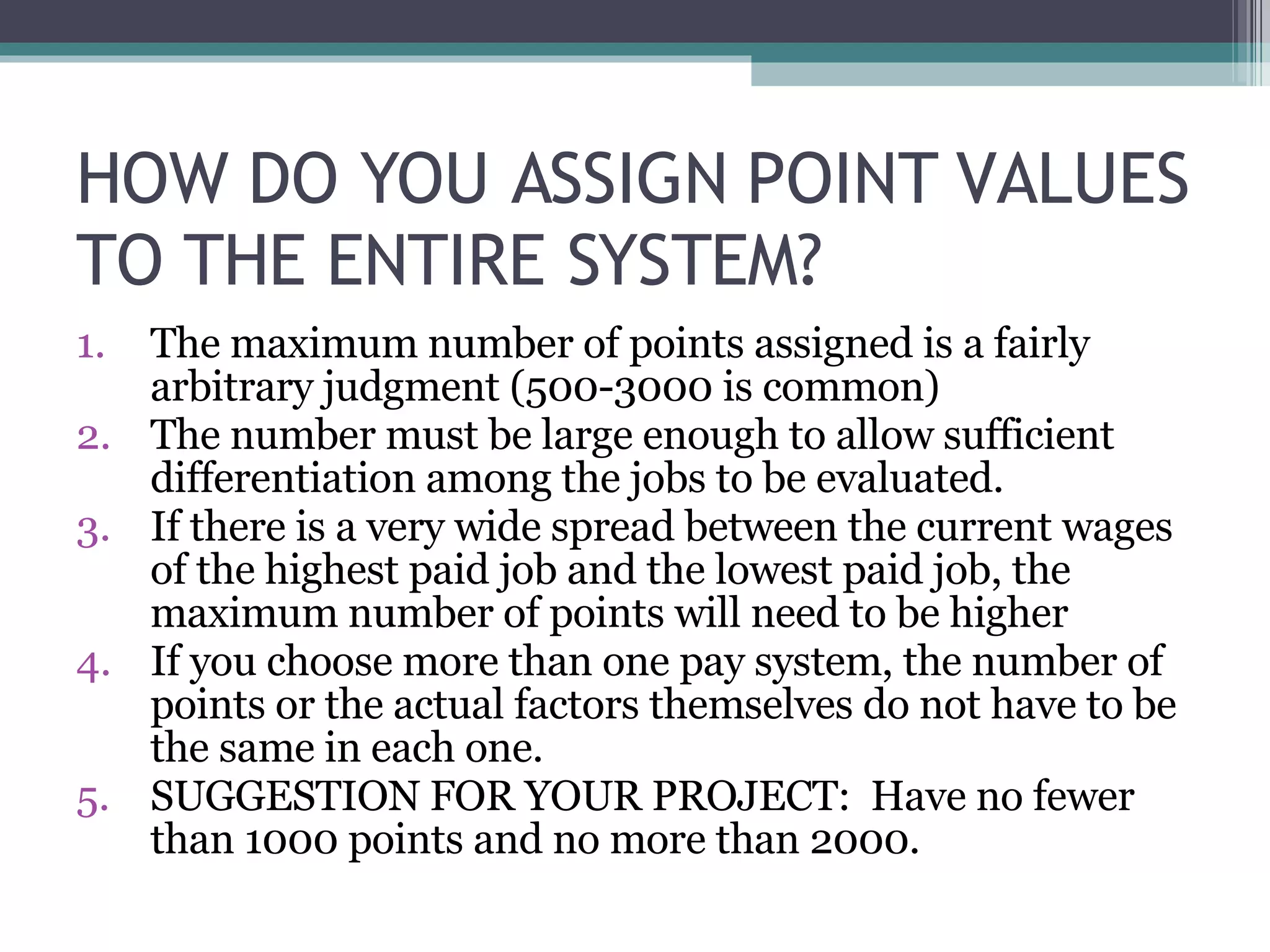

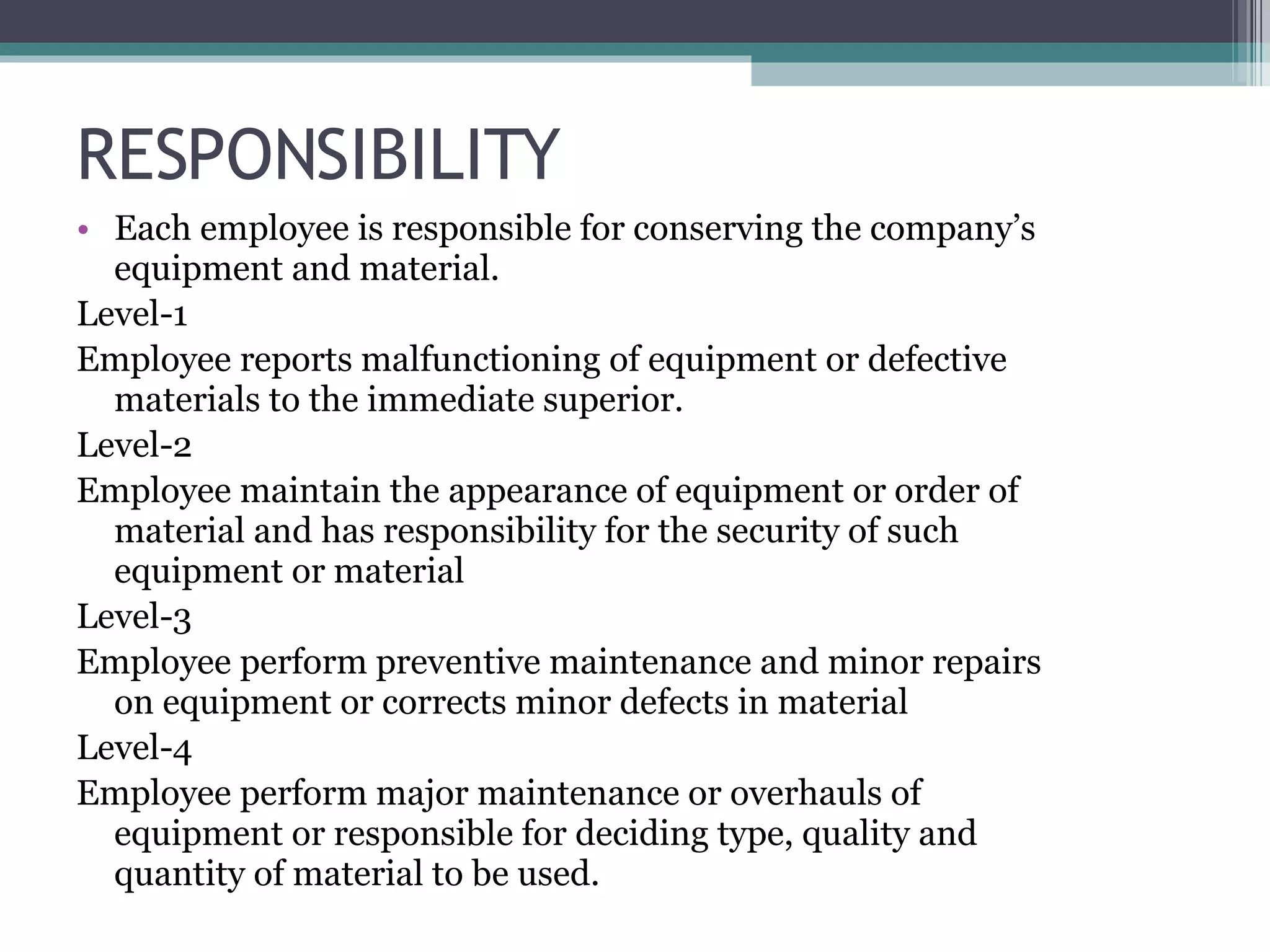

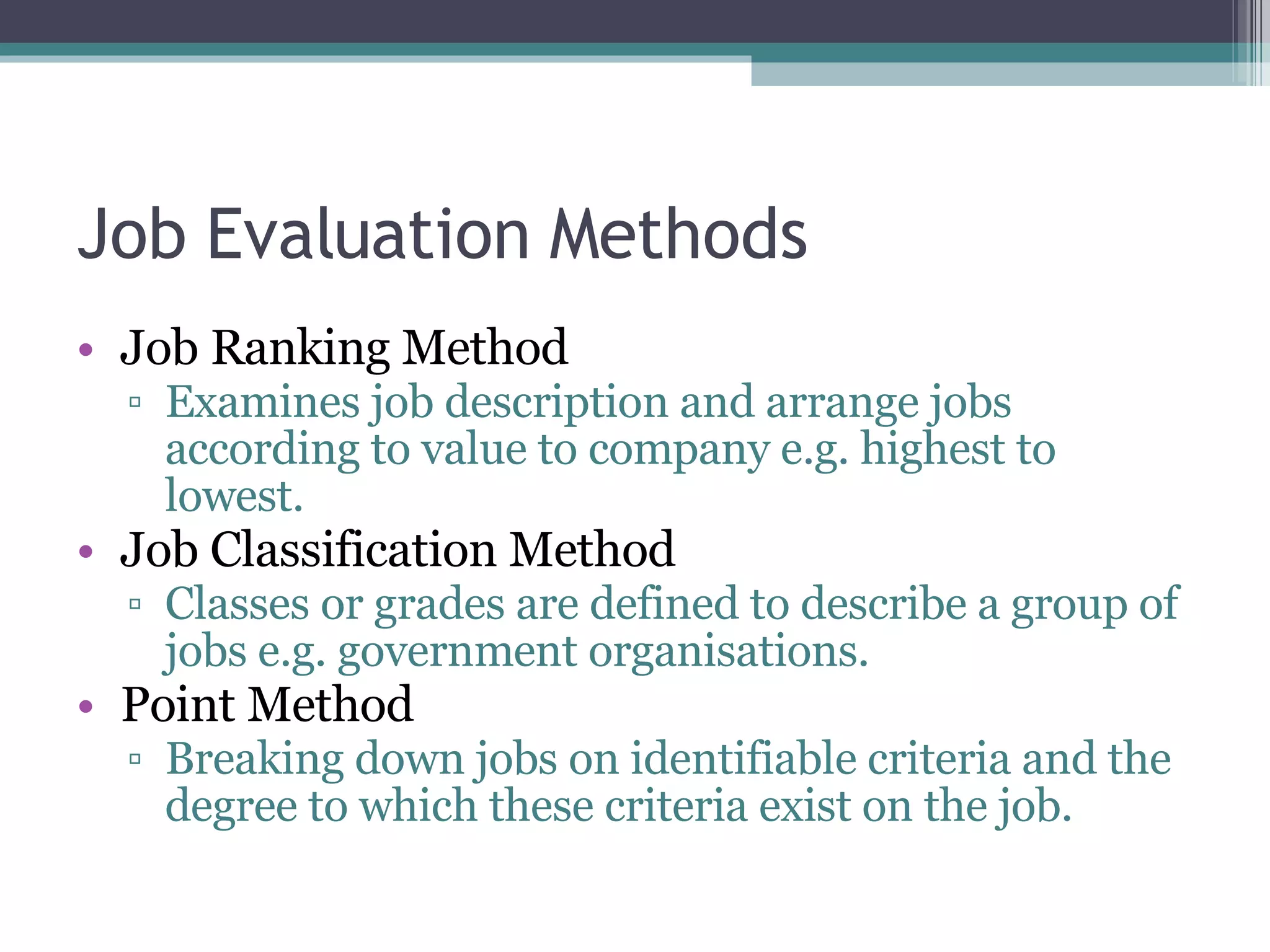

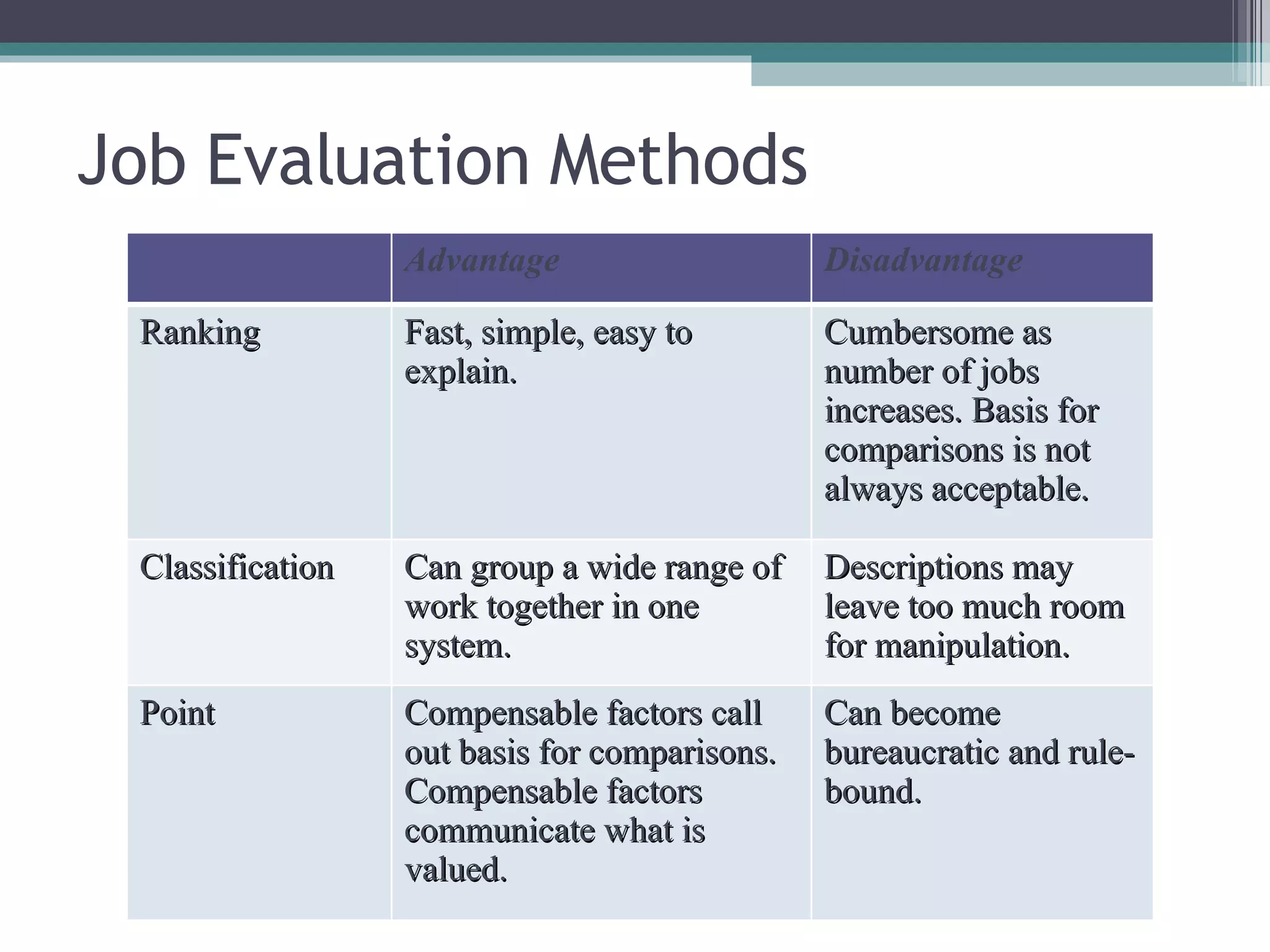

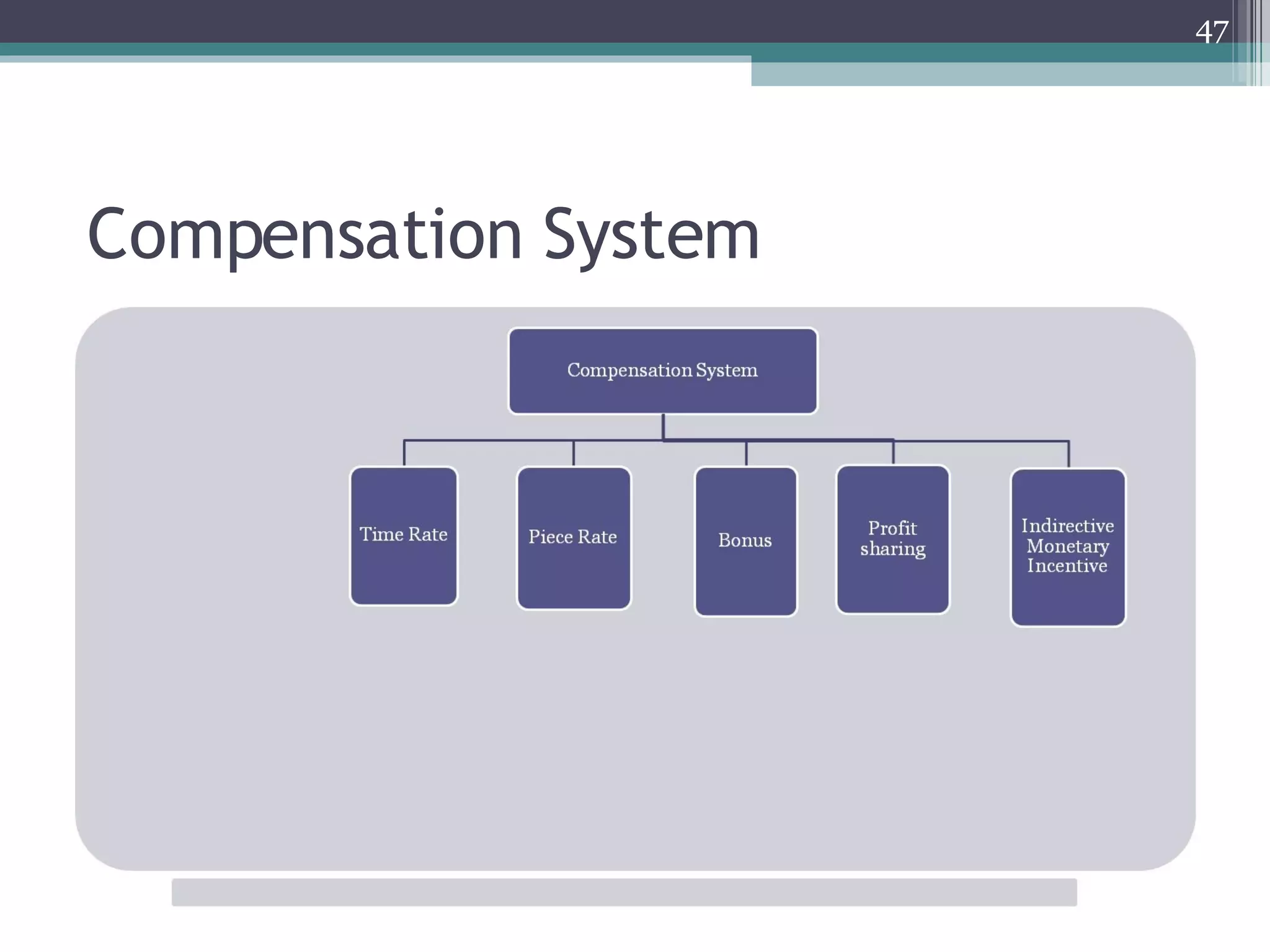

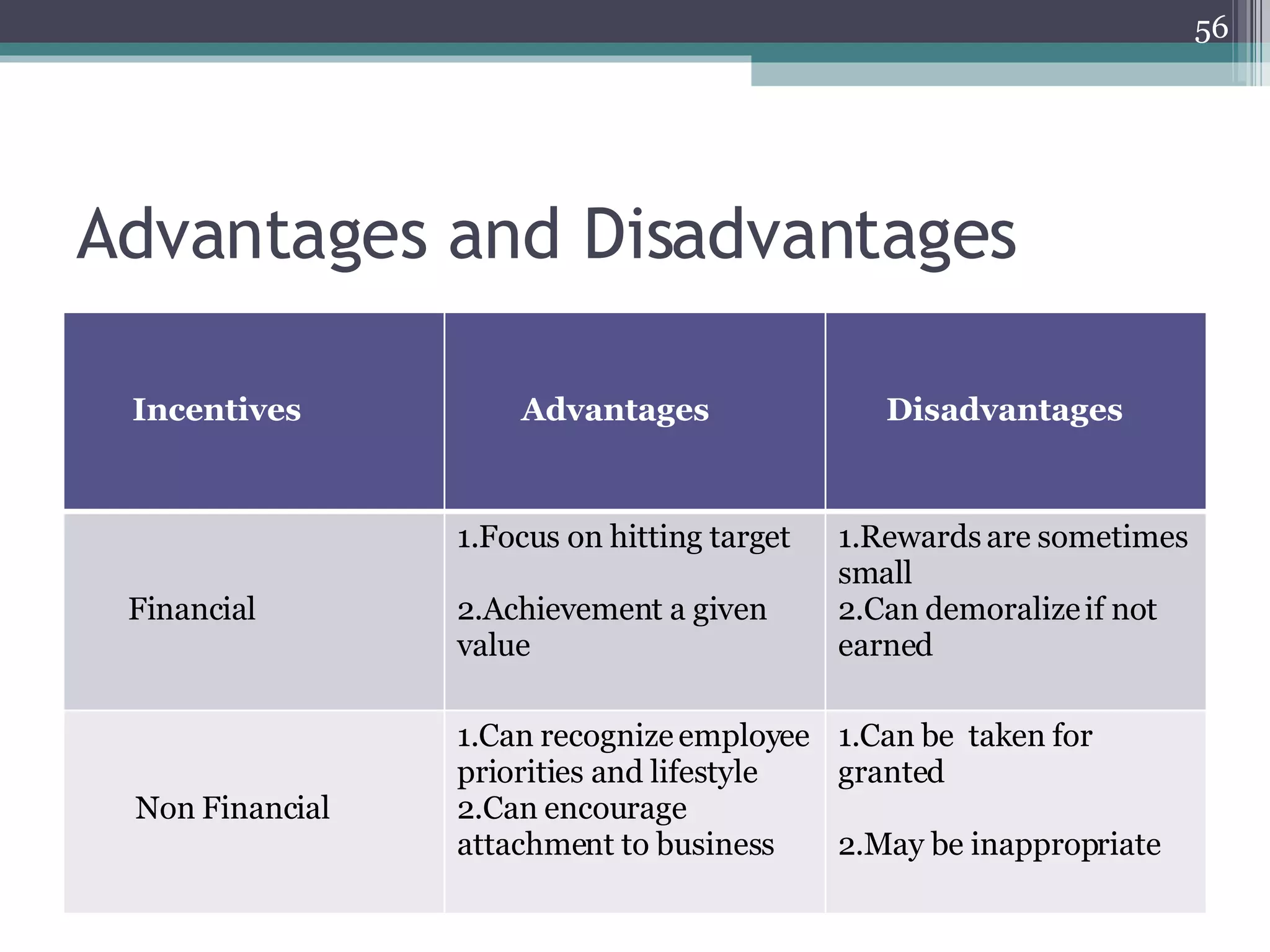

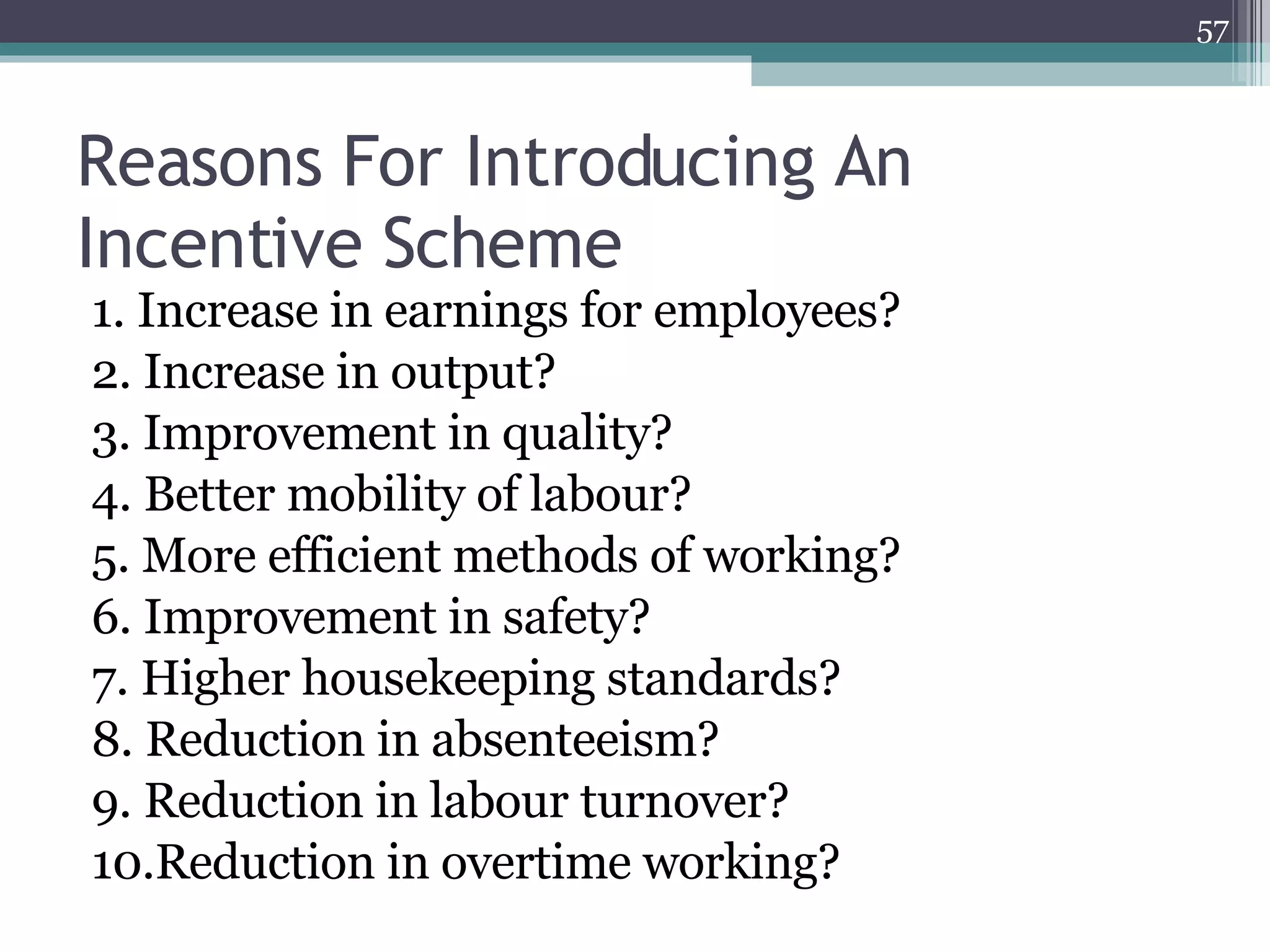

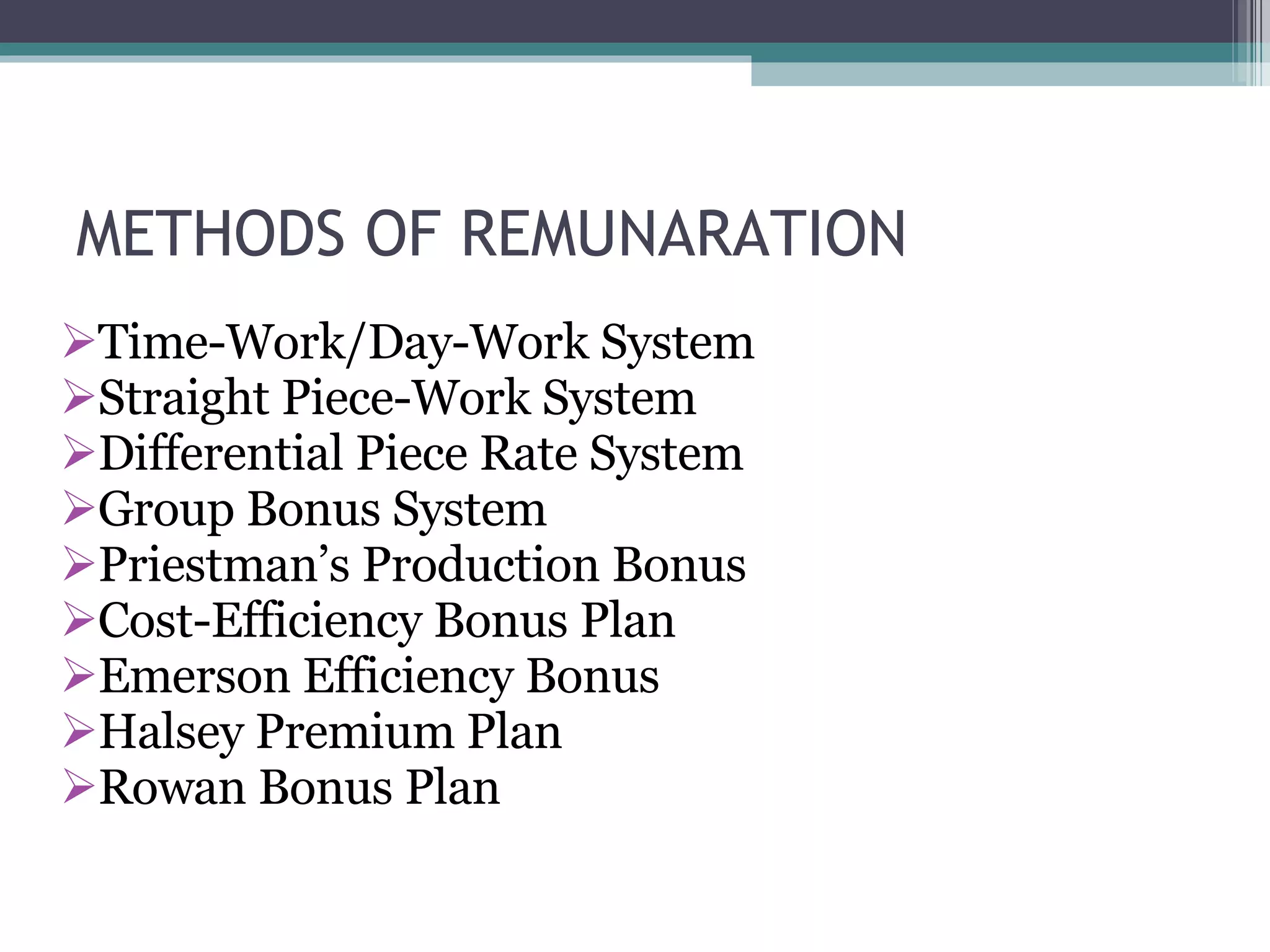

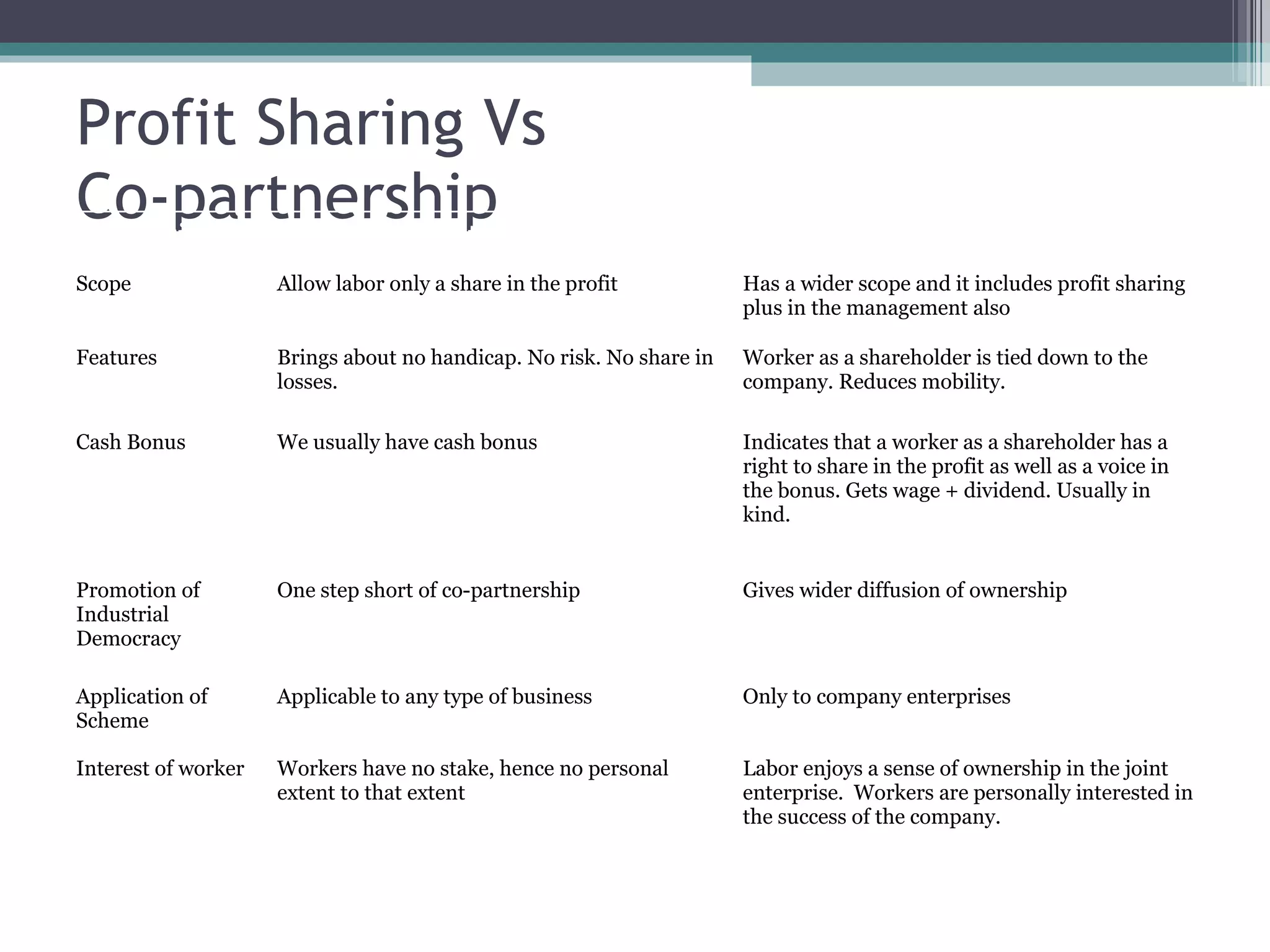

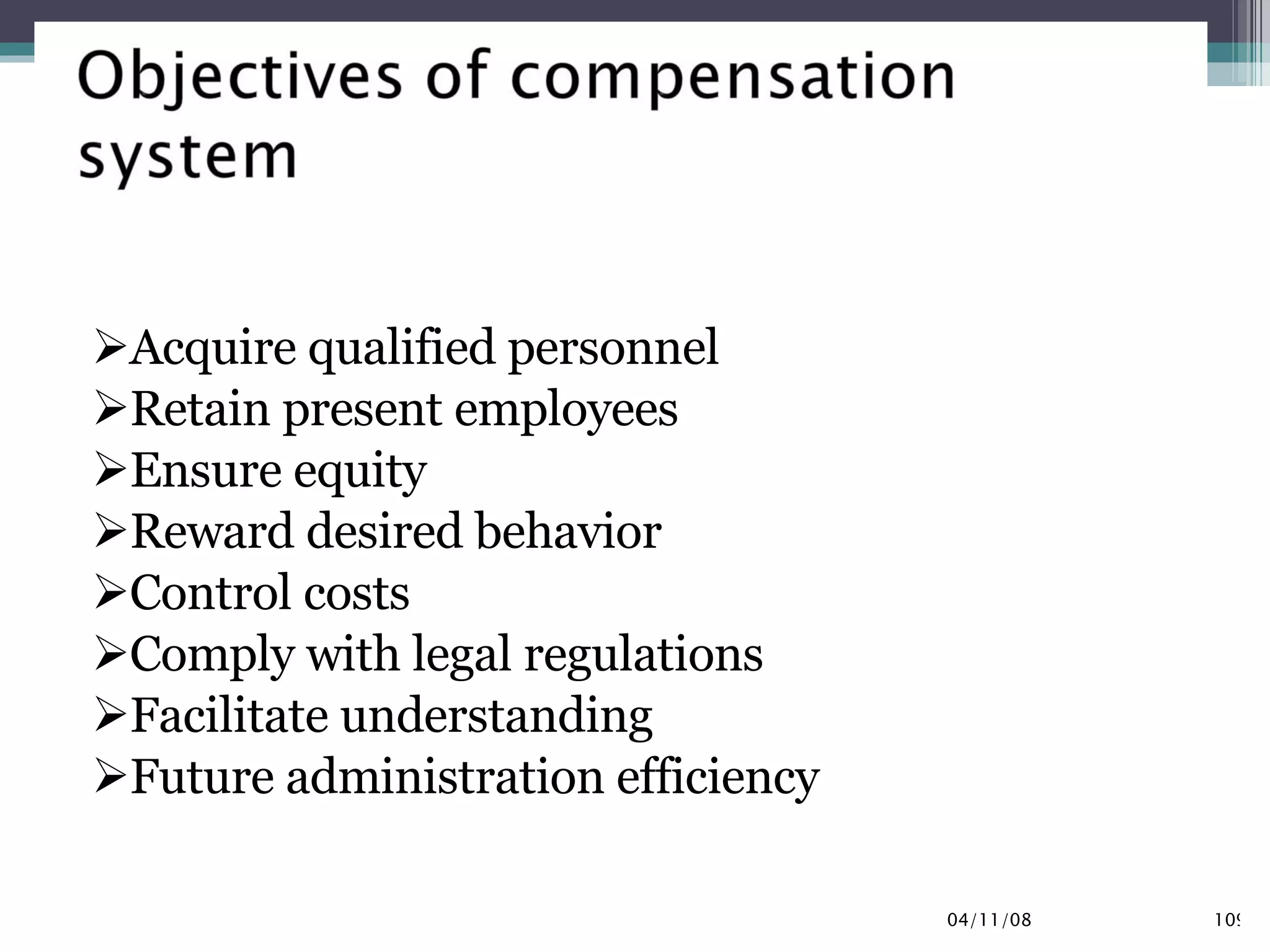

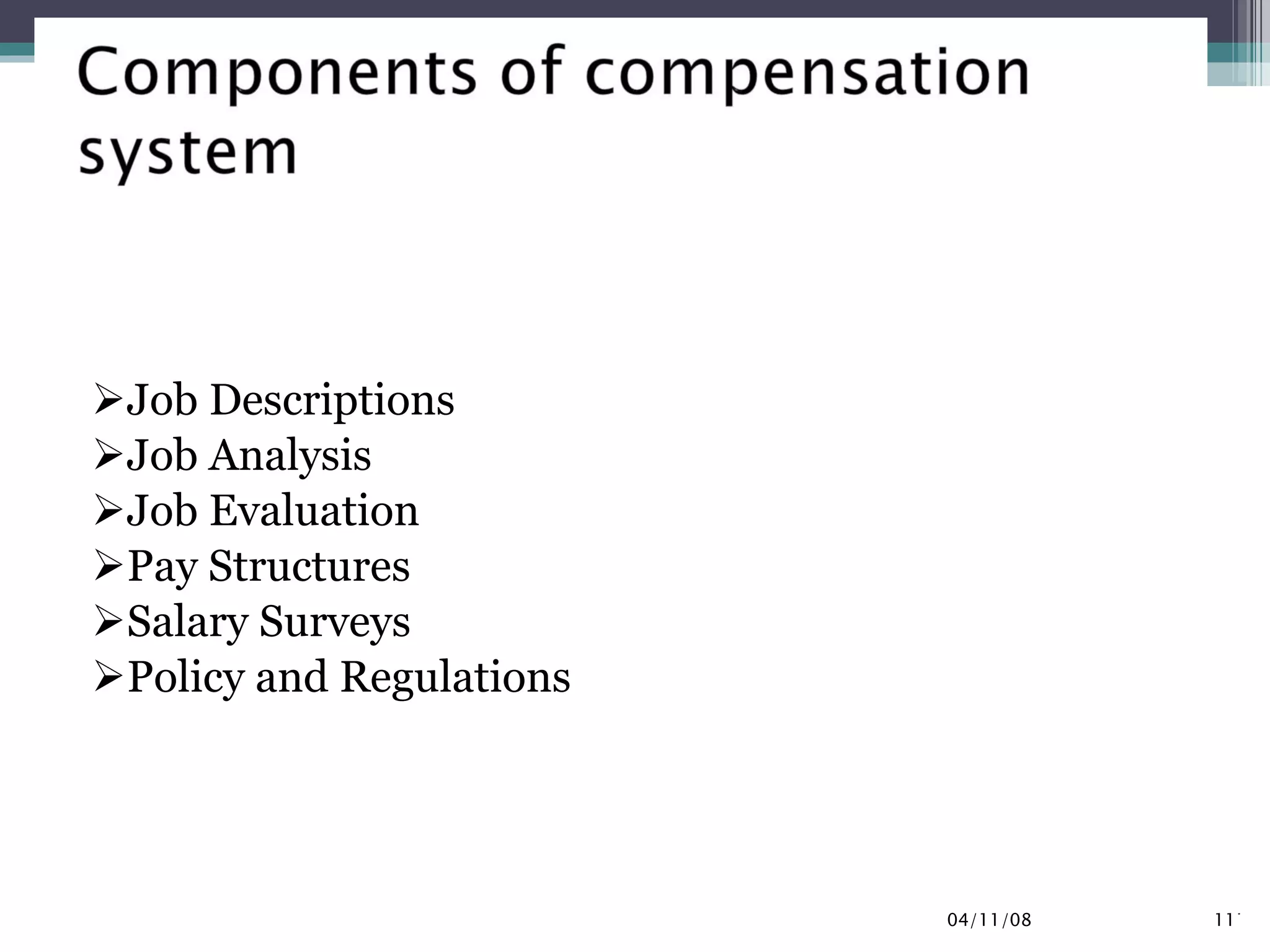

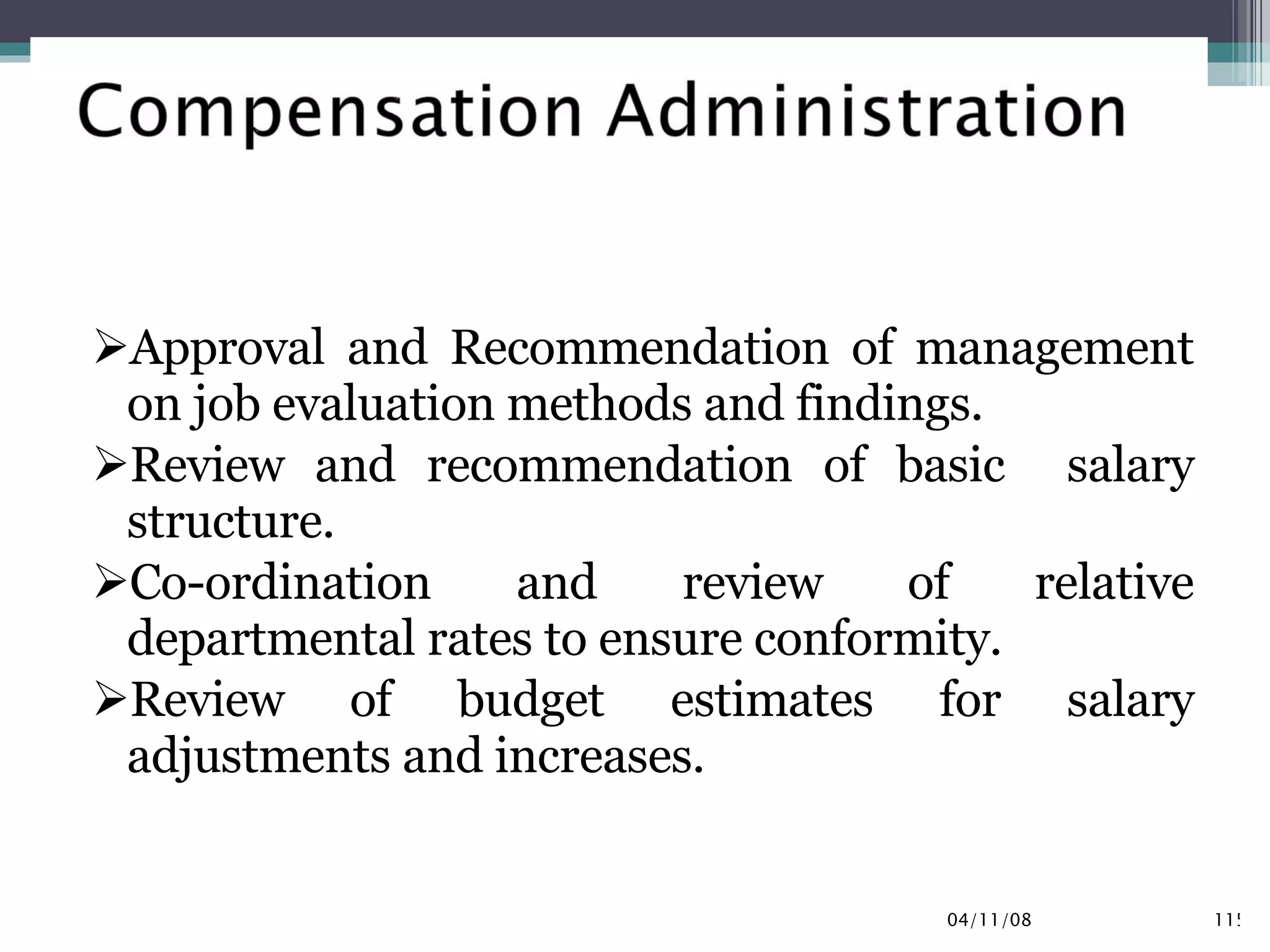

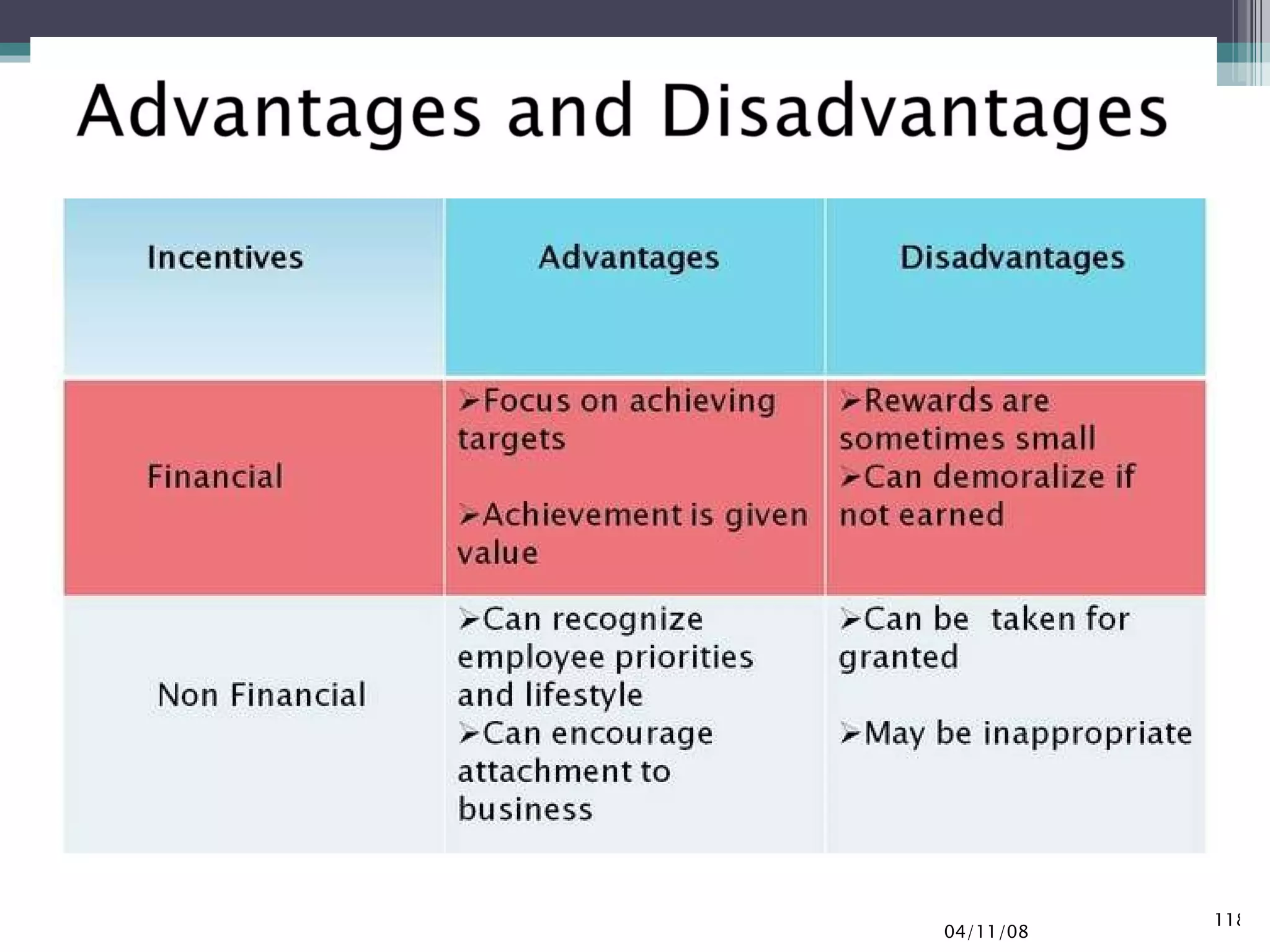

The document discusses compensation management and various compensation systems. It defines compensation and its key elements, including job evaluation methods, pay structures, and incentive schemes. It outlines the objectives and components of an effective compensation system, and how such systems are used, developed, and administered.