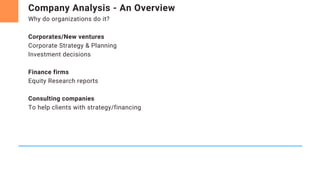

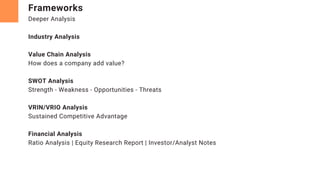

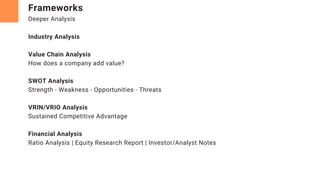

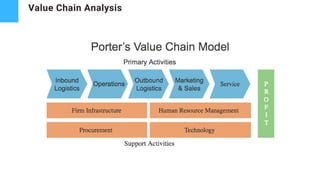

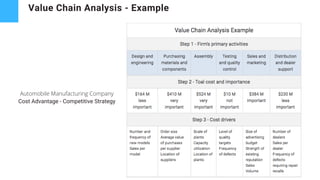

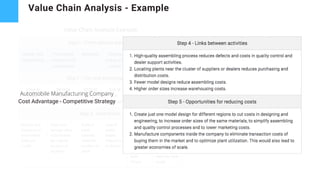

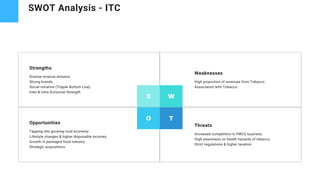

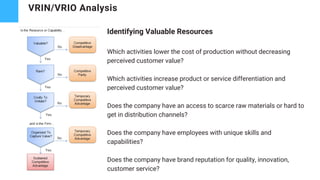

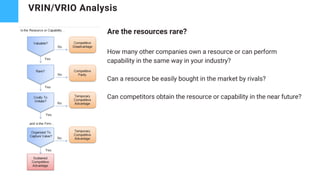

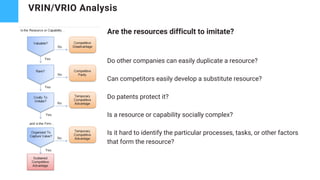

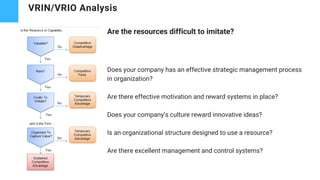

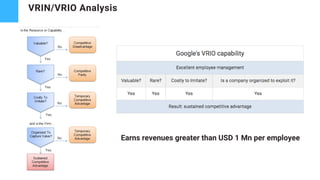

This document provides an overview of frameworks and factors to consider when analyzing companies. It discusses why individuals and organizations conduct company analysis, as well as hygiene factors to examine like products/services and financials. Deeper analysis frameworks are also covered, including industry analysis, value chain analysis, SWOT analysis, and VRIN/VRIO analysis to identify competitive advantages. The document uses examples to illustrate how to apply these analytical frameworks.