1. The document discusses the residential status of individuals, HUFs, AOPs, and firms under the Indian Income Tax Act. It provides examples and solutions for determining residential status based on the number of days spent in India and the location from which business affairs are controlled.

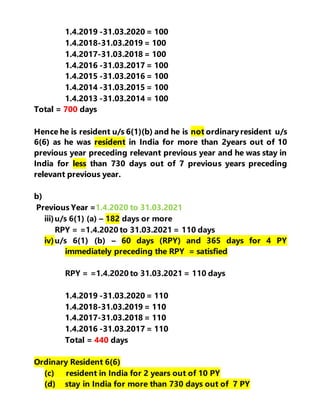

2. Residential status is determined based on satisfying conditions for being a resident under section 6(1) or by being ordinarily resident as defined in section 6(6).

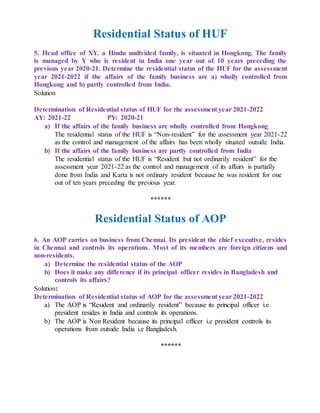

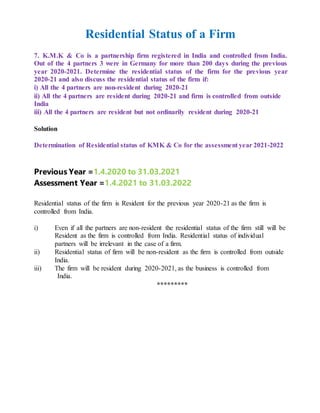

3. Location of control and management is the determining factor for residential status of HUFs, AOPs and firms, regardless of the residential status of members.