The document discusses the complexities of direct tax laws in India, emphasizing the need for practitioners to stay updated on interpretations and provisions. It outlines a revised edition of a comprehensive book designed to facilitate understanding of direct taxes through clear explanations, numerous illustrations, and recent case law. The authors, Dr. Vinod K. Singhania and Dr. Kapil Singhania, bring extensive expertise in tax laws and corporate economics.

![Contents

PAGE

I-7

u A few words from the authors I-5

u About the authors I-6

u Section-wise Index I-23

u Amendments at a glance I-29

u Gist of relevant Circulars, Clarifications and Notifications issued during

January 1, 2008 to February 2021 I-83

u Gist of landmark rulings of Supreme Court/High Courts [2008 - Feb. 2021] I-311

1 Basic concepts

1. Assessment year 1

2. Previous year 1

3. Person 5

4. Assessee 6

5. Charge of income-tax 6

6. Income 7

7. Gross total income 17

8. Total income and tax liability 21

9. Agricultural income 23

10. Difference between exemption and deduction 24

11. Assessment 24

12. Definition of “manufacture” 24

13. Capital asset 24

14. Company 24

15. Fair market value 24

16. Capital receipts vs. Revenue receipts 25

17. Capital expenditure vs. Revenue expenditure 31

18. Method of accounting 31

19. Definitions of amalgamation, demerger, infrastructure capital company and

infrastructure capital fund 32

20. Rules of interpretation 33

2 Residential status and tax incidence

22. What is relevance of residential status 47

23. Residential status - General norms 47

24. Residential status of an individual 48

25. Residential status of a Hindu undivided family 56

26. Residential status of the firm and association of persons 57

27. Residential status of a company 58

28. Residential status of “every other person” 62](https://image.slidesharecdn.com/taxmannsdirecttaxeslawpractice-professionaleditionsampleread-210414101733/85/Direct-Taxes-Law-Practice-Professional-Edition-6-320.jpg)

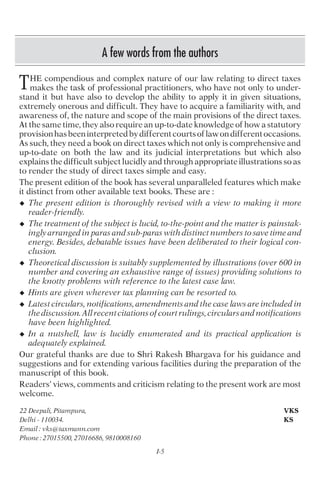

![immediately preceding the previous year in which cash is withdrawn (i.e., previous year 2020-21). Only in Situation

3, return of all earlier 3 years has not been uploaded before the due date. Therefore, in Situation 3, the threshold

limit is Rs. 20 lakh. In Situation 1 and Situation 2, threshold limit is Rs. 1 crore and amount of TDS, as calculated in

the above case study, will be valid. However, TDS computation in Situation 3 is as follows –

Date of cash withdrawal Amount of cash Cumulative Amount of TDS

withdrawal amount

Rs. in lakh Rs. in lakh

April 10, 2020 18.50 18.50 Nil

October 3, 2020 81.45 99.95 2% of Rs. 79.95 lakh

October 10, 2020 2 101.95 2% of Rs. 0.05 lakh + 5% of Rs. 1.95 lakh

March 6, 2021 40 141.95 5% of Rs. 40 lakh

Note - As mentioned earlier, if tax is to be deducted on the entire amount (once the threshold limit is exceeded), TDS

on October 3, 2020 and October 10, 2020 will be as follows –

October 3, 2020 : Rs. 1.999 lakh (i.e., 2% of Rs. 99.95 lakh).

October 10, 2020 : Rs. 3.0985 lakh (i.e., 5% of Rs. 101.95 lakh – Rs. 1.999 lakh).

420E.2-P3 Suppose in case study 420E.2-P2, Rs. 81.45 lakh is withdrawn in cash on June 26, 2020 (and not on

October 3, 2020).

SOLUTION:

In Situation 1 and Situation 2, TDS will remain unaffected. However, in Situation 3, the threshold limit of Rs. 20 lakh

is applicable with effect from July 1, 2020 and, consequently, TDS will be as follows –

Date of cash withdrawal Amount of cash Cumulative Amount of TDS

withdrawal amount

Rs. in lakh Rs. in lakh

April 10, 2020 18.50 18.50 Nil

June 26, 2020 81.45 99.95 Nil

October 10, 2020 2 101.95 2% of Rs. 0.05 lakh + 5% of Rs. 1.95 lakh

March 6, 2021 40 141.95 5% of Rs. 40 lakh

Note - See note given above.

TDS on payment by e-commerce operator to e-commerce participants [Sec.

194-O]

420F. Section 194-O has been inserted with effect from October 1, 2020. Provisions of this section

are given below –

■ Who is responsible for tax deduction at source - Where sale of goods/services of an e-commerce

participants is facilitated by an e-commerce operator through its digital or electronic facility or

platform (by whatever name called), such e-commerce operator is required to deduct tax at source

under section 194-O. For this purpose, “e-commerce operator” means a person who owns, operates

or manages digital or electronic facility or platform for electronic commerce. “e-Commerce

participant” means a person resident in India selling goods/services (including digital products)

through digital or electronic facility or platform for electronic commerce. “Services”, for this

purpose, include fees for technical services/professional services. For the purpose of this section,

e-commerce operator shall be deemed to be the person responsible for paying to e-commerce

participant.

■ Time of tax deduction at source - Tax is deductible by e-commerce operator at the time of credit

of amount of sale of goods/services to the account of an e-commerce participant or at the time of

payment thereof to such e-commerce participant by any mode, whichever is earlier.

Para 420F Income-tax - Tax deduction or collection at source 1238](https://image.slidesharecdn.com/taxmannsdirecttaxeslawpractice-professionaleditionsampleread-210414101733/85/Direct-Taxes-Law-Practice-Professional-Edition-21-320.jpg)

![■ Rate of TDS - Tax is deductible at the rate of 1 per cent (0.75 per cent up to March 31, 2021) of the

gross amount of such sale of goods/services. For this purpose, any payment made by a purchaser

of goods/services directly to an e-commerce participant for the sale of goods/services, facilitated

by an e-commerce operator, shall be deemed to be the amount credited/paid by the e-commerce

operator to the e-commerce participant and shall be included in the gross amount of such sale or

services for the purpose of tax deduction.

If the recipient does not have PAN, tax is deductible (by virtue of section 206AA) at the rate of 5 per

cent.

■ When tax is not deductible - Tax is not deductible under section 194-O if the following conditions

are satisfied –

a. e-commerce participant is an individual or HUF;

b. gross amount of such sale of goods/services through e-commerce operator during the previous

year does not exceed Rs. 5 lakh; and

c. such e-commerce participant has furnished his PAN or Aadhaar number to the e-commerce

operator.

■ TDS under any other section - Not possible - If tax is deductible under section 194-O (or not

deductible because of threshold limit of Rs. 5 lakh given above), tax cannot be deducted under any

other provisions of the Act. However, this rule is not applicable in the case of amount received/

receivable by an e-commerce operator for hosting advertisements or providing any other services

which are not in connection with the sale of goods/services given above.

■ Lower TDS certificate - Lower/nil TDS certificate can be obtained by e-commerce participants by

submitting Form No. 13 within the parameters of section 197 [see para 426.2].

■ Removing difficulty - If any difficulty arises in giving effect to the provisions of this section, the

Board may, with the approval of the Central Government, issue guidelines for the purpose of

removing the difficulty. These guidelines shall be laid before each House of Parliament and shall be

binding on the income-tax authorities and on the e-commerce operator.

420F-P1 XLtd.,Y,ZandCLtd.(e-commerceparticipants)supply goodsinIndiathroughAnazon(aSingaporebased

website) owned by Anazon Ltd. Anazon Ltd. wants to know tax to be deducted under section 194-O in the following

different situations –

Situation 1 - During the financial year 2020-21, X Ltd. sells goods of Rs. 44 lakh through Anazon Ltd. Anazon Ltd.

transfers Rs. 37.4 lakh (i.e., gross sales excluding GST : Rs. 44 lakh minus commission : 15 per cent) through RTGS

on March 31, 2021.

Situation 2 - The above payment is made by Anazon Ltd. in 3 instalments – Rs. 19.55 lakh on January 1, 2021,

Rs. 7.65 lakh on March 1, 2021 and the balance of Rs. 10.2 lakh is transferred to the account of X Ltd. (in the books

of Anazon Ltd.) on March 31, 2021 (actual payment is made through RTGS on May 18, 2021).

Situation 3 - In Situation 2, assume that e-commerce participant is not X Ltd. but X, an individual.

Situation 4 - During the financial year 2020-21, Y (an individual, e-commerce participant) supplies services

(aggregate value of which is Rs. 4.5 lakh) through Anazon Ltd. Y has furnished his PAN to Anazon Ltd.

Situation 5 - During the financial year 2020-21, Z (an individual, e-commerce participant) supplies goods (aggregate

value of which is Rs. 5 lakh) through Anazon Ltd. Z has furnished his PAN to Anazon Ltd.

Situation 6 - C Ltd. is an e-commerce participant. It supplies goods in India through Anazon Ltd. (i.e., e-commerce

operator). During the financial year 2020-21, C Ltd. sells goods of Rs. 60 lakh through Anazon Ltd., out of which

Rs. 20 lakh is directly received by C Ltd. and Rs. 40 lakh is received first by Anazon Ltd. and later on it is remitted to

C Ltd. on March 31, 2021. Commission of C Ltd. in the two cases is 15 per cent. C Ltd. gets the payment directly

from the customers as follows –

a. First payment of Rs. 18 lakh - It is received by C Ltd. on October 6, 2020.

b. Second payment of Rs. 2 lakh - Received by C Ltd. on January 10, 2021.

Amount of Rs. 40 lakh is remitted by Anazon Ltd. (after deducting 15 per cent of Rs. 60 lakh as commission) to C Ltd.

on March 31, 2021.

1239 TDS on payment by e-commerce operator Para 420F](https://image.slidesharecdn.com/taxmannsdirecttaxeslawpractice-professionaleditionsampleread-210414101733/85/Direct-Taxes-Law-Practice-Professional-Edition-22-320.jpg)

![SOLUTION:

Gross payment (before deducting commission) is subject to TDS under section 194-O at the rate of 1% (in non-PAN

cases, tax is deductible at the rate of 5%). However, if there is any GST indicated separately in the invoice, it shall

be excluded for the purpose of TDS – Circular No. 23/2017 dated July 19, 2017. Tax is deductible under section

194-O in different situations as follows –

Situation 1 - Tax is deductible at the rate of 1%† of Rs. 44 lakh (excluding GST) on March 31, 2021.

Situation 2 - One has to find out gross payment pertaining to Rs. 19.55 lakh, Rs. 7.65 lakh and Rs. 10.2 lakh (after

excluding GST). In this situation, tax is deductible as follows –

Date of payment to Net amount of Gross amount (i.e., net Amount of

e-commerce participant payment amount ÷ 0.85) TDS†

and date of TDS Rs. Rs. Rs.

January 1, 2021 19,55,000 23,00,000 23,000

March 1, 2021 7,65,000 9,00,000 9,000

March 31, 2021 10,20,000 12,00,000 12,000

Total 37,40,000 44,00,000 44,000

Situation 3 - e-Commerce participant is an individual. However, gross amount of sale through Anazon Ltd. during

the year exceeds Rs. 5 lakh. Consequently, tax is deductible by Anazon Ltd. as discussed in Situation 2.

Situation 4 - e-Commerce participant is Y (an individual). Gross amount of sales through e-commerce operator does

not exceed Rs. 5 lakh. Consequently, tax is not deductible under section 194-O.

Situation 5 - e-Commerce participant is Z (an individual). Gross amount of sales through e-commerce operator does

not exceed Rs. 5 lakh. Consequently, tax is not deductible under section 194-O.

Situation 6 - Even if the payment of Rs. 20 lakh is received directly by C Ltd. (e-commerce participant), tax will be

deducted by Anazon Ltd. on the entire Rs. 60 lakh (after deducting GST). Schedule for tax deduction under section

194-O is as follows –

- Payment of Rs. 18 lakh - It is received by C Ltd. on October 6, 2020. Date of tax deduction by Anazon Ltd. is

October 6, 2020 (amount of TDS is Rs. 18,000, being 1%† of Rs. 18 lakh).

- PaymentofRs.2lakh-ItisreceivedbyCLtd.onJanuary10,2021.DateoftaxdeductionbyAnazonLtd.isJanuary

10, 2021 (amount of TDS is Rs. 2,000, being 1%† of Rs. 2 lakh).

- Amount of Rs. 40 lakh - Net amount of payment is Rs. 31 lakh (i.e., Rs. 40 lakh – commission which is 15% of

Rs. 60 lakh). Tax is deductible by Anazon Ltd. on March 31, 2021 is Rs. 40,000 (being 1%† of Rs. 40 lakh).

420F-P2 In the above case study, the e-commerce participants are required to pay commission on sales to

e-commerce operator. e-Commerce participants want to know whether they have TDS liability under section 194H

or under any other section.

SOLUTION:

If tax is deducted under section 194-O (or not deducted because e-commerce participant is an individual and his

gross sales/services through an e-commerce operator during the financial year does not exceed Rs. 5 lakh), then tax

is not deductible under any other provision under the Act (including section 194H).

Deduction of tax in case of specified senior citizen [Sec. 194P]

420G. The provisions of section 194P (inserted with effect from April 1, 2021) are given below –

■ Specified senior citizen - Under section 194P, tax is deductible only in the case of “specified senior

citizen”. For this purpose, specified senior citizen is an individual who satisfies the following

conditions –

1. He is a resident individual.

2. He is 75 years or more at any time during the previous year (for the previous year 2021-22, a

resident individual shall be treated as “specified senior citizen” only if he was born before April 2,

1947).

3. He has income from pension which is credited in his pension account with “specified bank”.

† TDS rate has been reduced to 0.75 per cent during October 1, 2020 and March 31, 2021.

Para 420G Income-tax - Tax deduction or collection at source 1240](https://image.slidesharecdn.com/taxmannsdirecttaxeslawpractice-professionaleditionsampleread-210414101733/85/Direct-Taxes-Law-Practice-Professional-Edition-23-320.jpg)

![4.Hehasnootherincomeexceptinterestreceived/receivablefromanyaccountmaintainedbysuch

individual in the same “specified bank” in which he gets pension income.

5. He shall be required to furnish a declaration to the “specified bank”. The declaration shall contain

such particulars, in such form and verified in such manner, as may be prescribed.

■ Specified bank - “Specified bank” means a banking company as notified by the Central Govern-

ment.

■ Tax deduction by specified bank - Once the declaration is furnished by the specified senior citizen,

the specified bank would be required to compute the income of such senior citizen. For computing

total income, deduction under sections 80C to 80U should be given along with rebate under section

87A. The specified bank shall deduct income-tax on such total income on the basis of rates in force.

■ At what time tax is deductible by specified bank - It is not given in section 194P.

■ Return under section 139(1) not required - The provisions pertaining to submission of return of

income under section 139, shall not apply to the specified senior citizen for the assessment year

relevant to the previous year in which tax is deducted under section 194P.

Deduction of tax at source on payment for purchase of goods [Sec. 194Q]

420H. The provisions of section 194Q (inserted with effect from July 1, 2021) are given below –

■ Who is buyer - Under section 194Q, tax is deductible by buyer of goods. “Buyer” for this purpose,

means a person whose total sales, gross receipts or turnover from the business carried on by him

exceed Rs. 10 crore during the financial year immediately preceding the financial year in which the

purchase of goods is carried out. However, “buyer” does not include a person notified by the Central

Government (subject to such conditions as may be specified therein).

■ Who is responsible for tax deduction - Any person (being a buyer) who is responsible for paying

any sum to any resident seller for purchase of any goods of the value (or aggregate of such value)

exceeding Rs. 50 lakh in any previous year, is required to deduct tax at source under section 194Q

with effect from July 1, 2021.

■ At what time tax is deductible - Tax should be deducted by buyer, at the time of credit of such sum

to the account of the seller or at the time of payment thereof by any mode, whichever is earlier.

Where, however, the above sum is credited to any account (whether called “suspense account” or

by any other name) in the books of account of the person liable to pay such income, such credit of

income shall be deemed to be the credit of such income to the account of the payee and the

provisions of this section shall apply accordingly.

■ Rate of TDS - Tax is deductible by buyer at the rate of 0.1 per cent of the amount paid or payable

exceeding Rs. 50 lakh (in no PAN cases, tax is deductible at the rate of 5 per cent).

■ Threshold limit - Threshold limit is Rs. 50 lakh.

■ When tax is not available - Tax is not deductible in the following cases –

Cases when TDS under section Comments

194Q not applicable

Case 1 - If tax is deductible under If tax is deductible under any other section, then tax shall be deducted

any other section under that section and not under section 194Q. Even when tax is

deductible under any other section (but not actually deducted by the

payer), TDS provisions of that section will apply and not TDS under

section 194Q.

Case 2 - If tax is collectible under If a particular transaction is covered by TCS provisions of section 206C

the provisions of section 206C [other than sub-section (1H)], then tax will be collected by the seller

[but other than sub-section (1H)] (and tax is not deductible by the buyer under section 194Q).

If a particular transaction is covered by section 194Q as well as section

206C(1H), then TDS under section 194Q will apply and not TCS under

section 206C(1H).

1241 TDS on payment for purchase of goods Para 420H](https://image.slidesharecdn.com/taxmannsdirecttaxeslawpractice-professionaleditionsampleread-210414101733/85/Direct-Taxes-Law-Practice-Professional-Edition-24-320.jpg)

![■ Removing difficulty - If any difficulty arises in giving effect to the provisions of section 194Q, the

Board may, with the approval of the Central Government, issue guidelines for the purpose of

removing the difficulty. These guidelines shall be laid before each House of Parliament and shall be

binding on the income-tax authorities and on the person liable to deduct tax.

Deduction of tax at source from other sums [Sec. 195]

421. A person (resident or non-resident) responsible for making payment to a non-resident or

foreign company of any interest or any other sum (not being salary) is required to deduct tax at

source under section 195, if in the hands of recipient such payment is chargeable to tax in India. Tax

is deductible at the time of payment or at the time of credit to the account of payee, interest payable

account, or suspense account, whichever is earlier. Tax is deductible at the rates prescribed by the

relevant Finance Act [see Annex 1 for rates of tax deduction at source].

■ TDSliabilityundersection195arisesonlywhenincomeiscreditedtoaccountofpayeeoronactual

payment of same, whichever is earlier and mere accrual of income in hands of foreign company

would not be sufficient proximate reason for tax-deductor’s liability under section 195—C.J.

International Hotels Ltd. v. ITO (TDS) [2001] 79 ITD 506 (Delhi).

■ Payment to non-resident/foreign company is covered by section 195, whether payment is made

within India or the payment is made outside India. The status of the payment or the source of the

payment is not a relevant consideration while applying the provisions of section 195—Satellite

Television Asian Region Ltd. v. CIT [2006] 99 ITD 91/99 TTJ 1025 (Mum.).

■ Tax is deductible under section 195 whether the deductor is resident (or non-resident). Tax is

deductible even if non-resident deductor does not have any place of business, residence, business

connection (or any other presence) in India.

■ When payment of credit is given to a non-resident/foreign company and in the hands of recipient,

income is taxable in India, tax is deductible by the payer under section 195. If, however, such

payment or credit is covered by some other sections, tax is deductible under that section and not

undersection195.Forinstance,salarypaymentsarecoveredbysection192.Ifsalaryispaidtoanon-

resident, tax is deductible under section 192 and not under section 195. Likewise, if tax is deductible

under sections 194E, 194LB and 194LC, the provisions of section 195 are not applicable.

■ With effect from June 1, 2015, the person responsible for paying to a non-resident/foreign

company, any sum (whether or not chargeable under the provisions of this Act in the hands of

recipient) shall furnish the information relating to payment of such sum, in such form and manner,

as may be prescribed.

421.1 When tax is deducted at lower rate or when no tax is deducted - Tax at source should not

be deducted or should be deducted at lower rate, as the case may be, where the recipient has made

an application [Form Nos. 13, 15C and 15D] to the Assessing Officer and obtained a certificate to that

effect. See para 426.2.

421.2 Income of recipient taxable in India is subject to tax deduction, not the entire payment -

Under section 195, income of non-resident which is taxable in India is subject to tax deduction.

Where the payer of income (other than salary) considers that the whole of such sum would not be

income chargeable in the case of the recipient, he may make an application under section 195(2) to

the Assessing Officer to determine by general or special order the appropriate proportion of such

sum so chargeable, and upon such determination, tax shall be deducted under section 195 only on

that proportion of the sum which is so chargeable.

The main consideration would be whether payment of sum to a non-resident is chargeable to tax

under the provisions of the Act or not. That sum may be income or income hidden or otherwise

embedded therein. If so, tax is required to be deducted on the said sum; what would be the income

is to be computed on the basis of various provisions of the Act including provisions for computation

of the business income if the payment is a trade receipt. However, what is to be deducted is income-

Para 421 Income-tax - Tax deduction or collection at source 1242](https://image.slidesharecdn.com/taxmannsdirecttaxeslawpractice-professionaleditionsampleread-210414101733/85/Direct-Taxes-Law-Practice-Professional-Edition-25-320.jpg)