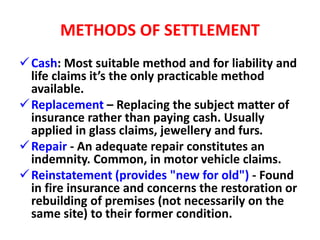

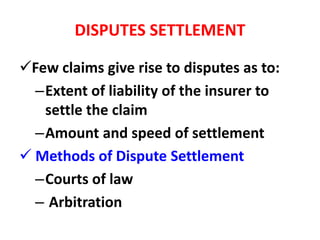

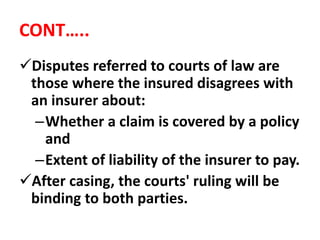

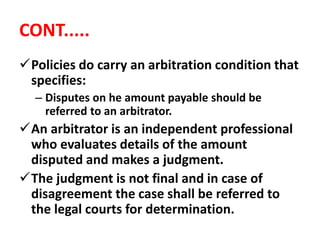

This document discusses the claims administration and claims process for insurance companies. It outlines the key steps as notification, processing, and settlement of claims. It emphasizes the importance of proper claims handling for customer satisfaction and retention. The claims department works with various stakeholders and has policies governing responsibilities, guidelines, approvals, and dispute resolution.