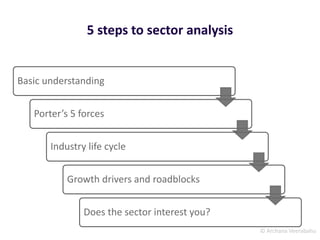

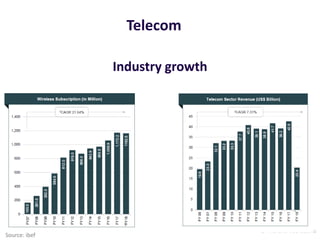

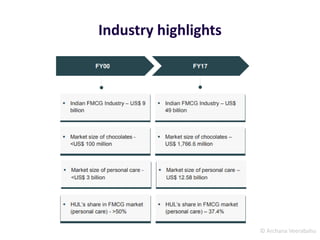

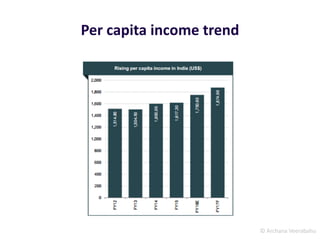

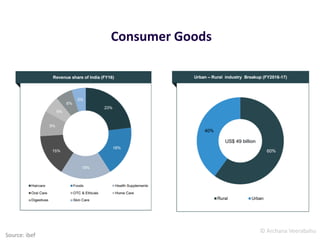

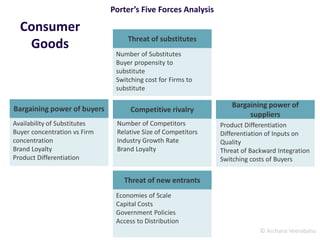

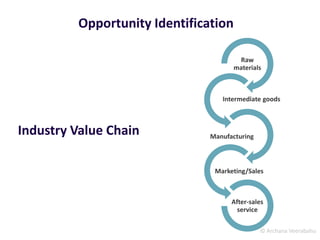

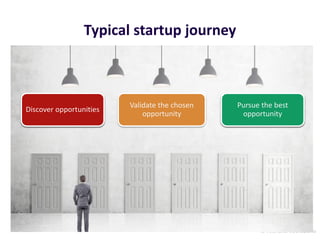

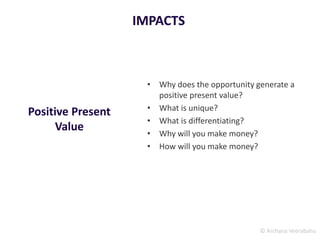

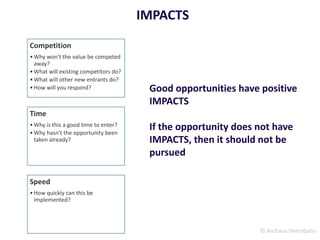

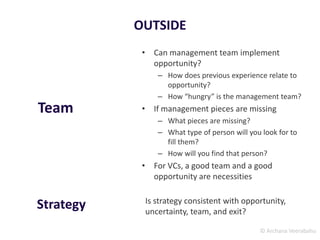

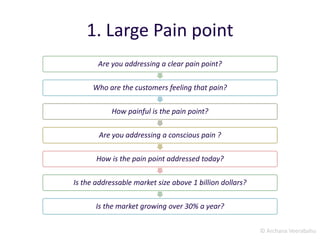

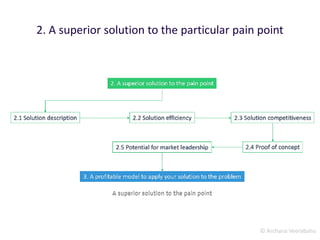

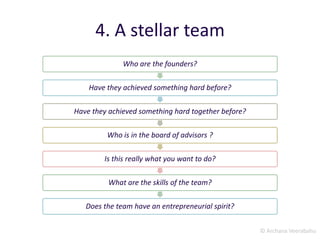

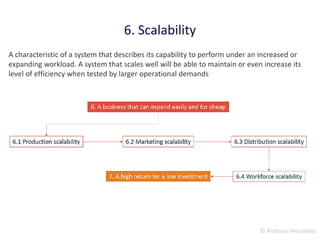

The document discusses frameworks for validating business opportunities, including Porter's Five Forces analysis and the 7+1 framework. It focuses on analyzing sectors like telecom and consumer goods using these models. Key aspects of opportunity validation covered include evaluating the market size, customer needs, competitive landscape, management team, and ensuring the opportunity has positive present value, is timely, and can be implemented and scaled efficiently.