Embed presentation

Download as PDF, PPTX

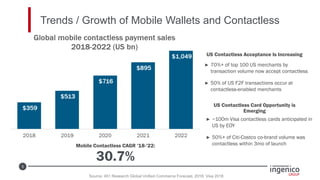

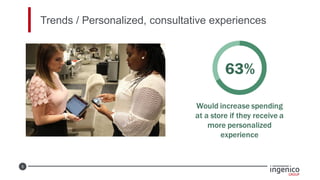

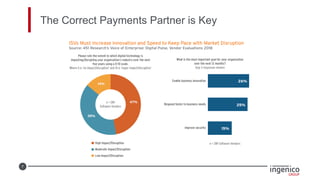

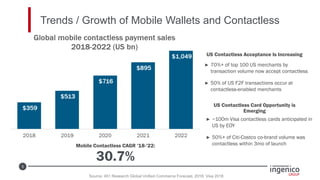

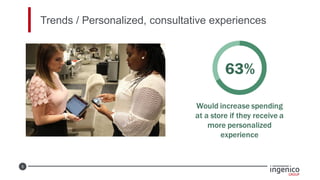

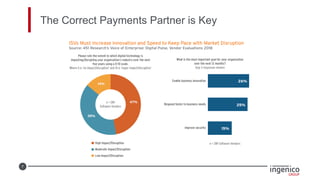

ISVs need to carefully choose a payment technology partner to support evolving payment trends, enhance their software value, and enable new business services. Key considerations for partners include their technology's support for multiple industries and use cases, payments and industry expertise, and sales and support capabilities. Without the right partner, ISVs risk higher fees, slower development, unreliable assistance, and damage to their brand from partner issues.