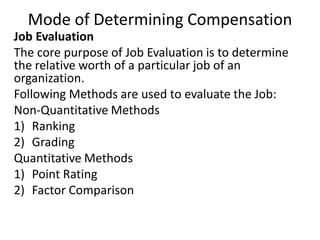

The document outlines the concept of compensation, describing it as a combination of financial and non-financial rewards provided to employees, which includes pay, incentives, and benefits. It emphasizes the importance of establishing a fair remuneration system to attract, motivate, and retain capable employees while detailing various compensation components and payment methods, including wages, bonuses, commissions, and non-monetary benefits. Additionally, the document discusses factors affecting compensation decisions and methods for evaluating job worth and determining equitable pay structures.