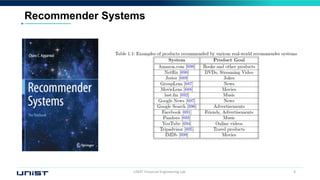

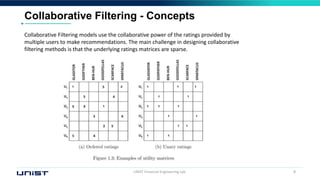

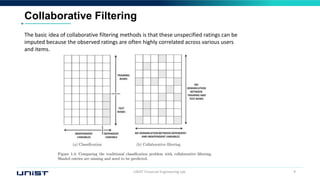

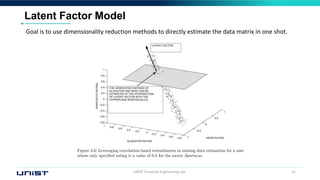

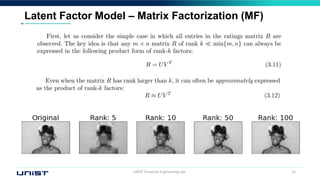

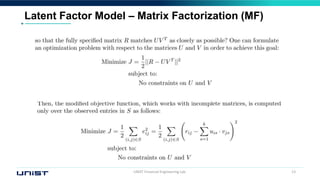

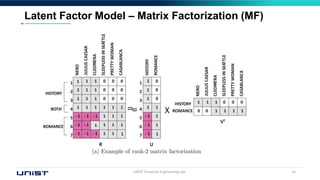

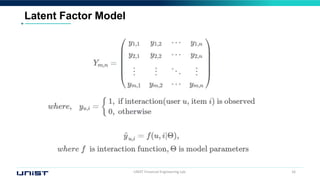

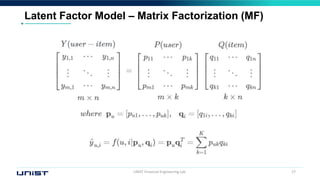

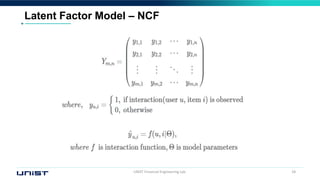

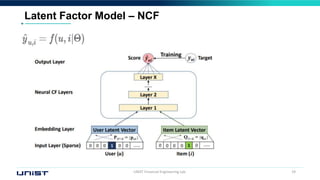

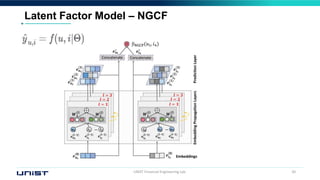

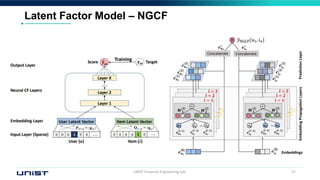

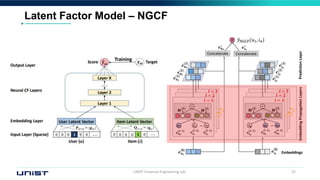

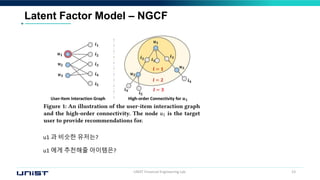

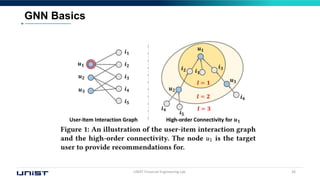

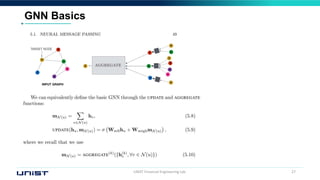

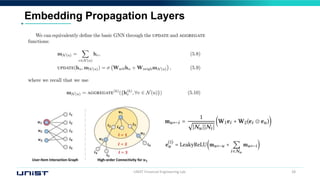

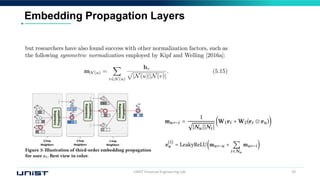

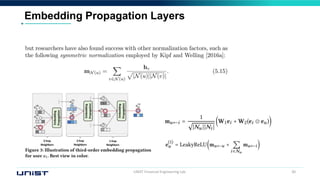

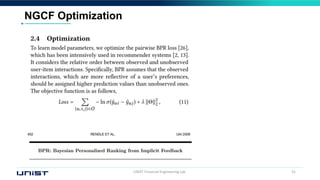

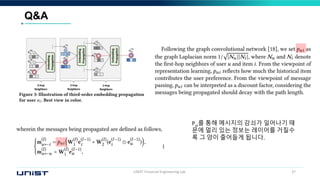

This document discusses neural graph collaborative filtering. It begins with an overview of recommender systems and collaborative filtering. It then discusses latent factor models, including matrix factorization and neural collaborative filtering (NCF). A key development was neural graph collaborative filtering (NGCF), which uses graph neural networks to model high-order connectivity in the user-item graph to address sparsity issues. NGCF aims to learn better embeddings by propagating user and item information through the graph.