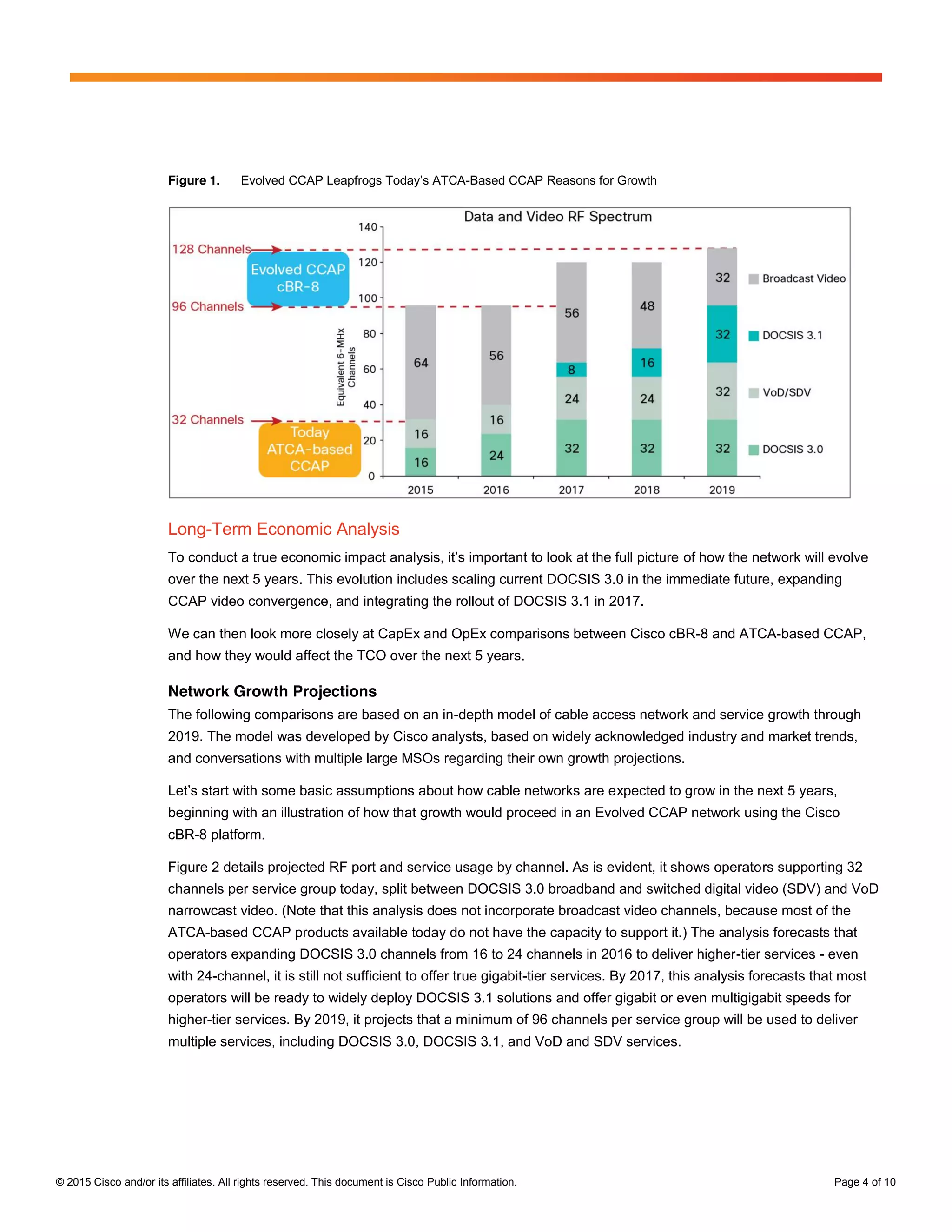

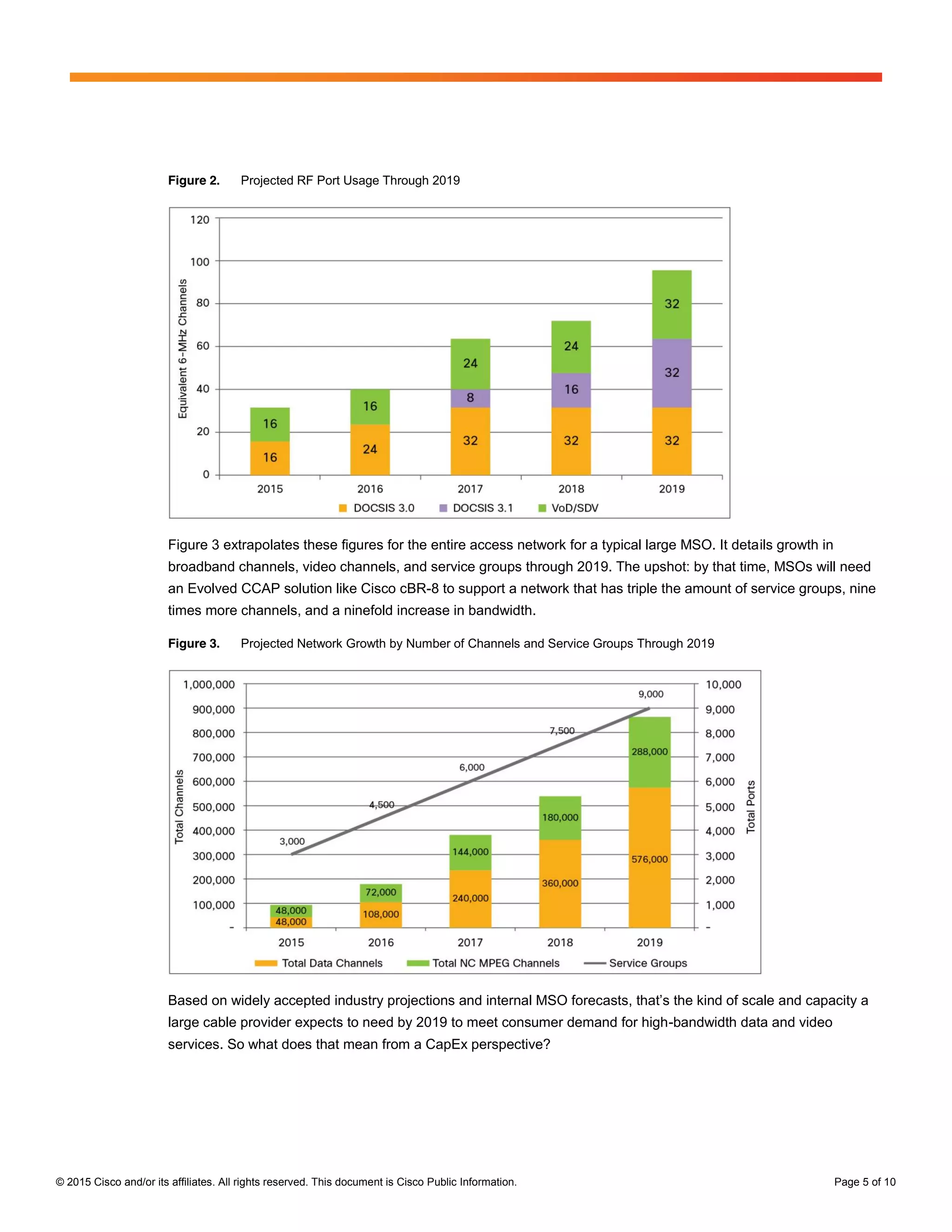

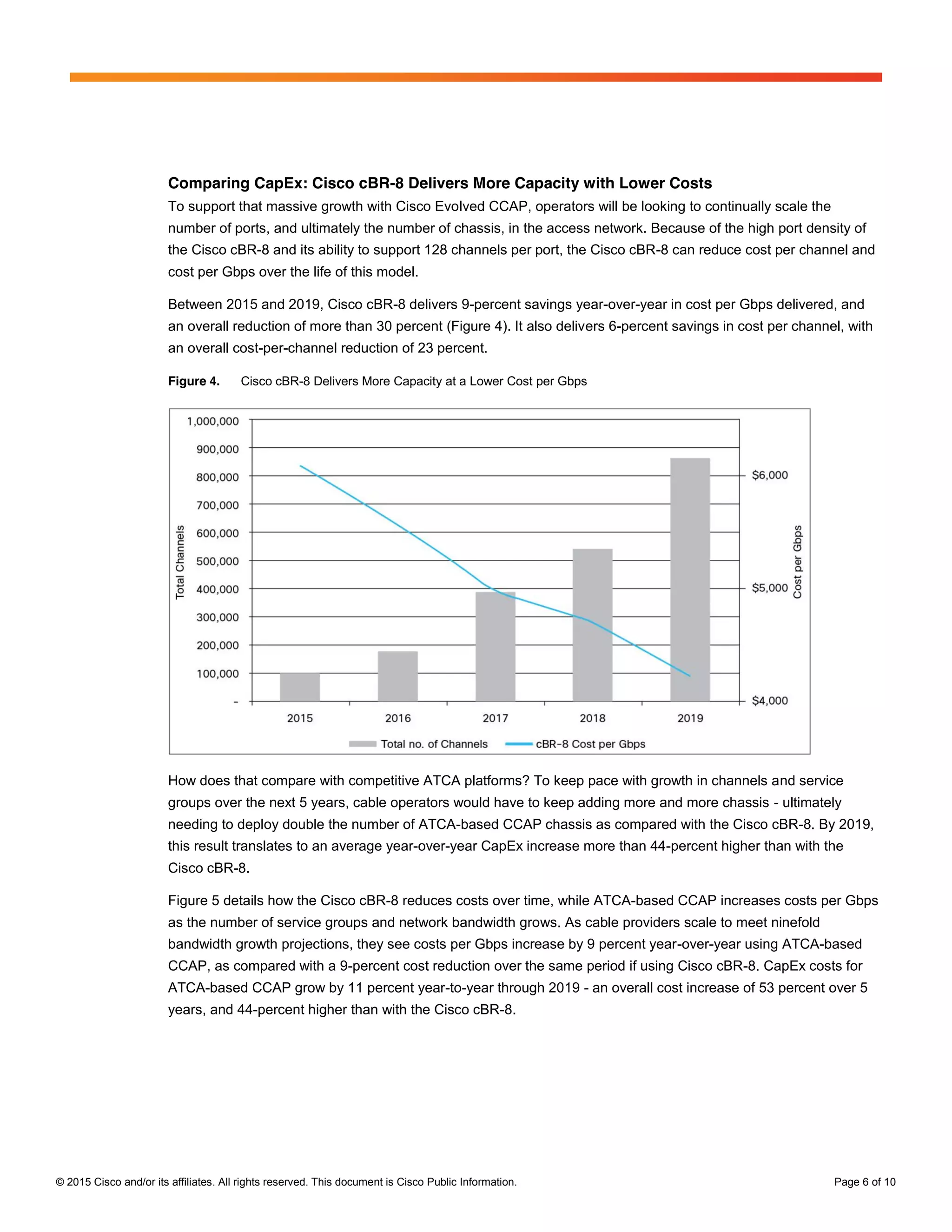

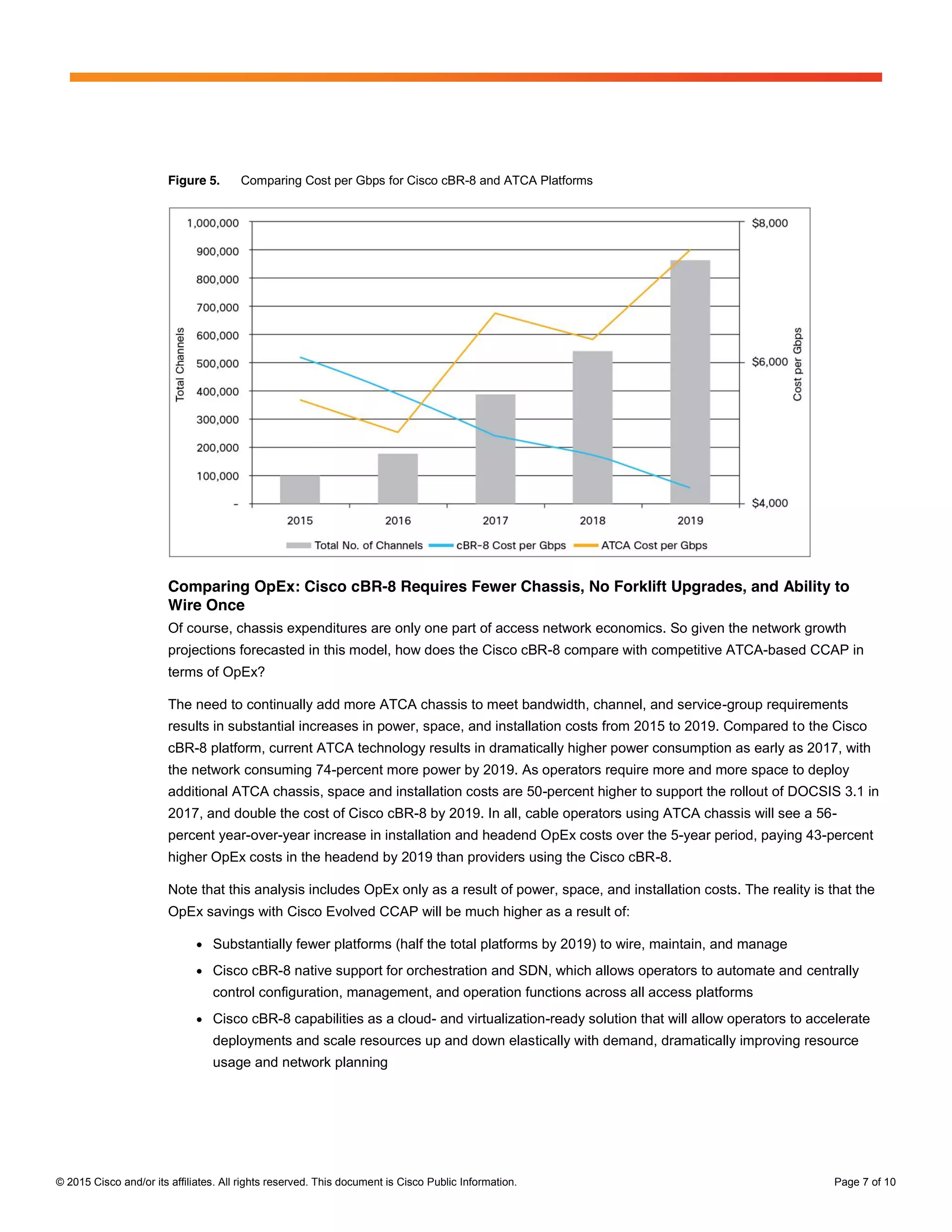

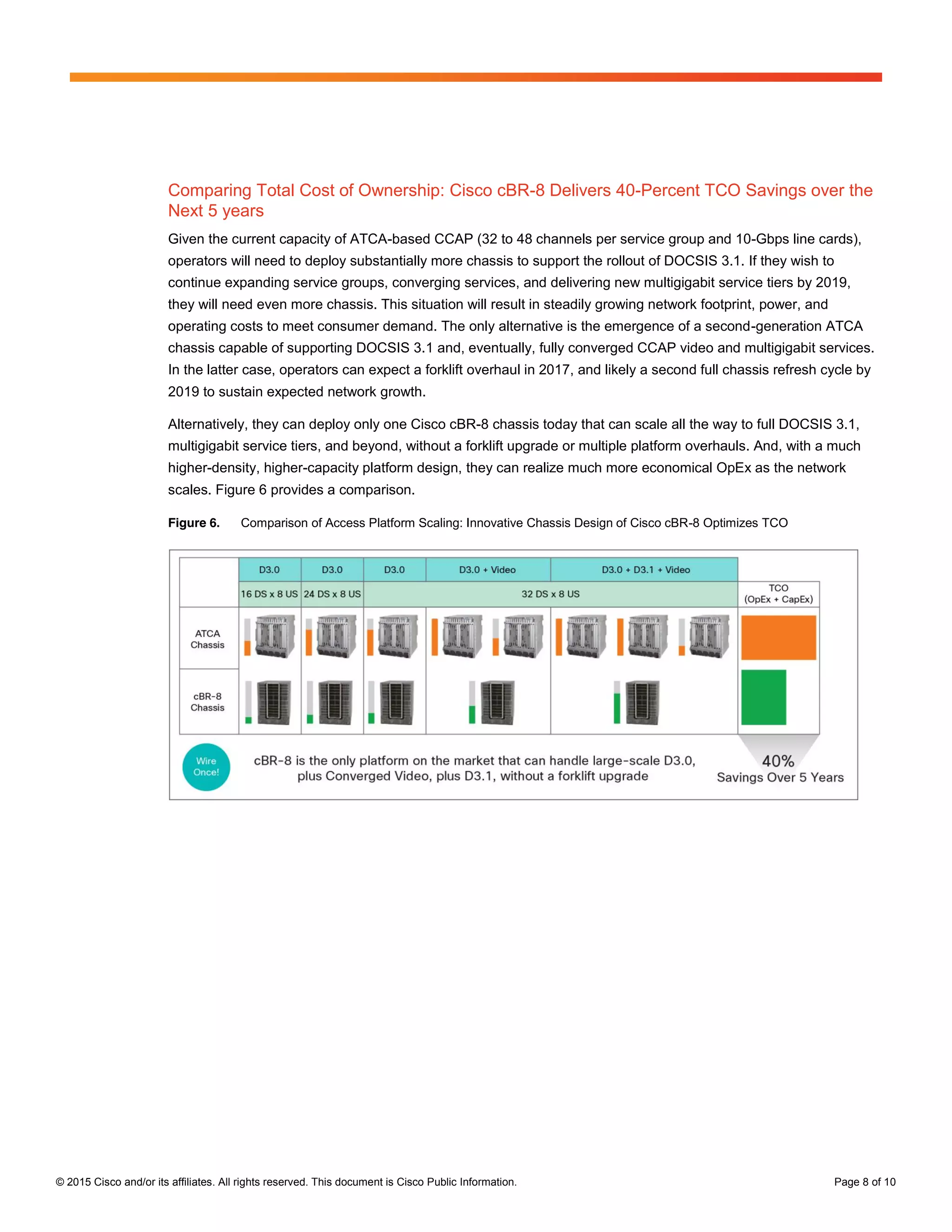

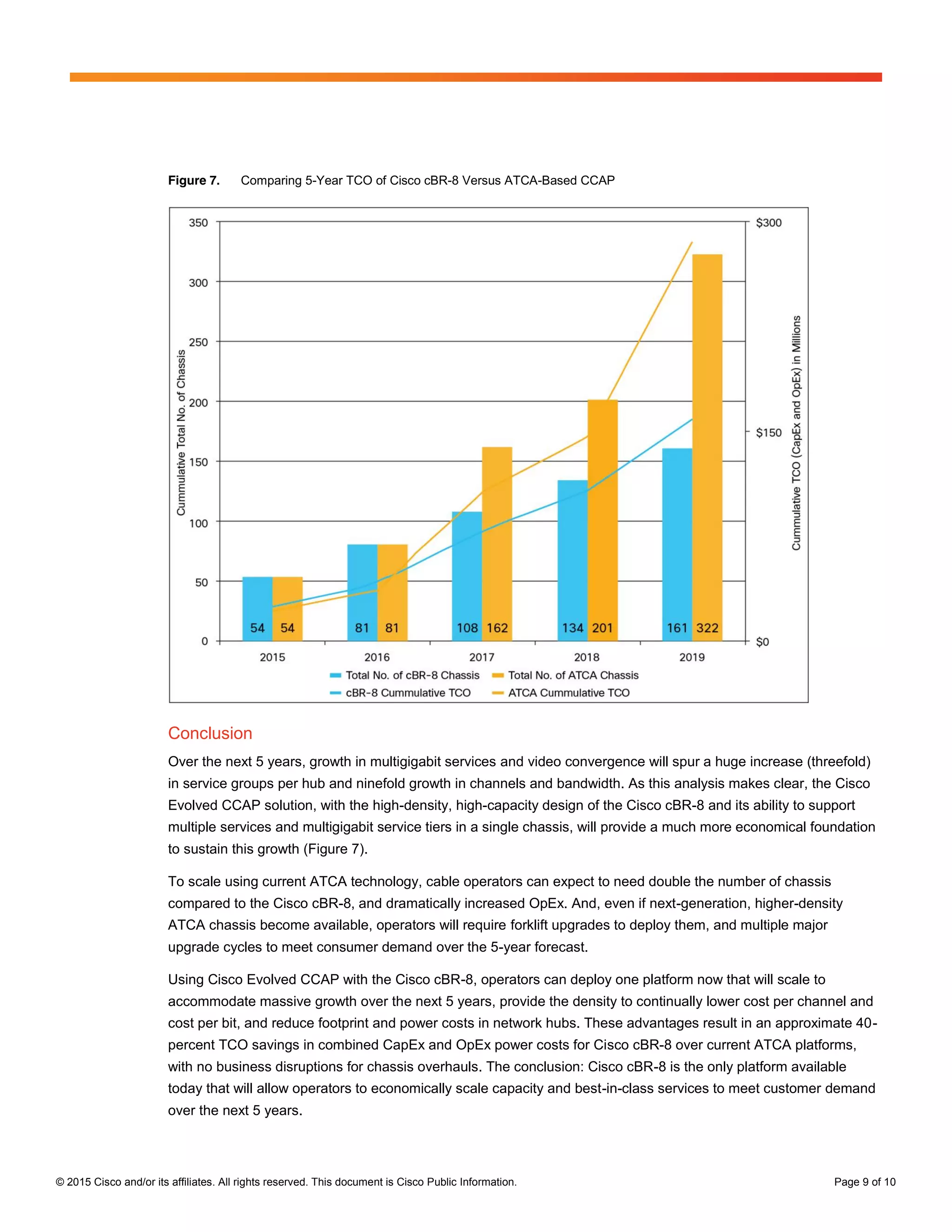

The Cisco CBR-8 evolved CCAP is designed to address the growing demand for bandwidth and video services among cable operators by enabling the delivery of multigigabit broadband and reducing capital and operating costs. It supports a significant increase in service capacity compared to existing ATCA-based solutions, offering substantial savings in hardware, space, and power costs over the next five years. By leveraging this platform, multiple system operators can remain competitive and meet the demands of the evolving digital landscape more efficiently.