Budget 2016 Analysis of Income Tax Provisions

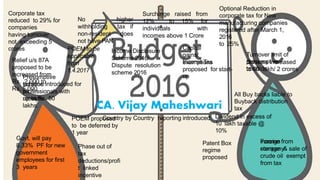

- 1. Surcharge raised from 12% to 15% for individuals with incomes above 1 Crore Income Disclosure Scheme 2016/ Dispute resolution scheme 2016 Presumptive taxationscheme introduced for allprofessionals with receiptsup to Rs. 50 lakhs. POEM to be applicable from 1.4.2017 Capital gains/ Income Taxexemptions proposed for start- up POEM proposed to be deferred by 1 year Govt. will pay 8.33% PF for new government employees for first 3 years All Buy backs liable to Buyback distribution tax Scheme increased to 50 lakh/ 2 crores No higher withholding tax if non-resident does not have PAN Optional Reduction in corporate tax for New manufacturing companies registered after March 1, 2016 to 25% Turnover limit of presumptive taxation Corporate tax reduced to 29% for companies having turnover not exceeding 5 crores Relief u/s 87A proposed to be increased from Rs. 2,000 to Rs. 5,000 Phase out of tax deductions/profi t linked incentive CA. Vijay Maheshwari Country by Country reporting introduced Patent Box regime proposed income from storage & sale of crude oil exempt from tax Dividend in excess of 10 lakh taxable @ 10% Foreign company

- 2. Tax Rates

- 3. Tax Rates of Individuals Income Other individuals Senior Citizen Super Senior Citizen Up to Rs. 2,50,000 Nil Nil Nil Rs. 2,50,001 to Rs. 3,00,000 10% Nil Nil Rs. 3,00,001 to Rs. 5,00,000 10% 10% Nil Rs. 5,00,001 to Rs. 10,00,000 20% 20% 20% Above Rs. 10,00,000 30% 30% 30% • Surcharge at 15% if TI > Rs. 1 Crore(Earlier it was 12%) • EC & SHES -3% of IT +Sur

- 4. Tax Rates of Firm Tax Rate 30% • Surcharge @ 12% if TI > Rs. 1 Crore. • EC & SHES -3% of IT +Sur

- 5. Tax Rates of Domestic Company 29 % 18.5 % Tax Rate MAT • Surcharge @ 7% if TI > Rs. 1 Crore, and 12% if TI > Rs. 10 Crores • EC & SHES - 3% of IT +Sur TO < 5 Crores TO < 5 Crores 30 %

- 6. Special Rate for newly Established Manufacturing Company – Sec. 115BA 25 % Tax Rate • Domestic Company registered on or after 1st of March, 2016. • Not engaged in any business other than the business of manufacture or production of any article or thing; research in relation to, or distribution. • Company has not claimed any benefit under section 10AA, Section 32, 32AC, 32AD, 33AB, 33ABA, 35(2AA) & (2AB), 35AS, 35CCC or 35CCD (additional depreciation, investment allowance, expenditure on scientific research) and any deduction under Part-C of Chapter-VI-A (Except Sec. 80JJAA) • Furnishes irrevocable option to claim this benefit before 139(1)

- 7. Tax Rates of Foreign Company 40 % Tax Rate 18.5 % MAT (if applicabl e) • Surcharge at 2% if TI > Rs. 1 Crore and 5% TI > Rs. 10 Crores • EC & SHES - 3% of IT +Sur

- 9. Increase in threshold limit for presumptive taxation scheme for persons having income from business Presumptive Scheme applicable - Total turnover or gross receipts not exceeding Rs. 1 crore Old provision s Presumptive Scheme applicable - Total turnover or gross receipts not exceeding Rs. 2 crore amendment Salary, remuneration, interest etc. paid to the partner shall not be deductible while computing income under section 44AD – Advance tax to be paid by March 15 of the FY

- 10. Old Provision –Section 44AD • Eligible Assessee engaged in eligible business. • Income @ 8% or higher income declared. • No deduction U/s 30 to 38 will be allowed. (SS-2) • However Interest and Salary subject to Sec. 40(b) in case of firm would be allowed. (Prov to SS2) • Depreciation deemed to been have been allowed. • Advance tax provision shall not be applicable (XVII-C) (Subsec. 4) • If claims lesser income and TI > maximum amount not chargeable to tax, Shall require to keep & maintain books of accounts as per Sec. 44AA and get his accounts audited and furnish report U/s 44AB. (Subsec. 5) • Not applicable on a person carrying profession [44AA(1]/Agency Business or earning Commission or brokerage.

- 11. Old Provision –Section 44AD Eligible Assessee : Resident Ind/HUF/Firm (Not LLP) Not claimed deduction U/s 10A, 10AA,10B, 10BA or Chapter VIA-C Eligible business Except business of plying, hiring or leasing goods carriage (Sec. 44AE) Turnover or receipt not more than Rs 1 Croes

- 12. Old Provision –Section 44AA &44AB Clause d of Sec. 44AA(2) (iv) & 44AB Maintenance of Books of accounts and to it Audited Carrying on business mentioned in Sec. 44AD; Claimed income lower than deemed income and TI > Maximum amount not chargeable to tax

- 13. Amended Provision –Section 44AD • In eligible business limit of 1 Cr. Uplifted to 2 crore. Effect : Now an assessee having TO upto 2 crore can take benefit of Sec. 44AD. • Proviso to Sec. 2 omitted . Effect : No Interest and Remuneration in case of firm is allowed now • Sub section 4 & 5 substituted. •Effect : •Advance tax provisions are applicable now

- 14. Amended Provision –Section 44AD • New Sub-Section 4 If deemed provision opted in a PY In any PY within next 5 PY not opted deemed provision Shall not be eligible for deemed provision for next 5 PY (from PY of not opting) • New Sub-Section 5 If sub-section 4 are applicable and TI > maximum amount not chargeable to tax, Shall require to keep & maintain books of accounts as per Sec. 44AA and get his accounts audited and furnish report U/s 44AB.

- 15. Amended Provision –Section 44AA & 44AB Example • Mr. X carrying eligible business having following :- •Question : •1. Can he opt 44AD in PY 2018-19? •2. Till which PY he can not opt 44AD? •3. Whether he has to keeps books of accounts and get accounts audited in different PY? •4. Suppose in FY 2017-18 his TO is 201 Lacs, then what would be situation in different PY? PY T.O. in Las Rs. Income declared 2016-17 150 12 2017-18 200 10 2018-19 100 8

- 16. Amended Provision –Section 44AA & 44AB Example –Continue …. • In same example :- •5. Suppose X is a partnership firm, what would be TI? •6. Suppose X is a LLP, what would be implication? •7. Suppose X earns commission income, what would be situation in different years? •7. Whether advance tax provisions would be applicable? If yes what would be due dates?

- 17. Presumptive taxation scheme for persons having income from profession – New Sec. 44ADA• Assessee engaged in the Specified profession (Section 44AA) • Total gross receipts does not exceed 50 lakh rupees in a P.Y., • 50% of the gross receipts to be Taxable income on presumptive basis • No deduction U/s 30 to 38 will be allowed. • Depreciation deemed to been have been allowed. • If claims lesser income and TI > maximum amount not chargeable to tax, Shall require to keep & maintain books of accounts as per Sec. 44AA and get his accounts audited and furnish report U/s 44AB.

- 18. Presumptive taxation scheme for persons having income from profession – New Sec. 44ADA Consequential amendment to Sec. 44AB in Clause d In place of Business the word profession substituted and in place of Sec. 44AD, Sec. 44ADA substituted. Limit of audit uplifted to 50 lacs as against 25 lacs (Clause (b) of Sec. 44AB) •Key Notes : •1. Despite Section 44AD, 44ADA applies on LLP also. •2. No interest and salary to partners are allowed in case of professional firm opting this section. •3. Advance tax liability is at par with normal provision (like 44AD no special provision), AT to be paid in 4 installments. •4. No dis-countinuance and in eligibility clause like 44AD. Professional is free to opt or not in each PY. •5. Very higher presumptive income as against recommendation of Eswar Committed (33.33%)

- 19. Changes in TDS & TCS

- 20. Increase in threshold limit for TDS Present Section Heads Old Threshold Limit (Rs.) New Threshold Limit (Rs.) 192A Payment of accumulated balance of Provident Fund due to an employee 30,000 50,000 194BB Winnings from Horse Race 5,000 10,000 194C Payments to Contractors Aggregate annual limit of 75,000 Aggregate annual limit of 1,00,000 194LA Payment of Compensation on acquisition of certain Immovable Property 2,00,000 2,50,000 194D Insurance commission 20,000 15,000 194G Commission on sale of lottery tickets 1,000 15,000 194H Commission or brokerage 5,000 15,000

- 21. Revision in TDS rates Present Section Heads Old Rate of TDS (%) New Rate of TDS (%) 194DA Payment in respect of Life Insurance Policy 2% 1% 194EE Payments in respect of NSS Deposits 20% 10% 194D Insurance commission Rate in force (10%) 5% 194G Commission on sale of lottery tickets 10% 5% 194H Commission or brokerage 10% 5%

- 22. TCS on Sale of Goods & Services (Sec 206C)Sub-Section (1D) amended Every person being a Seller Who receives any amount in cash as consideration for sale of Bullion or Jewellery or Any other goods or providing any service Shall at the time of receipt of such amount in cash Collect 1% of Sale Consideration If such consideration exceeds 2L, 5L & 2L respectively. Sub-Section (1F) inserted Every person being a Seller Who receives any amount as consideration for sale of motor vehicle of the value >10L Shall at the time of receipt of such amount Collect 1% of Sale Consideration

- 23. TCS on Sale of Goods & Services (Sec 206C)Analysis by creating different Situations Goods having value of 5L & money received in Bank account (by NEFT)? Goods having value of 5L & money received in Bank account (Cash deposited by Customer directly)? Consideration by bearer cheque, un-crossed cheque? Goods exchanged (Barter system)? In above if a part is received in cash? Buyer bought goods for personal consumption? Invoice raised later on 15-06-16 and cash received on 01-06-2016? Sale completed/Services rendered and Invoice issued before 01-06-2016 but payment received in cash on or after 01-06-2016? Sale completed/Services rendered but Invoice issued and payment received in cash on or after 01-06-2016? Consideration without ST- 200000/- plus ST 15000/- ?

- 24. TCS on Sale of Goods & Services (Sec 206C)Analysis by creating different Situations Continue …. Goods and Services both included in an invoice, value of Rs. 105000/- each ? On Service TDS is deducted by payer, will TCS apply? TDS deducted in part ? i.e. Value of service Rs. 250000/-, TDS made on Rs. 200000/-, cash received Rs. 50000/-? In above example no receipt in cash? In above example Rs. 45000 in cash & Rs. 205000/- cheque received?

- 25. TCS on Sale of Vehicle (Sec 206C) Analysis by creating different Situations Car sold of Rs. 1200000/-, receipts in cheque? Car sold of Rs. 1200000/-, receipts in cheque Rs. 1000000/- & in Cash 200000/-? 5 cars sold each having value of Rs. 500000/-? When to collect TCS, booking amount received on 01-06-2016 Rs. 200000/-, Sale made and balance Rs. 10,0000/- received on 30-06-2016? Entire amount received from Financer directly? Vehicle sold through sub-dealer? Booking cancelled, TCS to be refunded? Buyer not having PAN, higher rate of TDS applicable?

- 26. TCS on Sale of Vehicle (Sec 206C) Clarification By department (Cir No. 22/2016 dated 08-06-2016) TCS on Motor vehicle : Not on dealer but on retail sale Sale to, Govt deptt, Embassies, UN : TCS does apply TCS U/s (AD) Vs (IF) if MV is having value of Rs. 8 Lacs : (1D) applies TCS on Motor Vehicle : Payment received in installments : on Each inst @1%

- 27. Deeming fiction [Sec 50C & 43CA] 50C -Capital Assets w.e.f. 01-04-2003 43CA- Others [PGBP] w.e.f. 01-04-2013 •Language of both the provisions are same. •Judicial pronouncement in respect of Sec. 50C would also be applicable on Sec. 43CA 2723-Jun-16

- 28. Deeming fiction [Sec 50C] •The assets transferred is a capital asset. •Asset is Land or Building or Both •There is a value adopted, assessed or assessable by any authority of State govt for the purpose of stamp duty. •The actual consideration is less than the value of such authority. Then •Such value will be consideration for transfer of the asset. 2823-Jun-16

- 29. Prior amendment position Sec 50C Date for the purpose of Valuation •Normally date of registration of conveyance deed but Case covered Us/ 2(47) (v) i.e. (53A) •Sale agreement executed •Full value paid •Possession of property handed over Then date of sale agreement shall be date for Circle rate. Dy CIT Vs. S Venkat Reddy (2013) 32 Taxmann.com 24 (Hyd.) ITO .v. Modipon Ltd. (Delhi)(Trib.) (2015) www.itatonline.org CA. Vijay Maheshwari 2923-Jun-16

- 30. Prior amendment position Sec 50C Date for the purpose of Valuation •Normally date of registration of conveyance deed but Case covered Us/ 2(47) (v) i.e. (53A) •Sale agreement executed •Full value paid •Possession of property handed over Then date of sale agreement shall be date for Circle rate. Dy CIT Vs. S Venkat Reddy (2013) 32 Taxmann.com 24 (Hyd.) ITO .v. Modipon Ltd. (Delhi)(Trib.) (2015) www.itatonline.org CA. Vijay Maheshwari 3023-Jun-16

- 31. Post amendment position Sec 50C Insertion of proviso to SS (1) Seller • Value on date of agreement may be taken as Full value of Consideration. • Consideration or part received in a/c payee Cheque/DD or ECS on or before date of agreement Buyer Date of agreement - 31-3-2016, token money by A/c payee cheque of Rs. 1L Date of Registration - 30-6-2016 Transfe r Difference in language of Sec. 50C and 43CA? Otherwise than in cash By special mode Impact ?

- 32. TAXATION OF DIVIDEND INCOME IN HANDS OF RECEIPIENT – SECTION 115BBD AND SECTION 10(34) ICO 1 Resident Individual/ Firm / HUF :APPLICABILITY - • Recipient Resident :- • Individuals • HUF • Firm • Dividend could be :- • Declared, distributed or paid by domestic company • As per Section 2(22) excluding 2(22)(e) TAX TREATMENT :- • Income in excess of Rs. 10,00,000 shall be chargeable to tax @ 10% , without any :- • Deduction for any expenses/allowances; • Set off of losses DIVIDEND > 10 LAKH DIVIDEND > 10 LAKH

- 33. Tax benefits for individuals Small taxpayer relief u/s 87A – Income upto Rs. 5 lakhs Tax relief u/s 87A has been increased from Rs. 2,000 to Rs. 5,000 (subject to tax due) Relief under Section 80GG – Deduction for rent – No HRA The limit for deduction has been increased from Rs. 2000 p.m to Rs. 5000 p.m.

- 34. Time limit for acquisition/construction of self occupied property - Deduction of Interest- Section 24(b) Completion/ acquisition of house property should be completed within 3 years from the end of the F.Y. in which capital was borrowed. Old provision s Completion/ acquisition of house property should be completed within 5 years from the end of the F.Y. in which capital was borrowed. amendment

- 35. Deduction for acquisition of residential property – Section 80EECondition : - • Assessee : Individual • Loan sanctioned by financial institution between 1.4.2016 and 31.3.2017 • Loan for the purpose of acquisition of residential house property. • Property value less than 50 lakh and loan amount not exceeding 35 lakh • On date of sanction of loan assessee doesn’t own any residential houseDeduction – Till the repayment of loan continues : - • Deduction of interest on loan taken for residential house property shall not exceed 50,000. • No deduction shall be allowed under any other provision of the Act for such interest. • Limit over and above limit of Rs. 200,000 for self occupied property under Section 24.

- 36. Advance Tax (Sec. 211 & 234C) Due date For normal assessee For 44AD “Eligible business” 15th Jun 15% Nil 15th Sep 45% Nil 15th Dec 75% Nil 15th Mar 100% 100%

- 37. Charitable organization – Cease to exist or Converts to non- charitable organization – Chapter XII- EB - June 1, 2016 Charitable organizatio n • Additional income-tax at maximum marginal rate shall be levied in case of : - • Conversion of a charitable organization into any form not eligible for registration u/s 12AA • Merger with, any entity not registered u/s 12AA or having different objects or • Non distribution of assets of a charitable organization on its dissolution to another charitable institution registered u/s 12AA or approved u/s 10(23C), within 12 months of dissolution Non- Charitable organizatio n Merger/ Conversio n Transfer of Asset on dissolution

- 38. Other applicable Conditions • Accreted Income = Fair market value of Total Assets (Valued in prescribed manner) – Liabilities on specified date • No credit for tax and leviable even if trust or institution does not have any other income chargeable to tax in the relevant previous year. • Principal officer or the trustee and the trust or the institution shall be deemed to be assessee in default • Further, the recipient of assets, which is not a charitable organization, shall also be liable to be held as assessee in default in case of non-payment of tax and interest, to the extent of the assets received.

- 39. Start up Tax incentives

- 40. START UPS – TAX INCENTIVES 100% profits deduction for 3 out of 5 years LTCG exemption to assessee investing in Fund of Funds under Start up India Action Plan Capital gains on transfer of residential property exempt from tax if invested in eligible start up

- 41. Section 54EE – Investment into units of “Fund of Funds” under Start up India Action Plan Long term capital asset Taxpayer • Capital Gains from transfer of a long-term capital asset • Investment of whole or any part of capital gains in the long-term specified asset (LTSA), within 6 months from such transfer – Maximum Rs. 50 lakh • Quantum of exemption :-• Cost of Asset > Capital Gains – Entire gains exempt • Cost of Asset < Capital Gains – (Entire Capital Gains) * (Amount Invested/Entire gains)• LTSA transferred before 3 years – Capital gains exempt earlier chargeable to tax in year of transfer of long-term specified asset • LTSA – Units of notified fund issued before April 1 , 2019 Long term specified Asset Transfer of Investme nt in

- 42. Section 54GB – Investment into shares of qualified company – AY 2017-18 Residenti al Property Individual or HUF • Capital Gains from transfer of residential property • Subscription of shares of a company in eligible business/ eligible start up, until 31.3.2019 • Eligible business/eligible start up defined as per Section 80-IAC • New asset that can be acquired by the start up out of invested funds can include computer/computer software• Available to technology driven start-up so certified by the Inter-Ministerial Board of Certification notified by the Central Government in the Official Gazette • Acquire new asset before due date of return filing for investor • Taxpayer owns more than 50% shares of the company Eligibl e Start up Transfer of Investme nt in

- 43. Start up Income exemption - Section 80IAC Indi a I Co. Offshor e Offshor e Fund APPLICABILITY :- • An eligible start-up derives profits and gains from eligible business • Deduction of 100% of profits and gains for 3 consecutive AY, out of first 5 years since incorporation • Eligible startup should not be formed by split up or reconstruction etc of business • “Eligible business” means a business which involves innovation, development, deployment or commercialization of new products, processes or services driven by technology or intellectual property;India Investmen ts Oversea s Investmen ts

- 44. Start up Income exemption - Section 80IAC Turnover < 25 crores for every individual year, between 1.4.2016 to 31.3.2021 Turnove r Certificate of eligible business from the Inter- Ministerial Board of Certification Incorporation – 1.4 2016 to 31.3. 2019 Incorporatio n Certificat e

- 45. Filing of return of Income Section Earlier Now 139(1) Person not obligated to include income exempt u/s 10(38) , to ascertain whether his income exceeds the maximum amount which is not chargeable to income tax . Specific exclusion to provide that effect of Section 10(38) shall not be considered to arrive at income, which shall be considered to arrive at whether a person is liable to file ITR. 139(4) Belated return can be filed at any time before : - • One year from the end of the relevant assessment year or • Completion of assessment, whichever is earlier. Belated return can be filed at any time before : - • End of the relevant assessment year or • Completion of assessment, whichever is earlier.

- 46. Filing of return of Income Section Earlier Now 139(5) Belated return couldn’t be revised. Belated return can also be revised. 139(9)(aa) Non payment of self-assessment tax together with interest, on or before the date of furnishing of return could result in the ROI being considered defective It shall not be considered as defective

- 47. Payment to Railways covered for disallowance u/s 43B •Taxes •Employers Cont •Bonus or Comm •Interest on Loan to FI/Sch. Banks •Leave Encashment Old provision s Due to Railways for using the assets of the Railways covered amendme nt

- 48. Tax Incentive for employment generation – Section 80JJAA – AY 2017-18 Cost incurred on any employee whose total emoluments are less than or equal to twenty five thousand rupees per month – 30% of emoluments allowed as a deduction No deduction where Government pays for EPF Minimum number of days of employment in a financial year reduced from 300 days to 240 Condition of 10% increase in number of employees every year is proposed to be done away All employers who are required to get accounts audited u/s 44AB covered for this exemption

- 49. Phase out plan of incentives (Profit linked Deduction/ Weighted deduction) & Additional deduction

- 50. Phase out plan of incentives (Profit linked Deduction/ Weighted deduction) Section Existing Proposal 10AA- Special provision in respect of newly established units in Special economic zones (SEZ) Profit linked deductions for units in SEZ for profit derived from export of articles or things No deduction shall be available to units commencing manufacture or production of article or thing or start providing services on or after 1st day April,2020. (from previous year 2020-21 onwards). 35AC-Expenditure on eligible projects or schemes. Deduction for expenditure incurred by way of payment of any sum to a public sector company or a local authority or to an approved association or institution, etc. on certain éligible social development project or a scheme No deduction shall be available with effect from 1.4.2017 (i.e from previous year 2017-18 and subsequent years).

- 51. Phase out plan of incentives(Profit linked Deduction/ Weighted deduction) Section Existing Proposal 35CCD-Expenditure on skill development project. Weighted deduction of 150 per cent on any expenditure incurred (not being expenditure in the nature of cost of any land or building) on any notified skill development project by a company. Deduction shall be restricted to 100 per cent from 01.04.2020 (i.e. from previous year 2020-21 onwards). Section 80IA; 80IAB, and 80IB - Deduction in respect of profits derive from a) development, operation and maintenance of an infrastructure facility (80-IA) (b)development of special economic zone (80-IAB) (c)production of mineral oil and natural gas [80-IB(9)] 100 per cent profit linked deductions for specified period on eligible business carried on by industrial undertakings or enterprises referred in section 80IA; 80IAB, and 80IB. No deduction shall be available if the specified activity commences on or after 1st day April, 2017. (i.e from previous year 2017-18 and subsequent years).

- 52. Phase out plan of incentives (Accelerated Depreciation/ Weighted Deduction) Section Existing Proposal Section 32 read with Accelerated depreciation is provided to To amend the new Appendix IA read rule 5 of Income-tax certain Industrial sectors in order to with rule 5 of Income-tax Rules, 1962 to Rules, 1962- give provide that highest rate of depreciation Accelerated impetus for investment. The under the Income-tax Act shall be Depreciation. depreciation restricted to 40% w.e.f 01.4.2017. (i.e under the Income-tax Act is available from previous year 2017-18 and up to subsequent years). 100% in respect of certain block of The new rate is proposed to be made assets. applicable to all the assets (whether old or new) falling in the relevant block of assets.

- 53. Phase out plan of incentives (Accelerated Depreciation/ Weighted Deduction) Section Existing Proposal 35(1)(ii)- Expenditure on scientific research. Weighted deduction from the business income to the extent of 175 per cent of any sum paid to an approved scientific research association which has the object of undertaking scientific research. Similar deduction is also available if a sum is paid to an approved university, college or other institution and if such sum is used for scientific research. Weighted deduction shall be restricted to 150 per cent from 01.04.2017 to 31.03.2020 (i.e. from previous year 2017-18 to previous year 2019-20) and deduction shall be restricted to 100 per cent from 01.04.2020 (i.e. from previous year 2020-21 onwards). 35(1)(iia)- Expenditure on scientific research. Weighted deduction from the business income to the extent of 125 per cent of any sum paid as contribution to an approved scientific research company. Deduction shall be restricted to 100 per cent with effect from 01.04.2017 (i.e. from previous year 2017-18 and subsequent years).

- 54. Phase out plan of incentives (Accelerated Depreciation/ Weighted Deduction) Section Existing Proposal 35(1)(iii)- Expenditure on scientific research. Weighted deduction from the business income to the extent of 125 per cent of contribution to an approved research association or university or college or other institution to be used for research in social science or statistical research. Deduction shall be restricted to 100 per cent with effect from 01.04.2017 (i.e. from previous year 2017-18 and subsequent years). 35(2AA)- Expenditure on scientific research. Weighted deduction from the business income to the extent of 200 per cent of any sum paid to a National Laboratory or a university or an Indian Institute of Technology or a specified person for the purpose of approved scientific research programme. Weighted deduction shall be restricted to 150 per cent with effect from 01.04.2017 to 31.03.2020 (i.e. from previous year 2017-18 to previous year 2019-20). Deduction shall be restricted to 100 per cent from 01.04.2020 (i.e. from previous

- 55. Phase out plan of incentives (Accelerated Depreciation/ Weighted Deduction) Section Existing Proposal 35(2AB)- Expenditure on scientific research. Weighted deduction of 200 per cent of the expenditure (not being expenditure in the nature of cost of any land or building) incurred by a company, engaged in the business of bio- technology or in the business of manufacture or production of any article or thing except some items appearing in the negative list specified in Schedule-XI, on scientific research on approved in-house research and development facility. Weighted deduction shall be restricted to 150 per cent from 01.04.2017 to 31.03.2020 (i.e. from previous year 2017-18 to previous year 2019-20). Deduction shall be restricted to 100 per cent from 01.04.2020 (i.e. from previous year 2020-21 onwards).

- 56. Phase out plan of incentives (Accelerated Depreciation/ Weighted Deduction) Section Existing Proposal 35AD- Deduction in respect of specified business. In case of a cold chain facility, warehousing facility for storage of agricultural produce, an affordable housing project, production of fertiliser and hospital weighted deduction of 150 per cent of capital expenditure (other than expenditure on land, goodwill and financial assets) is allowed. In case of a cold chain facility, warehousing facility for storage of agricultural produce, hospital, an affordable housing project, production of fertilizer, deduction shall be restricted to 100 per cent of capital expenditure w.e.f. 01.4.2017 (i.e. from previous year 2017-18 onwards). 35CCC- Expenditure on notified agricultural extension project. Weighted deduction of 150 per cent of expenditure incurred on notified agricultural extension project. Deduction shall be restricted to 100 per cent from 1.4.2017 (i.e from previous year 2017-18 onwards).

- 57. AFFORDABLE HOUSING – SECTION 80 IBA 100% deduction of profits from developing and building affordable housing projects approved by the competent authority before the 31st March, 2019 Completion of projects within 3 years from approval Four metros – Land measuring 1000sq m, within municipal limits – Individual unit – 30sqmtrs Others – Land measuring 2000sq m – Individual unit – 60sqmtrs No unit to individual/his family members if a unit is already allocated to him

- 58. Income Declaration Scheme, 2016 – June 1, 2016 to notified date Income upto FY 2015-16 can be offered under this Scheme – Total tax rate of 45% Certain specific cases outside purview of the scheme – Assessment notice issued/ Black money cases, information received from foreign countries. Immunity from Wealth Tax, scrutiny, enquiry and prosecution for cases covered under the Scheme Declaration under the scheme through misrepresentation or suppression of facts - Declaration shall be treated as void Tax (etc). should be paid by a date specified by the Government failing which declaration shall be void

- 59. Section Key changes Sovereign Gold Bond Scheme, 2015 Redemption of Sovereign Gold Bonds, under the Scheme, by an individual shall not be liable to capital gains tax Rupee Denominated Bond - – Ay 2017-18 Capital gains, arising in case of appreciation of rupee between the date of issue and the date of redemption against the foreign currency in which the investment is made shall be exempt from tax on capital gains. Tax Treatment of Gold Monetization Scheme, 2015 – Ay 2016-17 • Deposit Certificates issued under Gold Monetization Scheme, 2015 notified by the Central Government, shall not be considered as a capital asset and shall therefore be exempt from capital gains tax. • Interest on Deposit Certificates issued under the Scheme shall also be exempt from income-tax 57 CAPITAL GAINS

- 60. Section Key changes Tax on receipt of shares of closely held company on demerger/ merger Any shares received by an individual or HUF as a consequence of demerger or amalgamation of a company, shall not attract the provisions of clause (vii) of sub-section (2) of section 56. Additional depreciation u/s section 32(1)(iia) That an assessee engaged in the business of transmission of power shall also be allowed additional depreciation at the rate of 20% of actual cost. Processing under section 143(1) Assessment under Section 143(3) shall be completed only when return is processed under Section 143(1). 58 RELIEF MEASURES

- 61. Section Key changes Extension of time limit to Transfer Pricing Officer in certain cases Where assessment proceedings are stayed by any court or where a reference for exchange of information has been made by the competent authority & the time available to the Transfer Pricing Officer for making an order after excluding the time for which assessment proceedings were stayed or the time taken for receipt of information, as the case may be, is less than sixty days, then such remaining period shall be extended to sixty days. 59 OTHER AMENDMENTS Amt received on death from NPS The whole amount received is exempt now. 15G/H for 194I Sec. 197A amended, now a Landlord may furnish 15G/H for non deduction u/s 194I.

- 62. Sec. 143(1) Scope of adj. extendedExisting provision : ITR filed is processed subject to adjustments for arithmetic errors and inaccurate claims apparent. Amendement: - now following adjustments can also be made • Setting off brought forwarded loss if previous year ITR was belated. • Expenditure reported to be disallowed in TAR but not added in ITR. • Deduction of special sections (10AA, 80-IA, 80-IB, 80-IC,80-ID or 80-ID) if ITR is belated • Income appearing in form 16, 16A or 26AS but not included in ITR. Before making such adjustment an opportunity shall be given to explain and rectify within 30 days.

- 64. Storage and Sale of crude Oil by Foreign Company – AY 2016- 17 onwards Indi a Offshor e Foreign Compan y APPLICABILITY :- • Foreign national Oil companies (NOCs) and multinational companies (MNCs) storing crude oil in a storage facility in India and selling crude oil to a person resident in India • Income from such activity exempt provided :-• Storage and sale is pursuance to an agreement or an arrangement entered into by the Central Government or approved by Central Government; and • Having regard to the national interest, the foreign company and the agreement or arrangement are notified by the Central Government in this behalf Indian Compan y Transfe r Storag e

- 65. Display of uncut Diamond by Foreign Company – AY 2016-17 onwards Indi a Offshor e Foreign Compan y APPLICABILITY :- • Foreign company engaged in mining of diamonds • No income shall be deemed to accrue or arise in India if : - • Display of uncut and unsorted diamonds (without any sorting or sale) • Within Special Zone notified by Central Government in this behalf Displa y

- 66. Preferential Patent regime – Section 115BBE Indi aI Co. Offshor e FCO Outsource R&D APPLICABILITY :- • Person resident in India and who is a patentee is eligible for this tax treatment • Royalty income in respect of a patent developed and registered in India covered, alongwith services in connection with amount constituting royalty – Sale or transfer not covered • Such income taxed @ 10% without any deduction in respect of any expenditure or allowance • Term royalty, developed, patent, patentee, patented article and “true and first inventor”. • Royalty includes payment for , Transfer of all or any rights, imparting information concerning working of and ‘use” of patent.

- 67. PLACE OF EFFECTIVE MANAGEMENT - POEM Application deferred by one year to 1.4.2017 CG to specify how IT Act provision shall apply to company which is deemed to have POEM for the first time in India – Exception may apply till assessment is completed for first year Notification providing the above shall be laid before both Houses of Parliament Apply from AY 2017- 18

- 68. Requirement to obtain PAN for foreign company – Effective June 1, 2016 – Section 206AA Resident NR Current Position :- • Resident Indian to withhold higher tax if the non resident recipient does not have a PAN in India, for any sum or income or amount on which tax is deductible under Chapter XVIIB Propos al • Section 206AA provision should not apply to a non-resident, not being a company, or to a foreign company, in respect of :- • Interest on long-term bonds as referred to in section 194LC • Any other payment, subject to such conditions as may be prescribed Payme nt Offshor e Indi a

- 69. MAT applicability on FII/ FPI – Effectiv e 1.4.2001 Indi a I Co.’s Offshor e FII/ FPI – No PE in India No MAT on FII / FPI where : - • Treaty Country • No PE in accordance with the Treaty • Non- Treaty Country • FII/ FPI not required to seek registration under any law for the time being in force relating to companies. Investment/ Sale of shares

- 70. Transfer Pricing – Country by Country Reporting & Master File International group having consolidated revenue above Euro 750 million covered Indian parent above the specified limit also to file report to the prescribed authority on or before the due date of furnishing of return of income for AY, relevant to the applicable FY Indian constituent of foreign group to provide details of parent company, on or before the prescribed date Where there are more than one entity of foreign parent, one entity can be nominated to submit the details

- 71. Transfer Pricing – Country by Country Reporting & Master File – AY 2017-18If parent is from a country where India does not have a CbC exchange agreement/ country is not sharing information, Indian entity to file CbC to prescribed authority on notification Authority can call for requisite information as desired, non furnishing whereof may invite penalty and interest Master File – Information to be provided shall be prescribed in Rules as per BEPS AP 13 Non furnishing of information may result in a penalty of Rs 5 lakh.

- 72. Equalization levy – Chapter VIII Indi a Indian Busine ss Offshor e NR OBJECTIVE :- • Address the challenges in terms of taxation of digital economy transactions APPLICABILITY • 6 % of consideration for specified services received /receivable by NR not having PE in India, from : - • Resident in India who carries out business or profession, or • From a non-resident having PE in India • NR exempt from tax on income arising from services where equalization levy is chargeable • NA if aggregate consideration does not exceed 1 lakh in a PY • Central Government shall make rules and notify applicability of Equalization levy Digital Supply of Goods/ Services

- 73. BUY BACK DISTRIBUTION TAX – SECTION 115QA ICO Shareholders BACKGROUND :- • Existing provisions apply only where buy back carried out as per Section 77A of the Companies Act • No clarity where Buy back carried out under Court approval / Companies Act 2013, other routes • Deduction considered as amount received by company on issue of such shares • Debate on what shall be such amounts in case of Corporate reorganization/other specific cases PROPOSED AMENDMENT :- • Buy back under any law for the time being in force covered under Section 115QA • Amount received by the Company in respect of the shares being bought back shall be determined in the prescribed manner - Rules to be framed Buyba ck

- 74. Disclaimer :- The analysis and views contained in this presentation are personal in nature, are meant only for information and do not constitute a professional advise to act/ or not act in any given circumstances. The viewers/ readers are required to consult their own advisors before arriving at a decision in any of their personal/ professional tax matters for the aspects dealt herewith. We do not accept any liability, direct or indirect, present or future or incurred in any manner whatsoever for consequences arising out of reliance on the content of this presentation. Neither the presenter, nor any of the parties connected with the transmission or distribution of this content assumes any responsibility for such outcomes. The tax and law matters are subject to interpretation which could be different for different parties, and the courts/ authorities may need not agree with the manner in which the subject is interpreted.

- 75. Thank You CA. VIJAY MAHESHWARI 12/B, 1st Floor, Vaishali Complex Deendayal Square, Shrikant Verma Marg BILASPUR(C.G.)-495001 Phone No. : (07752)407555 Cell : 98271 13251 Email- vaainho@gmail.com