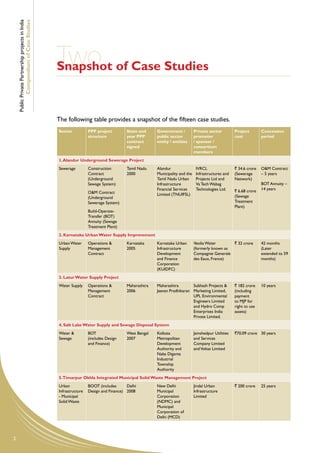

This document is a compendium of case studies of 15 public-private partnership projects in India. It was published by the Public-Private Partnership Cell of the Department of Economic Affairs, Ministry of Finance, Government of India. The case studies cover different infrastructure sectors and PPP structures. They describe each project, highlighting lessons learned around project preparation, procurement, development and risk allocation. The goal is to understand challenges in PPPs and identify best practices to improve future projects.

![Public Private Partnership projects in India

Compendium of Case Studies

The most apparent efficiency gain is seen in the manner in which the capital expenditure has been

incurred by the private sector. Based on available data, it can be observed that two major factors

appear to contribute towards this efficiency gain:

1. The private operator created greater capacity compared to the feasibility study concept and

in doing so achieved efficiency in capital expenditure. A simplistic analysis of average capital

expenditure per berth highlights an 11% efficiency gain. It is appropriate to place a word of

caution here. The capital expenditure in a port consists of infrastructure, superstructures

and equipment. Therefore, if more superstructures or equipment investments are made

then some of the infrastructure investments can get spread over a larger base, thereby

achieving greater economies in infrastructure created.

2. Another contributing factor to the efficiency in capital expenditure was the ability of the

private operator to negotiate better financing terms with the lenders. This resulted in a

lower interest rate (9% as compared to 15.5% interest rate in Feasibility Study and a longer

tenor of debt. Readers may note that interest rates are a function of prevailing market

conditions and the interest rates were declining during the period of financial closure for

the project. Therefore, there would have been a fortuitous timing in the investment cycle

that could have contributed to this efficiency.

As more data on the actual performance of the port is not publicly available and the fact that the

port has just completed its first year of operations, a more comprehensive analysis of VfM is not

possible. The table 28 presents the brief analysis.

Table 28 Project analysis

Feasibility Study Actual Achieved

Project Cost ` 1528 Cr ` 1700 Cr

Berths 4 5

Maximum vessel size 1,20,000 DWT 2,00,000 DWT

Cargo in Year 1 10 MTPA 8 MTPA

Interest Rate 15.50% 9%

Tenure 10 years 14 years

Efficiency in Project Cost 11%

[% Savings in Average Capex per Berth Achieved]

It may also be noted that if the optimism bias in the public sector expenditure was considered then

the efficiency gains achieved would be in excess of 11%. For example, if one was to assume that

there is a minimum 30% optimism bias in public capital expenditure programmes, then a capital

expenditure efficiency of 41% would be observed. As empirical data related to public expenditure

in ports for the state are not available, readers are advised to make their own judgments on the

quantum of optimism bias that they would expect and therefore compute the efficiency gains.

14.7 Key Learning and Observations

1. Robust project preparation by government sponsors prior to tender is critical.

As was experienced in the first round of tendering, realistic traffic projections were not

prepared thus leading to unfounded optimism from both the government and the bidders’

side.

2. Bid evaluation criteria need to be simple but robust. The first round of tendering

had several evaluation parameters that were working at cross purposes and encouraged

speculative bidding.

3. Addressing fundamental project related and contractual issues, prior to the

tender, is important.The second round of tendering experienced a long drawn contract

110](https://image.slidesharecdn.com/casestudiesppp-121230022252-phpapp02/85/Case-studies-ppp-115-320.jpg)