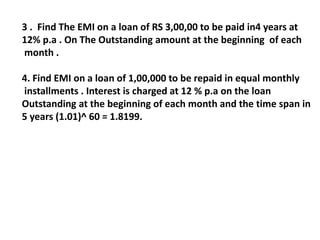

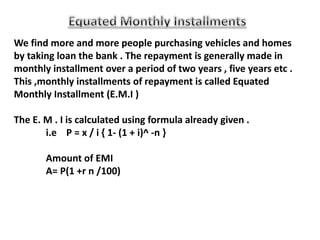

- An EMI (equated monthly installment) is a fixed monthly payment made towards a loan consisting of both principal and interest.

- The EMI can be calculated using the formula P = x/i(1-(1+i)^-n) where P is principal, x is monthly installment, i is monthly interest rate, and n is number of payments.

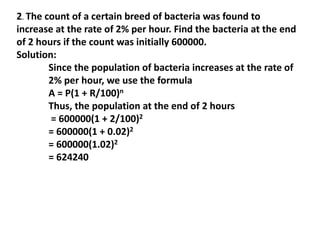

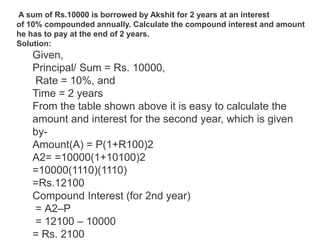

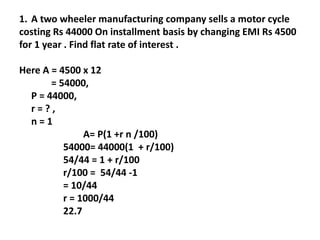

- Examples show calculating EMI for loans over different time periods (1-5 years) and interest rates (5-12% per year) by plugging values into the EMI formula.

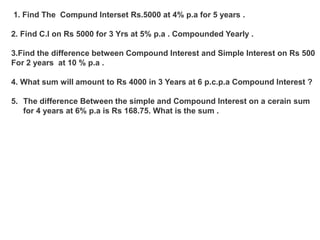

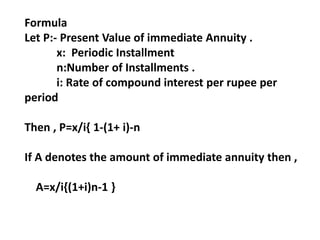

![2. ULIP is a scheme of unit trust of india under which a person can

deposit upto Rs 10000/-Per year . The status of ULIP is 10 Years

or 15 years , A person takes a membership of ULIP by paying

10000 for 10 years . Assuming the rate of compound interst to be

12% . Find the amount he will receive at the end of 10 years .

Solution :- Here x = 10000

n = 10

i= 0.12

To find amount A

Now A=x/i [ (1 + I ) ^n -1 ]

= 10000/ 0.12 [ (1.12) ^ 10 -1 ]

= Rs 175483](https://image.slidesharecdn.com/ch3-210711025116/85/Ch-3-intrerest-and-annutiy-20-320.jpg)

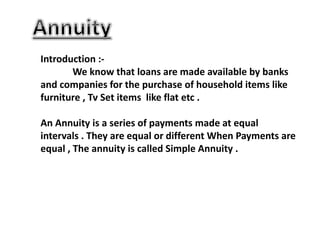

![3 . Find the amount of an annuity of Rs 400 payable quarterly for

3 years at 16 % p.a .

Solution :- Here installment x= 400

Period is 1 quarter

16% p.a means 4% per Quarter

i.e 4 paise per rupee

Thus , i=0.04

N : number of installment

= 3 x 4

=12

To find amount A

We have

A=x/i [ (1 + I ) ^n -1 ]](https://image.slidesharecdn.com/ch3-210711025116/85/Ch-3-intrerest-and-annutiy-21-320.jpg)

![= 400/0.04 [ ( 1.04)^12 -1 ]

= 10,000 [1.60103 -1 ]

= 10000 x 0.60103

= Rs 6010 approx](https://image.slidesharecdn.com/ch3-210711025116/85/Ch-3-intrerest-and-annutiy-22-320.jpg)

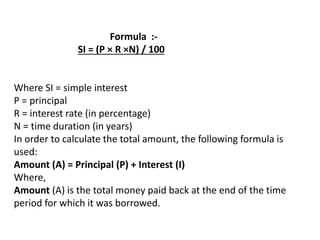

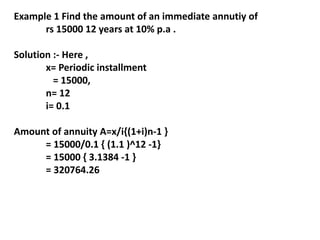

![2 .What is EMI of loan of RS 25000 if repaid in 4 years . At the rate

of interest 5 % p.a . On the outstanding amount at the beginning

of each year ?

Solution :- P=25000 , r=5 , n=4 years = 48 months

i = interest per rupee per month

= 12/1200

= 1/100

=0.01

Now P = x/i [ 1-( 1 + i)^ -n ]

25000 = x/0.01 [ 1- (1 + 0.01 ) ^ -48 ]

25000 = x/0.01 [ 1 –(1.01 )^ -48 ]

250 =x[ 1- 0.6203 ]

250 = x[ 0.3797]

x= 250 / 0.3797

x = 658.3459](https://image.slidesharecdn.com/ch3-210711025116/85/Ch-3-intrerest-and-annutiy-25-320.jpg)