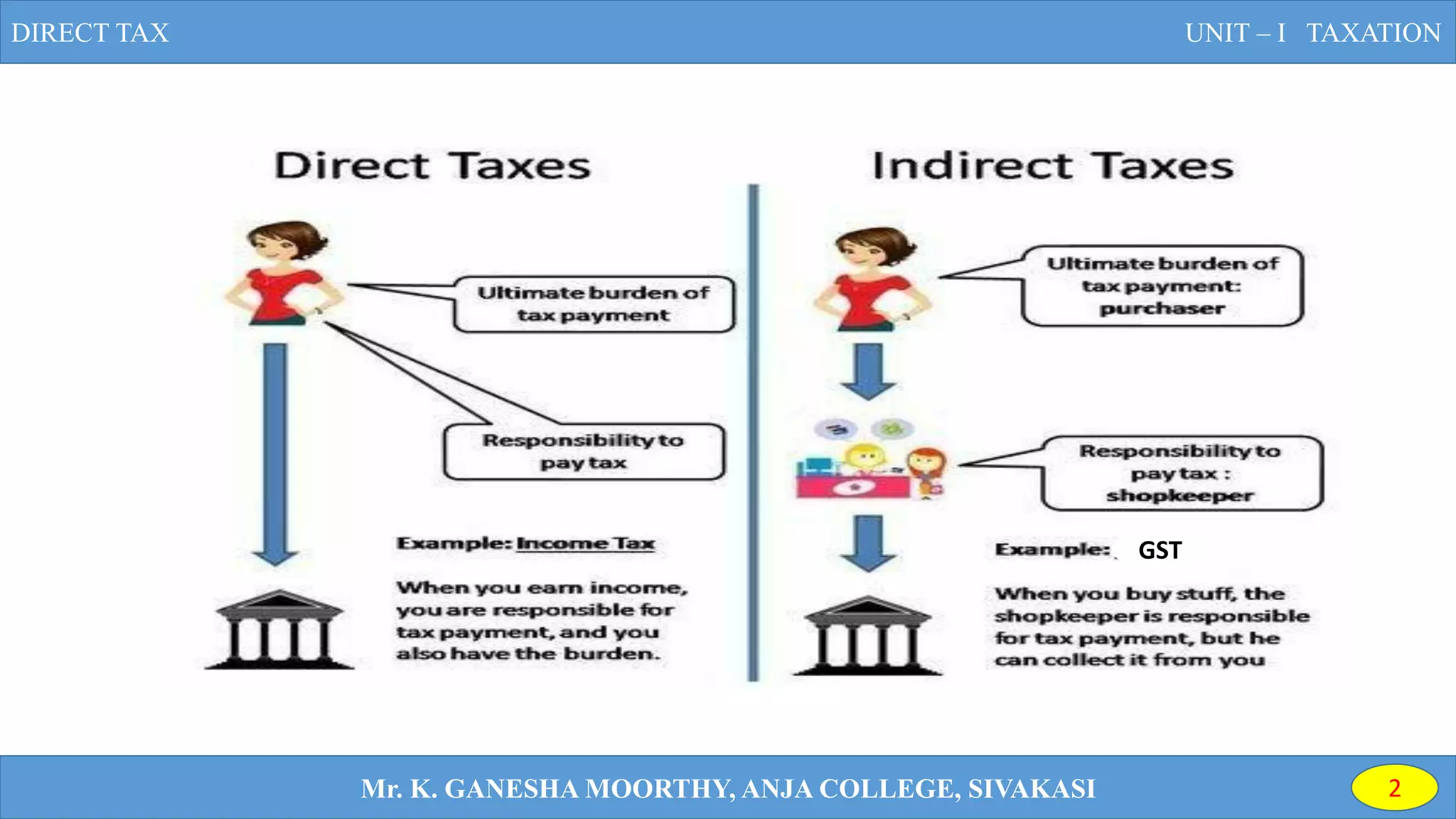

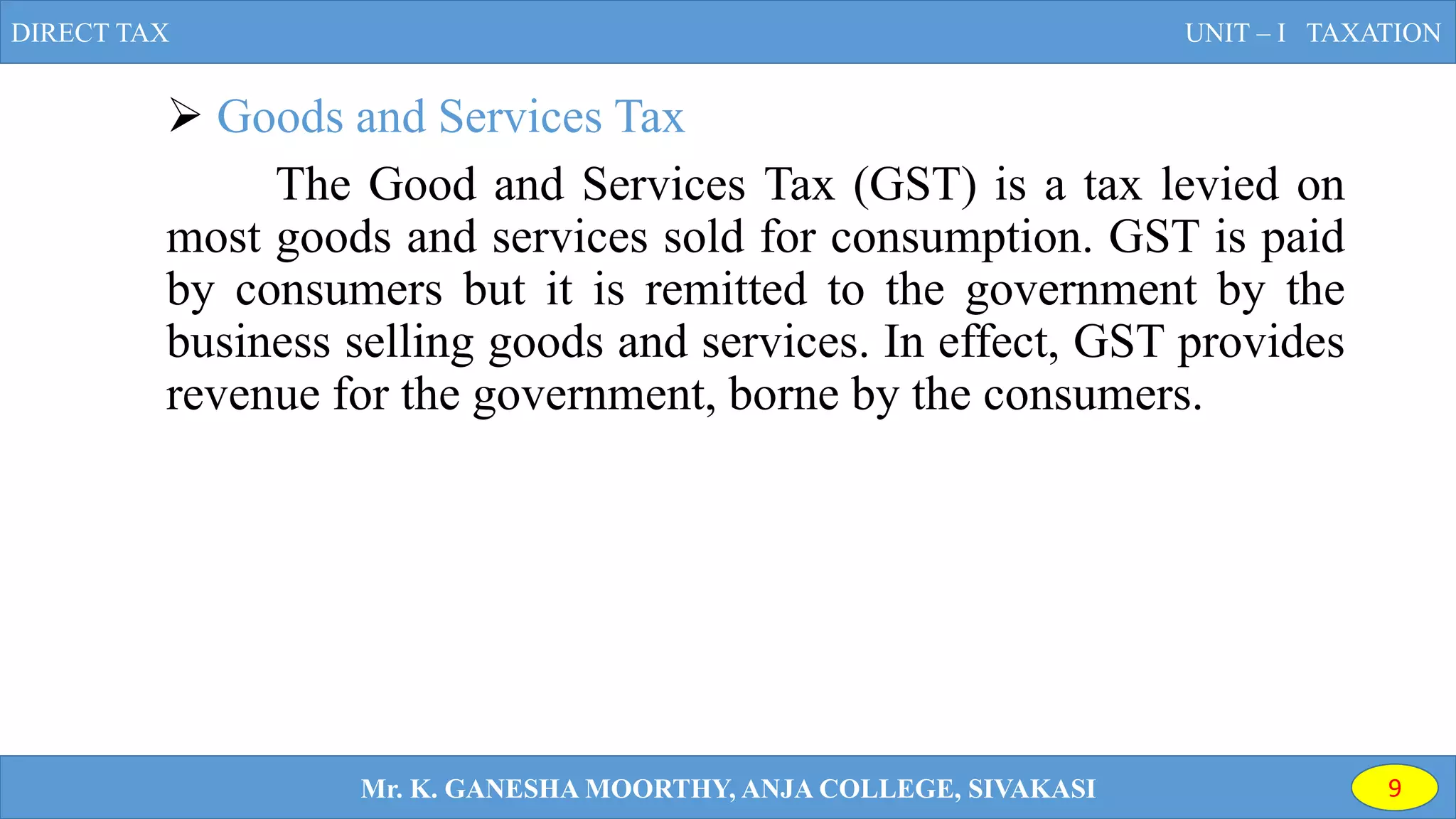

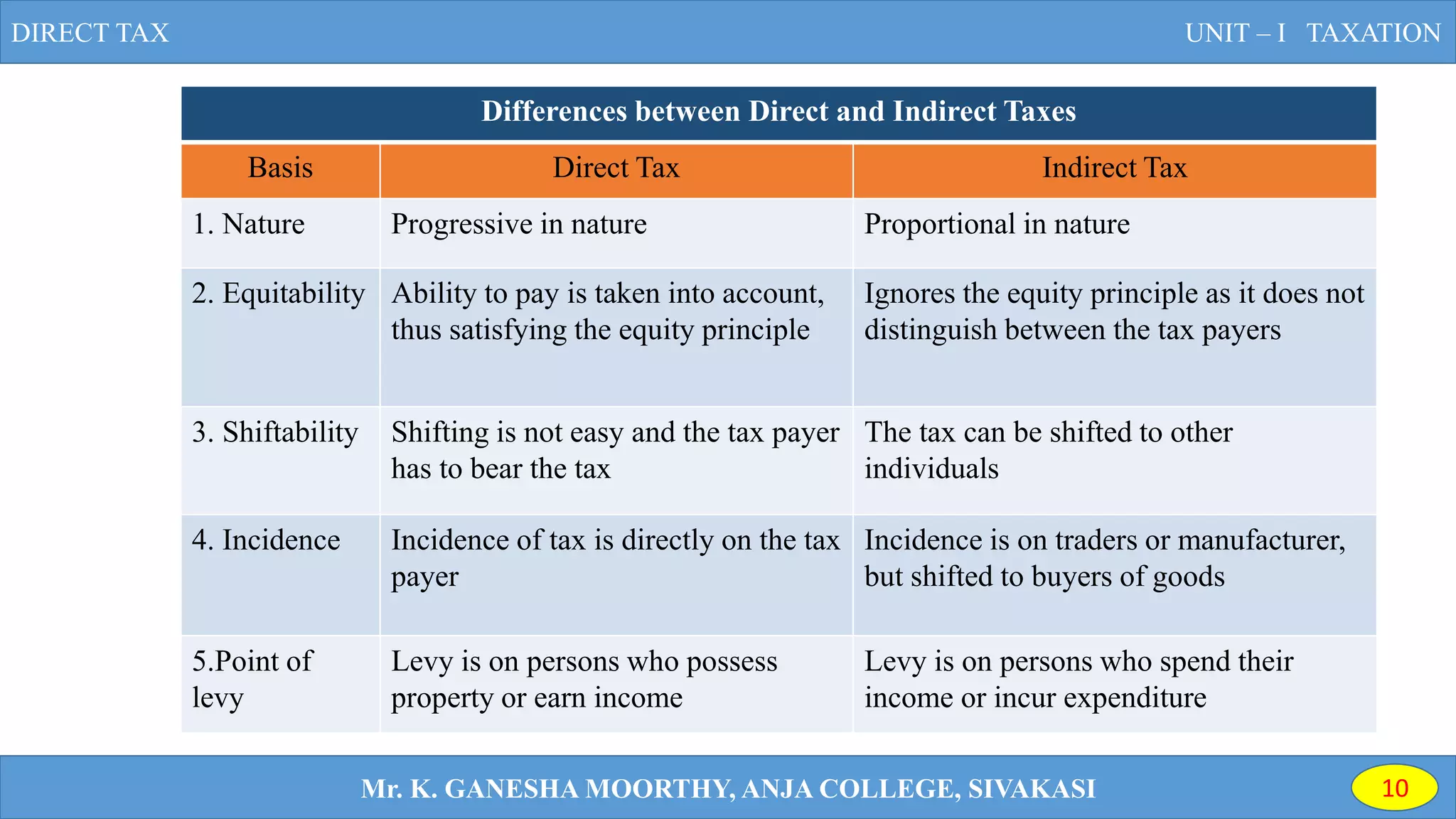

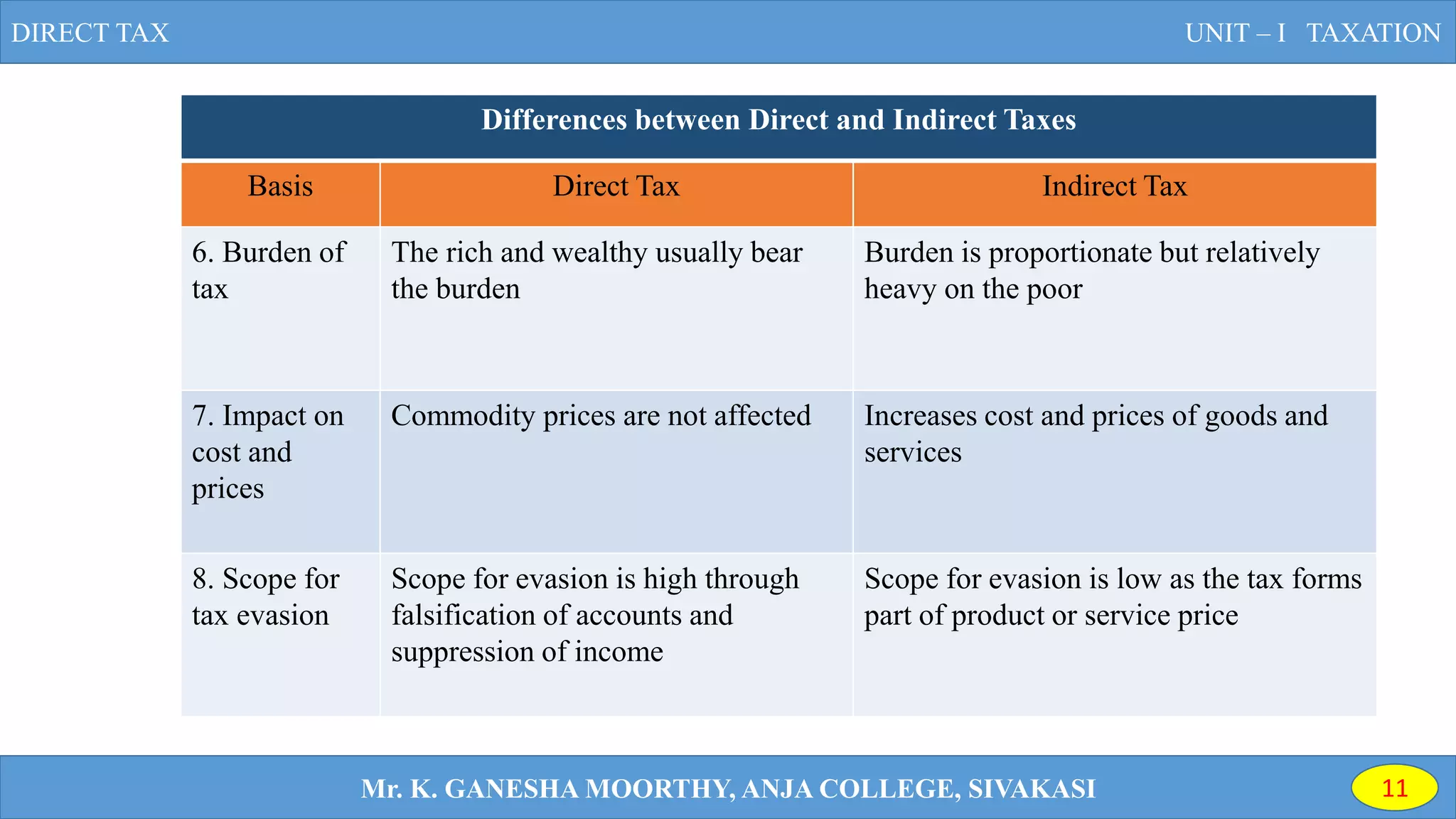

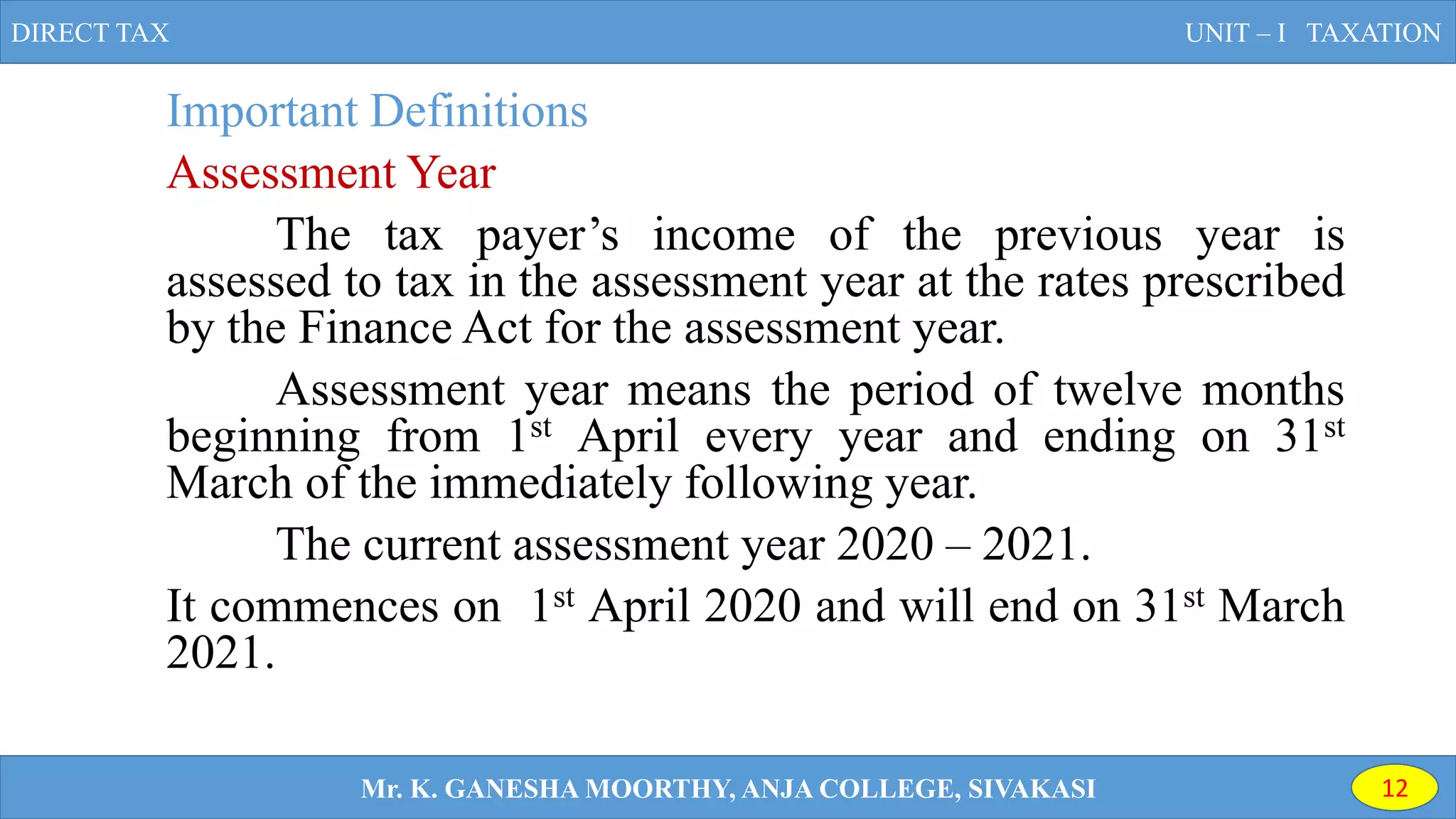

The document discusses various concepts in taxation. It defines key terms like direct tax, indirect tax, assessment year, previous year, person, assessee, and income. It also outlines the classification of taxes into direct taxes and indirect taxes. Direct taxes are further classified into those levied at the central, state, and local levels. Central direct taxes include income tax, corporation tax, dividend tax, wealth tax, and gift tax. Indirect taxes include central excise duty, customs duty, and goods and services tax (GST).