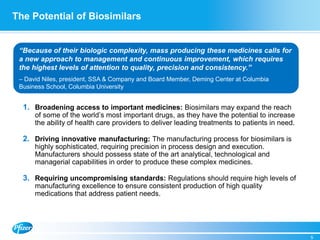

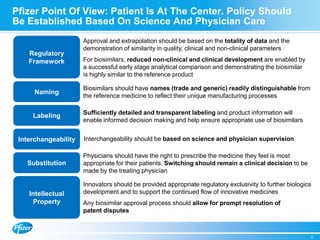

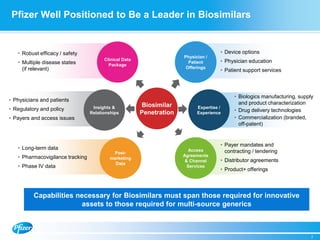

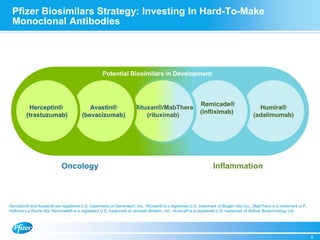

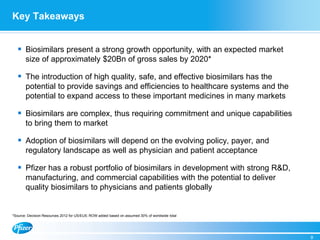

Diem Nguyen, regional president of North America for Global Established Pharmaceuticals at Goldman Sachs, presented at a biosimilars conference on April 2, 2015. The presentation discussed the attractive growth opportunity for biosimilars, with the market expected to reach $20 billion by 2020. It noted biosimilars have the potential to expand access to important medicines while providing savings to healthcare systems. However, biosimilars are complex to produce and require significant expertise in manufacturing. Pfizer believes policies should be based on science and physicians should have the ability to choose the treatment that is best for their patients. Pfizer is well positioned in the biosimilars space due to its capabilities and experience developing