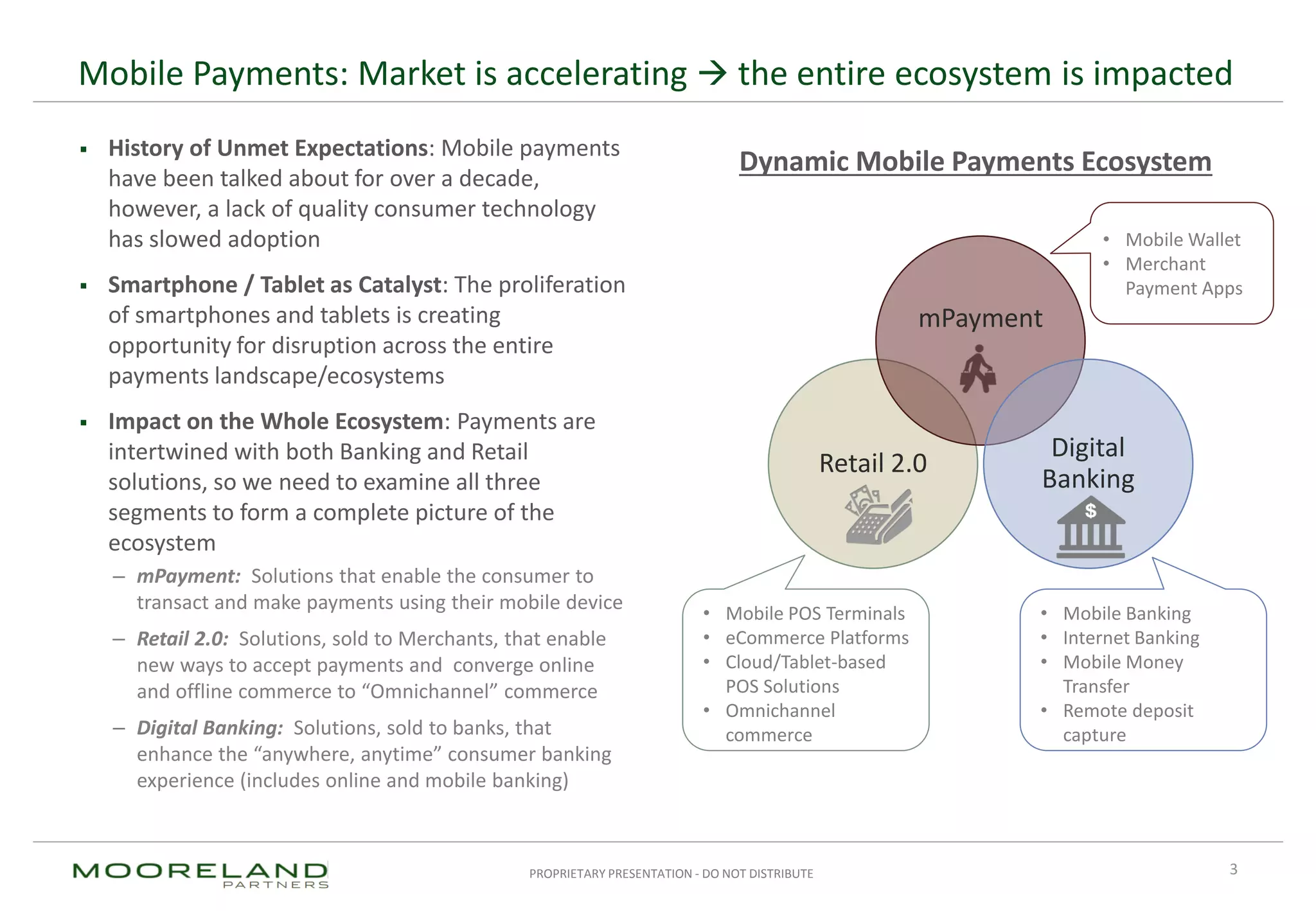

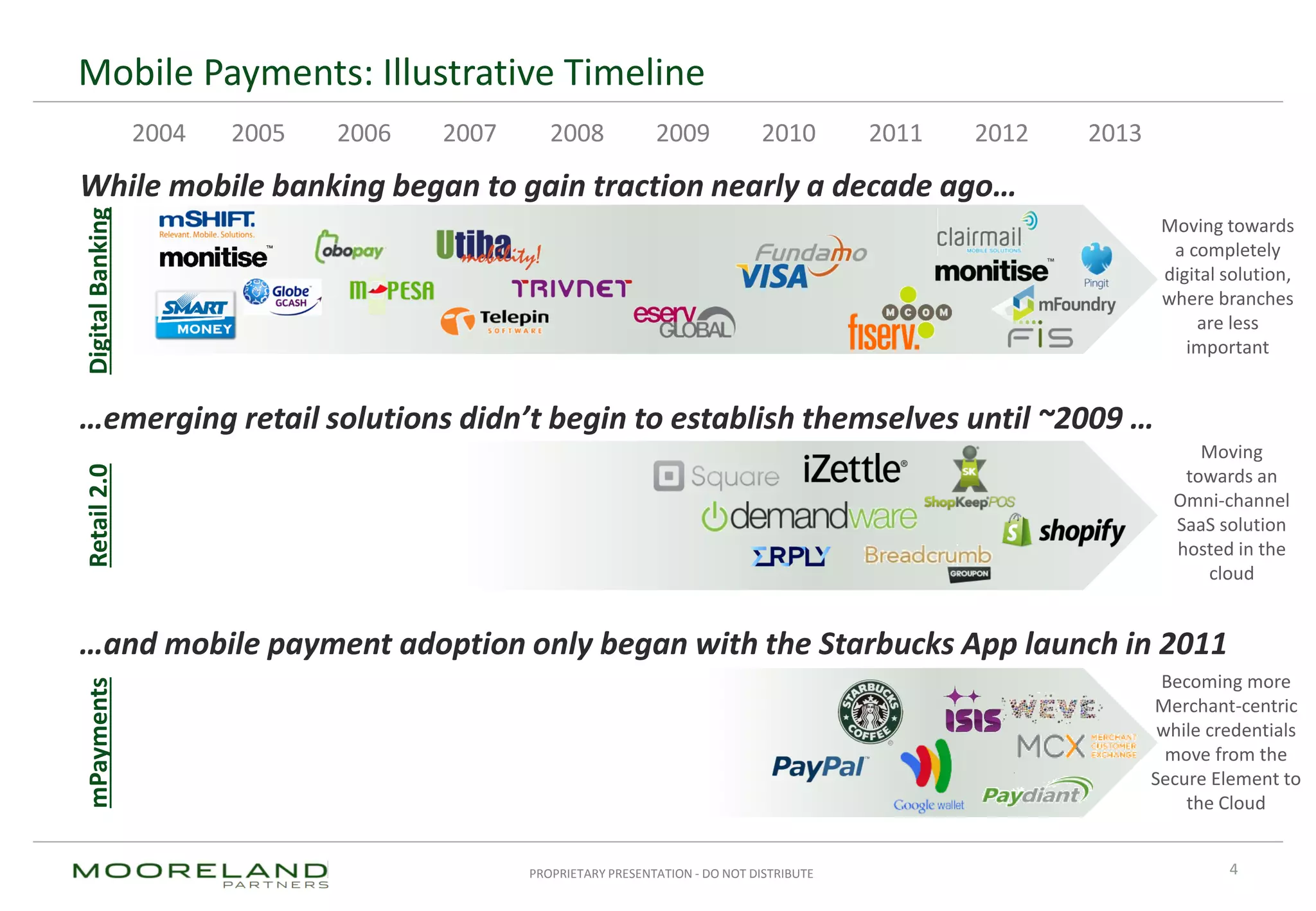

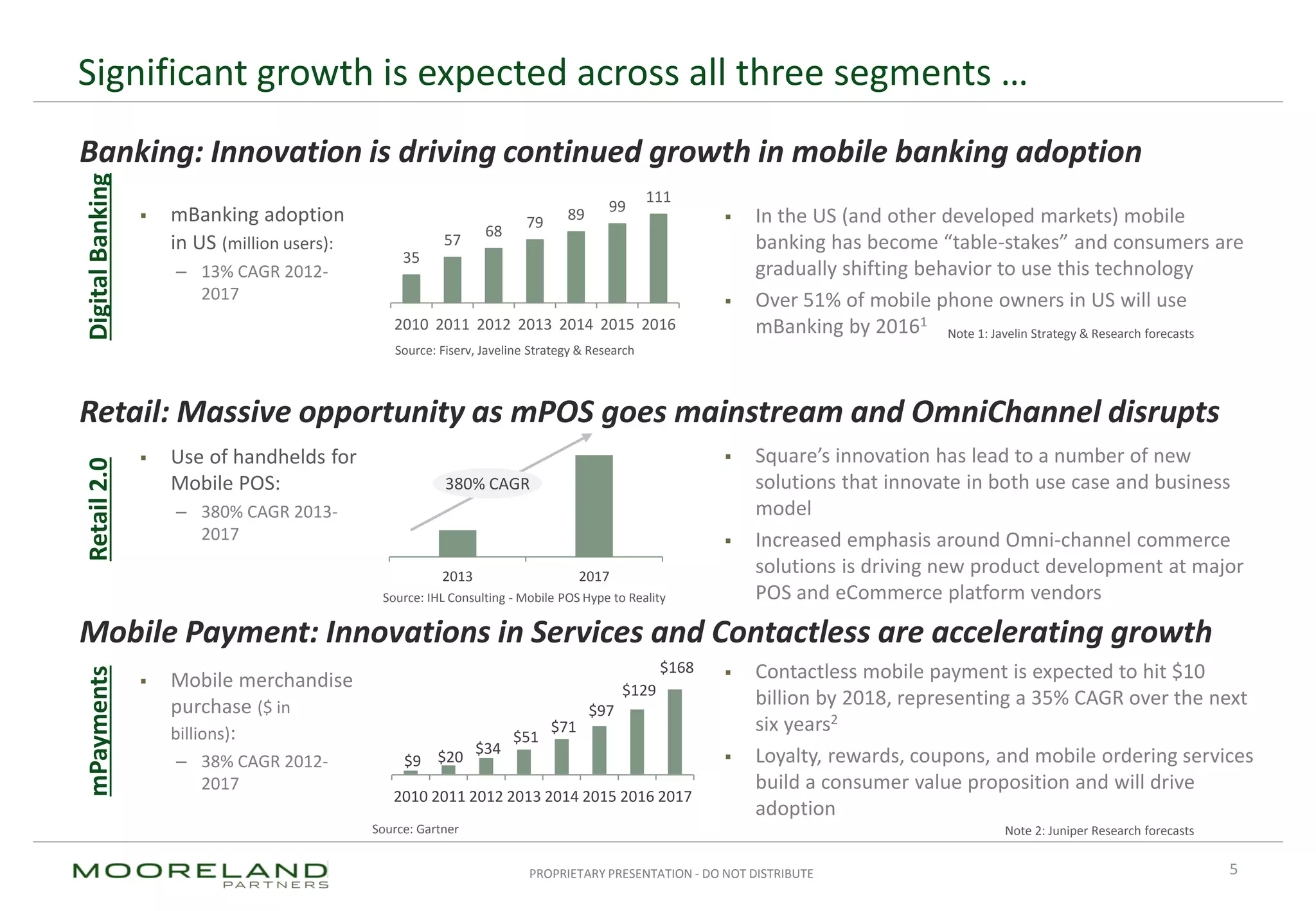

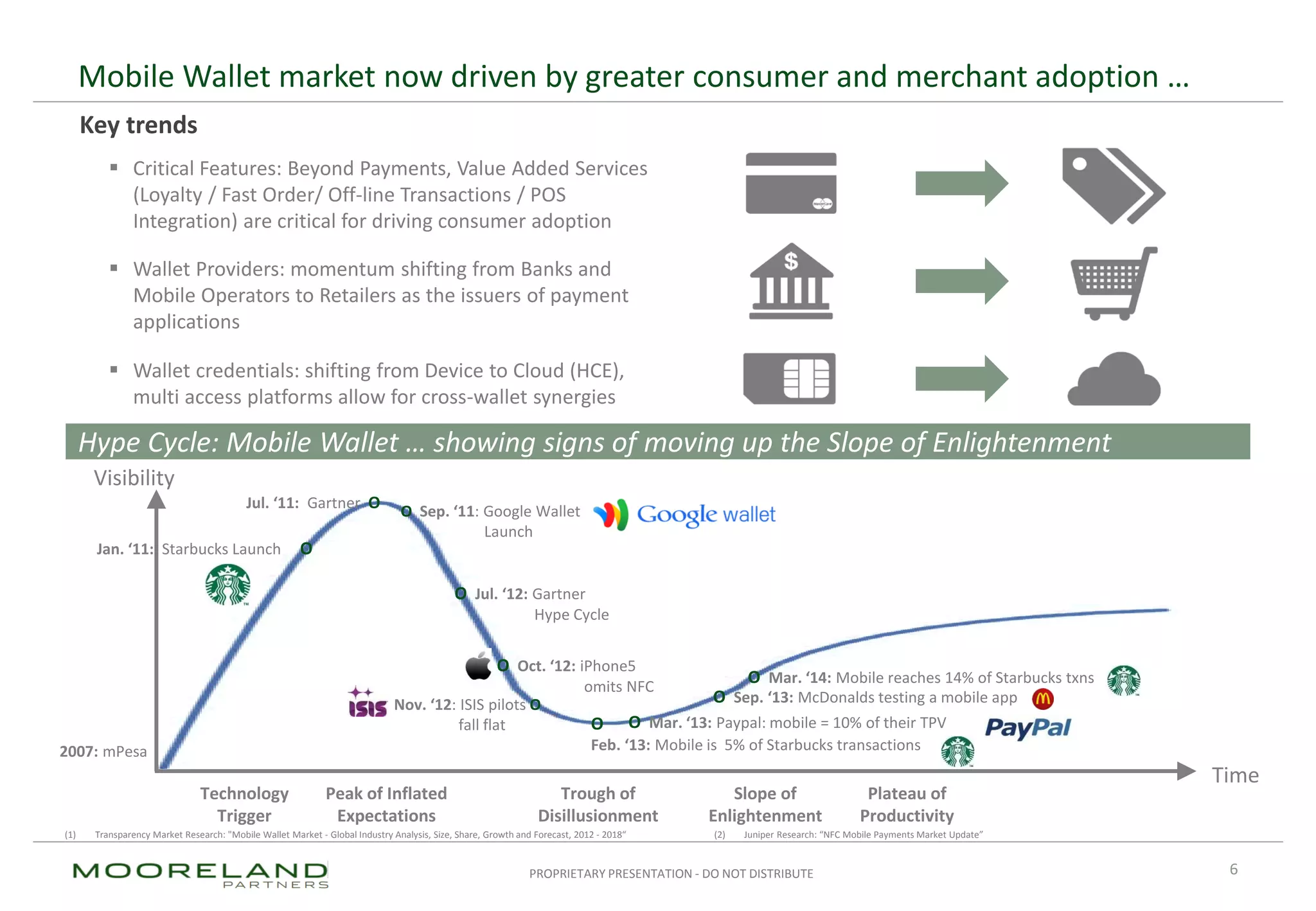

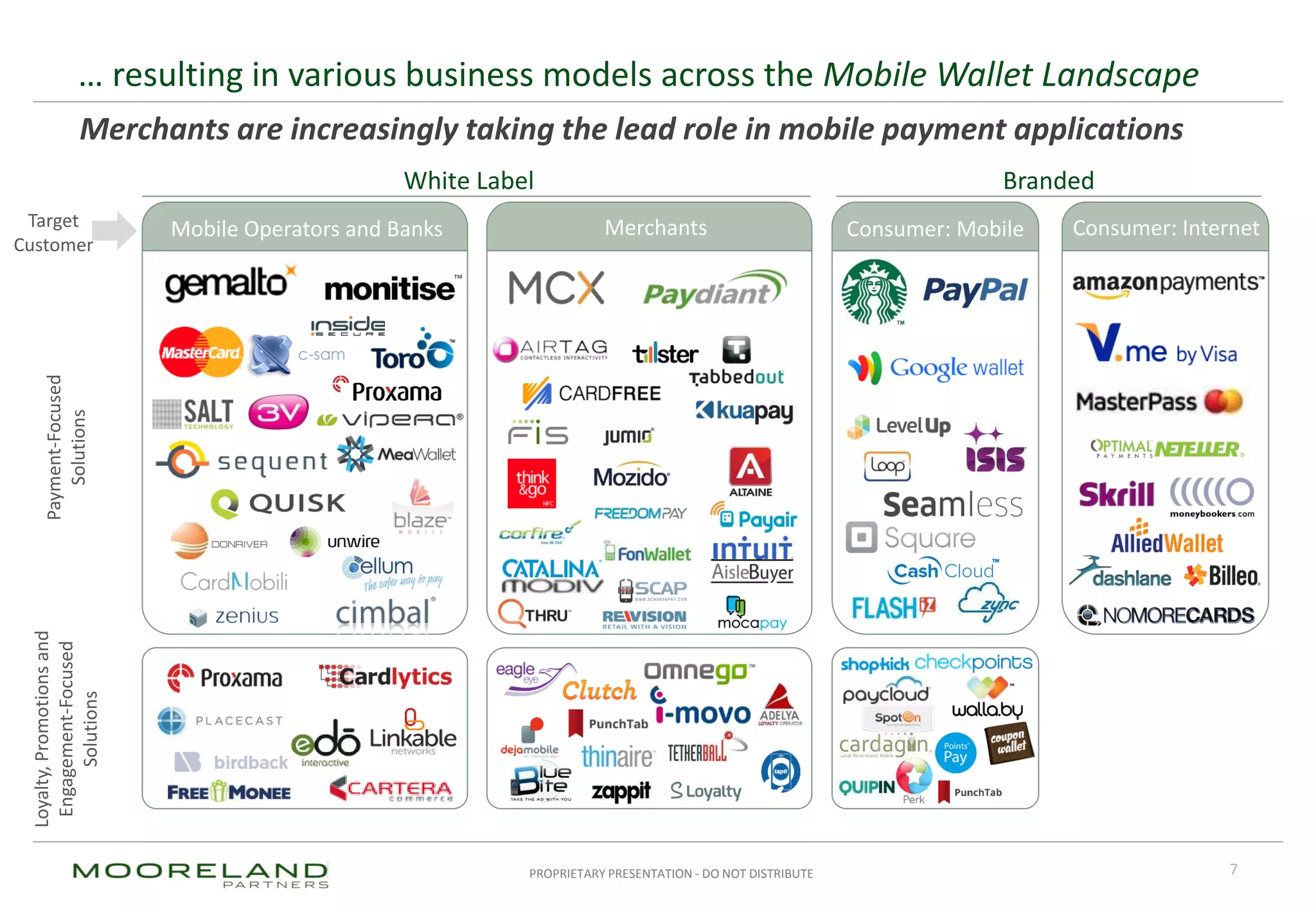

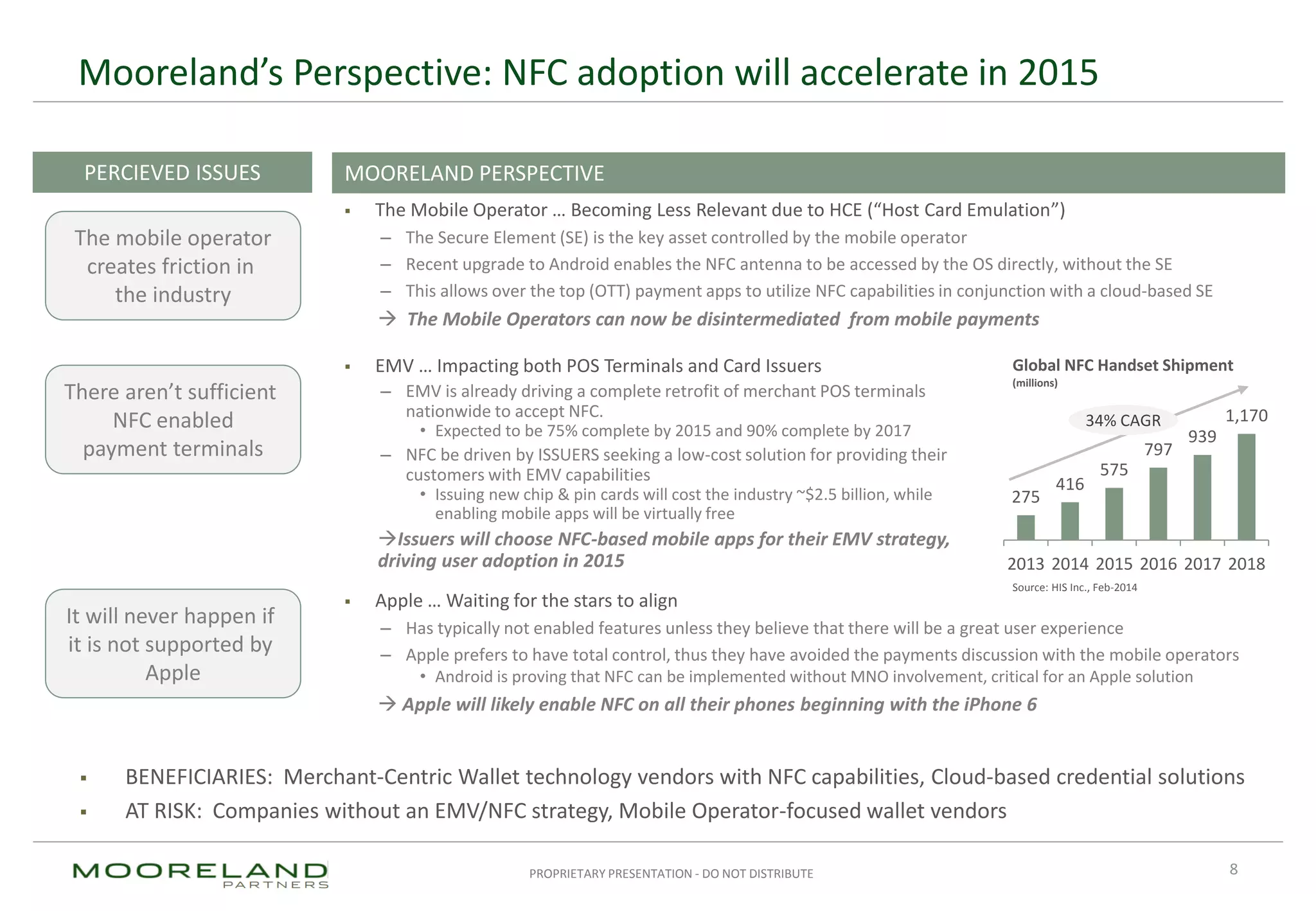

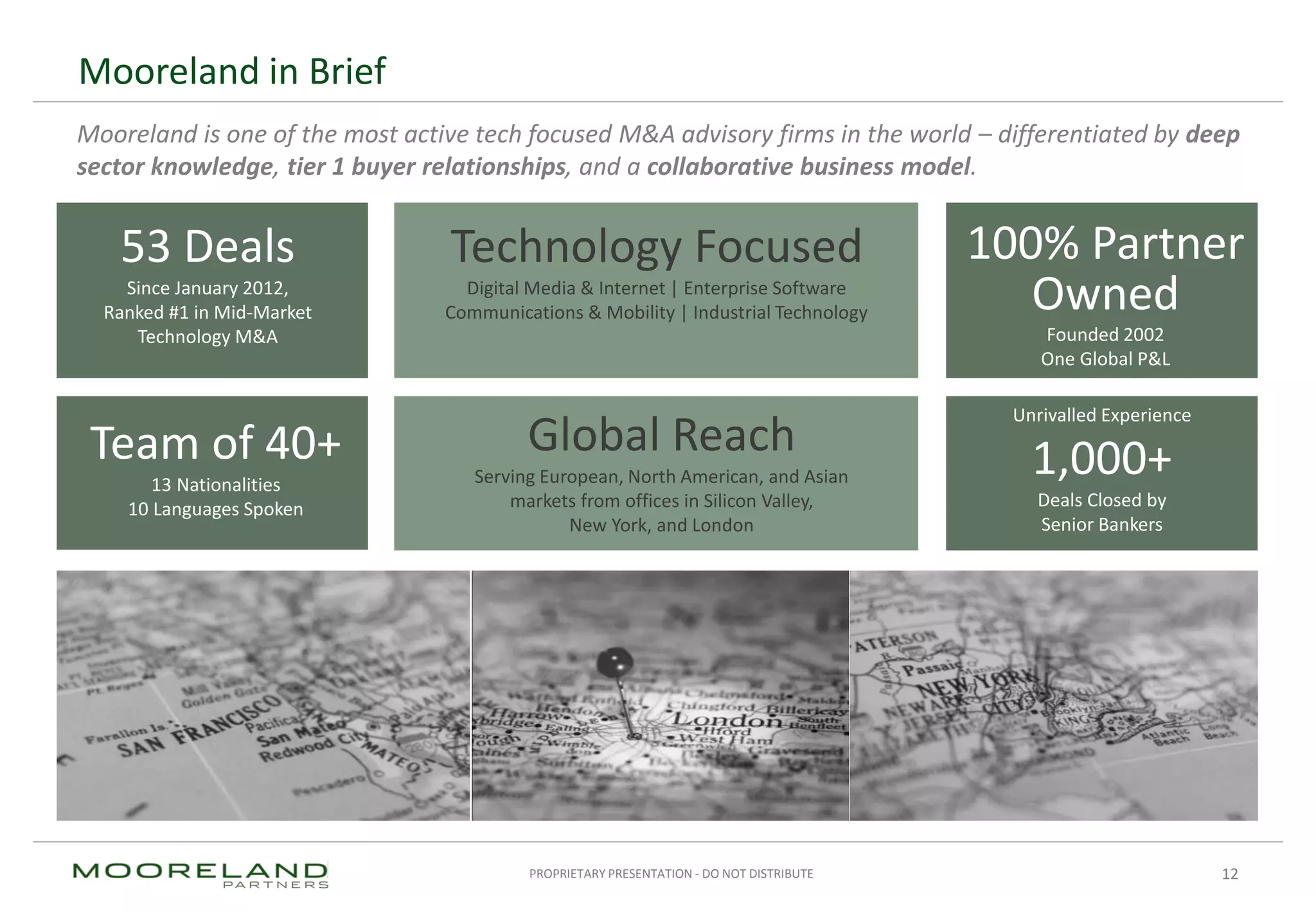

The document discusses the evolving landscape of mobile payments, highlighting the factors driving adoption, such as the rise of smartphones and the integration of banking and retail solutions. It emphasizes significant growth in mobile banking, mobile payments, and retail innovations, forecasting increased consumer engagement and adoption of contactless payment technologies. Additionally, it notes the shift from mobile operators to merchants in the mobile wallet space and predicts accelerated NFC adoption driven by technological advancements.