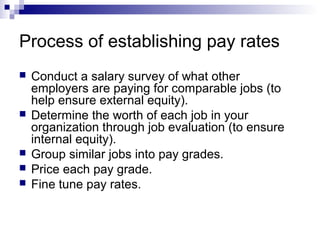

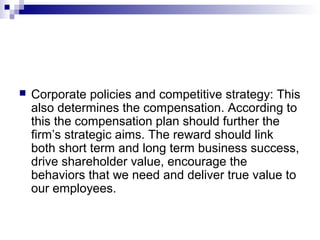

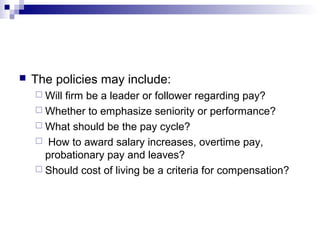

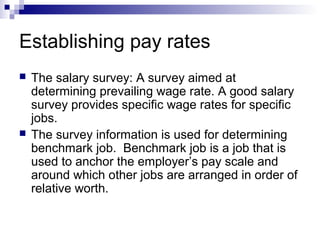

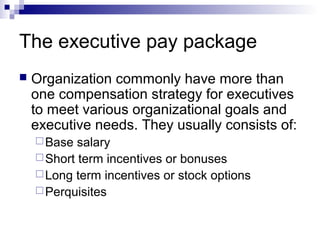

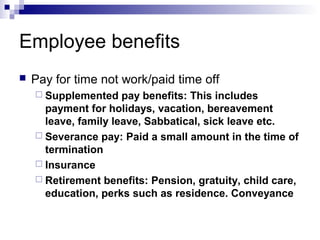

The document discusses compensation and its components. It defines compensation as all forms of pay arising from employee performance, including both financial and non-financial rewards. Compensation includes direct payments like wages and salaries, indirect payments like benefits, and performance-based versus membership-based rewards. It also outlines the purposes, factors, and processes involved in establishing compensation rates.