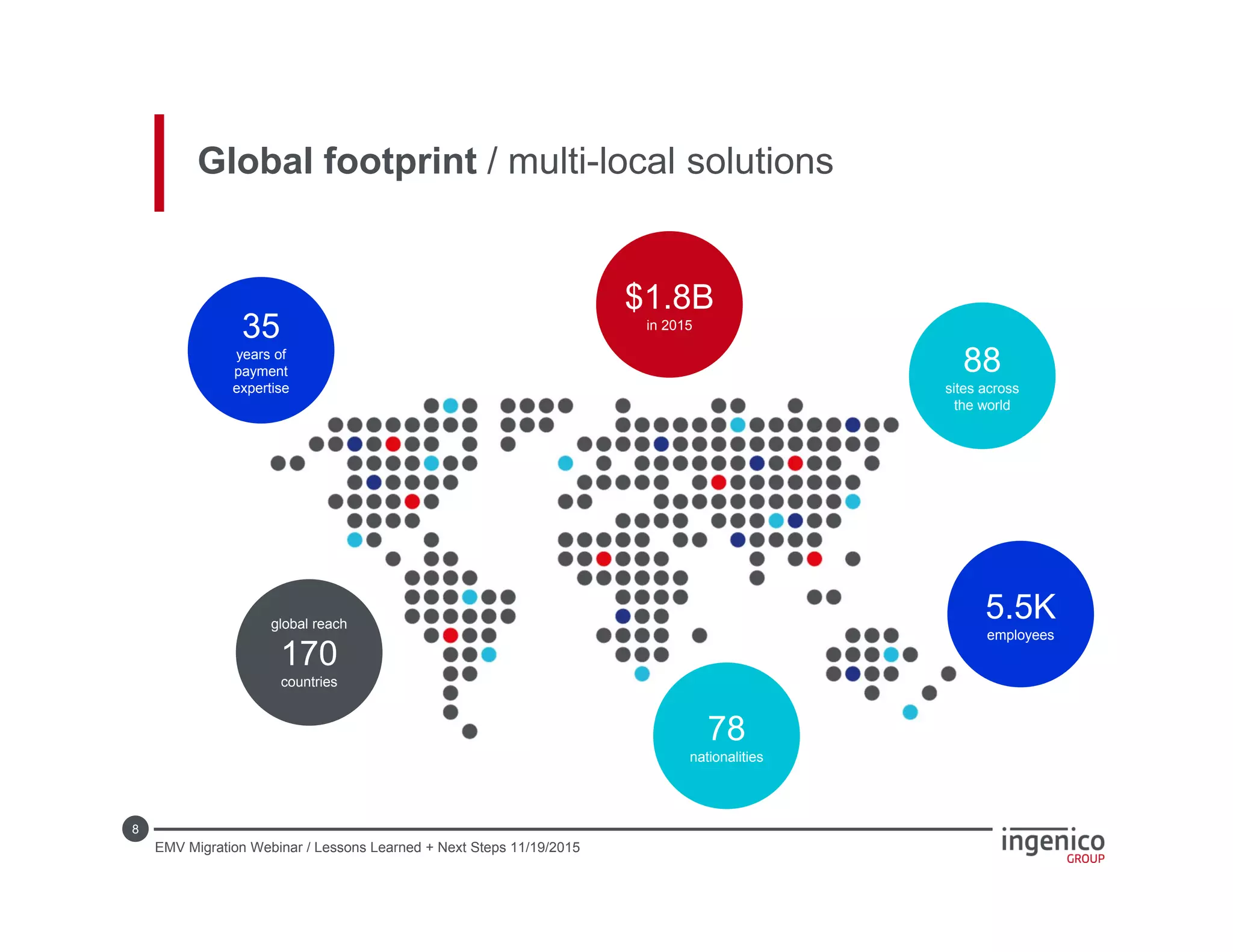

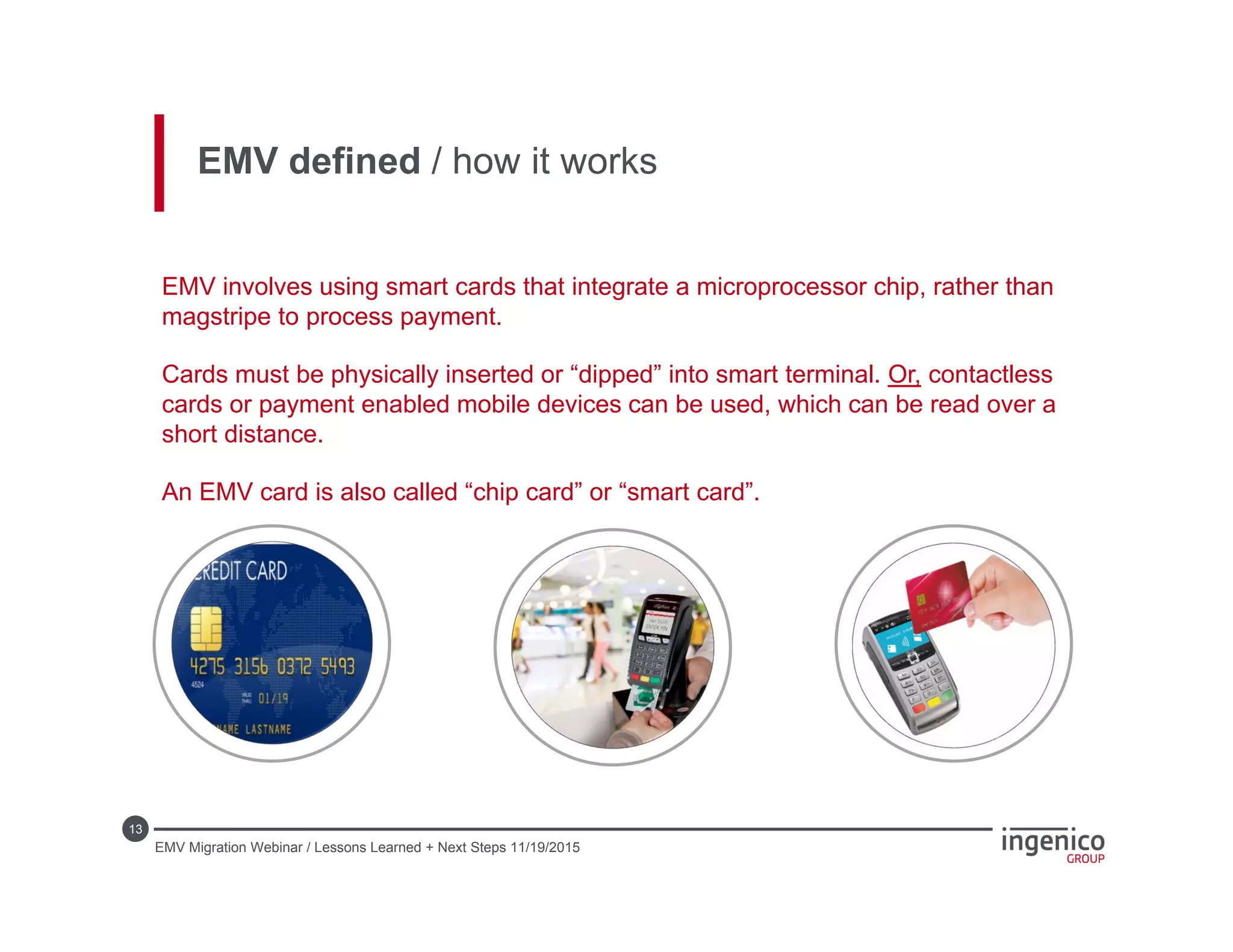

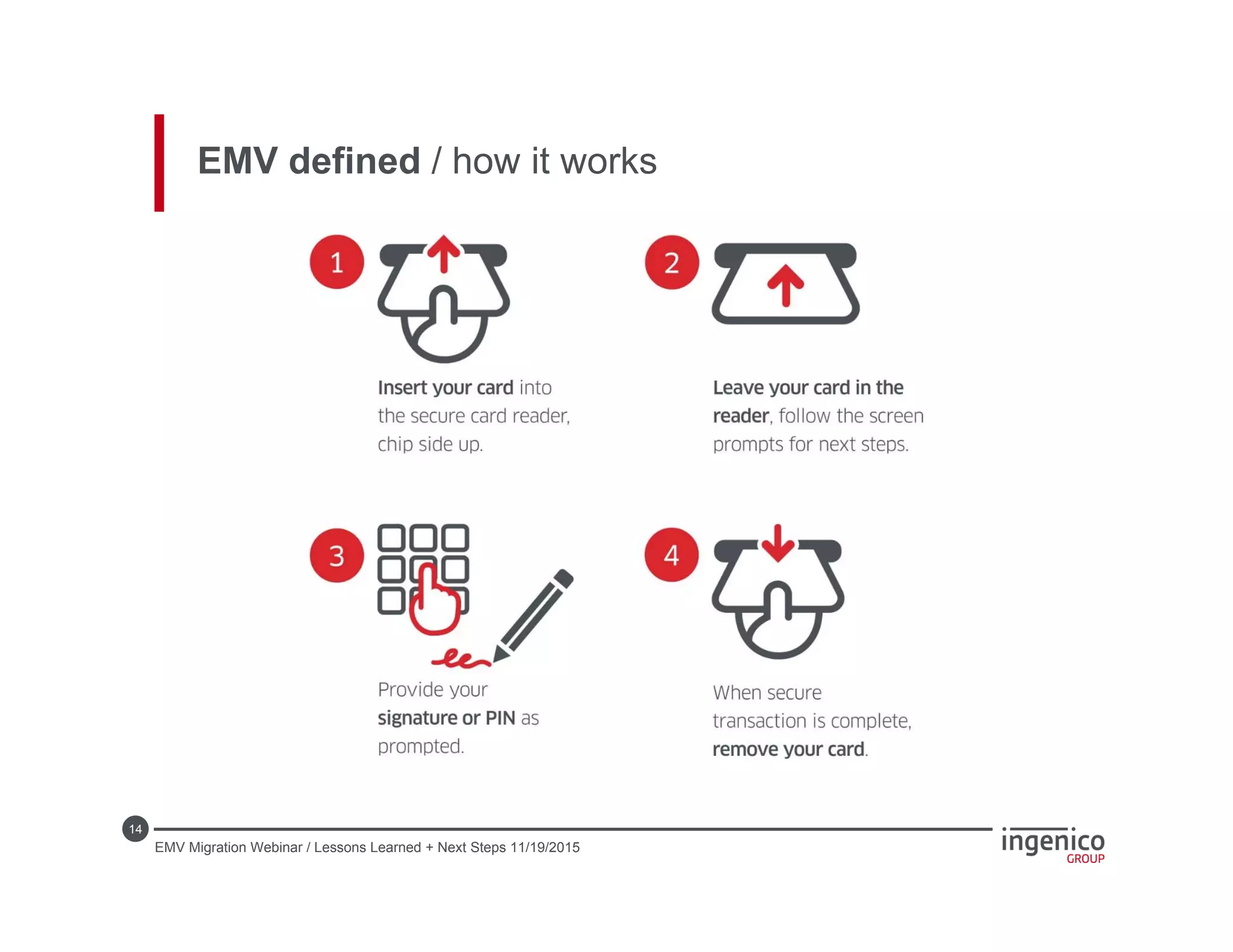

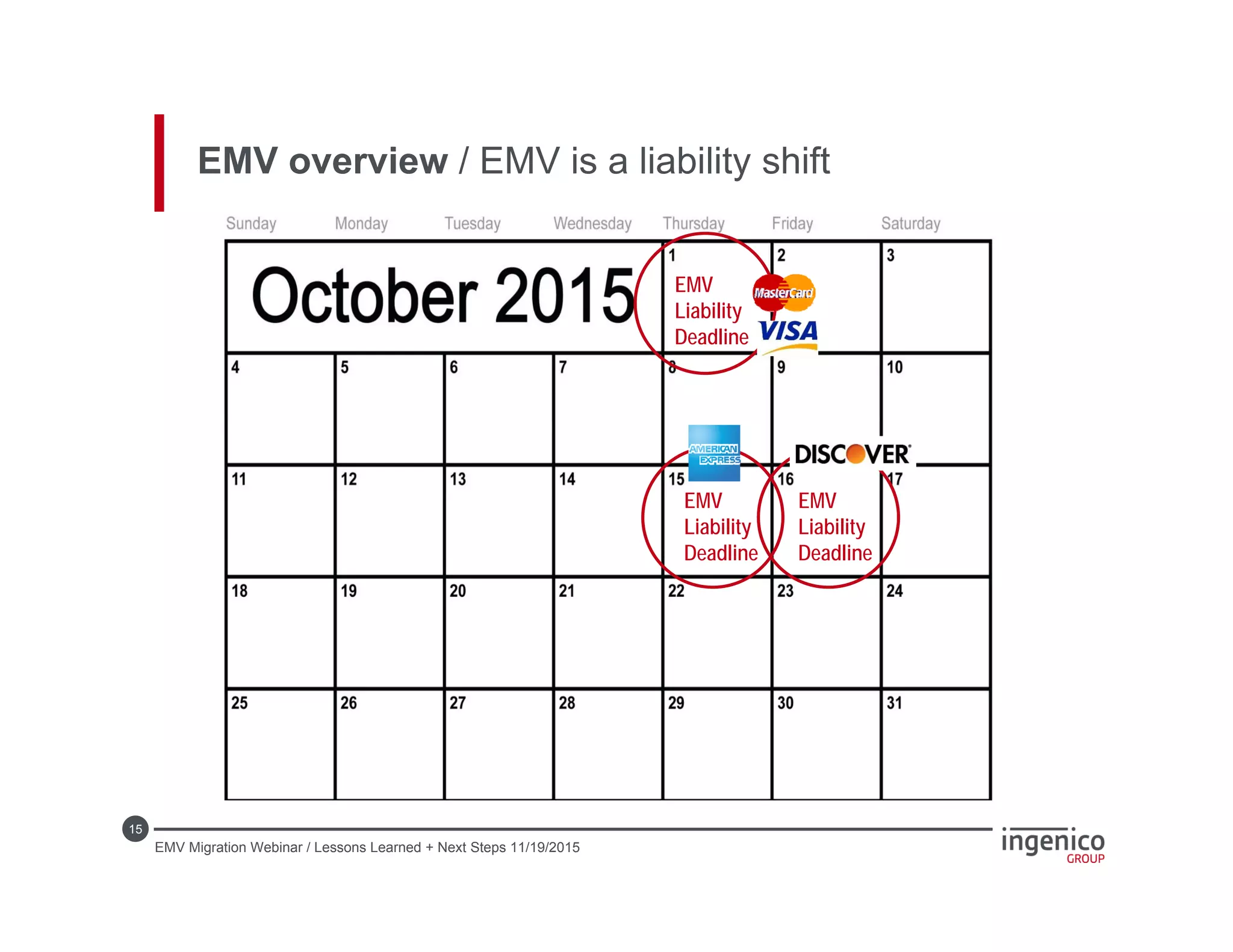

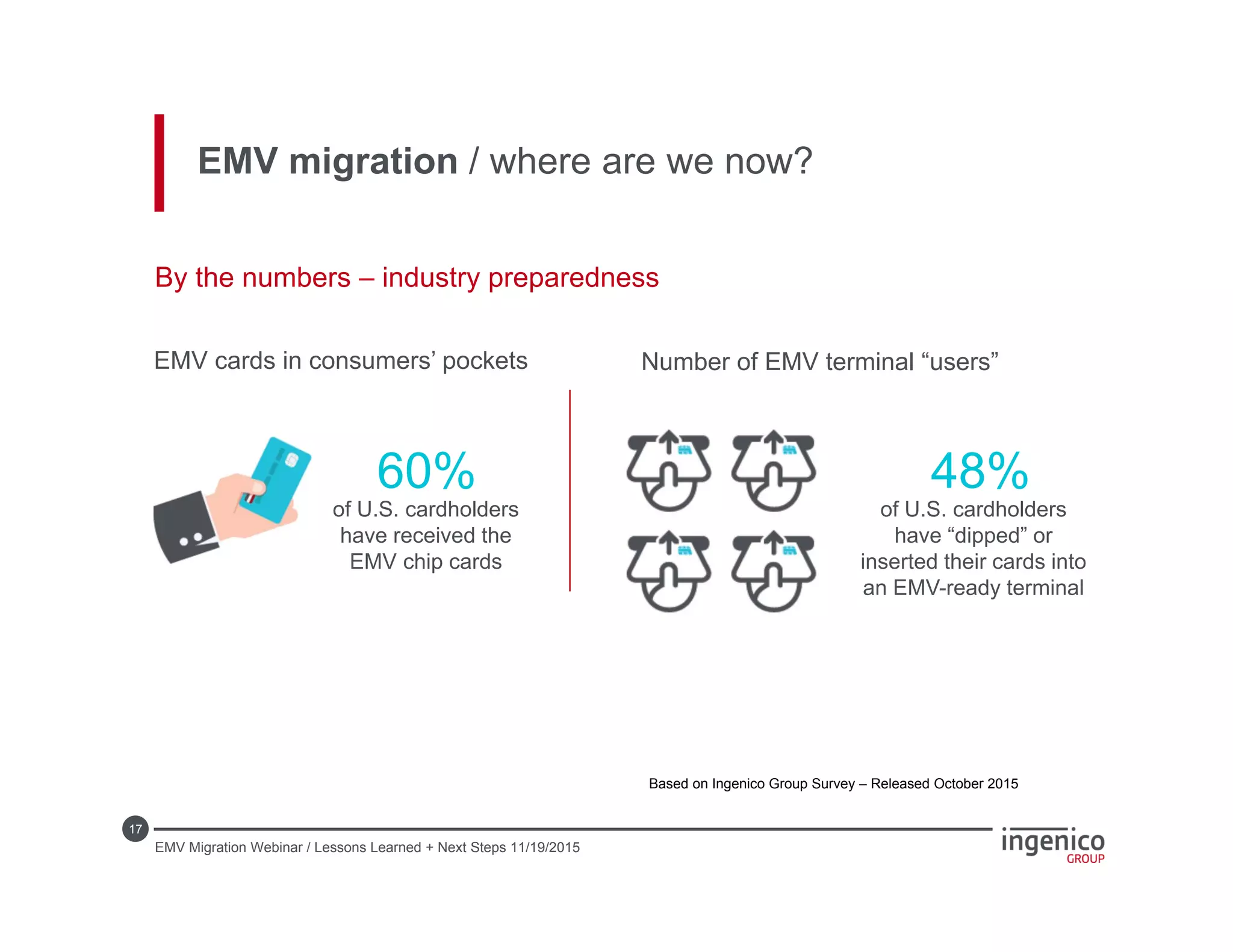

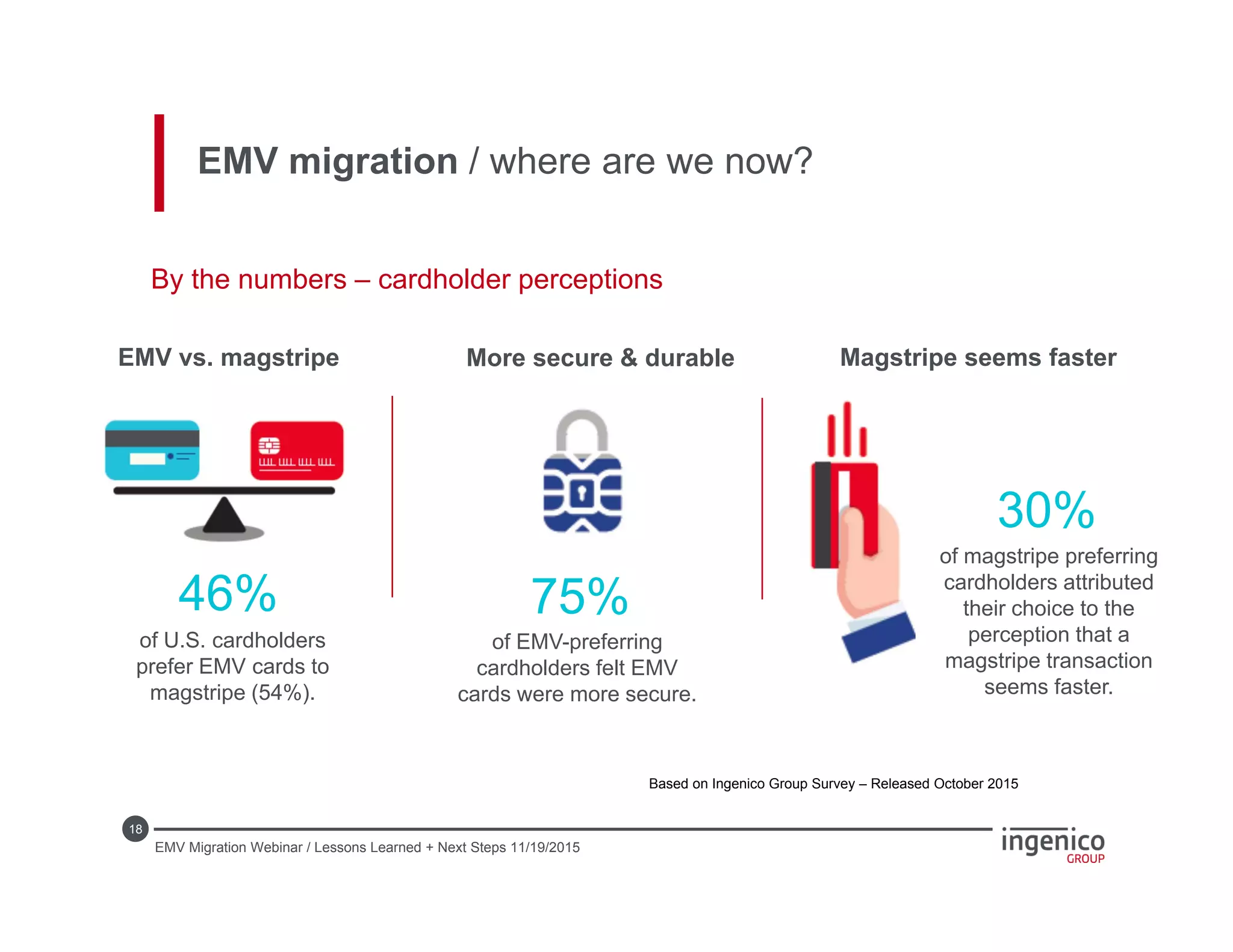

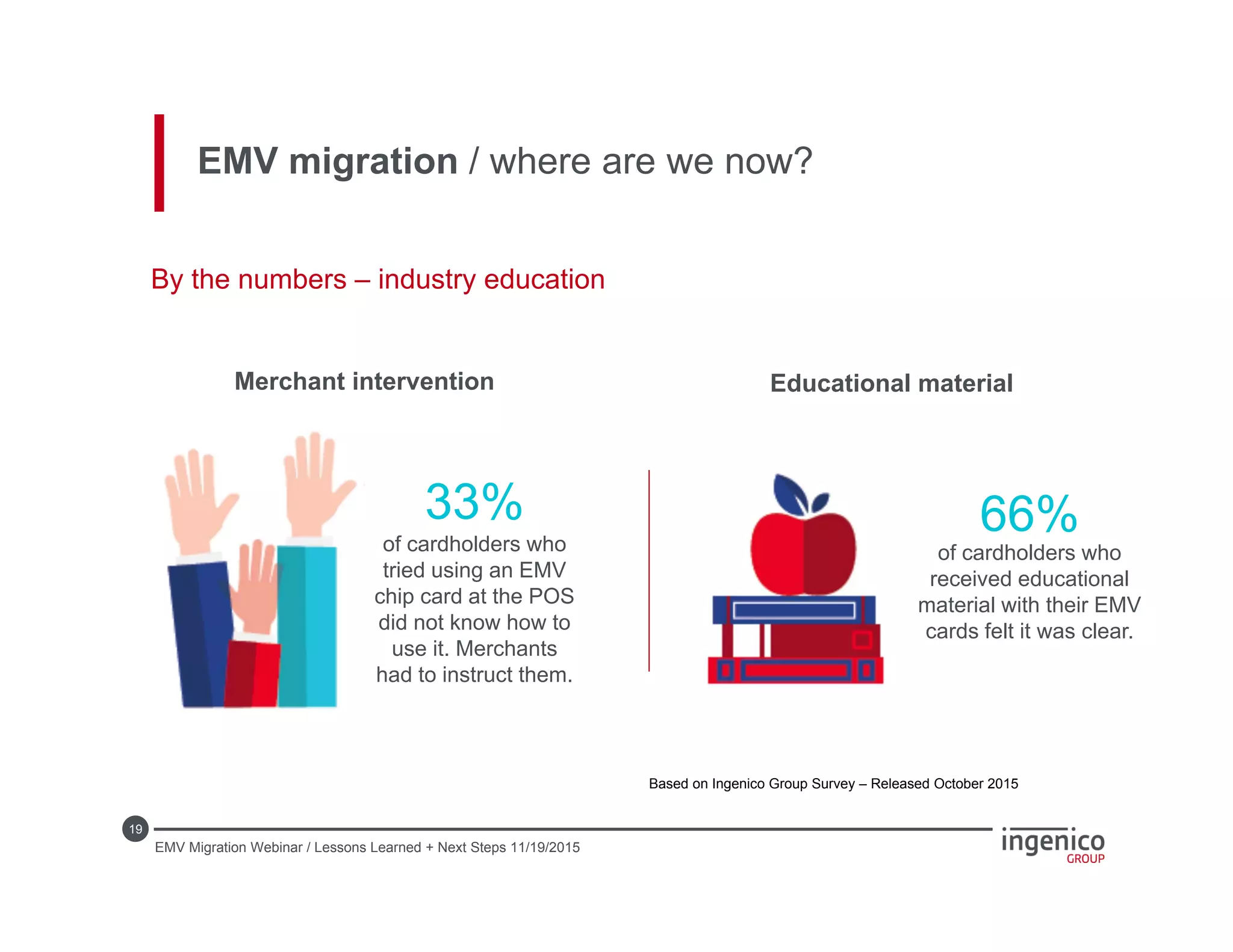

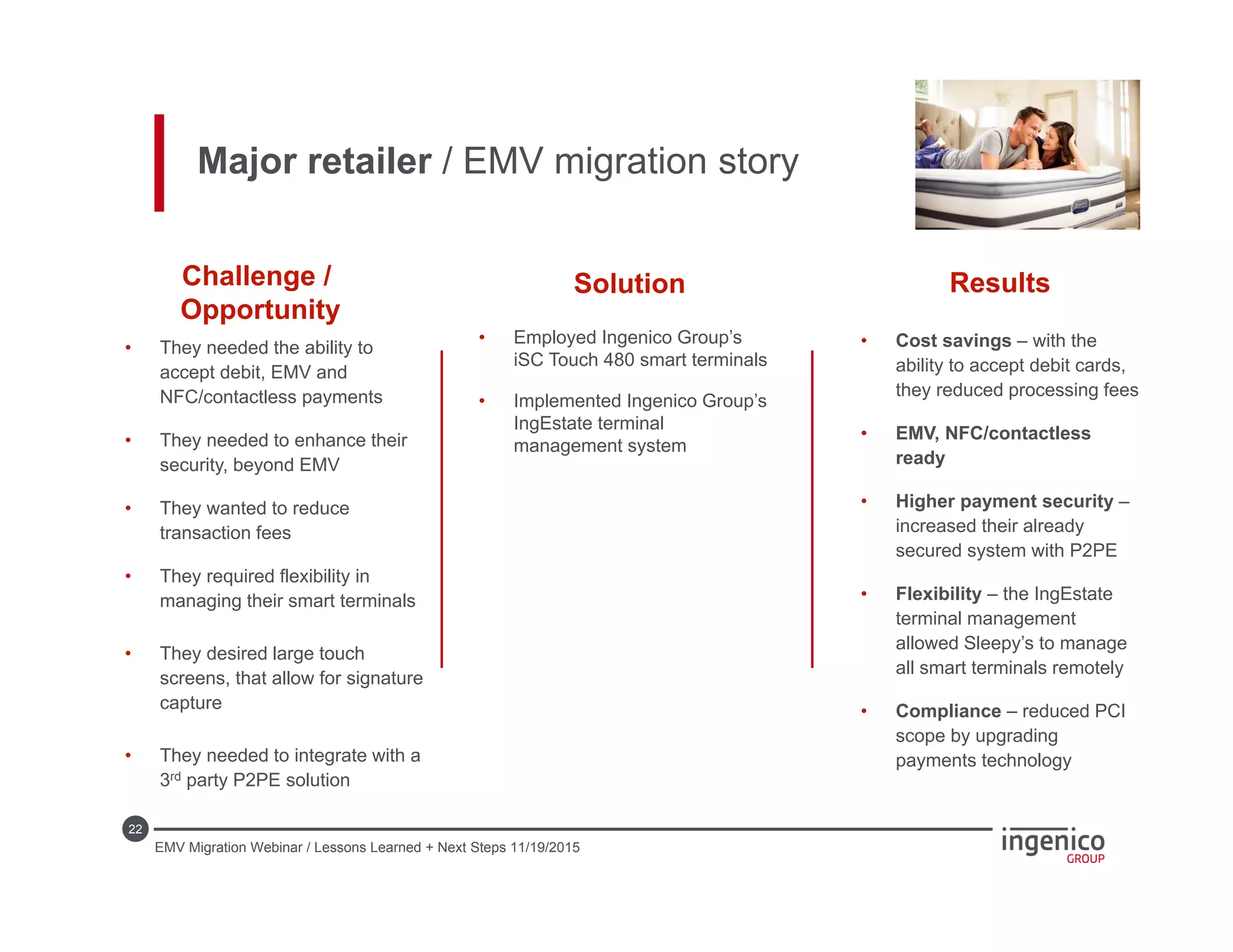

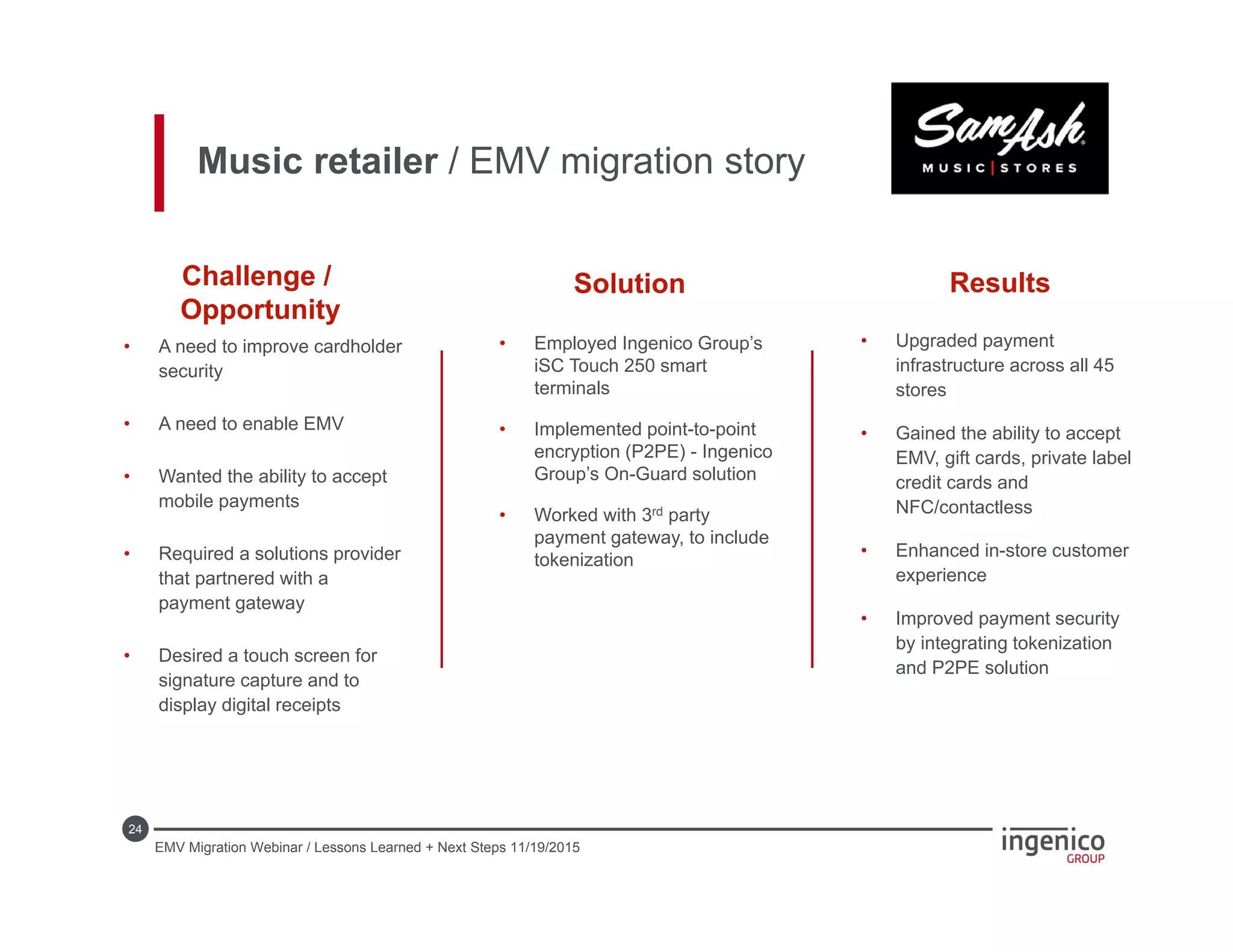

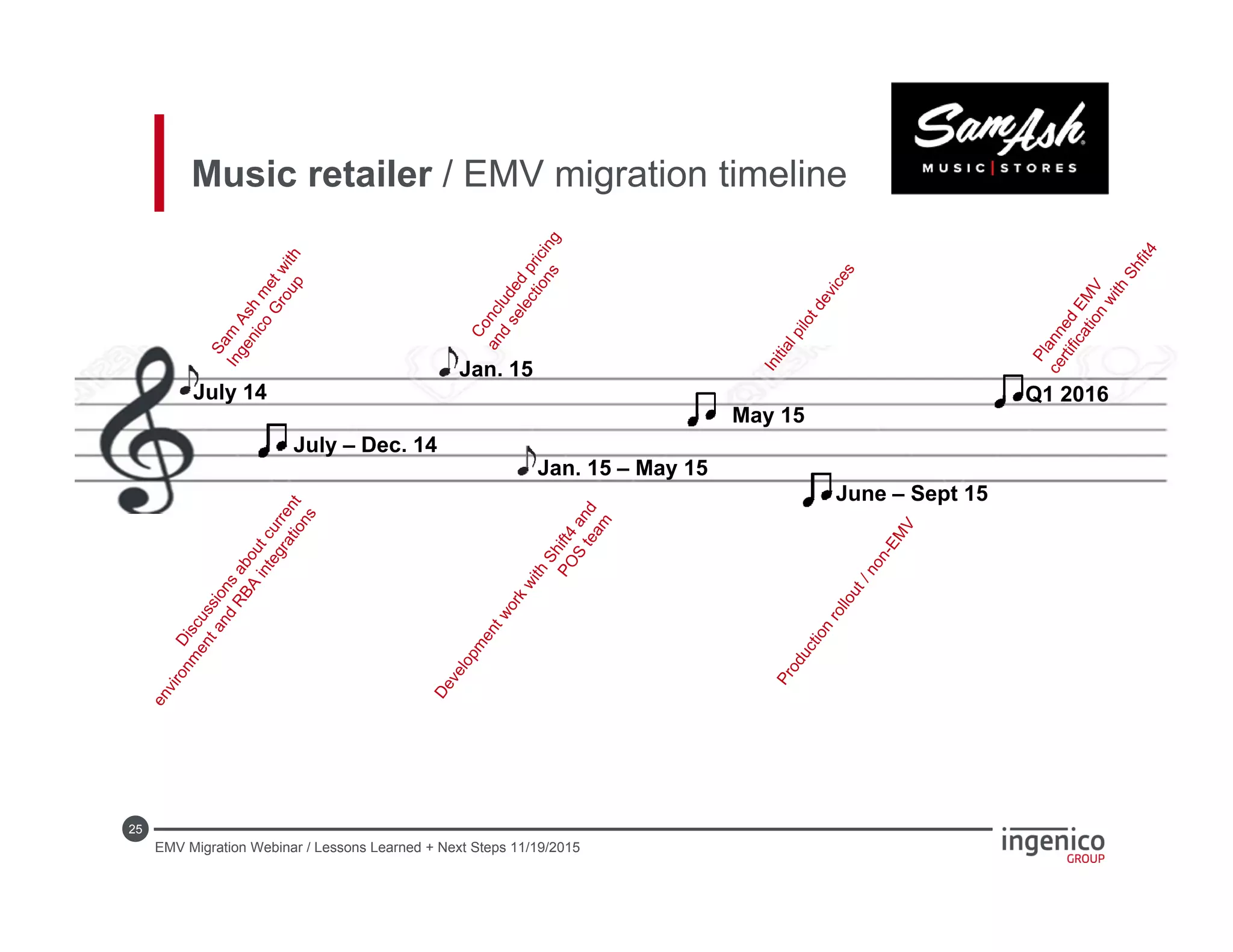

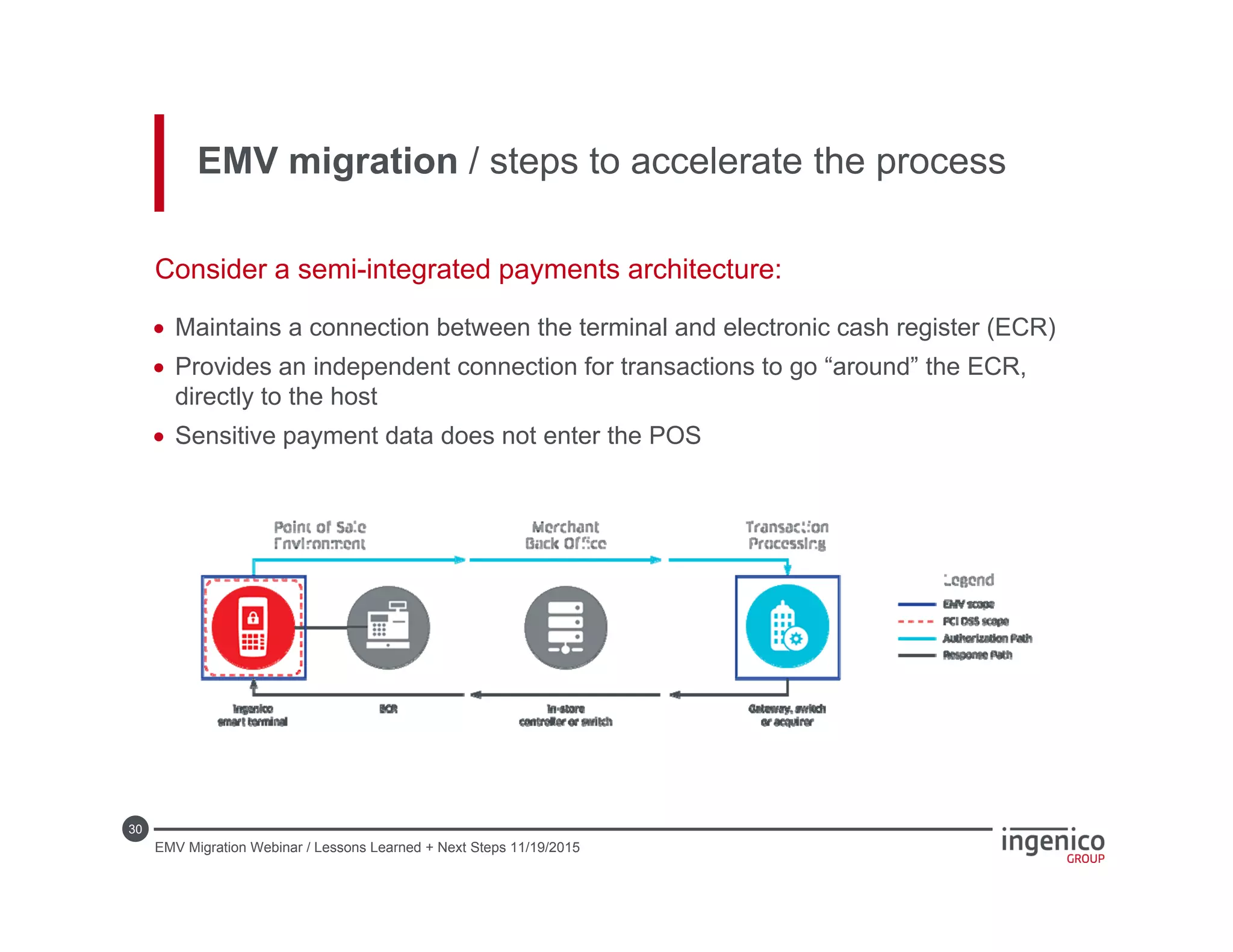

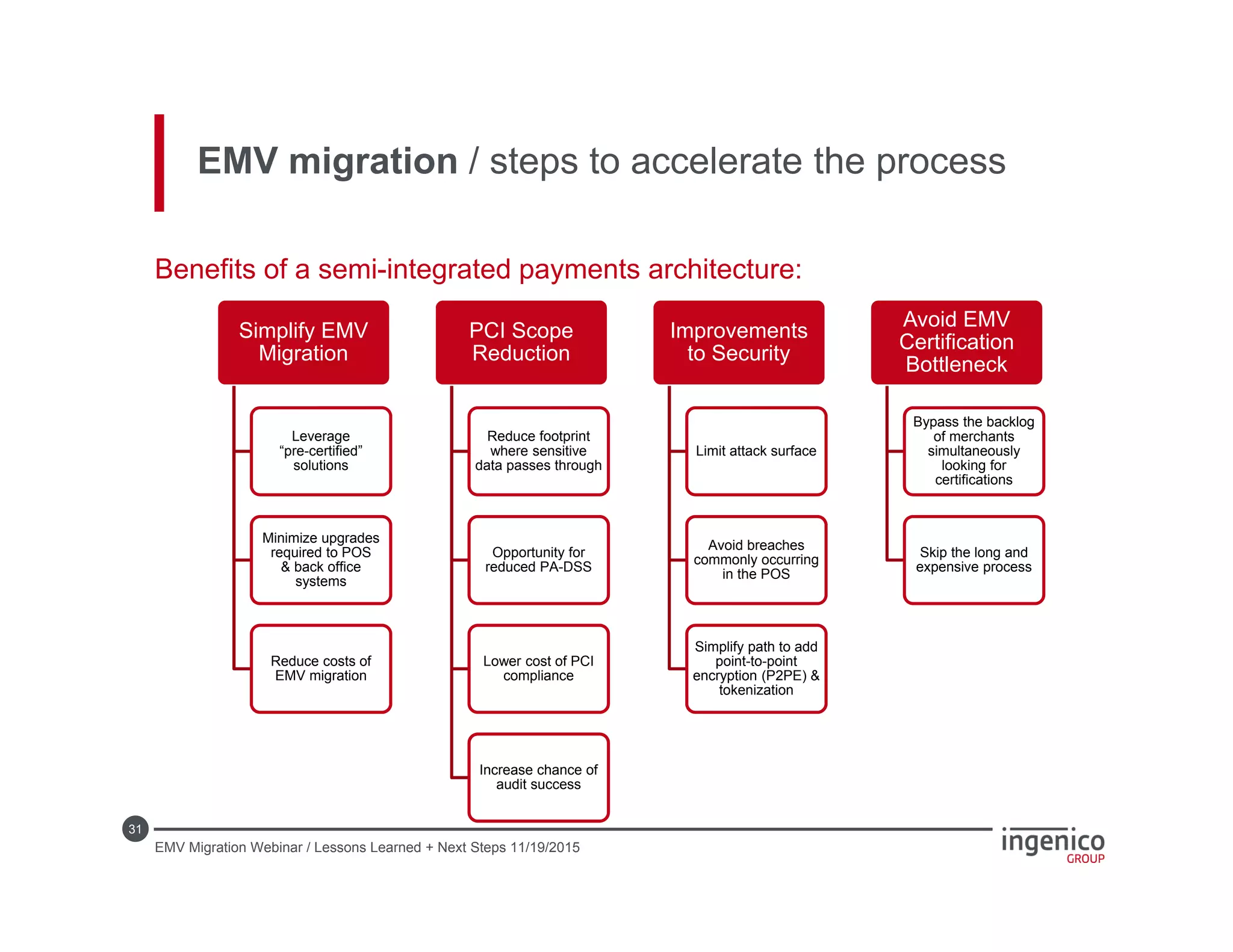

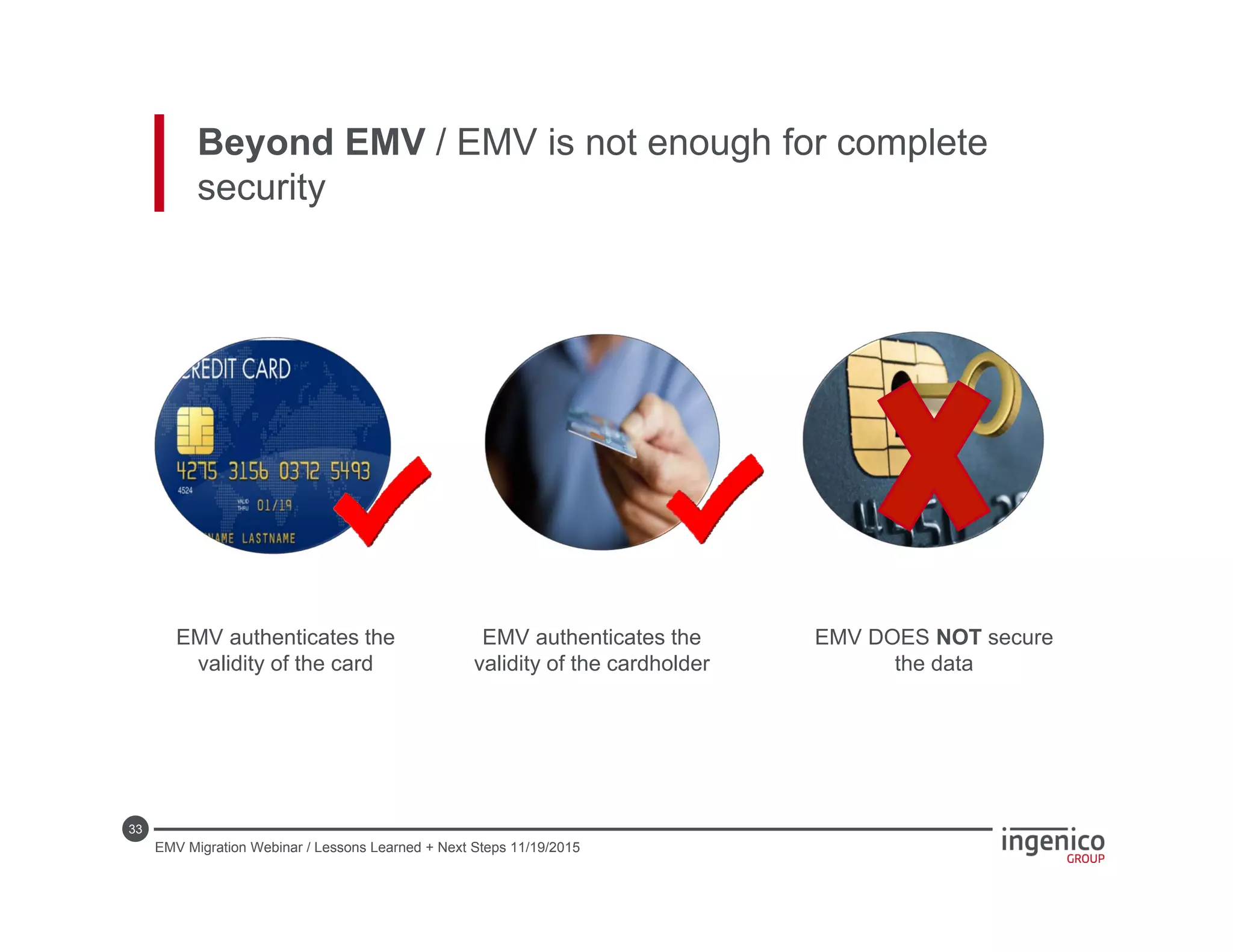

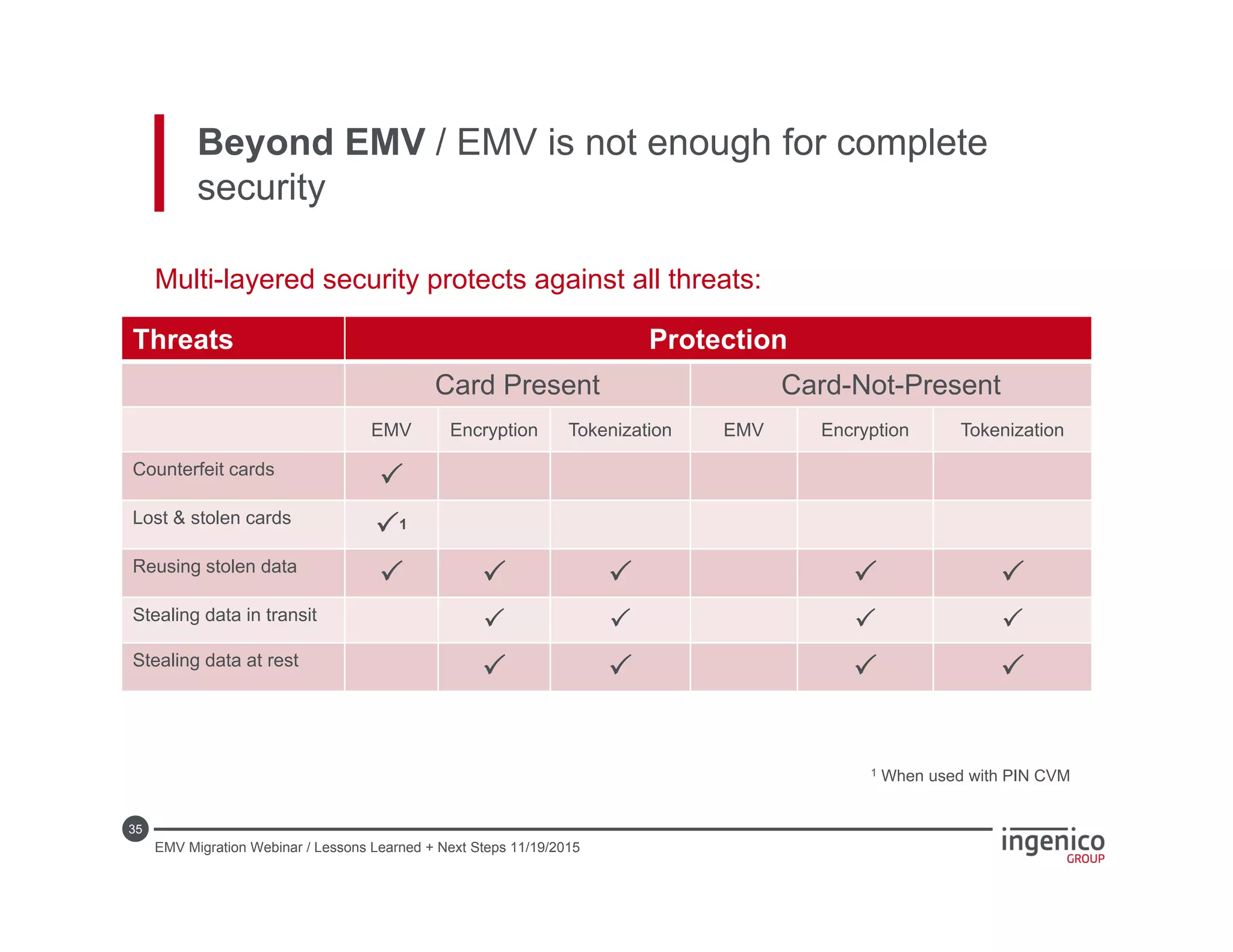

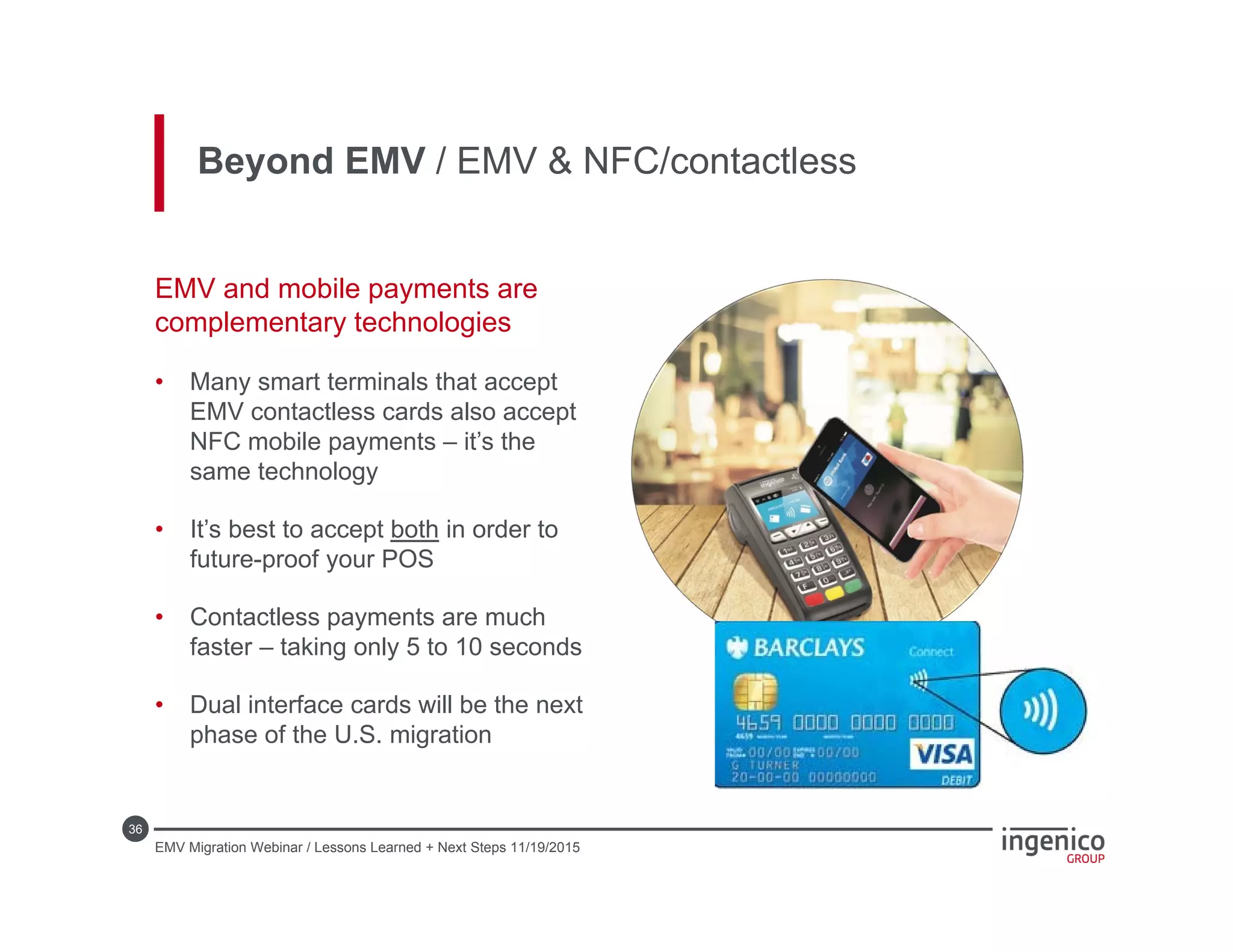

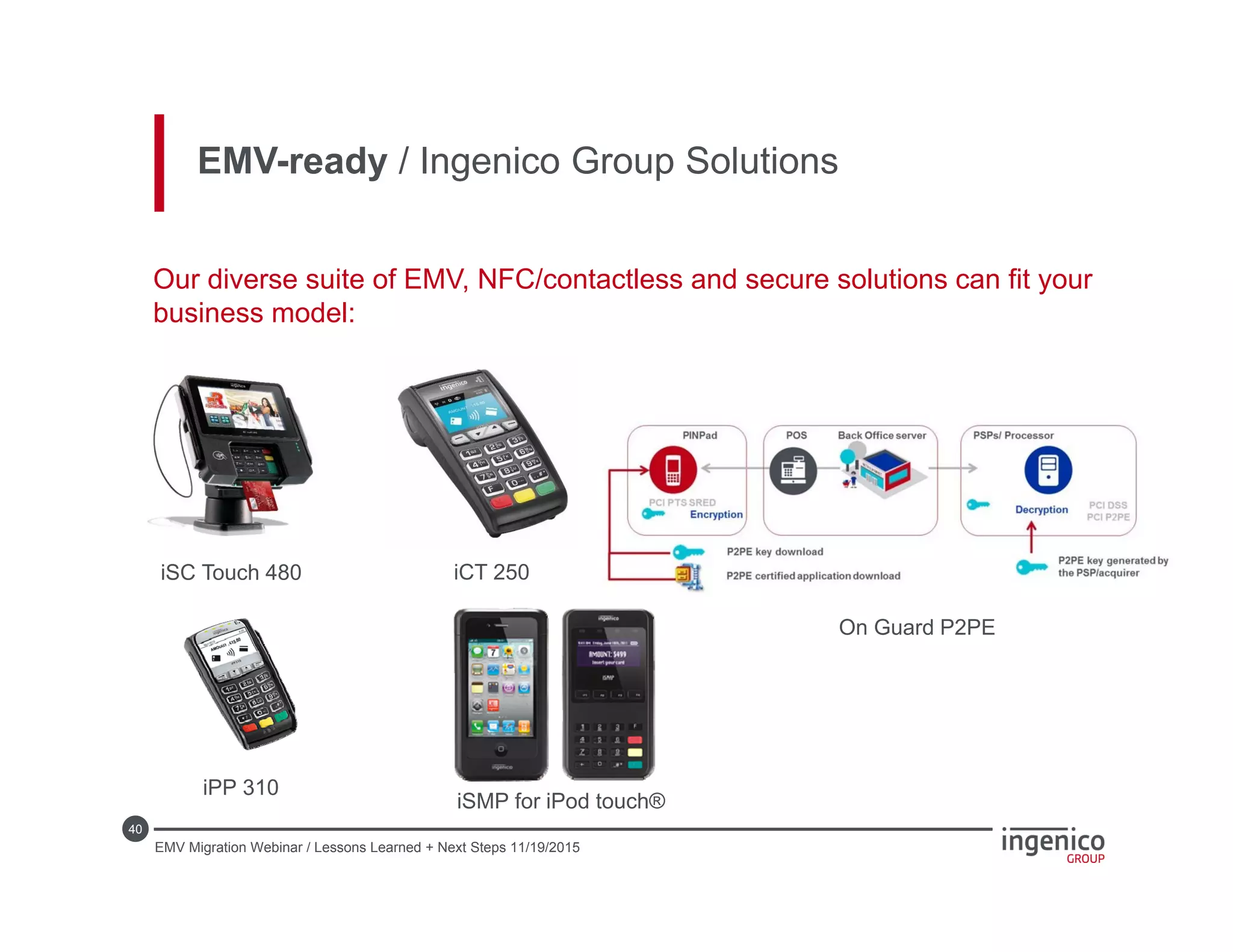

This document summarizes an EMV migration webinar hosted by Ingenico Group. The webinar provided an overview of EMV and the current state of EMV migration in the US. It then shared lessons learned from merchants that have implemented EMV, outlining their challenges, solutions, and results. The webinar also presented nine steps for accelerating an EMV migration and discussed how to future proof payments beyond EMV through solutions like point-to-point encryption and tokenization. Ingenico Group positioned themselves as an expert partner that can help merchants get EMV ready through their diverse payment solutions.