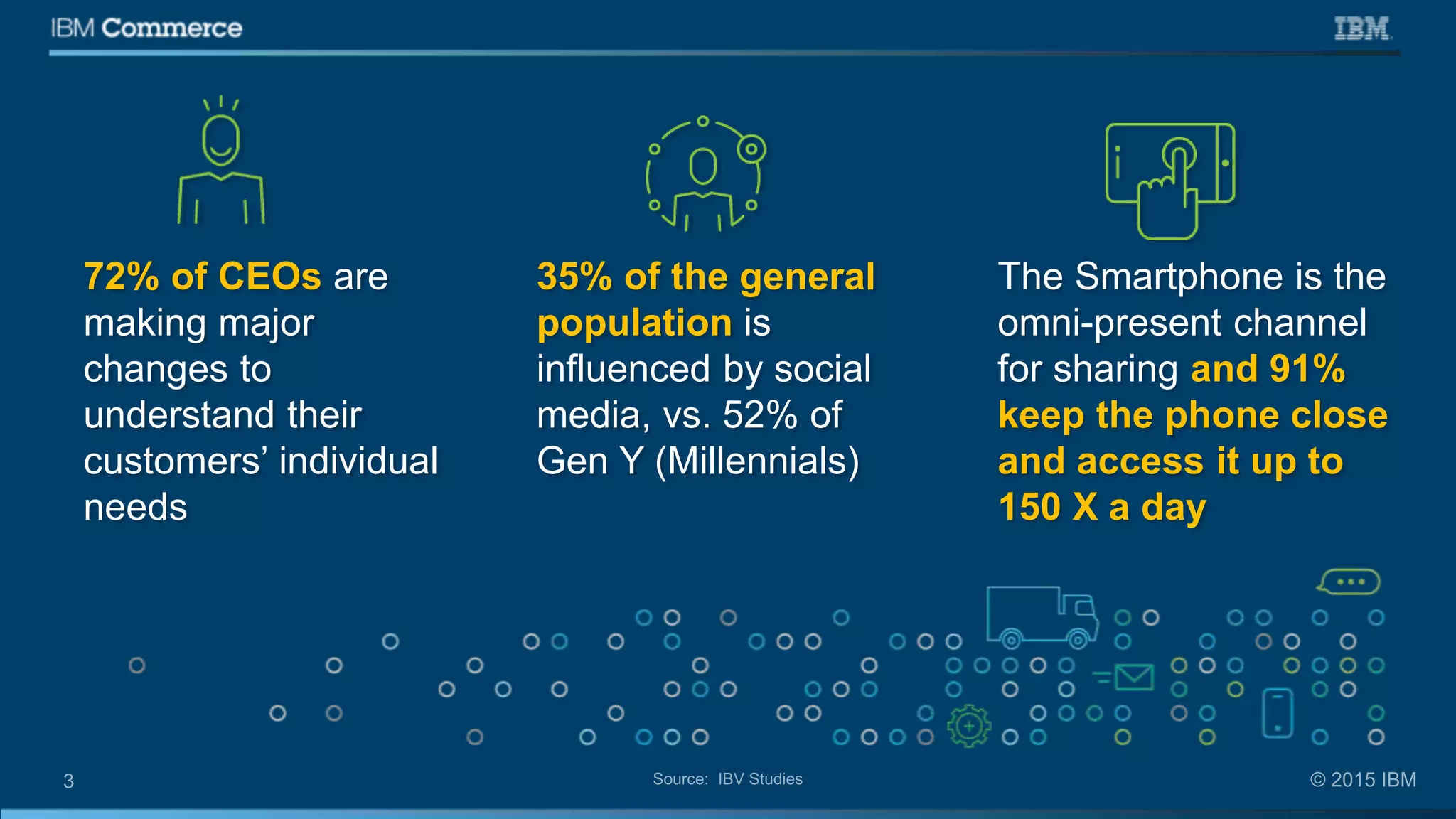

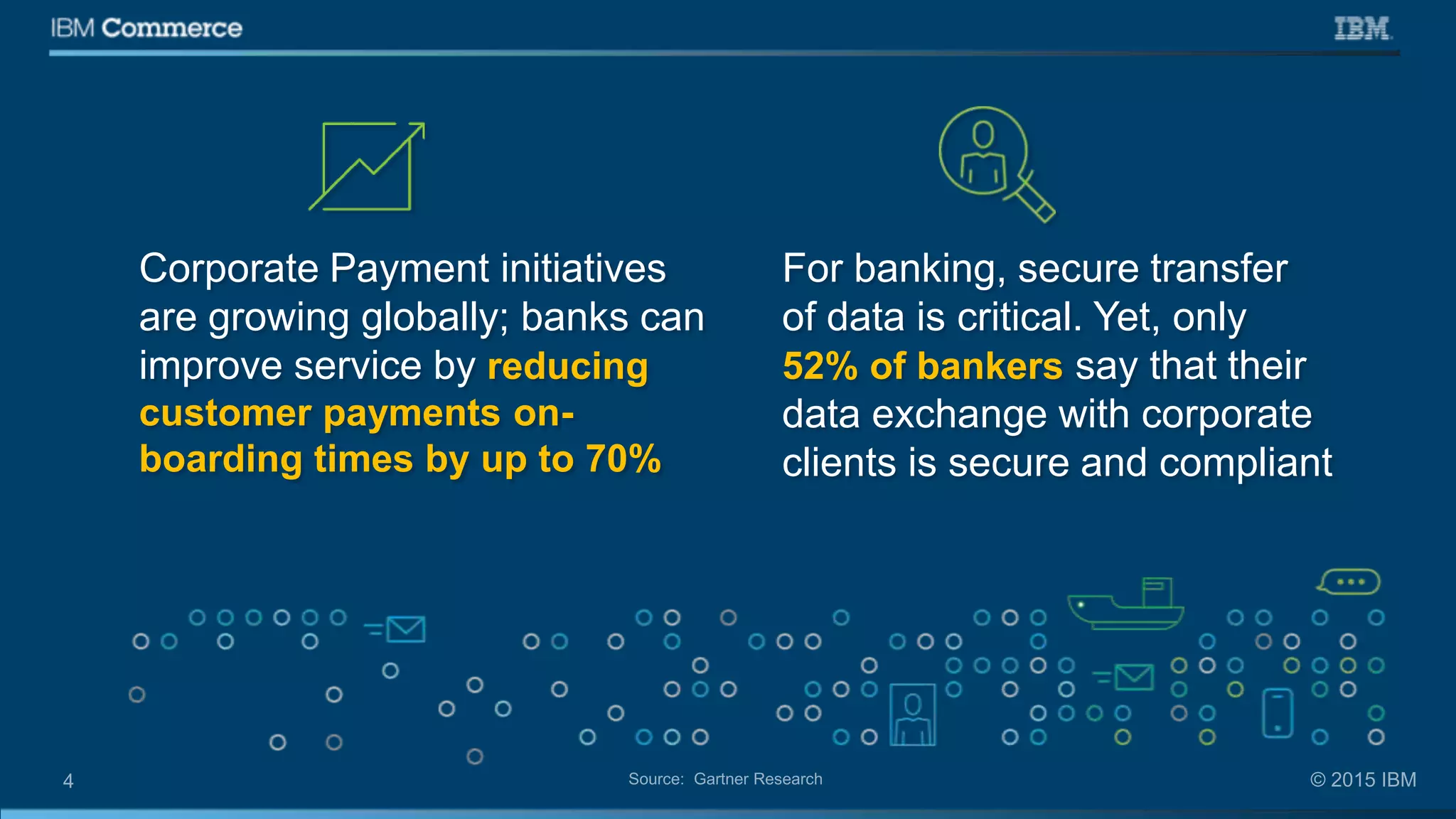

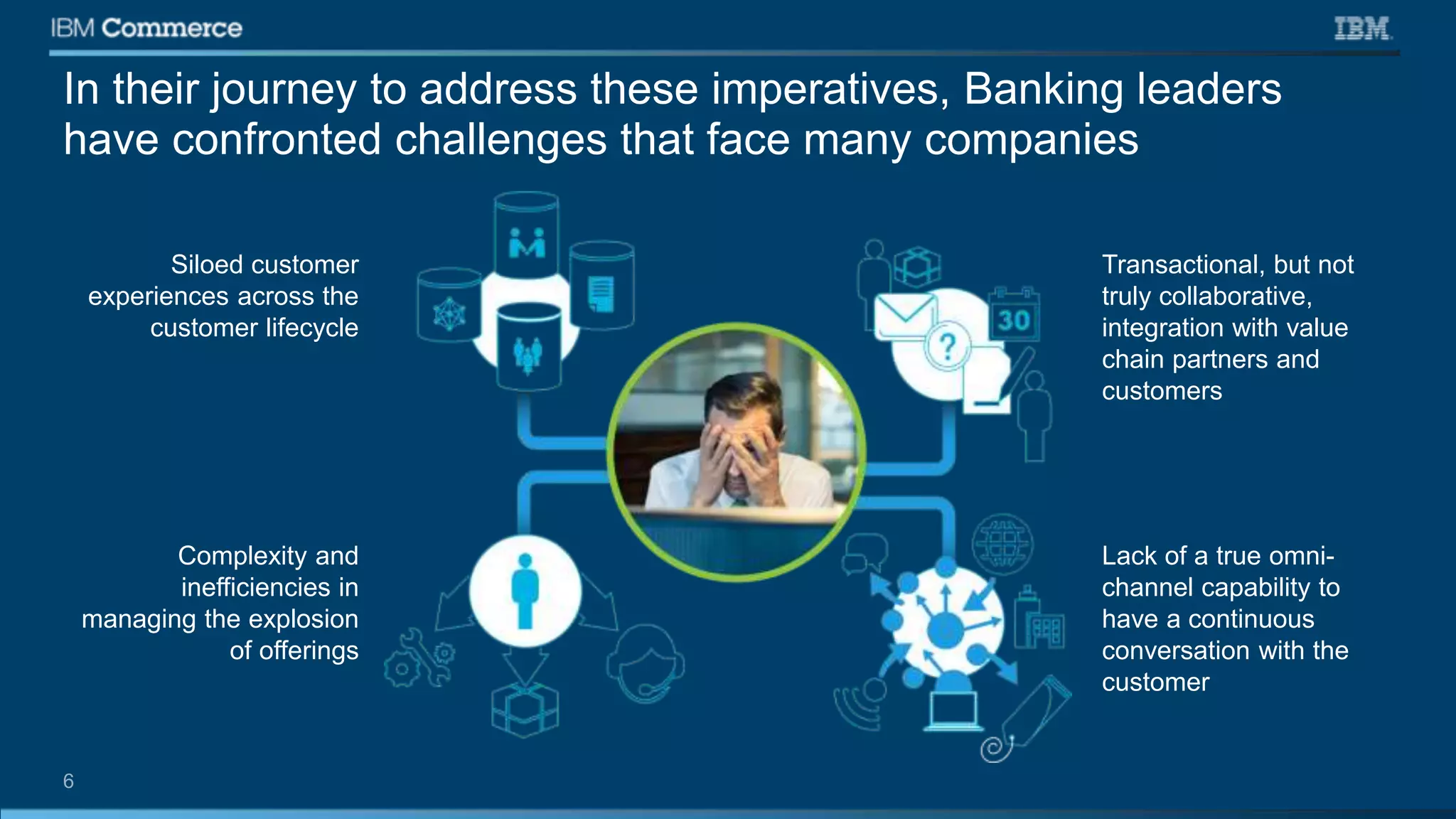

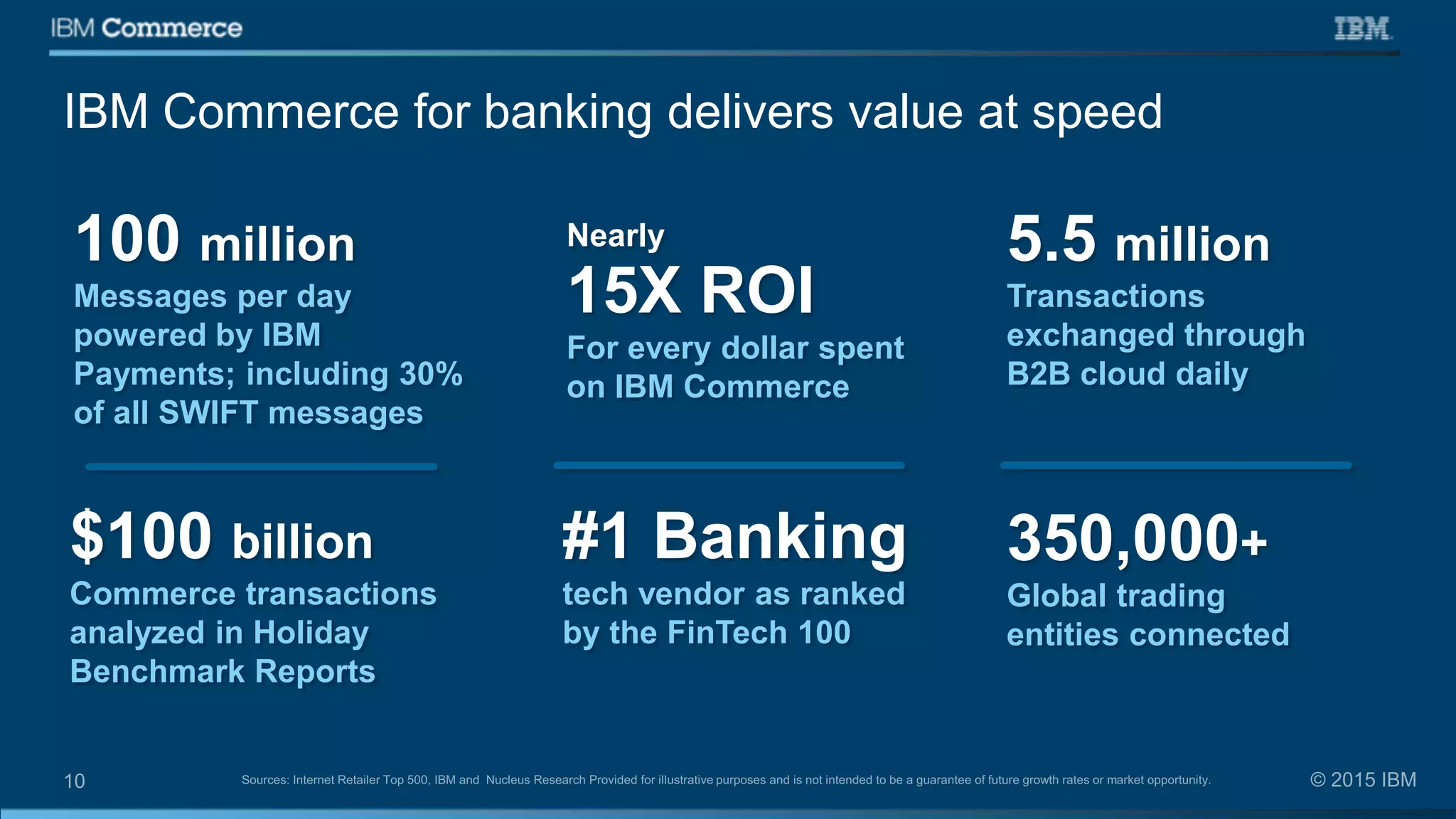

The document discusses the evolution of banking client engagement, emphasizing the need for personalized, immediate, and secure digital banking experiences. It highlights trends such as the impact of social media on customer behavior and the necessity for banks to improve real-time transaction capabilities while overcoming siloed experiences and inefficiencies. IBM's solutions for banking aim to enhance customer engagement and transaction security, making it a leading contender in the industry.