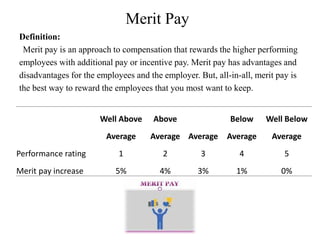

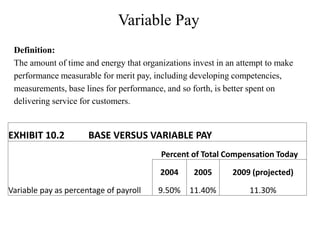

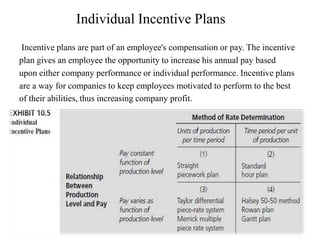

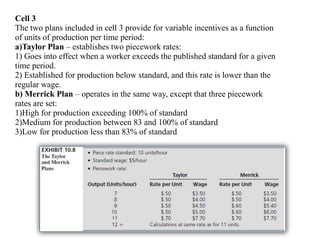

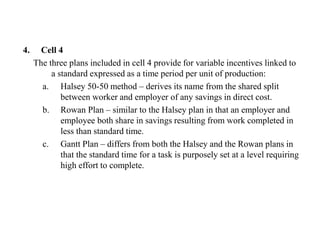

This document discusses various types of pay-for-performance plans including merit pay, variable pay, individual and group incentives, and long-term incentives. Merit pay rewards higher performers with additional pay based on their performance rating. Variable pay ties compensation to measurable performance factors. Individual incentives include piece-rate plans, standard hour plans, and plans that set multiple piece rates based on production levels. Group incentives like profit-sharing reward employee groups when organizational goals are met. Long-term incentives focus on long-term value creation through options, restricted stock, and plans with performance acceleration.