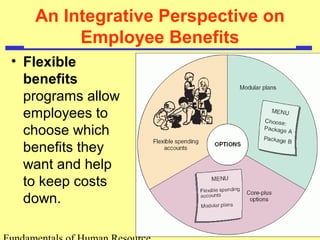

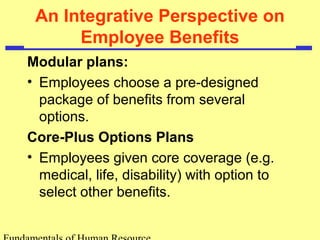

This document provides an overview of employee benefits, including legally required benefits like Social Security, unemployment compensation, workers' compensation, and FMLA. It also discusses voluntary benefits such as traditional health insurance, HMOs, PPOs, and retirement benefits like pensions and IRAs. Other benefits covered include paid time off, disability and survivor benefits, flexible spending accounts, and modular/core-plus benefit plan designs. The goal of a benefits package is to attract and retain employees while providing legally required coverage in a cost-effective manner.