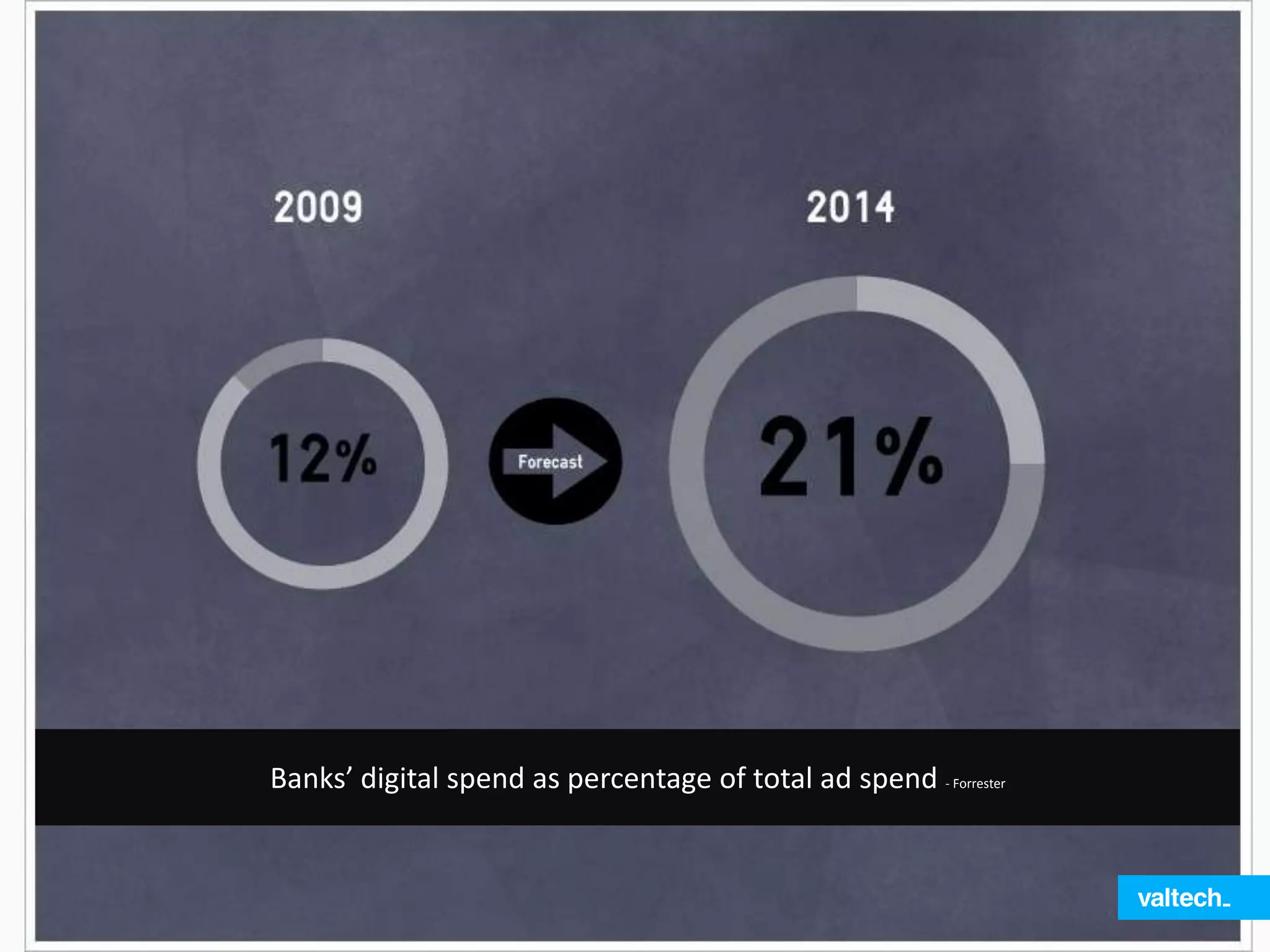

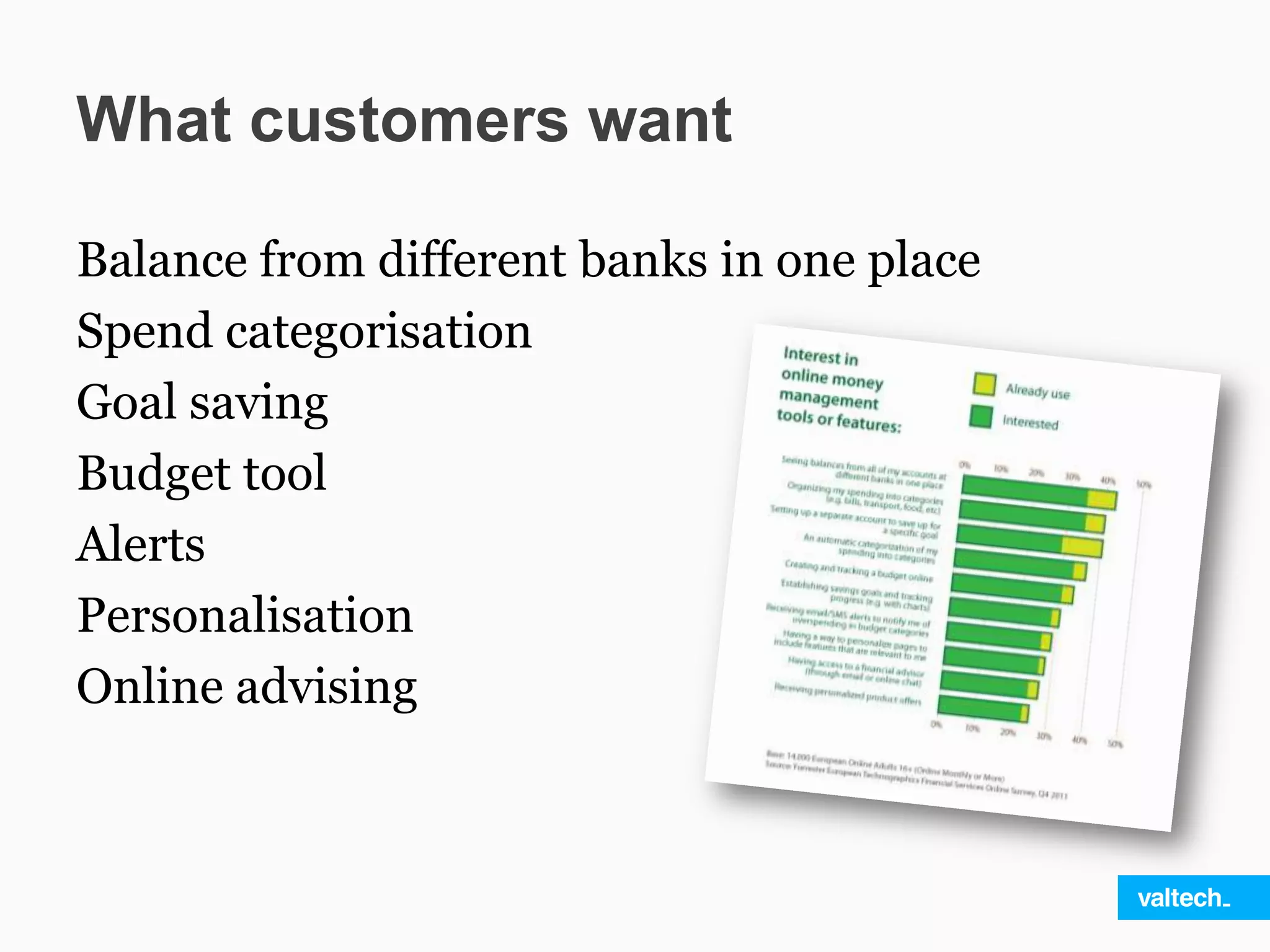

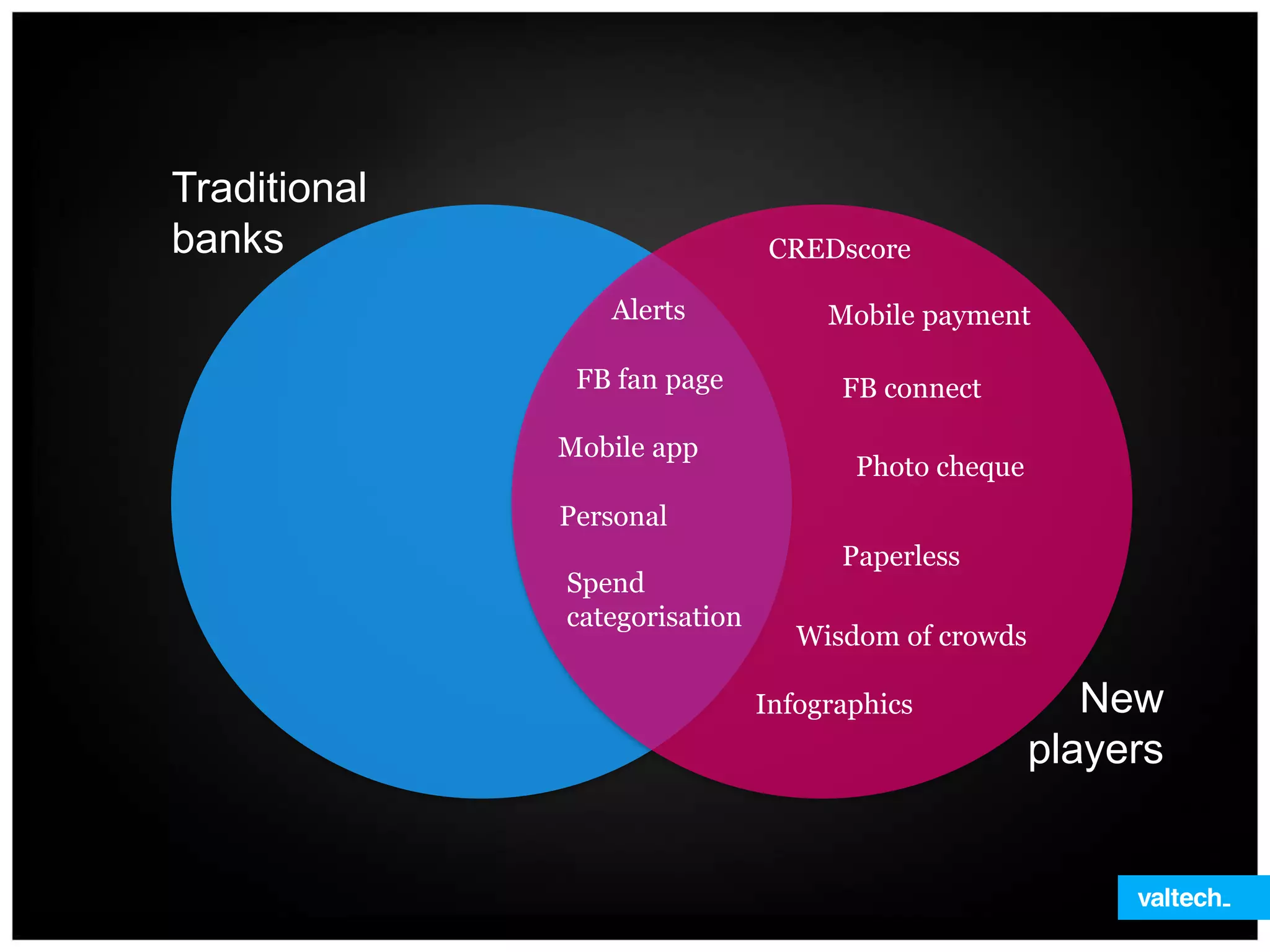

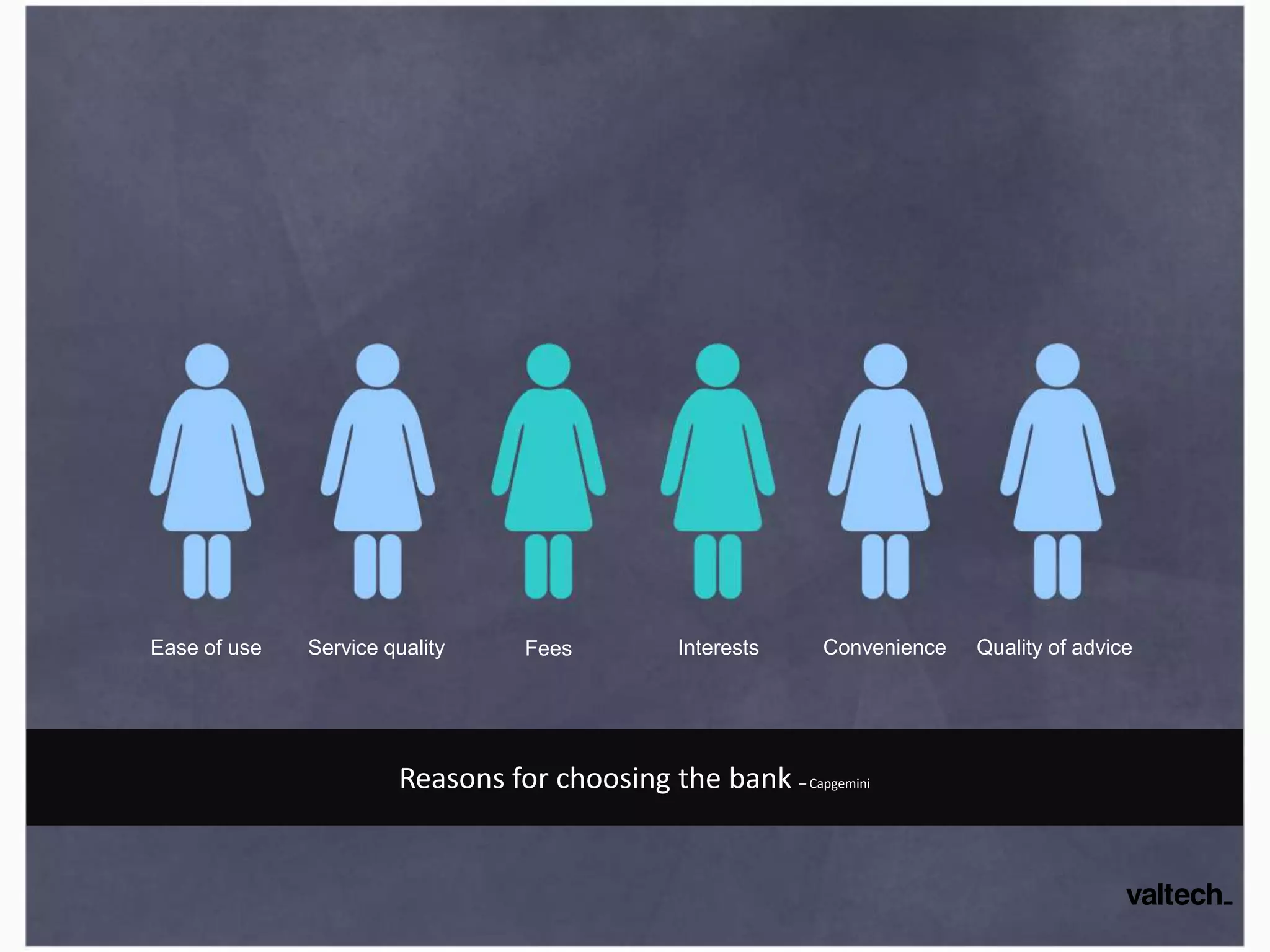

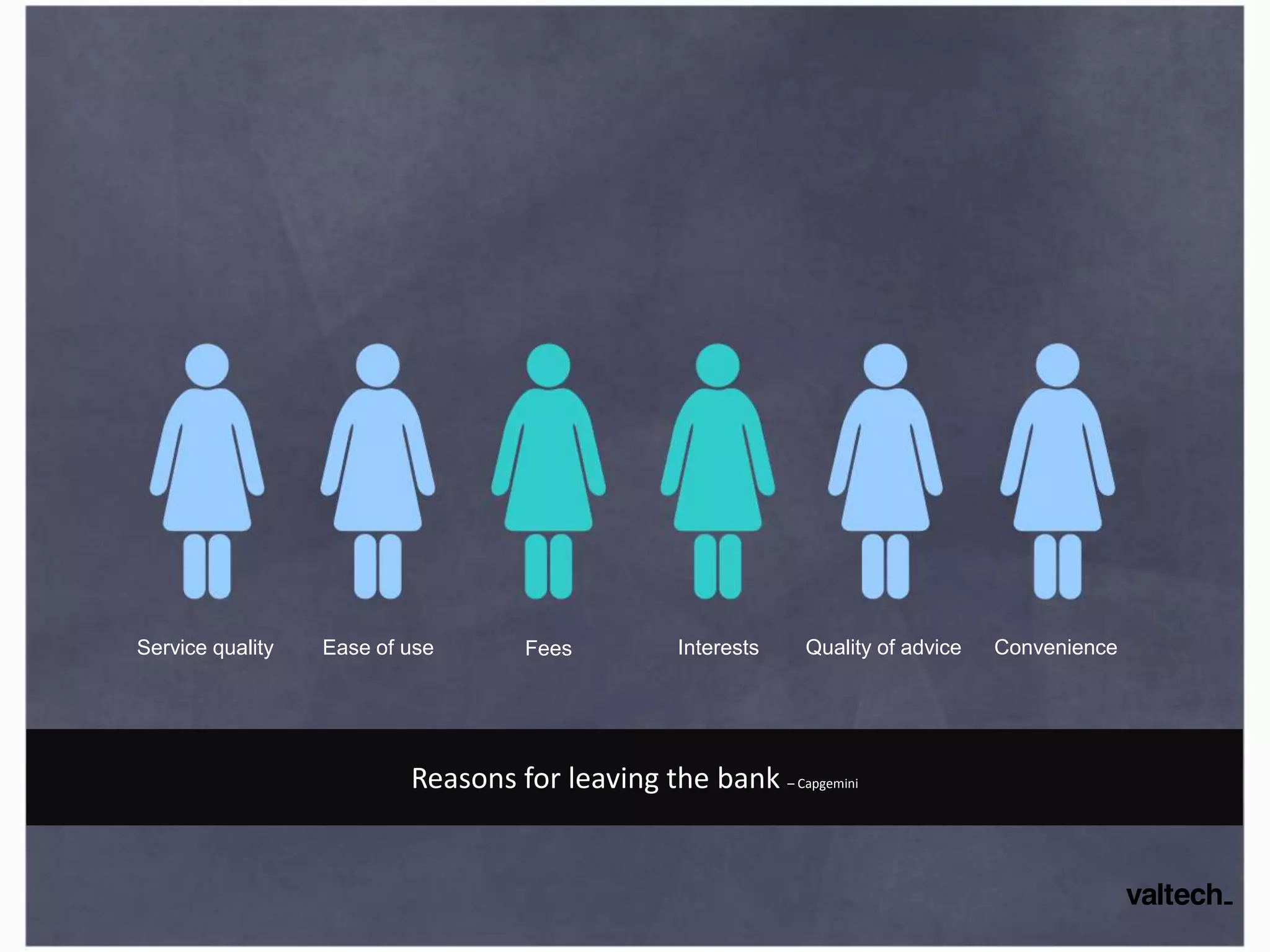

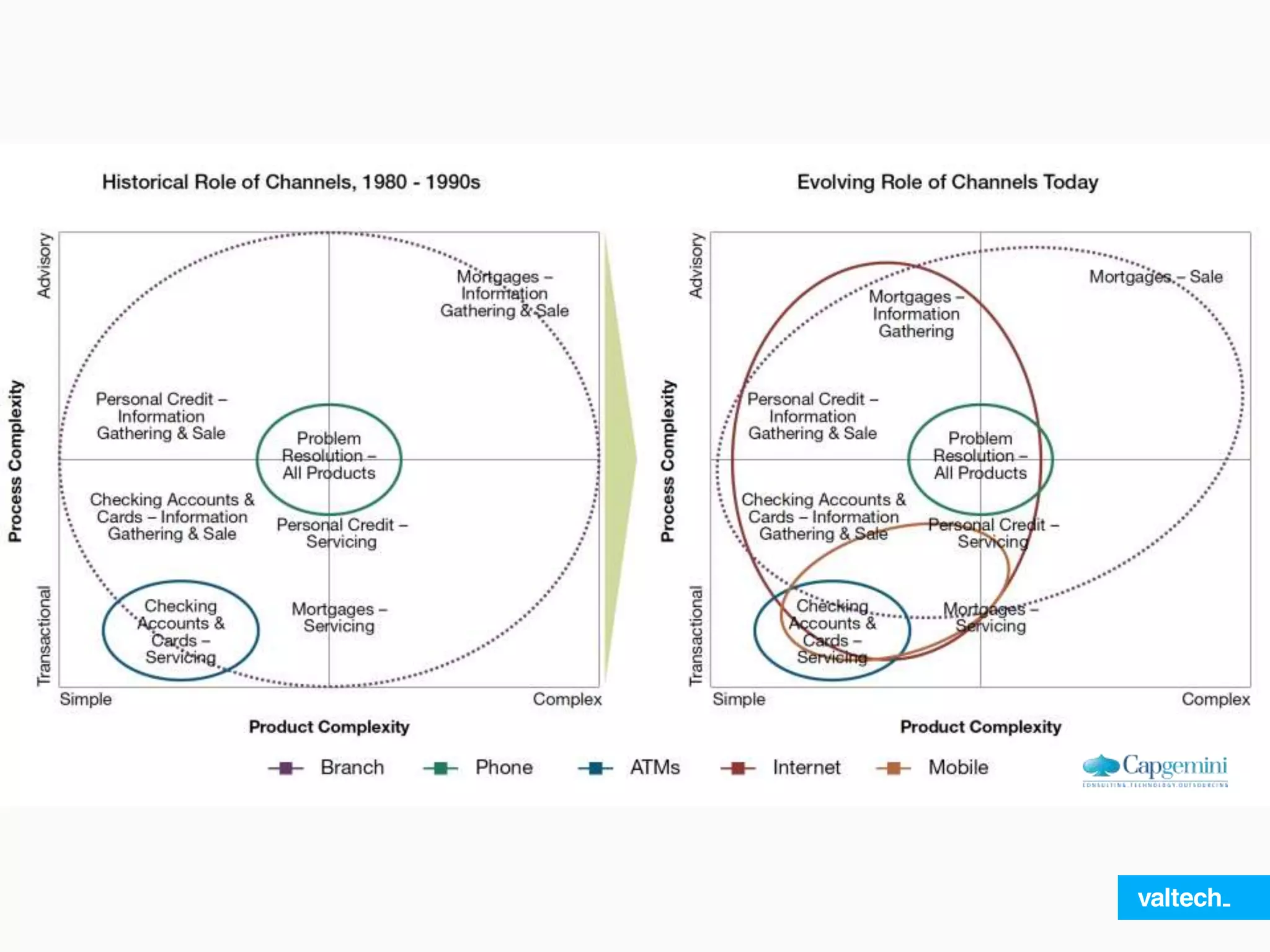

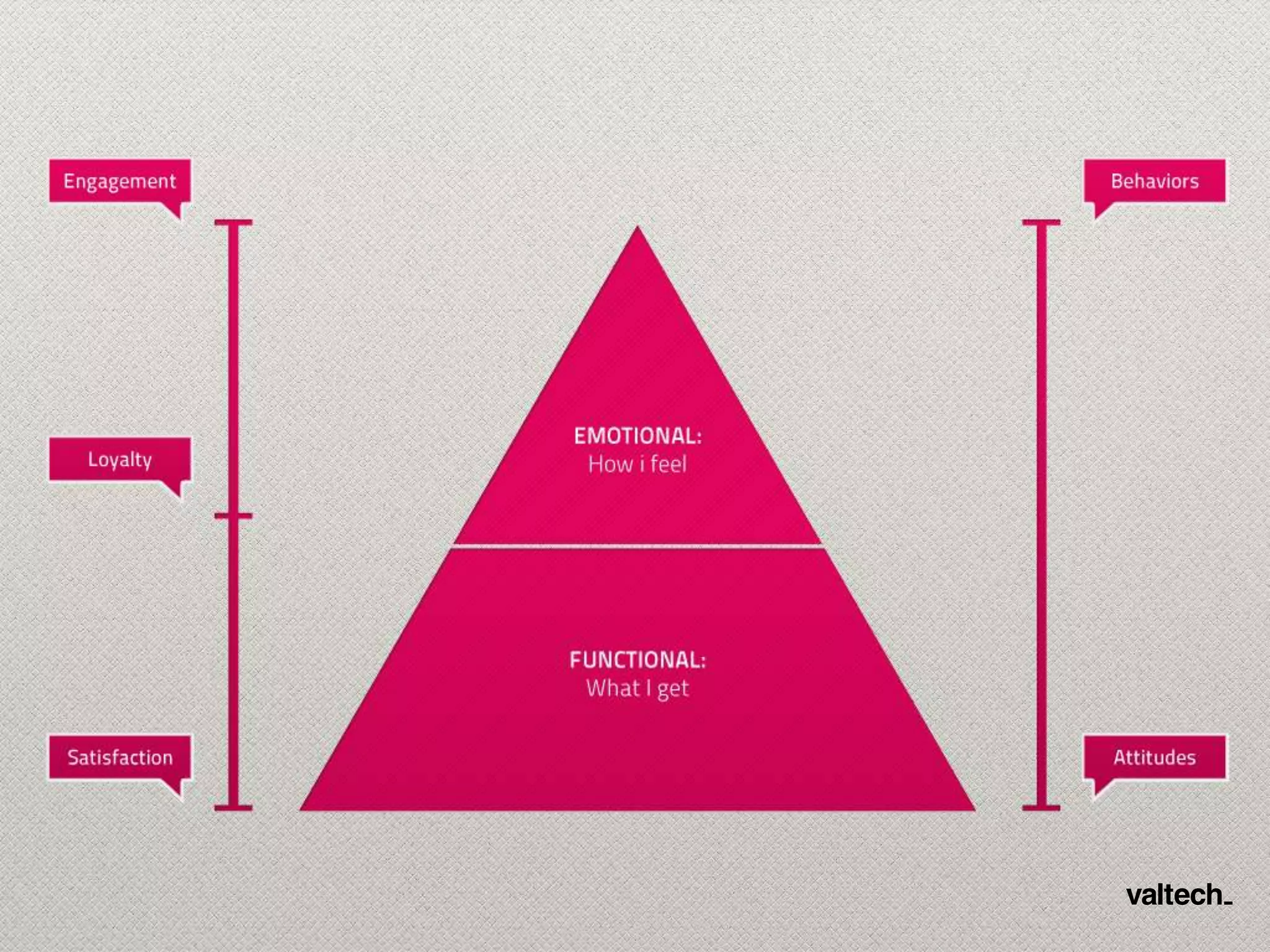

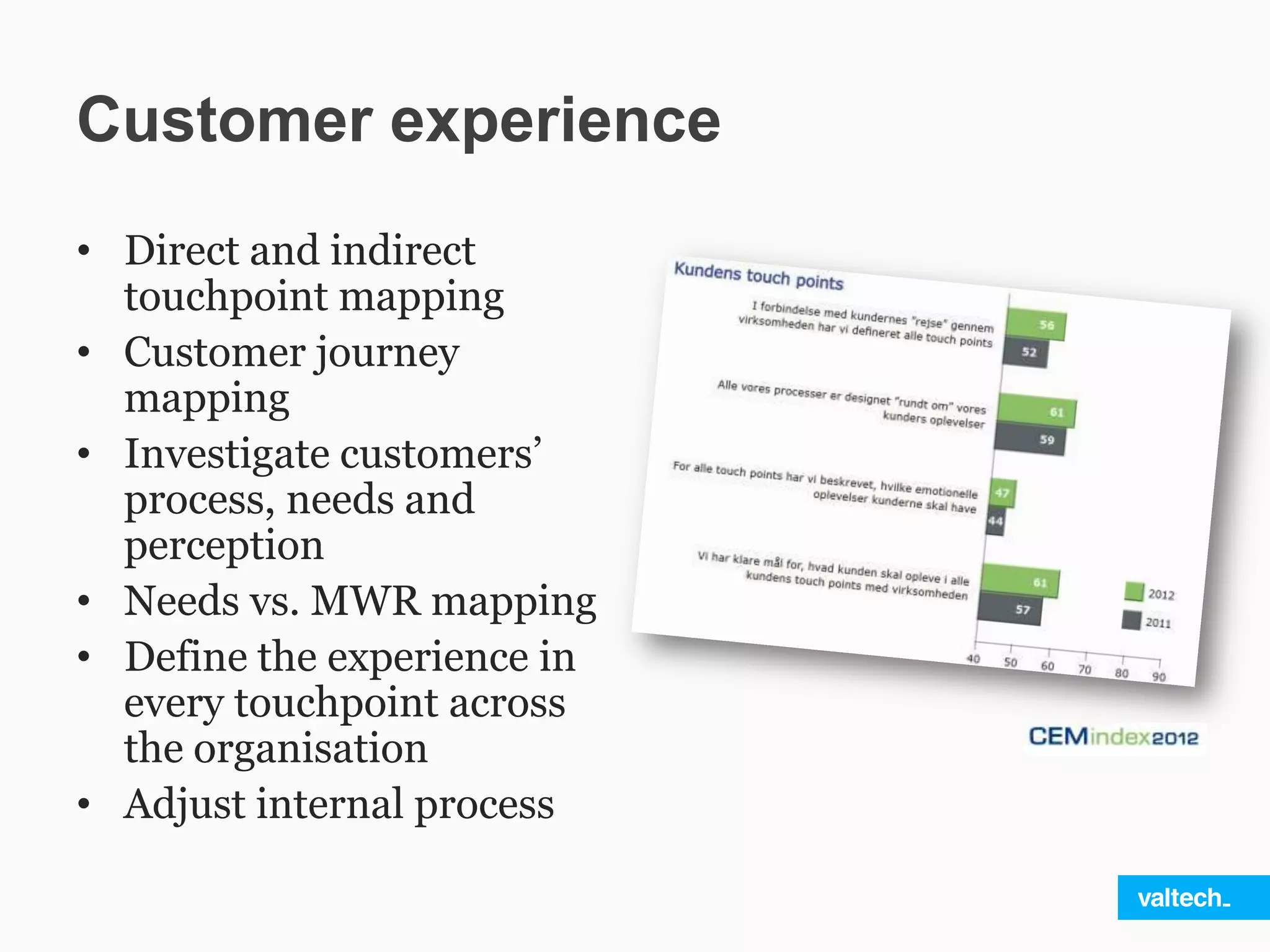

The document discusses the rising trend in banking service innovation, highlighting increased digital spending by banks and customer demands for features like personalization and data-driven tools. It emphasizes the competition from new players and the importance of customer experience as a driver for bank loyalty and growth. Additionally, it suggests a comprehensive approach to mapping and improving customer interactions across all touchpoints to enhance the overall experience.