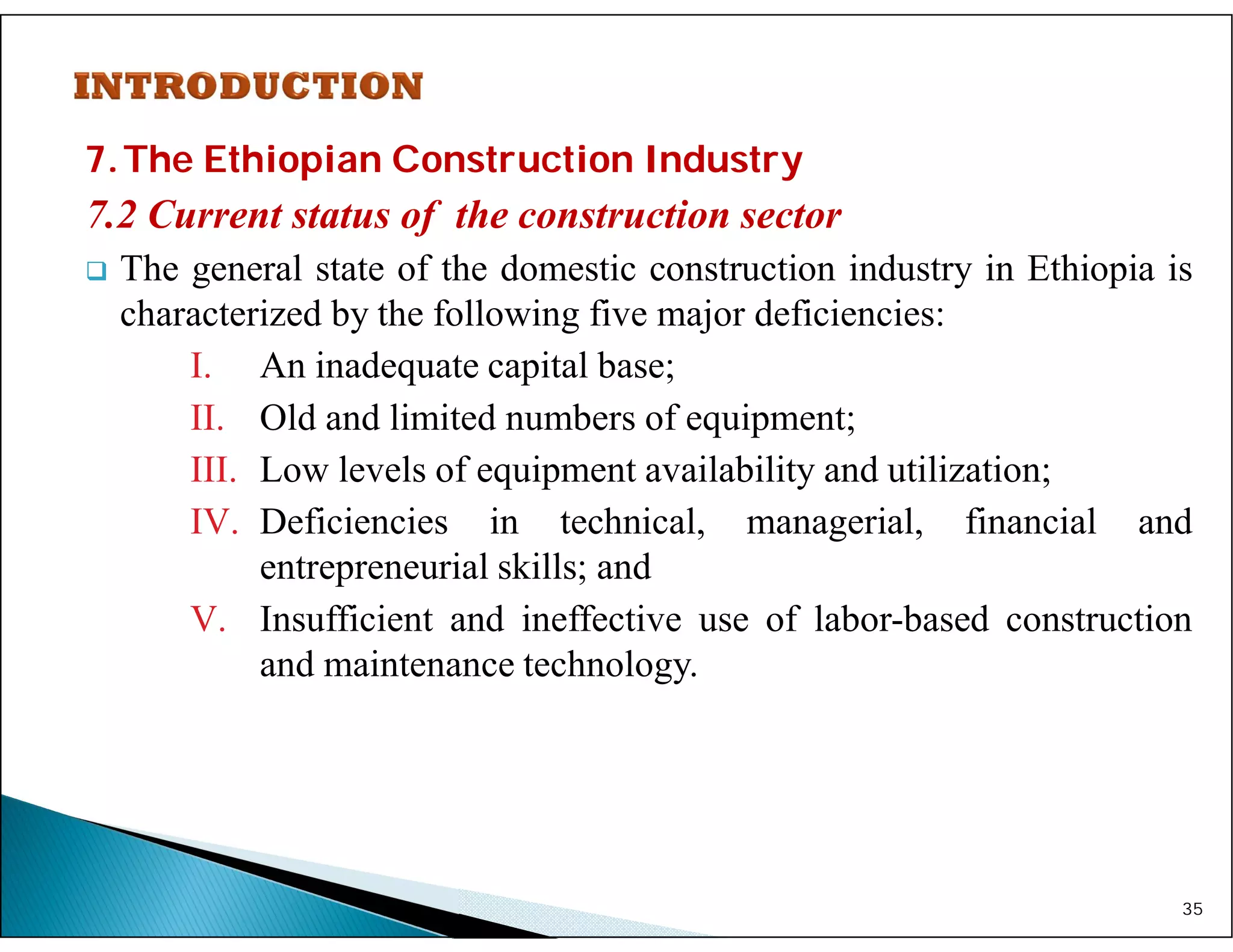

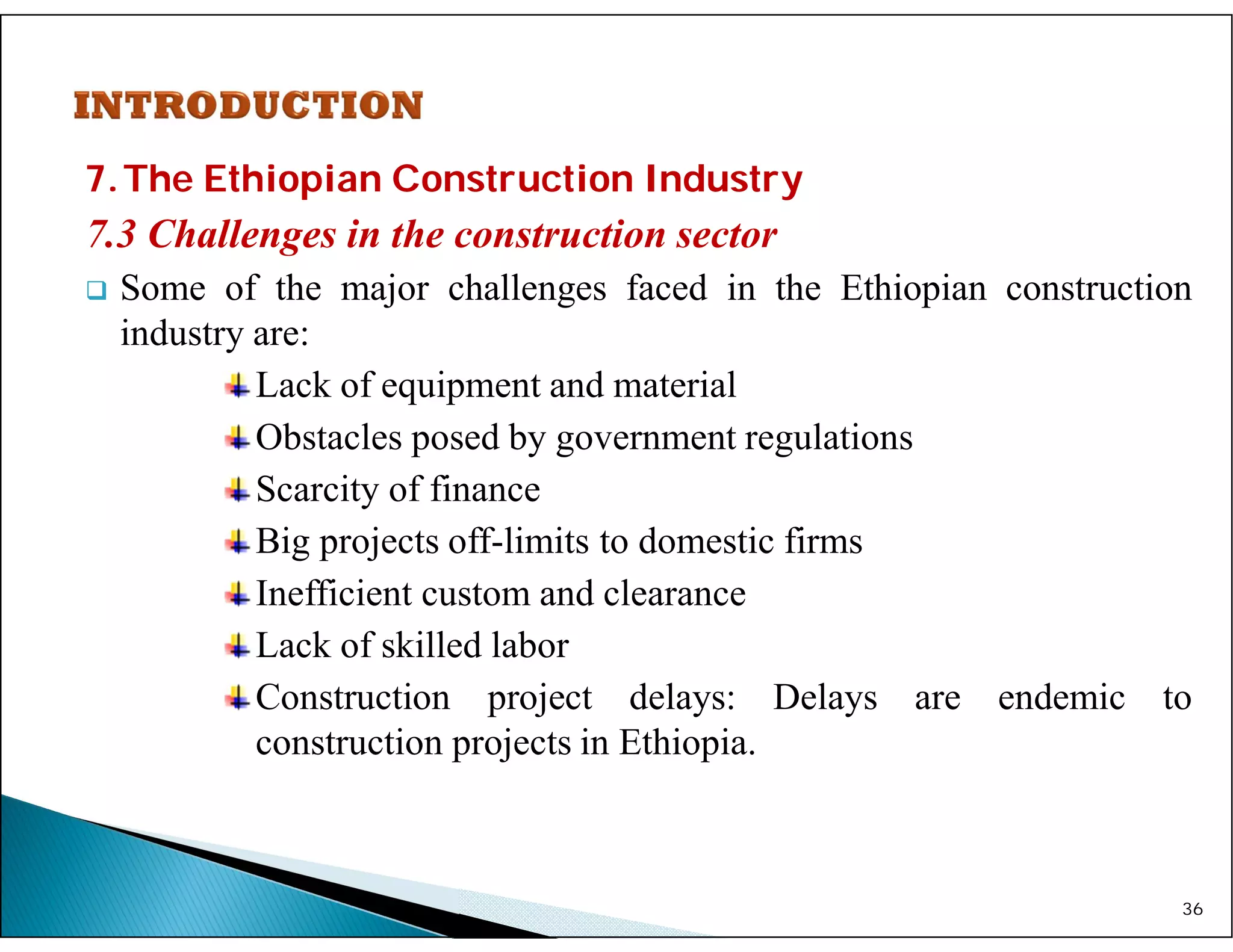

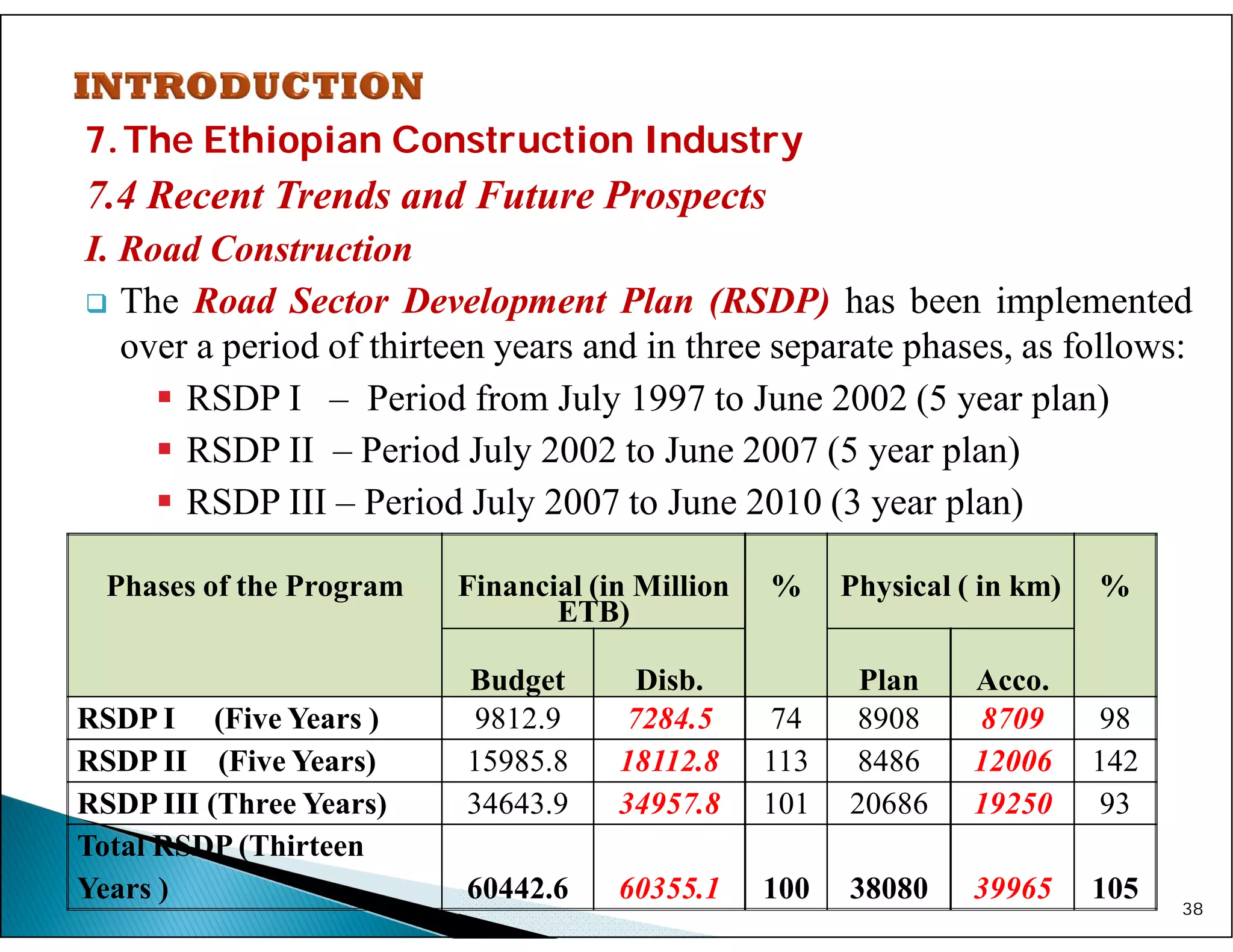

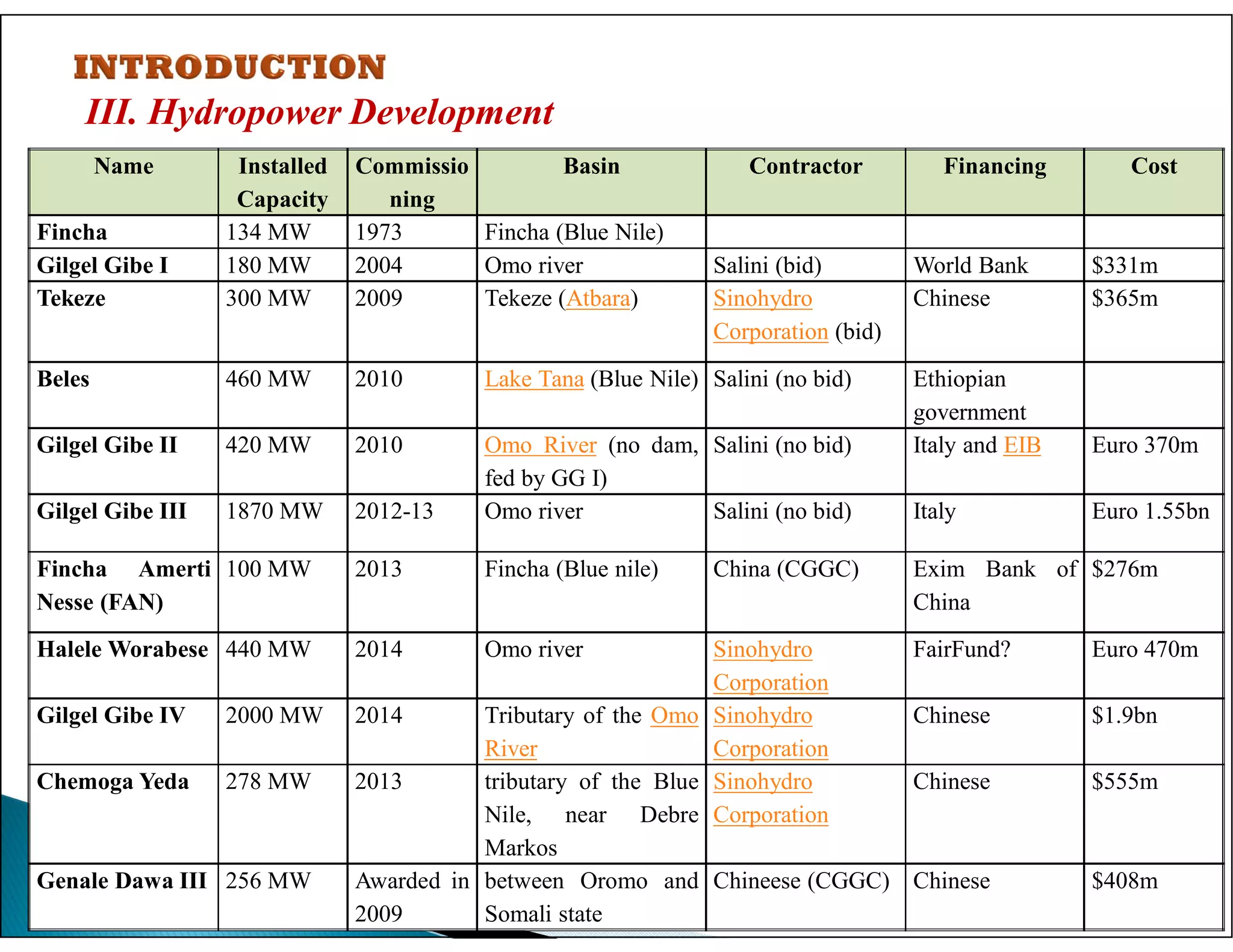

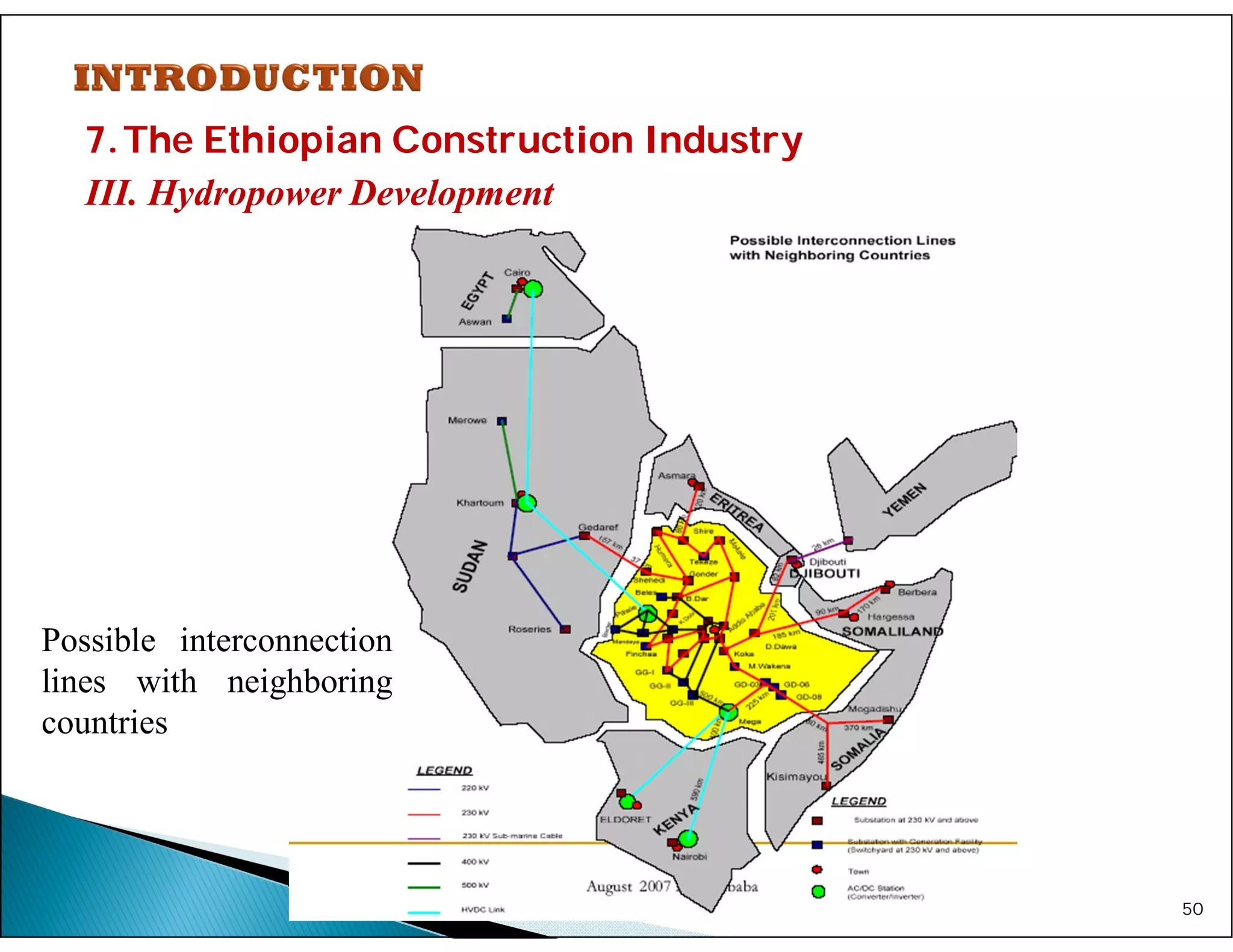

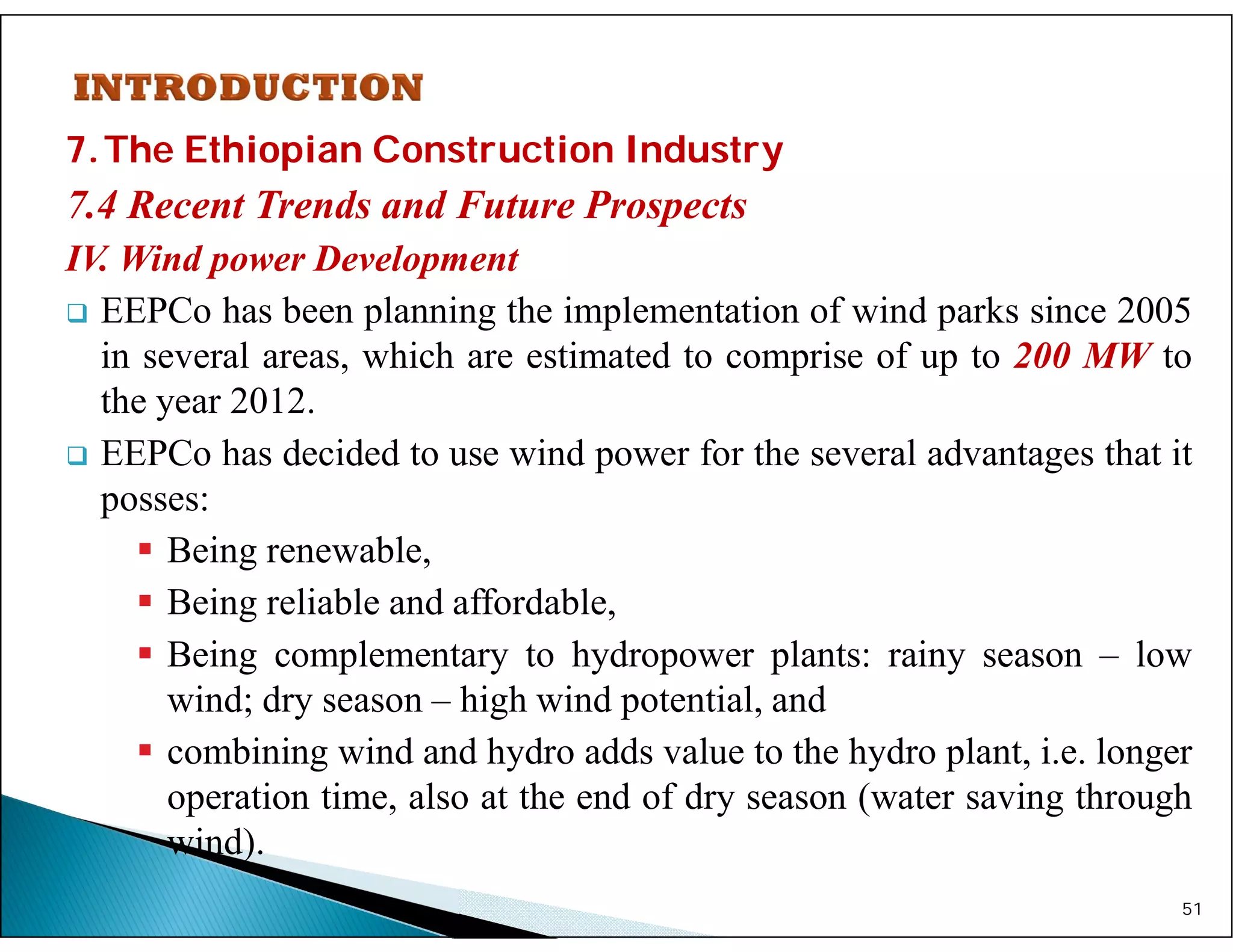

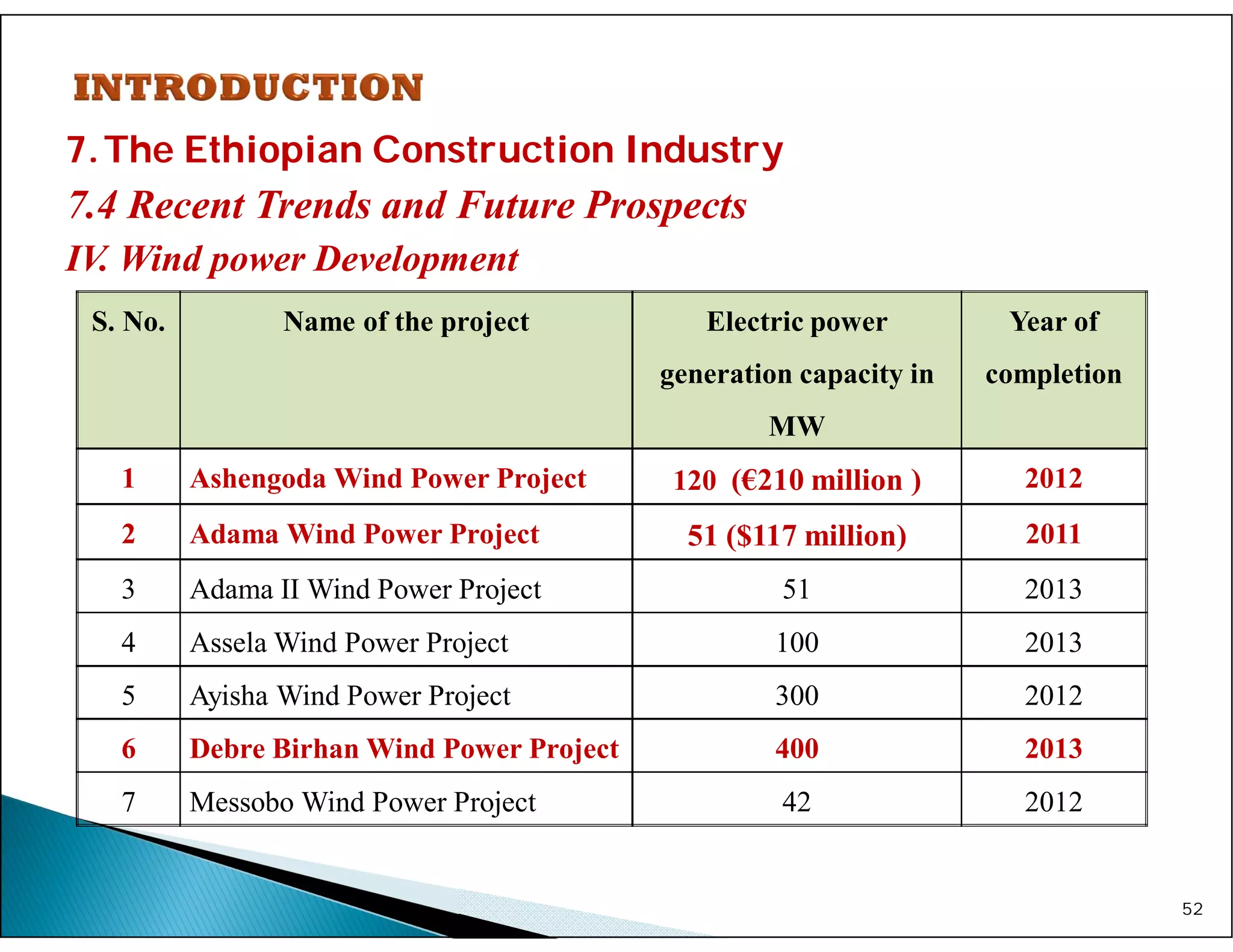

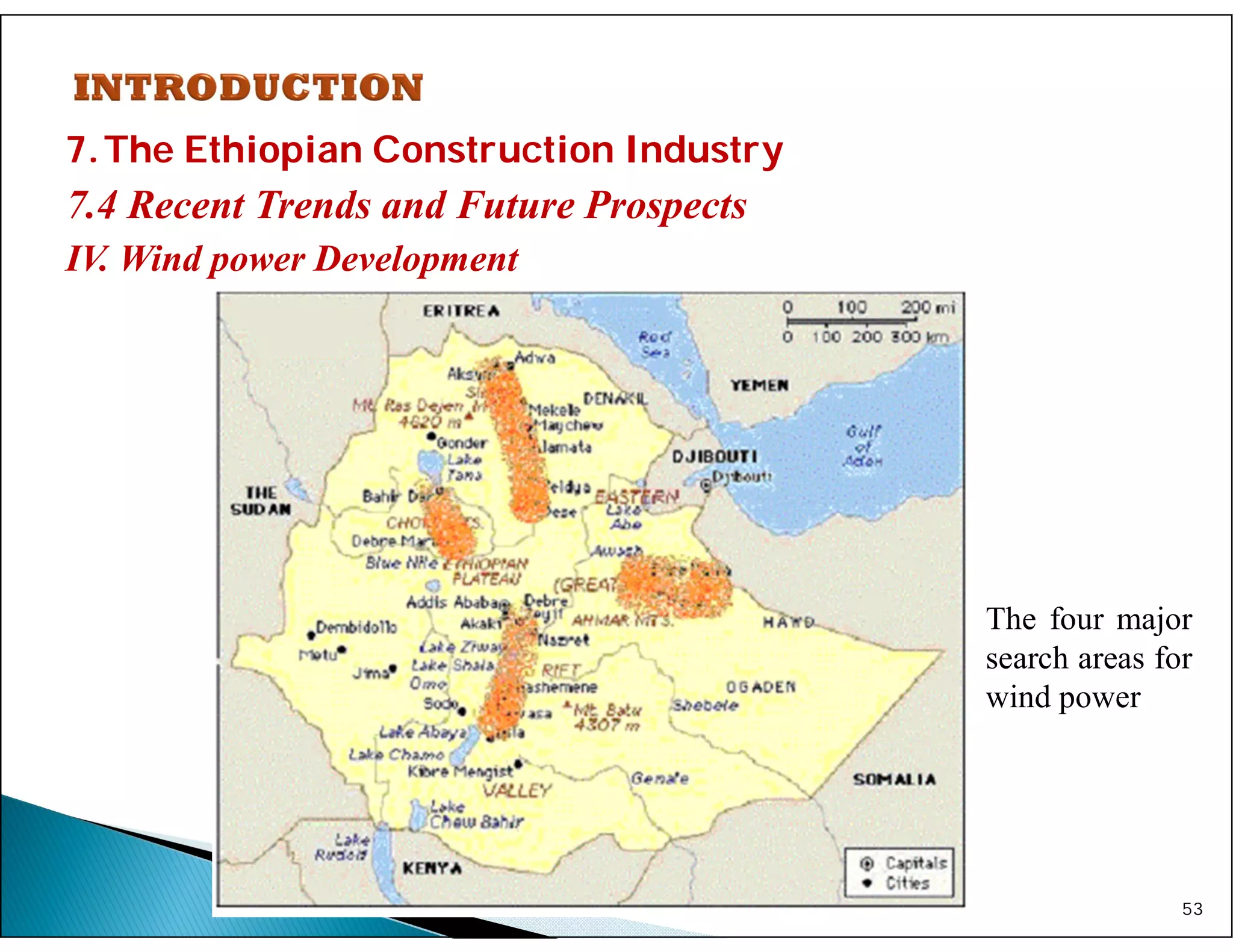

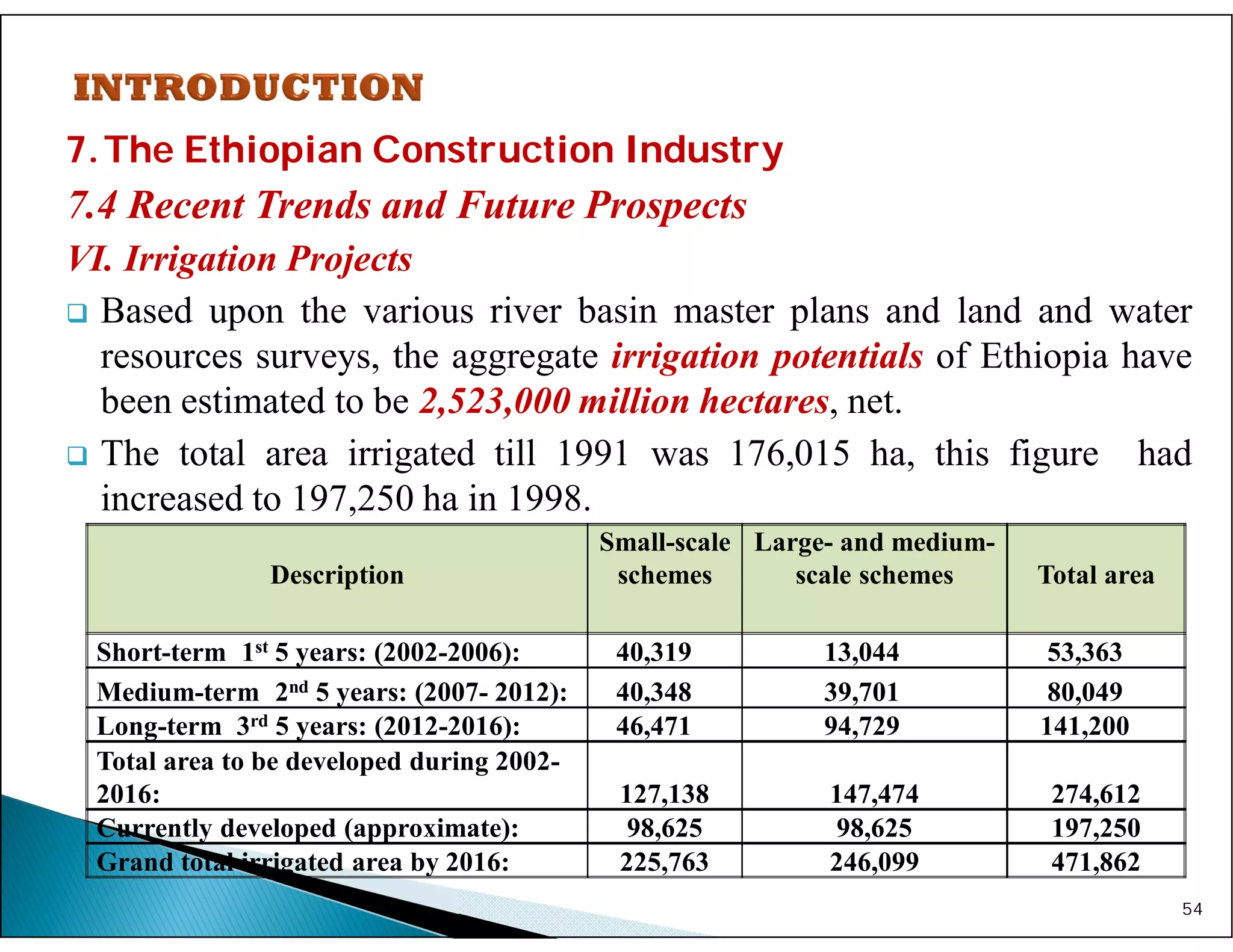

This document provides an overview of the construction industry in Ethiopia. It discusses construction projects, the construction industry, the typical life cycle and main parties involved in construction projects. It also outlines the key resources needed for the construction industry, including human resources, financial resources, physical resources and management services. The construction project management process is summarized as involving integration, scope, time, cost, quality, human resources, communication, risk and procurement management. Finally, the document discusses the historical development of the Ethiopian construction industry and identifies five distinct periods of development.