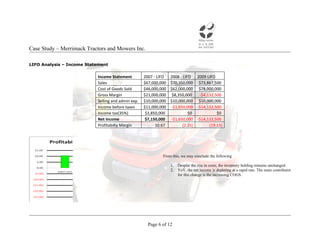

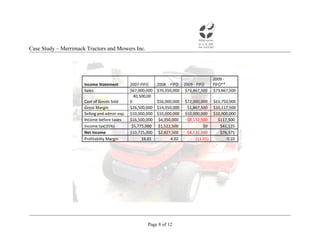

This document analyzes the inventory accounting methods of LIFO and FIFO for Merrimack Tractors and Mowers Inc. given rising costs of imports from China. Using a LIFO analysis, it shows that with LIFO, the company's net income would decrease rapidly over 2007-2009 despite sales increases, due to rising inventory costs. Switching to FIFO in 2008 would increase reported profits that year but likely lead to higher taxes in future years as costs rise. The document considers whether LIFO or FIFO is most suitable for the company given its current challenges meeting costs amid rising import prices from China.