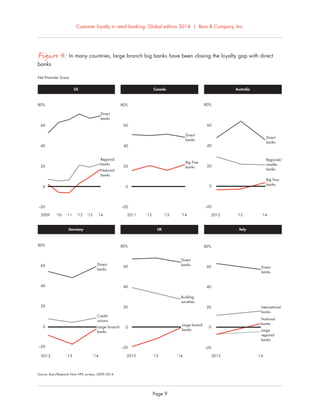

This document discusses trends in customer loyalty in retail banking globally. Key points include:

- Customers are conducting over 50% of banking interactions through digital channels like mobile apps and websites in most countries surveyed. Mobile is the most used channel.

- "Omnichannel" customers who use both digital and physical channels have higher loyalty and purchase more products than customers relying on a single channel.

- However, over 1/3 of customers purchased a new banking product from a competitor in the past year, showing potential for banks to improve sales through digital channels.