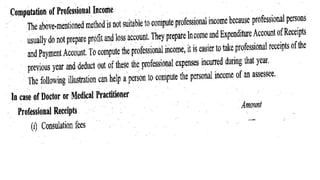

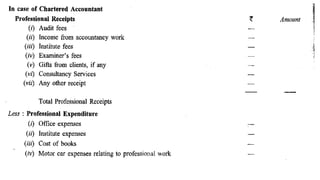

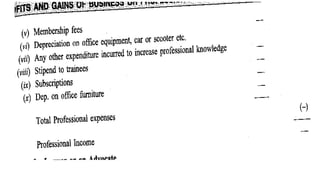

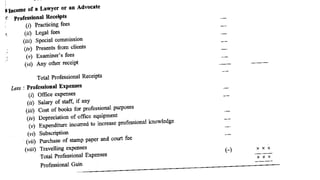

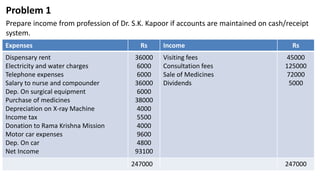

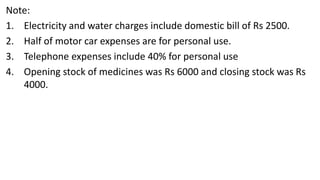

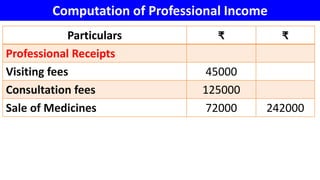

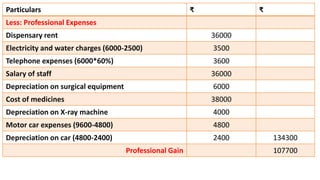

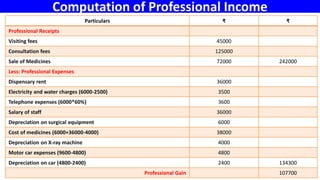

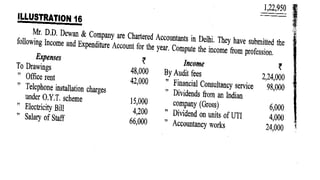

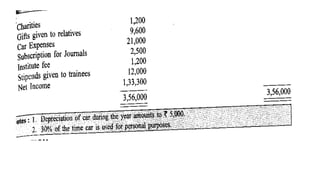

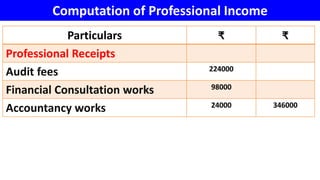

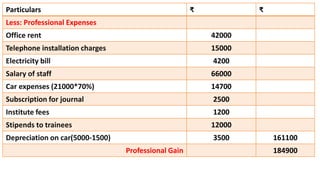

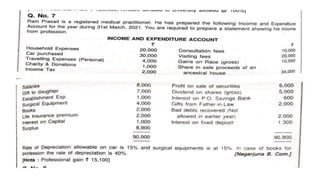

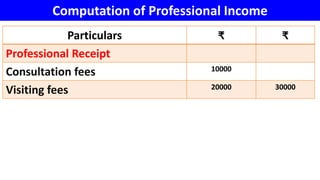

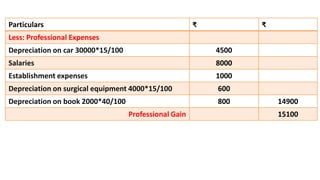

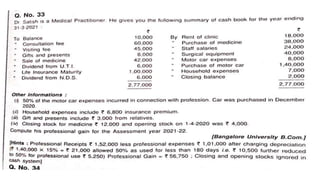

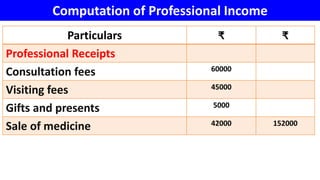

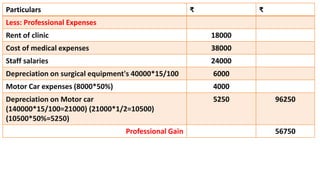

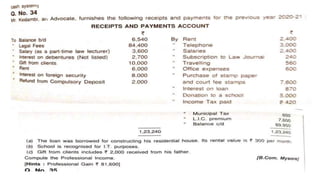

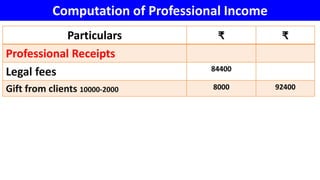

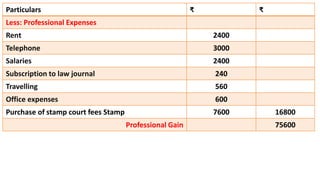

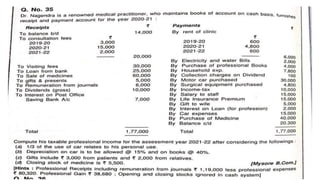

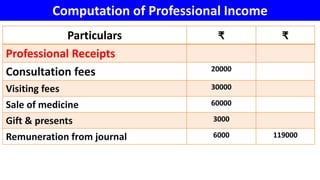

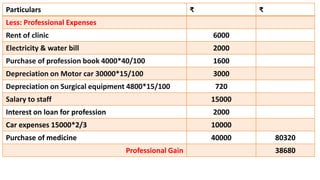

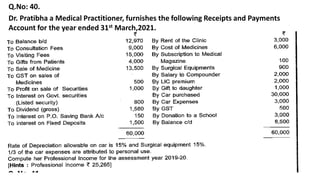

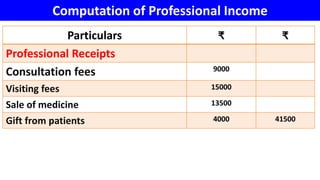

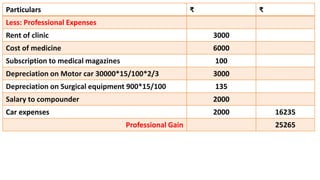

The document provides examples of computing taxable professional income for different professionals - a doctor, chartered accountant, lawyer, and medical practitioner. It shows how to calculate professional receipts and allowable professional expenses to determine the net professional gain or income based on the accounting system and other details provided. The computations deduct expenses like rent, salary, depreciation allowances, and other costs from the total receipts to arrive at the taxable professional income.