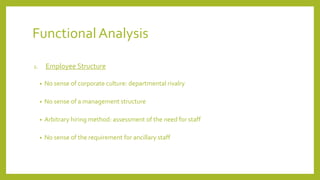

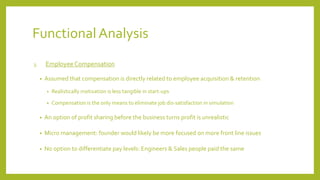

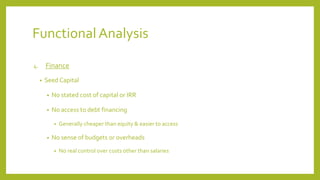

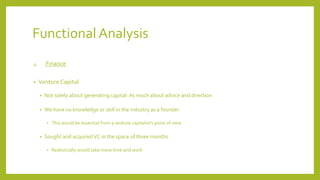

The document summarizes insights from a business simulation about starting a clean energy company. It discusses the short-term pressures of managing quarterly business metrics like profit and net worth. It also discusses the functional strategies employed, including pursuing product differentiation, growing employee numbers, and seeking venture capital. However, it notes shortcomings of the simulation in fully reflecting the real-life qualitative aspects, costs, and industry context of starting a business.