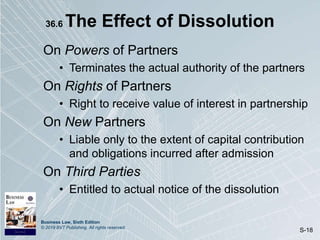

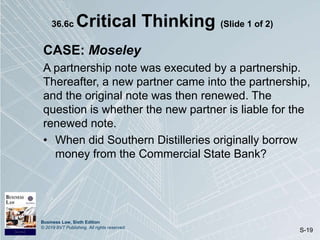

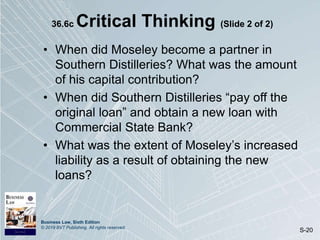

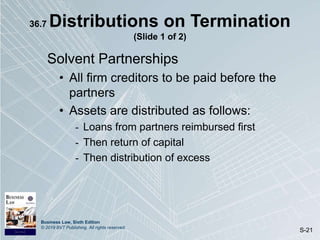

This document provides an overview of partnership law, including the definition of a partnership, partnership agreements, the rights and duties of partners, dissolution of partnerships, and distribution of assets upon termination. Key points covered include the three requirements for a partnership, provisions commonly addressed in partnership agreements, fiduciary duties of partners, methods of dissolving a partnership, effects of dissolution, and the process for distributing partnership assets when winding up is complete.