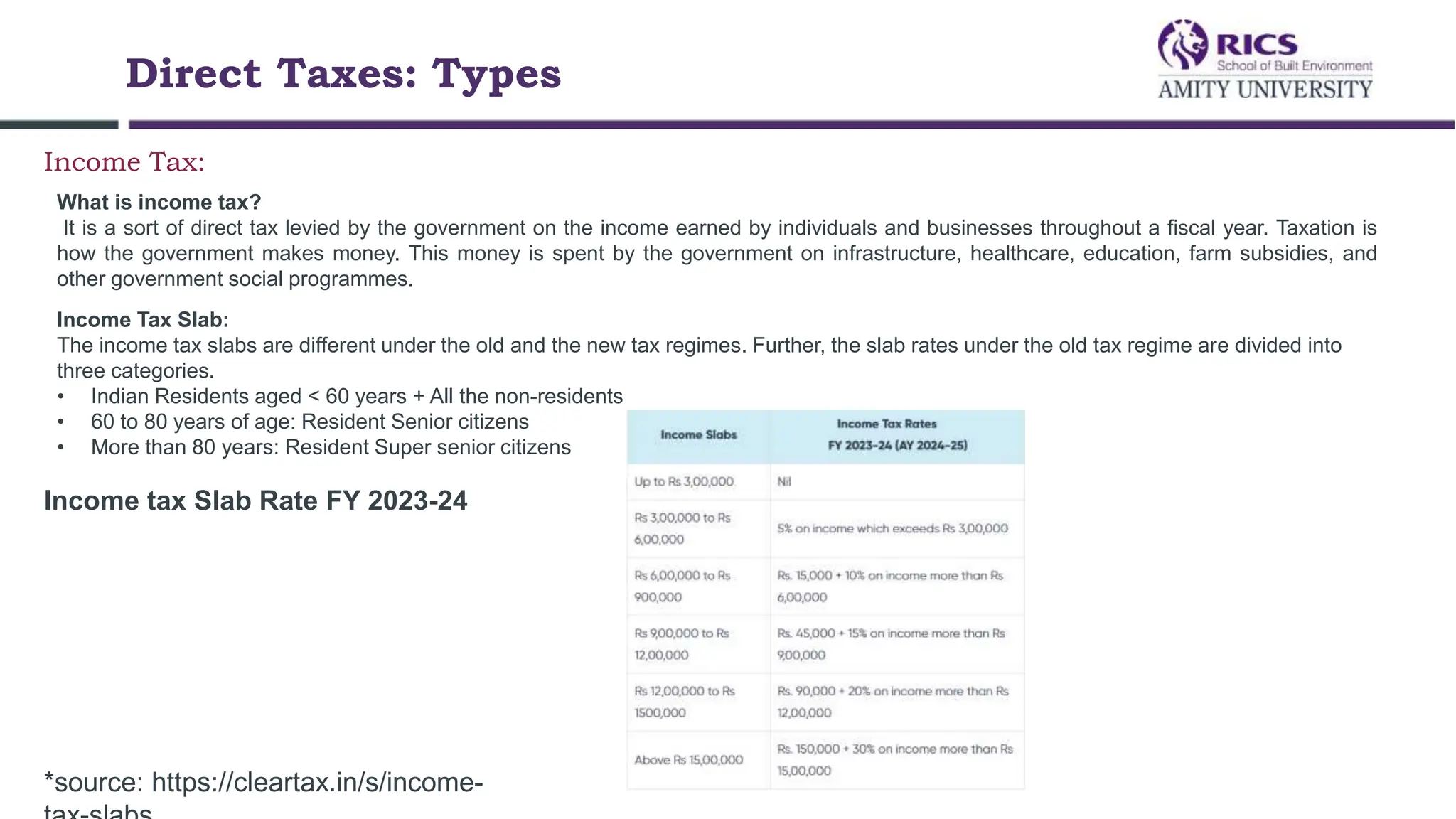

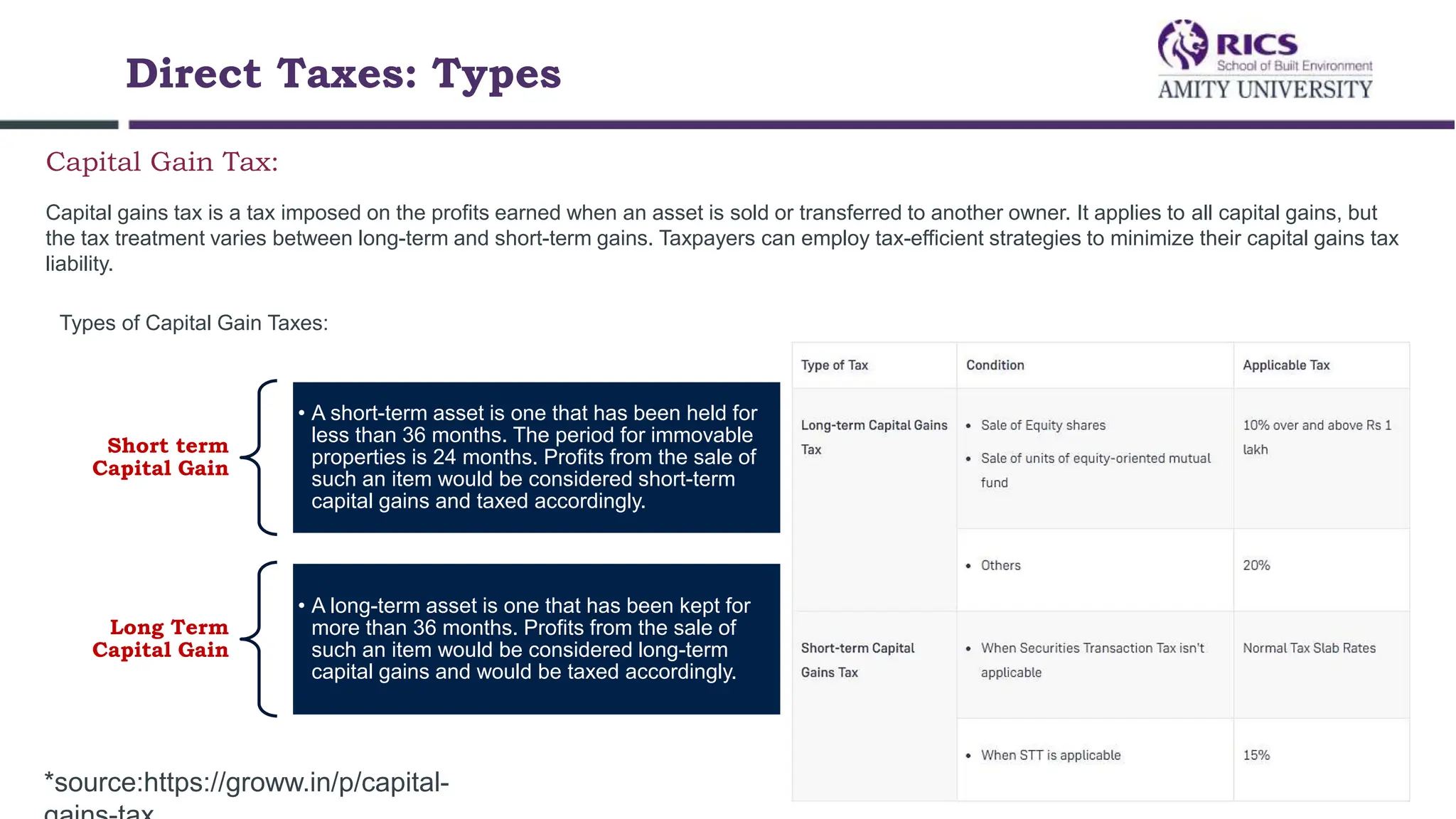

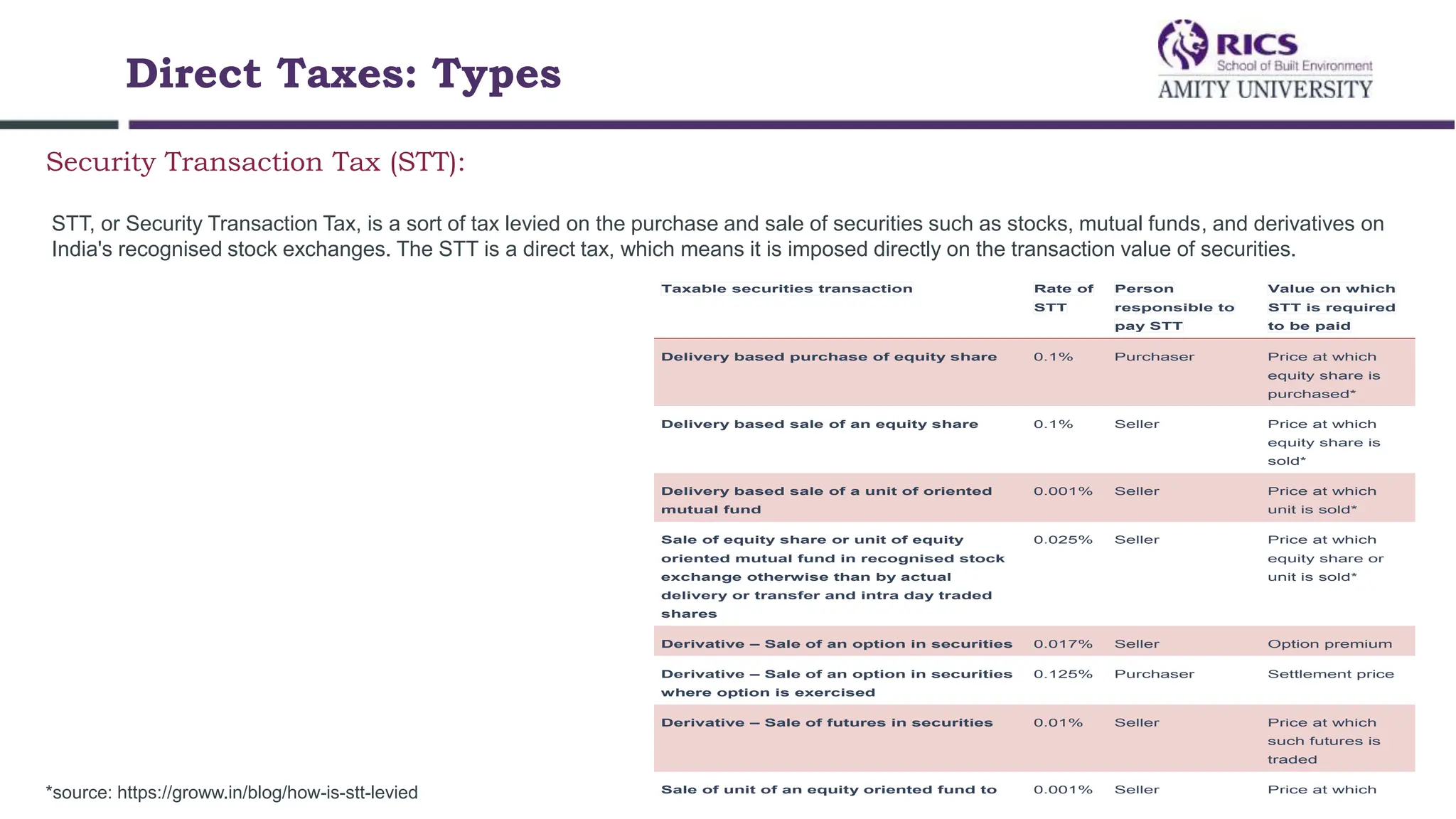

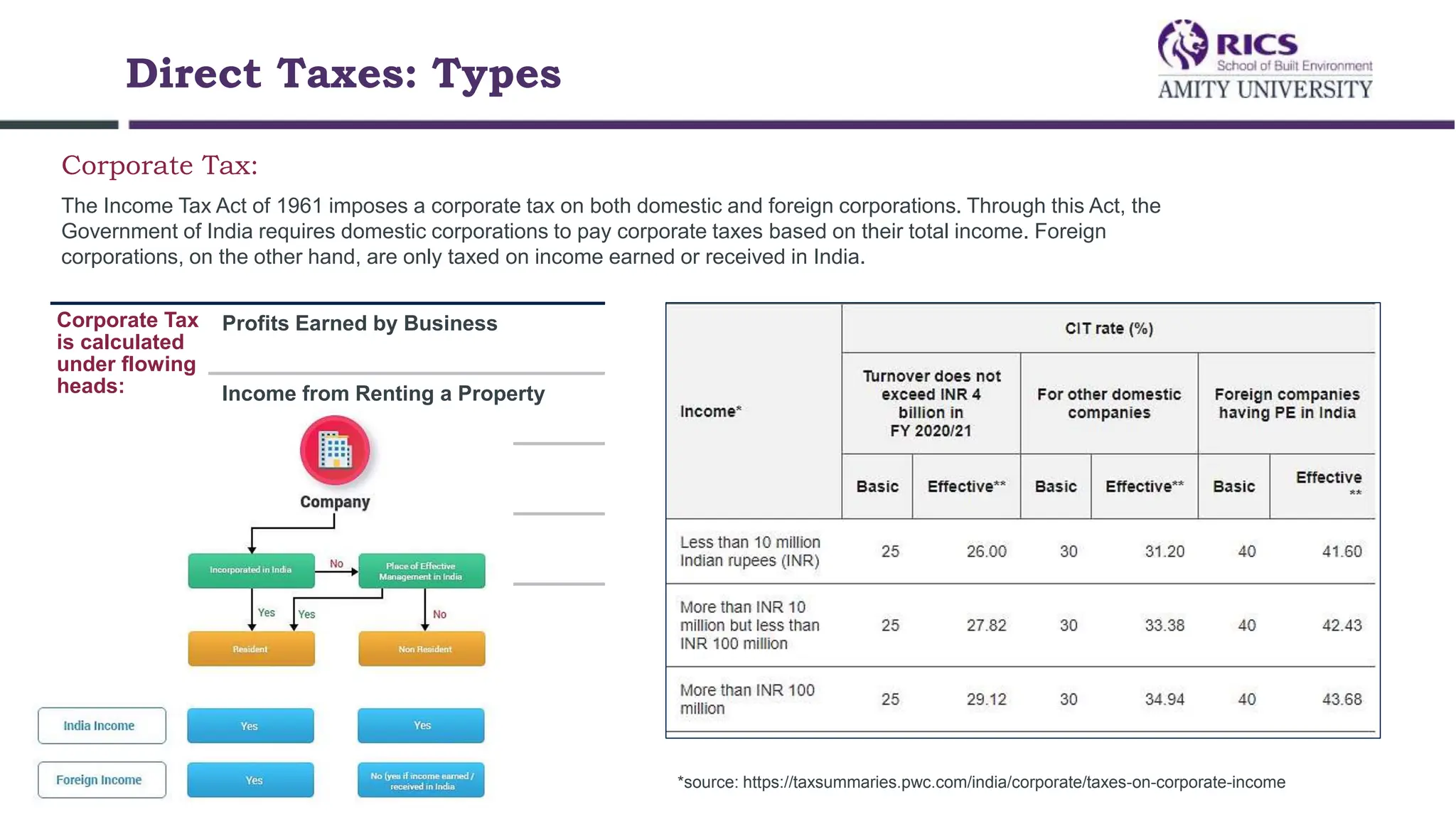

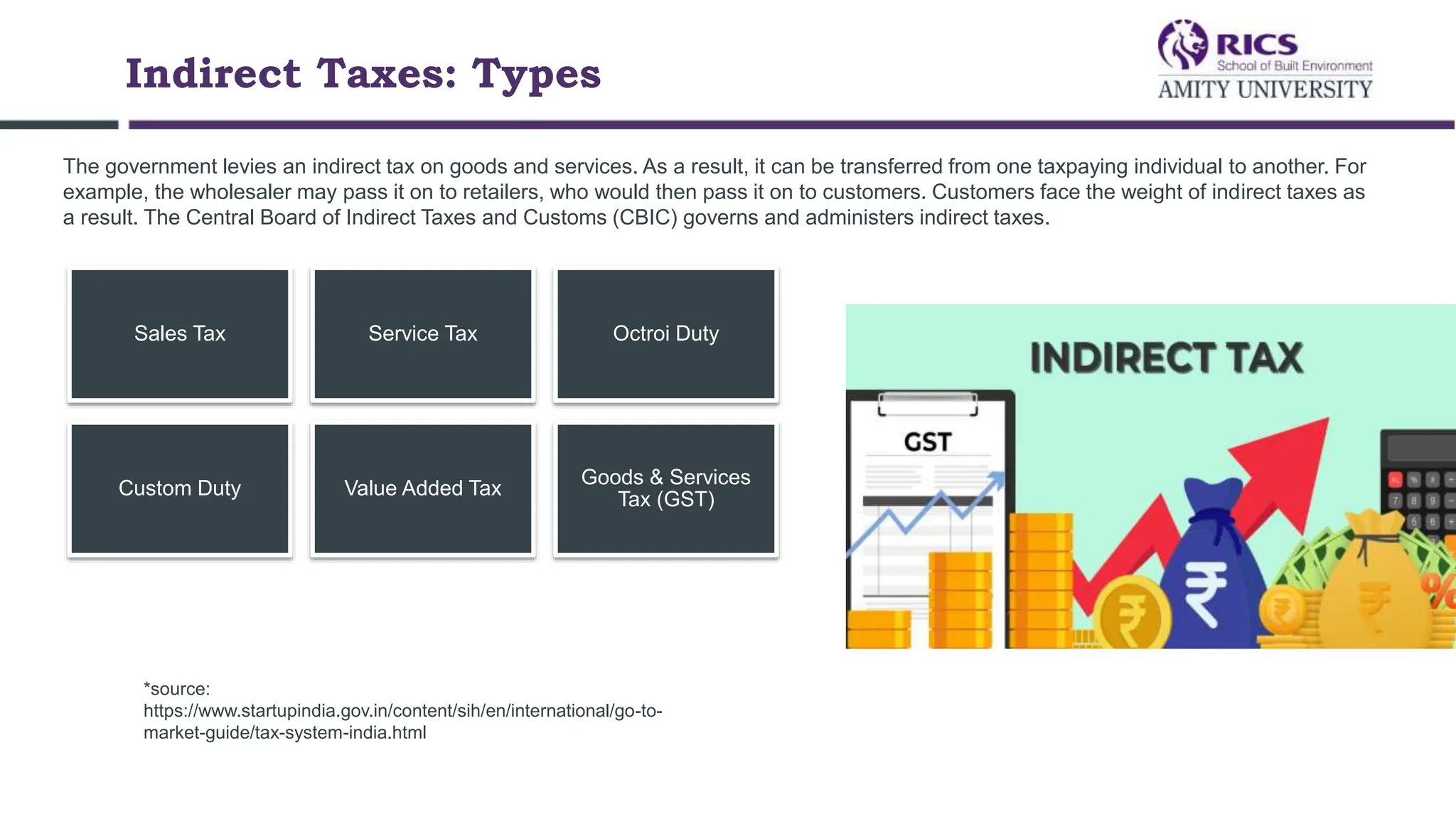

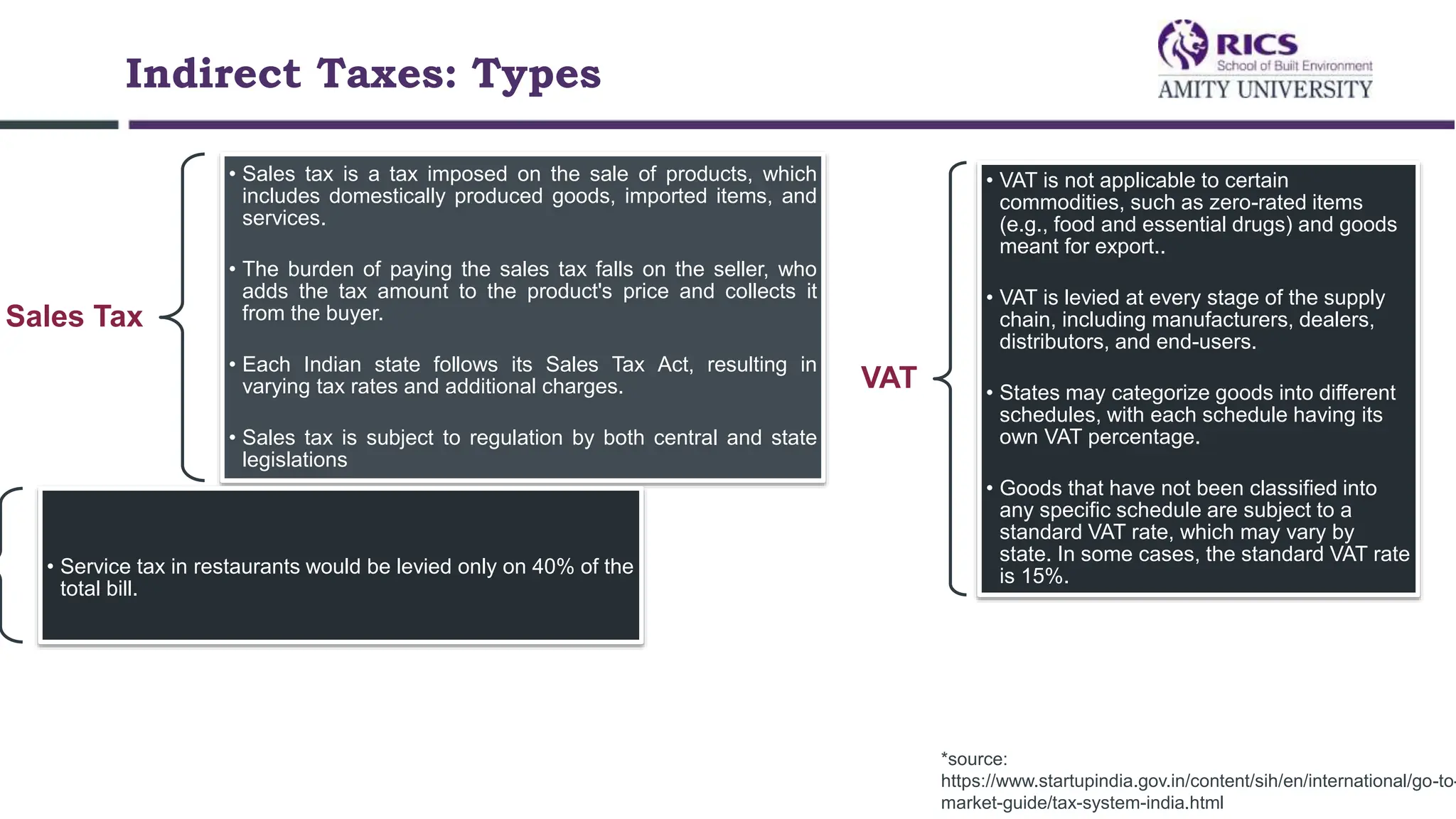

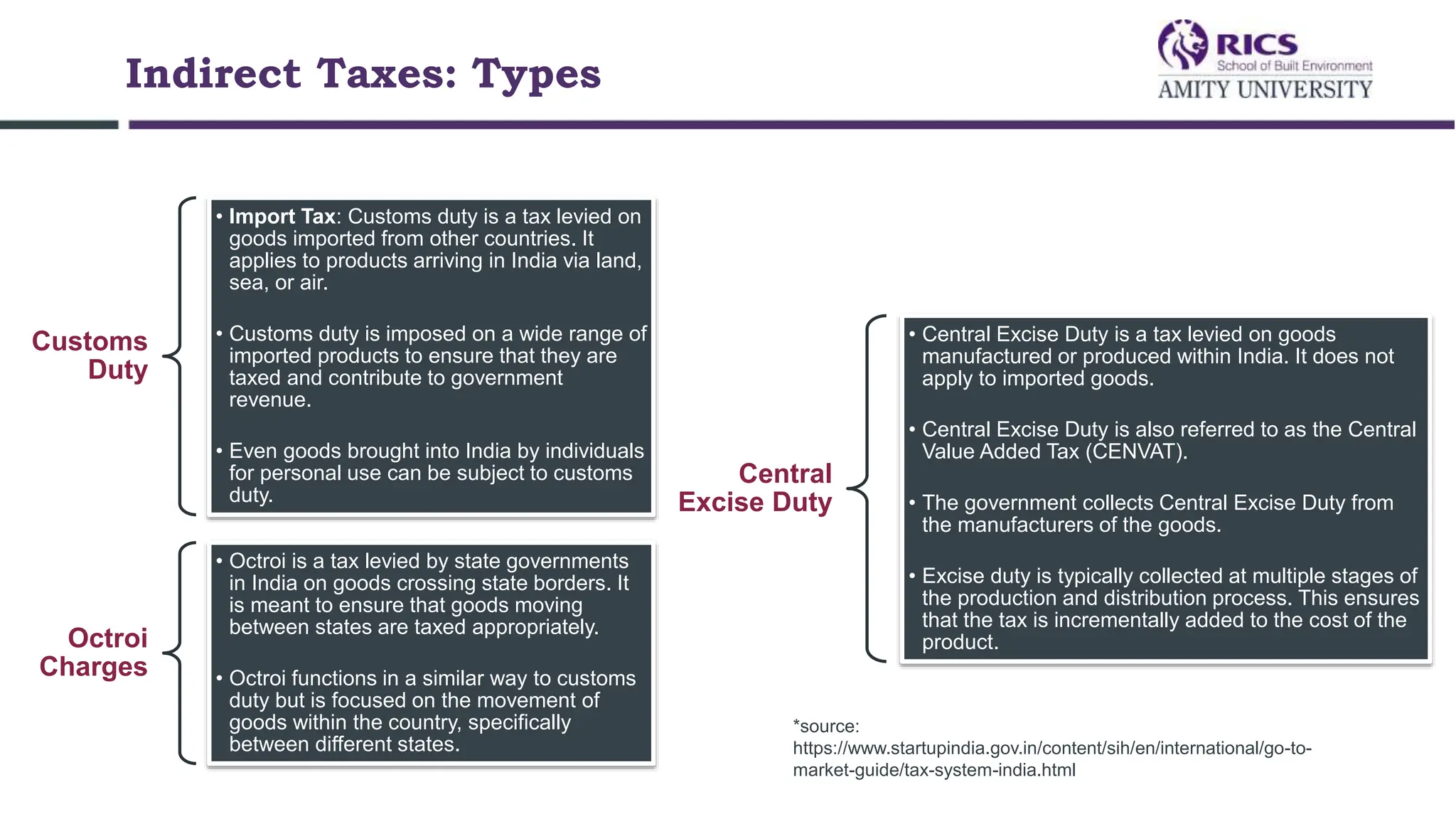

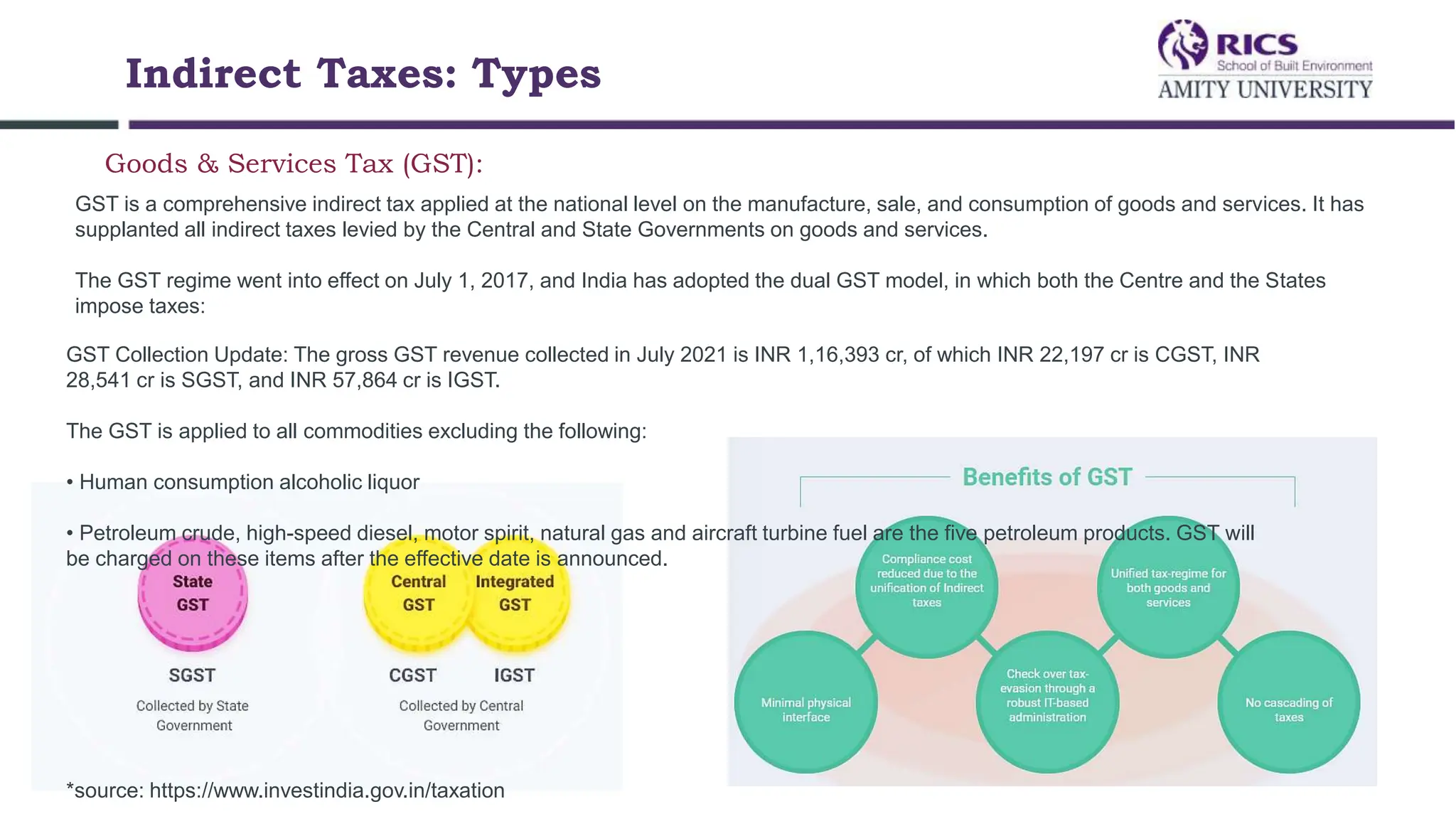

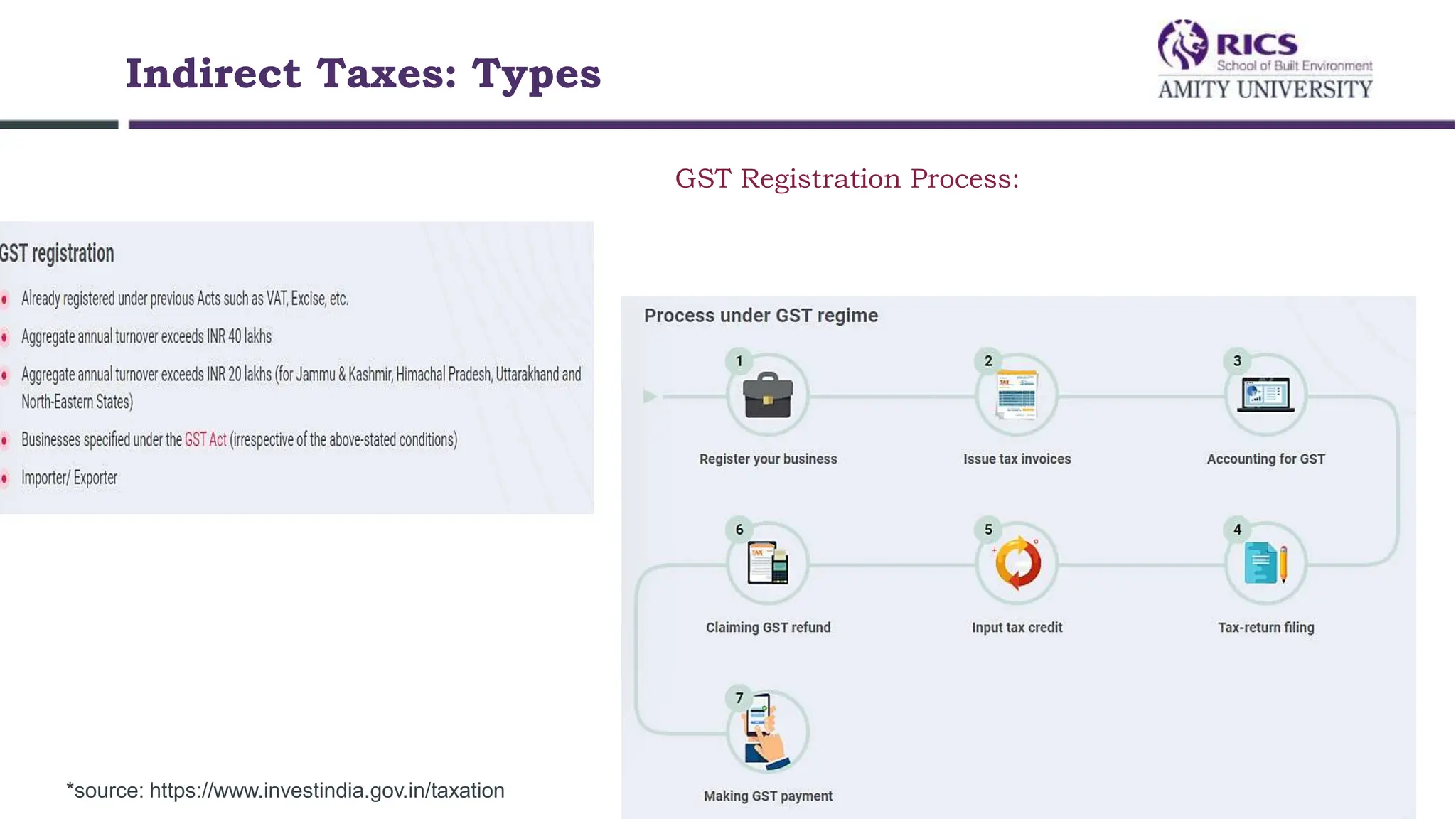

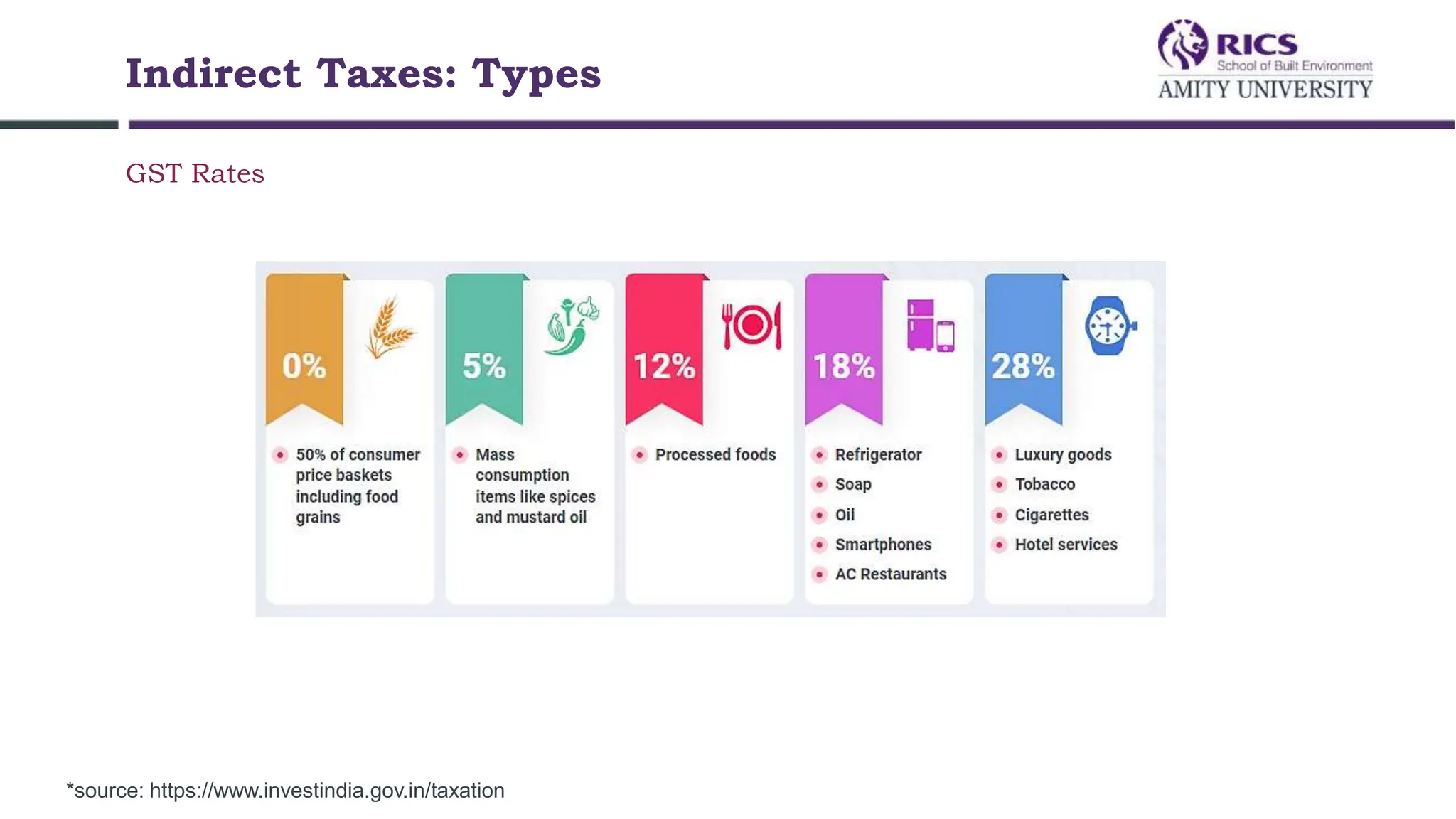

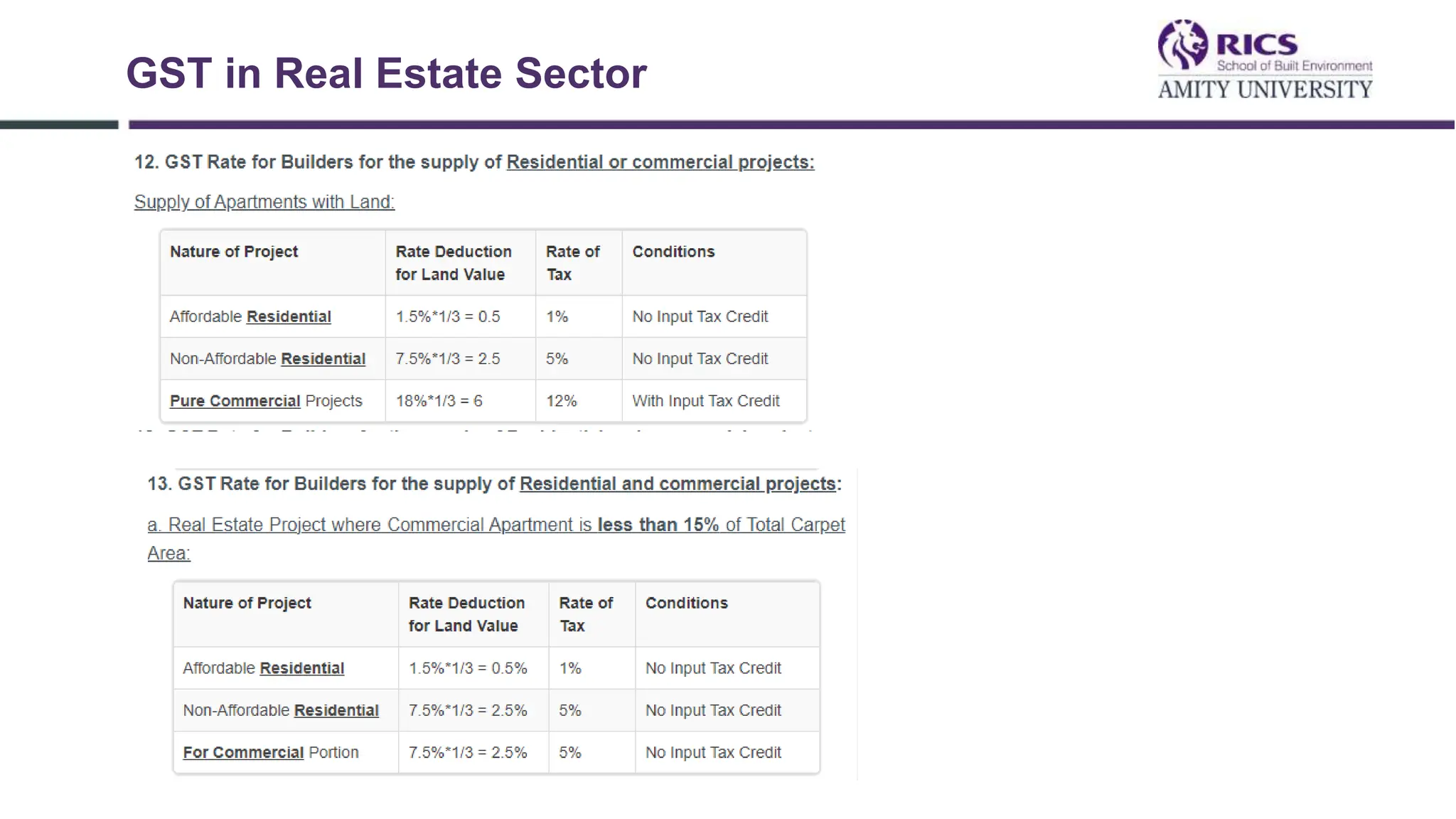

This document provides an overview of India's tax system, including both direct and indirect taxes. It begins with an introduction to taxation in India and explains that the government levies taxes to fund projects that benefit the economy and citizens. Direct taxes include income tax, capital gains tax, security transaction tax, and corporate tax, which are imposed directly on individuals and companies. Indirect taxes like sales tax, VAT, customs duty, and GST are included in the price of goods and services and can be passed along the supply chain. The document provides details on various direct and indirect tax types in India.