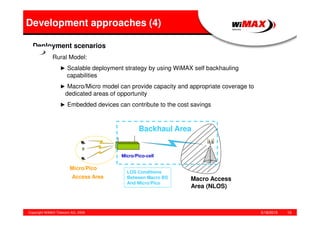

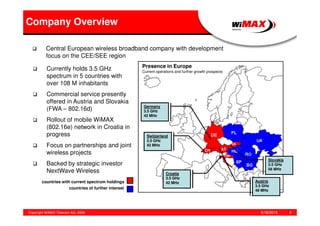

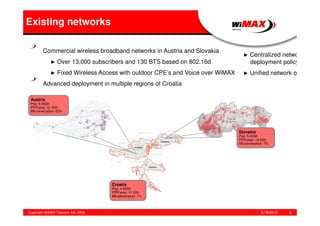

WiMAX Telecom AG holds 3.5 GHz spectrum licenses in 5 central European countries and has commercial WiMAX networks in Austria and Slovakia. The document discusses WiMAX's capabilities to provide high-speed wireless broadband and its positioning between DSL and 3G networks. It also examines business models and deployment scenarios for urban, suburban, and rural areas. Finally, it considers roaming agreements between WiMAX and WiFi networks to extend coverage and increase capacity.

![5/18/2015Copyright WiMAX Telecom AG, 2008 3

Spectrum Position

Country BW

[MHz]

Pops

[Mio]

Allocation

[MHz]

Technology Service

Austria

(nationwide,

differences between

regions)

Region 1: 56

Region 2: 42

Region 3: 42

Region 4: 70

Region 5: 42

Region 6: 42

average: 49

8.1 3438 - 3466 / 3538 - 3566

3410 - 3431 / 3510 - 3531

3473 - 3494 / 3573 - 3594

3410 - 3445 / 3510 - 3545

3473 - 3494 / 3573 - 3594

3473 - 3494 / 3573 - 3594

Neutral

FDD/TDD permitted

BWA incl. mobility

Croatia (regional) 28 - 42

average: 38.1

3.4 3410 – 3424 / 3510 - 3524

3427.5 - 3448.5 / 3527.5 - 3548.5

3476.5 - 3497.5 / 3576.5 - 3597.5

Neutral

FDD/TDD permitted

FWA (mobility to

be permitted –

following EU

decision)

Germany

(nationwide)

42 82.5 3431 - 3452 / 3531 - 3552 Neutral

FDD/TDD permitted

BWA (mobility to

be permitted – EU

decision)

Slovakia (nationwide) 28 (WT)

28 (Amtel)

5.4 3410 - 3424 / 3510 - 3524

3473 - 3487 / 3573 - 3587

Neutral

FDD/TDD permitted

FWA (mobility to

be permitted – EU

decision)

Switzerland

(nationwide)

42 7.5 3431 - 3452 / 3531 - 3552 Neutral

FDD/TDD permitted

BWA incl. mobility](https://image.slidesharecdn.com/e53f3594-72a4-4e8f-8867-654a53186a97-150518072908-lva1-app6891/85/Roaming-and-Seamless-Mobility-Conference-3-320.jpg)

![5/18/2015Copyright WiMAX Telecom AG, 2008 7

Considerations for the future plans

► Wireless can't win competition on bit rates against fixed line

broadband products, therefore differentiation required

► Currently available BWA bands are not suitable for a competition against

large area mobile networks in terms of ubiquitous coverage

► WiMAX market placement between DSL (no mobility but high bit

rate) and 3G (mobility but limited bit rates) -> expansion/enrichment

of WiFi-type business models

Deployment Objectives

► Outperform 3G by providing high capacity at much lower costs

► Outperform DSL by providing nomadic and mobile services in

dedicated [hot zones / cities ] areas

► Minimize CPE costs -> promote development of embedded devices

Development approaches (1)

=> Metro-Broadband-Zone](https://image.slidesharecdn.com/e53f3594-72a4-4e8f-8867-654a53186a97-150518072908-lva1-app6891/85/Roaming-and-Seamless-Mobility-Conference-7-320.jpg)